The concept of net assets

At the end of the next year, the company analyzes data on its existing assets and conducts a comprehensive assessment of them.

Thus, management comes to understand whether the organization looks attractive to current and future creditors, business partners and employees. The most characteristic indicator in this assessment is net assets, reflecting the real value of all property and finances without taking into account accounts payable and related liabilities.

You can learn about the essence of net assets from the article “Net assets - what is it in the balance sheet (nuances)?”

But sometimes this indicator goes negative. Net assets take a negative value if their total value at some point turns out to be lower than the amount of the authorized capital. As a rule, this fact is discovered when preparing the annual report.

Find out how to correctly calculate net assets in the Typical Situation from ConsultantPlus. To do everything right, get trial access to the K+ system and study the material for free.

More information about how the attractiveness of a company is assessed can be found in the article “Methodology for analyzing the balance sheet of an enterprise.”

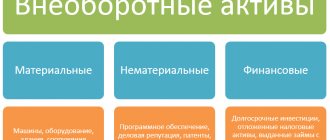

What are the assets of organizations

Net assets are the company's financial resources . With this money, management can pay creditors, pay for services or carry out activities. At the end of the year, all organizations find out with what result they reached its end. This is determined when drawing up final reports.

The value obtained from the calculations allows the development of partnerships with credit institutions, investors and various counterparties. The financial assessment of an enterprise follows a simple formula . They take the price outside of the current and current assets, take away debts from obligations, and the total cost of production.

If the indicator takes a negative value, you can confidently confirm the unsatisfactory state of affairs . Where the size of net assets is lower than the authorized capital. Free funds should be understood as property that is registered on the balance sheet without any encumbrance on obligations.

An assessment of the state of the enterprise is carried out before the reporting period when making decisions that depend on the value of the property. A positive value indicates the profitability of production, a negative value confirms the occurrence of:

- Work at a loss.

- Illiquidity of resources.

- Insufficient working capital to implement current production processes.

Management miscalculations and problems in financing determine:

- The ratio of the amount of short-term liabilities to inflated working capital.

- Audited from reports showing negative net assets.

- Analysis of the reasons, which shows a decrease in funds.

Effective measures are needed to correct the situation.

What to do if the value of net assets is less than the authorized capital

The formation of a company's net assets with a negative value entails the following problem: if for 2 years in a row the value of such assets continues to remain in the negative, the company is subject to liquidation.

Moreover, nothing will depend on the company, and liquidation will be carried out forcibly. The grounds for such actions are contained in paragraph 11 of Art. 7 Federal Law “On the tax authorities of the Russian Federation” dated March 21, 1991 No. 943-I. According to it, tax authorities have the right to initiate the liquidation of a legal entity through the court if its commercial activities have led to negative results. The organizational and legal form of the company cannot influence the decision of the tax authorities.

Important! Before the expiration of the 2-year period, the organization has the opportunity to take preventive measures and thereby avoid a negative scenario. As soon as net assets shrink to a value less than the capital specified in the charter, the owners must either increase the total volume of assets, or reduce the amount of authorized capital, or liquidate. The owners must make a decision within the first half of the year following the reporting year. These norms are enshrined in paragraph 4 of Art. 90 of the Civil Code of the Russian Federation for LLCs and clause 6 of Art. 35 Federal Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ for joint-stock companies.

A reduction in the size of the authorized capital must be accompanied by notification of this event to creditors. In addition, the company is given 3 days to report the event to the tax authority.

If the authorized capital is at a minimum and net assets are in the red, there is a real threat of liquidation. The initiative in this case belongs to the tax inspectorate, which files a corresponding claim in the arbitration court. In the statement, the tax authorities justify their request, and the final verdict remains with the arbitration.

When considering each case, judges carefully analyze the situation in the organization. If it turns out that the taxpayer is able to fulfill its obligations to creditors and the budget, the arbitrators refuse liquidation. Confirmation of this can be found in the resolutions of the FAS Moscow District dated September 25, 2009 No. KG-A41/9762-09 and the FAS East Siberian District dated October 4, 2012 No. A33-20303/2011, as well as in the information letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated August 13, 2004 No. 84.

Who can demand liquidation of a company

If the company does not make a decision to reduce its authorized capital or liquidate it within a reasonable time, creditors have the right to demand early termination or fulfillment of the company’s obligations and compensation for losses. In these cases, the following have the right to submit a liquidation demand to the court:

- bodies carrying out state registration of legal entities;

- other government bodies, including local government bodies, to which such a right is granted by law (clause 5 of Article 20 of Law No. 14-FZ).

The following may also apply to court to demand the liquidation of an organization:

- tax authorities (clause 16, clause 1, article 31 of the Tax Code of the Russian Federation);

- prosecutor (Article 35 of the Federal Law of January 17, 1992 N 2202-1).

Thus, one of the possible options is the forced liquidation of the company at the request of the tax authority. Moreover, if during liquidation it is determined that the value of the legal entity’s property is insufficient to satisfy the creditors’ claims in full, it can only be liquidated in the manner prescribed by the Bankruptcy Law.

Moreover, the obligation to apply to court for bankruptcy in this case is also established for the debtor himself (clause 2 of Article 9 of Law No. 127-FZ).

Increase in net asset value

An organization intending to increase its net assets has 2 possible ways to remedy the situation:

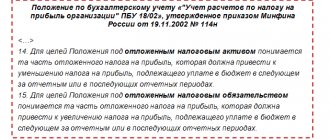

- Revaluate fixed assets (fixed assets) and intangible assets (intangible assets).

It is advisable to involve independent appraisers in this procedure, and make the assessment itself based on the results of the ended (or ending) year. If assets grow, then a positive difference arises between the new valuation amount and the one that was previously listed in the organization’s documents. The resulting difference should be written off to account 83, where additional capital is reflected. The essence of this posting is precisely that net assets have increased in volume.

More details on the rules for revaluation of fixed assets can be found in the article “How to determine the residual value of fixed assets.”

- Important! If the organization nevertheless decides to re-evaluate its assets, then subsequently it will have to be done constantly and systematically. This obligation is enshrined in clause 15 of PBU 6/01. The unsystematic and infrequent implementation of this procedure entails sanctions established by both the Tax and Administrative Codes of the Russian Federation. The main reason for possible penalties is that violation of regularity is inevitably accompanied by a distortion of the value of fixed assets and intangible assets.

The sanctions are as follows:

- Understated property tax of organizations entails a fine of 20% of the amount of tax not paid into the budget. The amount of the fine must be more than 40,000 rubles. (Article 120 of the Tax Code of the Russian Federation).

Gross distortion of financial statements arising from irregular revaluation of fixed assets and intangible assets entails administrative punishment for officials - a fine of 2,000 to 3,000 rubles. A gross violation of accounting means an underestimation of tax by accountants by no less than 10% or a distortion of any reporting line by more than 10% (Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

- Members of the company or owners of the company replenish assets (by depositing money into a current account or adding property).

The accountant will have to account for such funds in “Other income”. This posting actually means an increase in net profit and, accordingly, an increase in the amount of net assets.In order for the operation to be legal and not raise doubts among regulatory authorities, one important condition must be met - indicate the purpose of the deposit. The decision of the company's participants or agreement with them must mention that property or money is added to increase the value of net assets to the amount required by law.

Ways out of the crisis

To improve a company's financial position, managers can use several methods. One of the simplest ways is to revaluate assets. This will lead to an increase in the cost of the company's working resources. The disadvantage lies in the need for regular revaluation in the future.

If the net assets are negative, the founder can find a way out in an additional injection of cash. When transferring the required amount to the company's current account, the owner of the company must indicate for what purpose this contribution is being made. In the purpose of the payment, we recommend that you specify that the money is transferred to a legal entity to increase the value of net assets.

When an enterprise has negative net assets, not everyone knows what management should do. Here's the general approach:

| 1 | Determine the reporting period in which the minus value of this indicator first appeared |

| 2 | If 2 years have not passed since the designated date, then it is necessary to promptly initiate a revaluation of assets or look for ways to increase the value of assets by attracting investors, through additional injections from the founders |

| 3 | At the end of the two-year period, the tax authorities will initiate liquidation of the company |

Also see “Increase in Net Assets by Founders and Entries.”

Results

The formation of negative net assets is fraught with negative consequences for the company, including liquidation. So as soon as net assets shrink in volume to the extent that they become less than the authorized capital, the owners and management of the company should take emergency measures to correct the situation.

Even if the tax inspectorate filed a liquidation claim in arbitration, a negative scenario can be avoided.

If the taxpayer does not have large debts, the salary is paid regularly and in full, all taxes and fees are paid without delay, the judges take his side. Arbitrators will most likely consider the current situation not serious enough to liquidate the organization. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

***

The amount of net assets is an important indicator characterizing the financial condition of the company. A negative value of this indicator may serve as a reason for liquidation of the organization. However, even if the tax authorities file a claim, the company's management has a chance to save their company, but only if all current obligations are paid or paid off on time. In addition, management may make one of the decisions described in our article regarding the financial recovery of the company.

Similar articles

- Own capital - what is this line on the balance sheet?

- Assets and Liabilities

- Net assets on the balance sheet - what is it?

- What is the book value of assets?

- Net asset method

Negative consequences in the form of bankruptcy

As we see, the issue of reducing the company's net assets is periodically associated with its possible bankruptcy. This means that, in addition to the reasons discussed above, the basis for liquidation of a legal entity that is a commercial organization may be declaring it bankrupt (Article 65 of the Tax Code of the Russian Federation). Insolvency (bankruptcy) is understood as the inability of the debtor, recognized by the arbitration court, to fully satisfy the claims of creditors for monetary obligations and (or) to fulfill the obligation to make mandatory payments. However, filing a corresponding application with the court in this case is possible only if there are signs of bankruptcy.

Note. Signs of bankruptcy

A legal entity is considered unable to satisfy the claims of creditors for monetary obligations and (or) fulfill the obligation to make mandatory payments if the corresponding obligations and duties are not fulfilled by it within three months from the date on which they should have been fulfilled (Clause 2 of Article 3 of the Law N 127-FZ).

In this case, a bankruptcy case can be initiated provided that the claims against the debtor - a legal entity in the aggregate - amount to at least 100,000 rubles. (Clause 2 of Article 6 of Law No. 127-FZ). The following have the right to apply to the court to declare a debtor bankrupt (except for the debtor): bankruptcy creditor; authorized bodies (clause 1, article 7, article 2 of Law No. 127-FZ).

And in a number of cases, the debtor himself is obliged to apply to the court with such a statement (Article 9 of Law No. 127-FZ). Thus, participants (founders) must decide to apply to the court to declare the company bankrupt if the value of net assets is less than the minimum authorized capital and there are grounds provided by law for initiating bankruptcy proceedings. Failure to submit such an application entails, as stated at the beginning of the article, the subsidiary liability of those who are entrusted with the responsibility of making a decision on filing an application.

If you still cannot avoid a bankruptcy case, then the following useful information will help you cope with your problems. Bankruptcy procedures include:

- financial recovery (restoration of solvency and repayment of debt in accordance with the schedule);

- settlement agreement (applied at any stage of consideration of a bankruptcy case in order to terminate it by reaching an agreement between the debtor and creditors).