Home / Taxes / What is VAT and when does it increase to 20 percent?

Medium and large manufacturing enterprises that use the services of a large number of suppliers often face the problem of:

When calculating vacation pay to employees, situations arise that require recalculation. The recalculation may be caused by an error

Taxpayer Legal Entity is a program that was developed by the Federal State Enterprise. In the process

Hello! Today we’ll talk about filling out a tax return under the Unified Agricultural Tax and give examples. Unified agricultural tax –

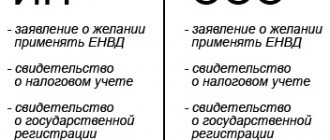

Situations when individual entrepreneurs and organizations decide to switch from one tax regime to another occur

The procedure for accounting for expenses for income tax purposes. Tax legislation has a rule: for

Author: Ivan Ivanov Part-time worker - a specialist who, during time off from work, carries out certain labor

Questions discussed in the material: What are the general rules for accepting goods How to accept goods by quantity

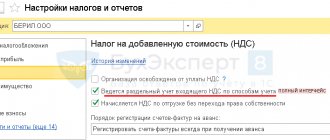

Transactions not subject to VAT: complete list of VAT-exempt transactions and goods for sale