The founder has the right to pay his contribution to the authorized capital not only in cash, but also in property (if provided for by the Charter). In joint-stock companies, property contributed in payment for shares is subject to a monetary valuation by an independent appraiser. In limited liability companies, property worth more than 20 thousand rubles is subject to mandatory valuation.

The monetary valuation of the property contributed to the authorized capital is made by the founders and cannot be higher than the valuation made by an independent appraiser. In a joint-stock company, the assessment is carried out by the board of directors or the supervisory board of the company. In an LLC, it is approved by a decision of the general meeting of company participants, adopted unanimously by all company participants.

Receipt of fixed assets from the founder

The primary documents to be reflected in the accounting of fixed assets received from the founders will be:

- act of an independent appraiser on the assessment of a fixed asset;

- decision of the general meeting of founders on the monetary valuation of property contributed to the contribution to the management company.

When recording fixed assets received from the founders in the accounting, different situations are possible; they will be discussed further, but in any case it is necessary to create a commission to receive incoming fixed assets. If the organization has only one general director, the commission is not created. The director himself determines whether the fixed asset is ready for operation or whether it needs to be modified until it is ready.

The decision of the commission or director is reflected in an act in the OS form, which must be drawn up for each fixed asset or group of fixed assets.

The main remedy from the founder - citizen

If the founder, an individual, contributes property as a contribution to the authorized capital, draw up an act in any form on the receipt of fixed assets. Attach a copy of the founders' protocol on monetary valuation and a report from an independent appraiser to the deed.

At the time of receipt of fixed assets, the organization draws up, depending on their type, the following acts:

- act in form OS-1 Act on acceptance and transfer of fixed assets;

- act in form OS-1a Act on acceptance and transfer of the building;

- act in form OS-1b Act on acceptance and transfer of groups of fixed assets.

Individuals do not have to fill out the above acts, therefore information about the organization - the deliverer, as well as the sections “Information on the condition of the fixed asset as of the date of transfer” and “Passed” are not filled out.

Immediately after drawing up the act in the OS form, fill out in one copy an inventory card in form No. OS-6 (OS-6a) or an inventory book in form No. OS-6b (for small enterprises) based on the data of the act and accompanying documents (for example, technical passports, instructions for use).

5.2. Receipt of equipment requiring installation

In addition to the start of the production process, taxes are calculated and reports are prepared and submitted to the authorized bodies.

Important! The transferring party's fixed assets transferred free of charge are subject to VAT. However, the recipient cannot deduct this amount of VAT and does not reflect it in accounting. The invoice is not recorded in the purchase ledger.

Equipment and vehicles used in the main production and commercial activities of an economic entity are called fixed assets. They are reflected on the company's balance sheet at the company's current market level. For this purpose, accounting account N01 is opened. Accounting for other income in connection with the gratuitous receipt of a fixed asset is not carried out at a time, but gradually, during its useful life, simultaneously with the calculation of depreciation. And initially the cost of the object relates to future income.

True, there is one nuance here. The received property is not recognized as income only if, within one year from the date of its receipt, the specified property (except for cash) is not transferred to third parties (paragraph 5, sub-clause 11, clause 1, article 251 of the Tax Code of the Russian Federation).

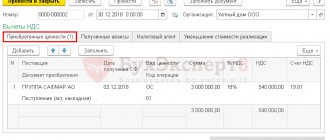

The sole founder transferred equipment (fixed assets) to the LLC free of charge in order to increase the value of net assets by forming additional capital. An independent appraiser assessed the market value of the equipment. The following documents have been drawn up: the decision of the sole participant to increase additional capital; act of acceptance and transfer of property.

If this is possible, that is, the three conditions listed above are met, then the next question arises - what amount to take for the initial cost of this property.

The main asset from the organization - the founder, which was taken into account by him as OS

If the founder-legal entity had property taken into account as a fixed asset, then the act in the OS form is drawn up in two copies. The transferring organization keeps one copy of the act, and transfers the second to the receiving party, where it independently fills out the section “Information about the fixed asset as of the date of acceptance for accounting.” Each copy of the act is signed by both parties.

The organization that received the fixed asset additionally draws up its act in the OS form, where it independently fills in information about the received fixed asset.

After drawing up the act, an inventory card or inventory book is drawn up.

Authorized capital and procedure for its payment

Authorized capital means funds that were initially invested by the founders or shareholders to ensure authorized activities. The size of the authorized capital corresponds to the property minimum, which guarantees the interests of the creditors of this legal entity.

The form of the authorized capital is regulated by law and directly by the organization’s charter. The size of the authorized capital may include the following components:

- par value of shares issued by the organization;

- government investments;

- private shares;

- buildings, structures, equipment;

- the right to use the results of intellectual property.

In order for an organization to be registered, it is necessary to contribute at least 50% of the authorized capital. But it should be noted that the legislation provides an exception for such an organizational and legal form as a joint-stock company. A joint stock company can obtain state registration without contributing authorized capital. But at the same time, half or more of the amount of the authorized capital must be paid for a period of no more than 3 months after state registration, the rest - no later than a year.

Basic entries for accounting for fixed assets received from the founder

| Debit 08 Credit 75-1 | reflects the value of the fixed asset received from the founder as a contribution to the management company. |

| Debit 08 Credit 23 (26, 60, 76...) | reflects the costs of bringing the property received as a contribution to the authorized capital to a condition suitable for use |

| Debit 19 Credit 60 (76) | VAT is reflected on costs associated with bringing the fixed asset to a state suitable for use |

| Debit 01 (03) subaccount “Fixed asset in operation” Credit 08 | the fixed asset was put into operation and registered at its original cost |

| Debit 68 Credit 19 | VAT deduction has been made |

Free assistance from the founder: postings

]]>]]>

All sorts of collisions happen in the life of an enterprise, so if it is necessary to pay off urgent payments or cover a loss, the founders can financially help the company. This is done by providing a loan, a property contribution (exclusively for an LLC), or a gratuitous transfer of funds or property. Let's figure out how these revenues are taken into account in the company's accounting.

Founder's help

The legislator does not interfere with the founder, giving him the right to help the company. One type of monetary assistance is a loan, i.e. temporary financial assistance transferred on a repayable basis.

Or you can finance a company or contribute property free of charge, thereby replenishing the company’s capital. In any case, the transactions performed must be reflected in the accounting records.

Only after this the funds received can be spent on the needs of the company or for its intended purpose, if there are special instructions from the founder.

How to apply for free financial assistance from the founder

The beginning of the process of documenting the transfer of gratuitous assistance is to hold a meeting of the company’s participants, at which the details of its provision are agreed upon. The decisions made are recorded in the protocol.

Then, depending on the type of gratuitous assistance of the founder, the corresponding agreements are drawn up: agreements of donation, gratuitous transfer of assets, loans, borrowings, etc. Agreements come into force after the transfer of assets.

Free assistance from the founder is a common way to help the company. It is formalized in a written decision, which indicates the purposes for which the transferred assets should be directed. Money is credited from the founder using the other income/expenses account – 91.

Account 98/2 of gratuitous receipts is not used for transactions with funds, since it is intended to account for income from the receipt of property. Basic transactions with the gratuitous assistance of the founder:

| Operations | D/t | K/t |

| Non-refundable financial assistance from the founder to the bank account | 51 | 91/1 |

| Arrival of OS | ||

| An OS object was transferred as a gratuitous receipt | 08 | 98/2 |

| Transferring the OS into operation | 01 | 08 |

| Accrual of depreciation on the OS | 20 | 02 |

| The cost of fixed assets is reflected as part of other income | 98/2 | 91/1 |

| Transfer of materials | ||

| Inventory and materials transferred from the founder | 10 | 98/2 |

| Materials written off for production | 20 | 10 |

| The cost of inventory items is reflected in other income | 98/2 | 91/1 |

| Help to pay off losses | ||

| A decision was made to pay off the loss | 75 | 84 |

| Crediting funds to cover the loss | 51 | 75 |

| Contribution of money by the founder to the authorized capital | ||

| Funds contributed to the management company | 75,50,51 | 80 |

| Contribution made: | ||

| – cash to the cash desk | 50 | 75 |

| – goods | 41 | 75 |

| – Inventory | 10 | 75 |

| – OS | 08 | 75 |

| Transfer by the founder of OS to increase net assets | 08 | 83 |

| Replenishment of the reserve fund | ||

| Funds contributed by the founder to add reserve capital | 50,51 | 91/1 |

| The company's income for the year was determined | 91/1 | 99 |

| Net annual income calculated | 99 | 84 |

| Deductions were made to the reserve fund in accordance with the charter | 84 | 82 |

Free financial assistance from the founder: taxation

In tax accounting, profit in the form of gratuitous financial assistance received from a legal entity or individual is included in non-operating income subject to tax.

But, unlike accounting, gratuitous receipts from the founder are not always recorded in tax accounting. This depends on the size of the share in the authorized capital owned by the founder. Art.

38, 250, 251 of the Tax Code of the Russian Federation list cases when contributions transferred free of charge are not subject to taxation:

| Type of gratuitous assistance | When it's not taxed |

| Property, money | If the share of the helper in the authorized capital of the company is more than 50%. In this case, assistance from the founder is not considered taxable income. However, if the assistance is provided not financial, but property, and these assets are sold within a year from the moment they are taken into account, then the income will have to be reflected. If the founder’s share in the management company is no more than 50%, The income received must be reflected by dating it to the day the assistance was received. It is necessary to evaluate property at market value, as in accounting. By the way, it is impossible to write off what they received in the form of assistance as expenses for “simplified” people, since only paid amounts can be attributed to their expenses. |

| The recipient company is the owner of more than 50% of the capital of the assisting company | |

| Money, property, property and non-property rights | Transferred to increase the company’s net assets with the target direction of monetary assistance fixed in the constituent documents |

This procedure is acceptable for enterprises of all forms of ownership. The preferential category of gratuitous financial assistance from the founder in terms of taxation includes an interest-free loan agreement, since no interest is accrued on the money, and the loan is returned at the end of the loan period. The company had no profit as such, which means that no tax is charged on the loan amount.

Financial assistance from the founder on a repayable basis: postings

A cash loan is repayable financial assistance from the founder, returned to the founder after a specified period. Funds are transferred on the basis of a loan agreement. It can be interest-bearing or non-interest-bearing.

The terms of the loan are specified in the agreement:

- If the loan is issued with interest, then the interest rate is specified in the contract;

- An interest-free loan involves no interest at all.

In addition, agreements often stipulate for what purposes the funds should be spent.

In accounting for loans, account 66 is used (for short-term loans, up to 1 year), or account 67 (for long-term loans, over 1 year). Based on these circumstances, the postings will be as follows:

| Operations | D/t | K/t |

| Funds received under a loan agreement | 51 | 66,67 |

| Interest on the loan is reflected | 91 | 66,67 |

| Borrowed funds were returned to the founder | 66,67 | 51 |

| Loan interest transferred | 66,67 | 51 |

Source: https://spmag.ru/articles/bezvozmezdnaya-pomoshch-uchreditelya-provodki

Write-off and sale of a car: accounting and registration

Law No. 402-FZ does not provide for the mandatory use of documents contained in albums of unified forms, but when developing their own primary accounting documents, organizations can use unified forms approved by the State Statistics Committee of the Russian Federation as a model. In this case, you can use the rules for preparing documents given in GOST R 6.30-2003 (see.

also information from the Ministry of Finance of the Russian Federation dated December 4, 2012 No. PZ-10/2012).

Accounting for fixed assets is carried out in accordance with the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01 (hereinafter referred to as PBU 6/01), Guidelines for Accounting for Fixed Assets, approved. by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines), and the Chart of Accounts for accounting of financial and economic activities of organizations, approved. Price

We recommend reading: Basic taxation system for individual peasant farms

Special situation: property is intended for resale

Usually this is a batch of goods that is intended for sale by an organization, but was purchased by a hasty founder in advance, before state registration.

METHOD 1. The company buys goods from the founder and then sells them to its customers

Registration and taxes are the same as in method 1 on p. 73.

Info

In addition, keep in mind that when selling goods you will have to pay VAT on their entire cost. But you don’t have any input tax that could be deducted.

An exception is VAT on the resale of a car.

Tax Code of the Russian Federation.

The founder will have the proceeds from the sale of goods as income for personal income tax at the time of receipt of money from the company. 5 p. 1 art. 208 Tax Code of the Russian Federation. Moreover, the commission is not deducted from the personal income tax base, even if the company immediately withheld it from the money received from customers without transferring it to the founder. 1 tbsp. 210

Attention

Tax Code of the Russian Federation. There is no need to withhold personal income tax when paying the founder the proceeds for goods. The founder under the agreement acts as an ordinary individual, therefore the company is not a tax agent.

2 tbsp.

226, sub. 2 p. 1 art. 228 Tax Code of the Russian Federation; Letters of the Ministry of Finance dated July 16, 2013 No. 03-04-06/27721, dated June 28, 2013 No. 03-04-06/24647. The founder can reduce this income by property deduction in the same way as in method 1 on p. 73. At the end of the year, he will have to submit a return for this tax.

Insurance premiums from the amount due to the founder under the commission agreement, net. 3 tbsp.

alishavalenko.ru

A similar approach does not apply to VAT recovered on a gift in cases where it is not subject to accrual after the gift.

By virtue of clause 16 of Art. 270 of the Tax Code, the restored VAT does not reduce the tax base, but, according to paragraphs.

2 p. 3 art. 170 Attention Tax Code, subject to mandatory accounting when taxing profits.

Since a donation is not recognized as a sale for the purposes of Chapter 25 of the Tax Code, and if the donor has previously used his right to a depreciation premium, then when making this donation he has the right not to restore it and not to take it into account for taxation. Info The above tax is required to be paid by the donee due to the receipt of non-operating income as a gift. At the same time, if the property is used for internal purposes, excluding its further transfer to someone within a year after receipt, such property may be unrecognized income for tax purposes.

Selling a car to the founder

Income should be taken into account on the date of sale of the car (Art.

271 of the Tax Code of the Russian Federation). There will be no expenses if you took into account the redemption price of the car in expenses earlier when putting it into operation (sub.

3 p. 1 art. 254 of the Tax Code of the Russian Federation). If you did not take into account the redemption price of the car (1000 rubles) in expenses earlier, write it off on the date of sale of the car (sub.

2 p. 1 art. 268 of the Tax Code of the Russian Federation). Accounting In accounting, when selling a car, make the following entries: DEBIT 73 CREDIT 91 subaccount “Other income” - reflects the sale of the car to the founder working in the organization (sale value including VAT); DEBIT 91 subaccount “Other expenses” CREDIT 68 subaccount “Calculations for VAT” - VAT accrued; DEBIT 91 subaccount “Other expenses” CREDIT 10 - 1000 rub. the cost of the car has been written off.