Companies and individual entrepreneurs acting as tax agents for the withholding and transfer of personal income tax from the income of their own employees and other individuals submit Calculation 6-NDFL to the Federal Tax Service on a quarterly basis. The declaration has been introduced since the beginning of 2021, but its preparation still raises many questions among accountants and businessmen. Not everyone knows how to reflect unwithheld personal income tax in 6-personal income tax correctly, in which cases this should be done and in which it should not. Representatives of the Federal Tax Service wrote many explanatory information letters about filling out Calculation lines in various cases. Let's look at the reflection of unwithheld tax in more detail in order to avoid mistakes that entail the preparation of various explanatory letters and penalties.

Delayed wages: possible problems for the employer

According to the law, the employing company is required to pay wages twice a month. First, an advance is given, and then the remaining main part of the remuneration. The date of receipt of these funds must be stipulated in the employment contract, as well as in the internal regulations of the company itself, and in collective agreements. A delay of even a day is a direct violation of employee rights.

Untimely distribution of earned funds threatens the employer with questions both from the tax service, if appropriate payments are not made, and from the labor inspectorate.

According to the Labor Code, an employee has the right to refuse to further perform his duties after a prior written warning. An application for this can be submitted 14 days after the date on which the employee should have received his money.

The employer is also obliged to compensate for the delay with compensation at a special rate, which is calculated by the Bank of the Russian Federation. Many employees do not know about this, which business entities use successfully. According to the administrative code, a defaulter may be subject to a penalty under Art. 5.27.

Attention! In the event of a malicious violation of Labor legislation and a long delay in wages, the guilty person is brought to criminal liability under Art. 145 of the Criminal Code of the Russian Federation.

Results

So, long delays in salaries due to the fault of tax agents are not only fraught with sanctions from the legislator, but also created a separate group of situations for filling out calculations, which required a separate explanation from the fiscal authorities.

Sources:

- tax code of the Russian Federation

- labor Code

- Code of Administrative Offenses

- Criminal Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Salaries were accrued, but there were no payments: clarifications on report 6 personal income tax

The day of receipt of wages is considered to be the last day of the month when income was accrued. According to the tax code, transfers must be made no later than the next business day. This rule applies not only to wages directly, but also to vacation and sick leave payments that were made during the reporting period.

Documents regulating the completion of report 6 personal income tax

Filling out report 6 personal income tax, if wages are accrued but not paid, is stipulated by the following legislative acts:

- Tax Code of the Russian Federation Art. 230 clause 2.

- Letter of the Federal Tax Service of the Russian Federation dated May 24, 2021 No. BS-4-11/9194).

These documents regulate the rules for filling out a report in the case of unpaid but accrued income.

For each completed line of the personal income tax report, there is its own article in the Tax Code:

- line 100 - art. 223;

- line 120 - art. 226 clause 6, as well as art. 226.1 clause 9;

- p. 110 - art. 226 clause 4, art. 226.1 clause 7.

If difficulties arise, it is recommended to turn directly to legislative acts, which regulate the details of the report in detail.

Recalculation of wages into 6 personal income taxes is also considered a problem. It is carried out in the event of: an employee being recalled from vacation;

- recalling an employee from vacation;

- dismissal of an employee who has not paid off the advance;

- error by accountants when calculating or filling out;

- accrual of bonuses and other payments for the already expired period.

If the responsible person makes an error, it is enough to recalculate and send the updated data on time to the tax authority.

Rules for filling out the first section

The report is produced quarterly. Everyone who is considered a tax agent, that is, is a subject of economic activity, must necessarily record Document 6 of the personal income tax, if during the specified period an advance payment, earnings or receipt of other income on which taxes are paid was made at least once.

It is important to know! Section 1 of the reporting is drawn up on an accrual basis. All documentation must be submitted for the first three months, then for 1-2, 1-3 quarters and at the end of the year for the entire period.

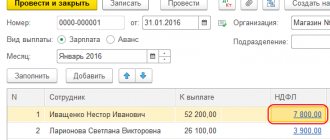

You must fill out line 070 of the first section. It reflects the total amount of personal income tax withheld as of the calculation date.

In line 080 you need to enter what tax liabilities were not withheld on the date of writing the declaration from January 1 of the current year. Under number 060, you must indicate how many employees have received a salary.

For example, earnings are calculated and accrued for the 1st quarter of the year. All money was paid only in April. Actually, tax liabilities were withheld already in the second period. Therefore, when filling out accounting documentation, zeros must be entered in lines 070 and 080.

The salary, which was accrued for the first quarter and paid in the second, is indicated in lines 020 and 040 and in the three-month report and in the semi-annual document.

A completely different filling option if we are talking about a fixed advance payment. Such income is provided for payment to foreign citizens when working under a patent. In report 6 personal income tax there is a separate line for this - 050. Moreover, the amount in line 050 should not exceed the figures in line 040.

Design of the second section

Data on wages paid must be indicated in the second section for the period in which the income was issued to employees. If the salary accrued in the 1st quarter was received in the second, then this section should be filled out only in the half-year report.

The section is formatted as follows:

- In line 100, you must record the day on which your current earnings were received.

- Lines 110-120 remain null.

- Number 130 is the amount of accrued salary.

- 140—enter zero.

It is important to know! If earnings have not been issued at the time of filing the quarterly report, then the second section of the form should be left blank. The rolling salary of 6 personal income tax is indicated for the month when the operation is completed and the finances are received by the employee.

Sample filling

Example: the company successfully calculated salaries for the initial 2 quarters, but did not pay them due to financial difficulties. The first transfers began in June. By the 20th, the entire debt was paid. At the same time, taxes were also paid. The monthly salary was calculated in the amount of 150 thousand. For 6 months, the salary amount is 900 thousand.

When filling out 6 personal income taxes for the 1st quarter, you must make a calculation and enter the following data:

- 010 - tax rate 13%.

- 020 (payroll for the 1st quarter) - 450 thousand.

- 030 - no deductions (0).

- 040 - amount of calculated personal income tax - 58,500 rubles.

The second section remains blank. The half-year report looks like this:

- 010 — 13%

- 020 - 900 thousand.

- 030 — 0.

- 040 - 117 thousand.

- 070 - tax withheld for 5 months 97,500.

- 130 - 150 thousand for each month;

- 140 – for each of 5 months 19,500.

Then, starting from the 3rd quarter, the 6NDFL report is compiled as usual. In the second section, accounting must recalculate taking into account repaid debts to employees.

If employee income is accrued and received within one quarter, then the entry is made in the usual manner. For example, if April earnings were handed over only in May, then for the second quarter 6 personal income tax is filled out as standard, both sections.

Responsibilities of an agent if it is impossible to withhold personal income tax

Line 080 is filled in with an accrual total during the reporting year.

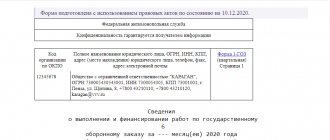

At the end of 2021, if line 080 is completed, the company must draw up a certificate in form 2-NDFL with sign “2” about the impossibility of withholding tax and submit it to the Federal Tax Service at the place of its registration no later than March 2, 2021.

A person who received income in kind, from which it was not possible to withhold tax, is obliged to notify the tax agent within the same time frame by sending him the same certificate. Also, no later than April 1, 2020, the company must include this certificate as part of the annual 2-NDFL certificates, but with the sign “1”.

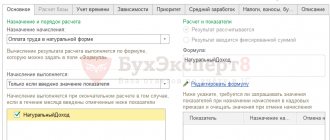

Reflection of the advance in the report

Advance is the part of the salary that the employer is required to pay in accordance with the law. The Labor Code states that an employee must receive payment for work twice a month. Preliminary payments are associated with this, which are usually paid in the middle of the month. The exact date is specified in internal documents and the agreement with the employee.

There is no special line in the 6 personal income tax report for salary advances. But in this case it is necessary to reflect the income received. Conditions of the Tax Code:

- Personal income tax must be calculated on the date of actual receipt of money.

- The tax must be issued at the time of salary payment, so that according to all documents it is calculated from the employees’ income, and not from the company’s accounts.

- The date of receipt of income is usually considered to be the last day of the month, including weekends.

Advice! This means that at the time the advance is issued, it is not yet considered income, which means there is no need to reflect it in the report. This can be done on the day you receive your basic salary. Tax is calculated on both incomes at the same time.

Overpaid personal income tax: indicate or not

There is no need to separately notify tax authorities about the refund of overpaid tax. This is not provided for by current tax legislation. After all, the refund is actually made against upcoming payments.

In turn, in section 2 of form 6-NDFL for the corresponding reporting period, you need to indicate only those transactions that were carried out over the last three months of this period.

Let us remind you that the tax agent is obliged, upon a written application from the taxpayer, to return to him the overpaid amount of personal income tax. The law provides a three-month period for this.

Early payment of wages in 6 personal income taxes

If the salary is paid ahead of schedule, you also need to consider how to fill out 6 personal income taxes. Early payment is considered to be the accidental and intentional payment of income to employees before the last day of the month. This may happen due to circumstances or simply by mistake. According to the Letter from the Ministry of Finance dated December 15, 2021, it is stated that early salary is not income, like an advance payment. In this case, the principle of filling out the quarterly report is the same. The amount must be paid on the same date as the receipt of the main payment. If all earnings are issued ahead of schedule, then they can be processed on the date specified in the employment contract as the day the salary was issued.

At the same time, there is permission from the Federal Tax Service, which states that early payments can be equated to income. If the money is issued on June 25, then in the report for the 2nd quarter, according to the documents, the tax will be issued from the organization’s funds, which is prohibited. But in fact, the company will deduct them from the money received by the employees.

It is important to know! Most experts consider the option of filling out 6 personal income tax, as with a salary advance, to be more correct. Therefore, accountants often use this method of writing a report. To avoid confusion in such a case, it is easier to enter early earnings into the standard salary date and file 6 personal income taxes in the standard manner.

When no deduction is made from employees

Some categories of employees have tax benefits; on their basis, personal income tax is either not collected at all or partially withheld. Not taxed:

- Alimony;

- maternity benefits;

- severance pay upon dismissal due to layoff, agreement of the parties or in connection with retirement;

- funds from the employer’s net profit used to pay for medical services for the employee or his close relatives;

- gifts worth less than 4,000 rubles;

- compensation for the cost of vouchers and other payments (Articles 215, 217 of the Tax Code of the Russian Federation).

Persons who have tax deductions are exempt from paying tax on their amount. In this case, the right to the benefit must be documented.

Advances on personal income tax paid by foreigners are also taken into account when obtaining a patent. Tax is not withheld from such employees again.