Author of the article: Sudakov A.P.

Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production, premature wear is possible.

Disposal of unusable instruments

Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use. If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

Systematization of accounting

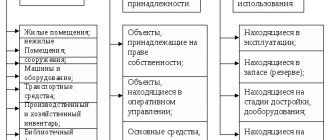

09/30/2018 Contents Equipment, buildings, structures, machines, equipment, vehicles and other property related to fixed assets can be written off from the balance sheets of enterprises, companies, organizations and institutions:

- in connection with the construction, expansion, reconstruction and technical re-equipment of enterprises, workshops or other facilities.

- that have become unusable due to physical wear and tear, accidents, natural disasters, violation of normal operating conditions and for other reasons;

- obsolete;

At the same time, property related to fixed assets is subject to write-off only in cases where it is impossible to restore it or is not economically feasible, and also when it cannot be sold or transferred to other organizations, institutions, companies, and enterprises. When decommissioning equipment at an enterprise, you should be guided, first of all, by the methodological instructions for accounting of fixed assets. Below we publish an extract from the guidelines for accounting of fixed assets, registered with the Ministry of Justice of the Russian Federation on November 21, 2003.

valid at the time of publication of the material on May 25, 2016. (You should check the official websites for changes and additions.) VI. Disposal of fixed assets 75. The cost of an item of fixed assets that is disposed of or is not constantly used for the production of products, performance of work and provision of services, or for the management needs of the organization, is subject to write-off from accounting.

76. The disposal of an item of fixed assets is recognized in the accounting records of the organization on the date of the one-time termination of the conditions for their acceptance for accounting given in “clause 2” of these Guidelines. Disposal of an item of fixed assets may occur in the following cases:

- transfers in the form of a contribution to the authorized (share) capital of other organizations, a mutual fund;

- liquidation in case of accidents, natural disasters and other emergency situations;

- sales;

- write-offs in case of moral and physical wear and tear;

What should be considered low-value and wearable property

For a long time, low-value and wearable items were taken into account in account 13. But now it is missing, although the MBPs themselves have not disappeared anywhere. By all criteria, this material resource should be classified as fixed assets, but its value is too small to be included in the corresponding OS account (01). Therefore, although the term IBE is not used in professional accounting language, low value is present.

It includes current assets for which:

- cost - for one unit no more than 40 thousand rubles;

- operating time - up to a year or two;

- subsequent resale is not envisaged.

They are also characterized by:

- application in the manufacture of goods directly or for the purpose of managing the production process;

- assistance in generating income.

Low-value property is included in current assets, and their value is written off as expenses:

- completely, provided that the service life is one year;

- in parts, when he is 2 years old.

Although small business enterprises are written off, they continue to be reflected in accounting (not in tax accounting) as part of industrial property. And at the enterprise, their movement must be constantly monitored to ensure safety. It is for the safety of the physical value that low value, even with zero value, is taken into account in the documentation. And this happens before it is completely worn out. The accounting policy should establish the maximum value of low-priced items.

IBP are items that are purchased by an enterprise in order to use them for a long time. But their cost is immediately written off in full to the cost of production.

Example No. 1. The organization bought a filing cabinet, paying 25 thousand rubles for it. (without VAT). This acquisition relates to furniture, that is, to fixed assets. But since its cost is less than the established limit (40 thousand rubles), the table is considered low-priced. 25 thousand rubles. written off to management expenses immediately upon commissioning.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Free legal advice online

The involvement of lawyers in legal disputes is due to the need to fully protect the personal interests of citizens. As practice shows, citizens avoid legal assistance in order to save money, but in practice this is associated with high costs.

Even citizens with a lawyer's education do not always keep up with current changes in legislation, so it would be advisable to consult a qualified specialist.

The convenience is that consultation with a lawyer is free and online.

Where and how to get free legal advice? is provided throughout the Russian Federation. Citizens, residents of the state, as well as non-residents of the country who temporarily reside in the Russian Federation can take advantage of the support.

Moreover, lawyers can advise interested parties outside Russia, but only within the framework of domestic legislation. Legal advice is provided free of charge online around the clock, regardless of weekends and holidays. The response time from specialists on the website is up to 15 minutes.

There is no need to register on the Internet portal and you can send a personal appeal anonymously. Attention! The online lawyer provides answers to questions and continues to support the client in the event of further difficulties. Legal advice can be obtained in the following ways:

- use the online chat service;

- call the hotline.

- draw up a contact form for the feedback service;

Online legal consultation can also be carried out via email.

The advantages of the services of our law firm are due to the professional attitude of our specialists to their work, the receipt of regular training courses, as well as participation in official forums.

This ensures that individuals and businesses can receive advice that complies with current legal provisions.

Certificates are provided

Top five questions that are asked most often

Question No. 1. The individual entrepreneur is engaged in leasing space in the administrative building. They are furnished with furniture purchased at the expense of the individual entrepreneur. Is it possible to write them down as expenses and reflect them in accounting?

Such costs can be included in expenses. They are completely economically justified, since renting out space along with the furniture installed on it is a source of income for this individual entrepreneur.

Question No. 2. The company (OSNO) purchases about a hundred items of office supplies every quarter. They are immediately distributed to employees to ensure their work. Is it necessary to reflect the cost of office supplies in which primary documents?

To avoid claims from auditors and tax authorities, you should do this.

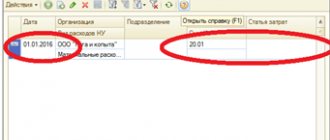

- Goods are accounted for. 10 with this notation: Dt 10 → Kt 71

- The receipt order is filled out.

- When distributing stationery to employees, a demand invoice is issued. On its basis, the value of the low value is written off: Dt 26 → Kt 10

Question No. 3. How to determine the amount of low-value property?

The amount depends on the characteristics of the enterprise. IBP does not include OS whose cost is more than 40 thousand rubles. These two factors should be taken into account and fixed for accounting purposes (mandatory) in the order on accounting policies.

Question No. 4. Is it possible to write off low-value property on the day it is received if payment for it has not yet been reflected in the accounts?

Is it possible. In accounting, a low value can be written off at the same time it is received. Whether the payment has gone through or not at this point does not matter.

Question No. 5. An individual entrepreneur bought a microwave for his employees. Will its cost be included in the expenses of the simplified tax system?

No. Expenses can only include those that are fully justified and used in production. In every enterprise, IBP accounting should not be underestimated, although it is an inexpensive asset.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓

Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Certificate of write-off of equipment that has become unusable

Using this link you can download “” for free in doc format, 12.0 KB in size. All organizations are faced with the need to write off old equipment.

Computers, office equipment and other property must be disposed of according to a write-off report. Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use. A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them.

Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act. It is recommended to write off material assets that:

- obsolete;

- extremely worn out;

- damaged when repair is impossible or economically unfeasible.

- do not exist based on inventory results;

- cannot be used because they have become unusable;

Every year, the head of the organization must issue an order appointing a commission to write off fixed assets.

The chairman of such a commission is, as a rule, a deputy director, and the members of the commission are the chief accountant, economists and engineers.

In most cases, fixed assets are subject to write-off in the following cases:

- It is impossible or economically infeasible to restore the object.

- The property fell into disrepair.

- Equipment does not exist as a single entity.

All three circumstances must be present, otherwise the write-off will be illegal.

For example, you cannot write off a computer on the grounds that its performance is not sufficient to run a program. The hardware remains suitable for lower performance programs such as word processing or email.

Certificate of write-off of a tool that has become unusable

Copyright: Lori's photo bank Tools and equipment used in the enterprise become unusable over time.

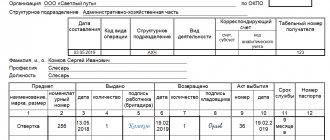

If they cannot be restored and cannot be used in the future, they must be excluded from the organization’s property by writing off. This operation must be properly documented. The write-off of an instrument that has become unusable takes place in a strictly established manner and must be documented in an act (clause

56 Guidelines for accounting of special tools, approved. Order of the Ministry of Finance of the Russian Federation dated December 26, 2002 No. 135n). This document confirms the fact of write-off and reflects the main reasons for its publication.

A well-drafted act will ensure the reliability of accounting, and regular write-off of worn-out instruments will reduce the tax burden on the organization.

Reasons and grounds for writing off material assets

- /

- /

October 3, 2021 0 Rating Share We recommend a selection The reasons for writing off material assets can be varied: from identified defects to obsolescence. Find out more in our material about the reasons and grounds for writing off valuables. Material assets are subject to write-off if they:

- Consumed during the normal production process in the manufacture of final products or semi-finished products.

- They have lost their original properties and cannot be used for their intended purpose.

In the first case, for the write-off of each batch of raw materials and materials, there is no need for a special written permission from management - the write-off is carried out according to established standards, which must be justified and approved by the head of the enterprise.

We recommend reading: Power of attorney to represent the interests of an individual docx

The write-off process has its own characteristics, which will be discussed in one of the subsequent sections.

In the second case, writing off valuables requires an individual approach, and in each case, writing off is carried out on commission. Methods for writing off material assets should be reflected in the accounting policies of the enterprise. Detailed write-off processes (templates for documents for write-off, regulations for their execution and reflection on accounting accounts, other aspects) are prescribed in the internal regulations of the enterprise (Regulations on accounting and write-off of valuables, orders, instructions, instructions).

Thus, even before the start of writing off assets, the enterprise needs to regulate this process (develop internal regulations and instructions) and consolidate important accounting aspects in the accounting policy.

Writing off valuables during the production process is a natural process. It is impossible to make a product without using up certain materials.

It does not matter what type of final product is manufactured - write-off of raw materials is inevitable. Its quantity and types depend on the complexity and composition of the final product.

Possible ways to value low-value items

The accounting regulations provide for several options for assessing inventories. It can be carried out at cost:

- each individual unit purchased;

- weighted average;

- first in time for purchasing materials (FIFO method).

Low valuation is a special component of material reserves. The initial cost of the IBP contains all the costs that the enterprise incurred during the purchase. This is reflected in the relevant primary documentation.

Based on this, it is necessary to write in the order on accounting policies that IBP is assessed based on the actual cost of each individual unit. At the same time, you should not forget to add the amount of expenses for its purchase. A list of primary documentation is also included here. With its help, the movement of the IBP from capitalization to write-off will be traced.

IBP does not include workwear, since according to the law it should be classified as a type of property that is taken into account especially.

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8,000 books purchased |

Certificate of write-off of a tool that has become unusable

If the write-off process continues for several days, for example, an inventory of property is being carried out, then you need to indicate in the act the time period of the entire process. Document title Can have two forms - “Writ-off act ...” or “Writ-off act ...”, any of the options is correct Text part Begins indicating the basis for creation. Since in most cases this is an order from the manager, this is how it is written “Based on the order...”.

The exact details of the administrative document must be indicated. Approval stamp by the manager. Placed in the upper right part of the form.

For the write-off procedure, interested parties are invited: this may be the immediate manager of the enterprise, an accounting employee, a storekeeper or another person responsible for storage and sales. The chief engineer may be invited if obsolete or defective equipment is being written off. All of the above members of the commission are personally present when the act is drawn up and seal it with their signatures. Attention: The document is approved by management and transferred to the accounting department for further accounting actions.

ImportantFor current repairs To confirm the validity of writing off materials for current repairs, an inspection report of the premises to be repaired is drawn up, indicating the indications. The list of upcoming work is approved by the manager.

Based on the estimate, an act of writing off materials for current repairs is drawn up. The act displays the actual materials consumed, indicating their cost and acquisition costs.

Example of filling out The form of the act for write-off of materials is arbitrary. But the document should be drawn up in such a way that no additional questions arise regarding the reasons and grounds for write-off.

The inventory results, prepared accordingly, will confirm the fact of a shortage of property. In addition, you need to contact the internal affairs authorities with a statement of theft. If this is not done, then the organization will not be able to reduce the income tax base on the value of stolen assets. It is possible to prove with documents that the thieves have not been found only with a copy of the decision of the investigator or inquiry officer to suspend the criminal case on the basis of subparagraph 1 of paragraph 1 of Article 208 of the Criminal Code. procedural code of the Russian Federation.

Answers to common questions

Question No. 1: Perhaps the enterprise is faced with a natural decline in small business volumes. How will this affect income taxes?

Answer: The norms of natural loss, developed by industry departments and approved by Decree of the Government of the Russian Federation of November 12, 2002 No. 814, can reduce the tax base, but within the established limits of these norms (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation).

Question No. 2: Due to the introduction of new technology, costs for IBP have decreased, how can I issue a refund?

Answer: Due to the fact that each technology used provides its own economic benefits, they must be calculated independently based on standards. And they can be taken into account during transfer to the warehouse. The organization can, subject to reducing the use of IBPs, either use them if necessary, or implement them.

Rate the quality of the article. We want to become better for you: If you have not found the answer to your question, then you can get an answer to your question by calling the numbers ⇓ Legal Consultation free Moscow, Moscow region call

One-click call St. Petersburg, Leningrad region call: +7 (812) 317-60-16

Call in one click From other regions of the Russian Federation, call

One-click call

Certificate of write-off of a tool that has become unusable

› › › Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production of products, premature wear is possible.

Disposal of unusable instrumentsAccidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use.

If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

All material assets of a business entity are taken into account in its financial documentation.

Therefore, it is impossible to simply throw away an item that is unusable.

At the very first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting. Instruments that have become unusable must be removed from the register by writing off. The procedure is regulated by the norms of legal sources.

Its competent implementation makes it possible to eliminate inconsistencies in various reporting forms. In order to prevent theft of the enterprise’s property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation. It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further operate the tools due to their damage, as well as the amount of equipment that is subject to write-off. A mandatory element of the write-off procedure is the drawing up of an appropriate act indicating the fact of the event and the justified reasons for its initiation.

How to write off tools that have become unusable

Contents Page 1 Instrument accounting in the IRC is carried out in the same way as in the CIS, using accounting cards. The instrument is received based on requirements, invoices or limit cards.

Writing off as expense is carried out on the basis of reports of loss (wear, breakage or loss) of the tool, which indicate the reasons and culprits for the premature failure of the tool.

According to these acts, worn-out instruments are handed over to a restoration base or scrapped.

Accounting for tools and devices in factory warehouses and distribution warehouses is organized similarly to accounting in material warehouses.

Accounting for instruments in the CIS is carried out in an accounting group using graded turnover cards, filled out daily on the basis of primary receipt and expenditure documentation, or in a document-copy form by laying out primary documents in a card index with the output of the current balance and monthly recording of the turnover results in a monthly graded turnover card . Instrument accounting should be concentrated in the OGM.

Each instance of a flat tool is assigned an individual number.

The book of registration of flat tools indicates the workshop in which the tool is operated and the frequency of its inspection.

Planar tools are repaired only in a special area. The quality control department systematically monitors the condition of flat tools in the workshops according to a schedule.

A tool that has lost its accuracy is removed from service and sent for repair to the RMC. If the instrument being tested turns out to be suitable, a note is made about this in its passport. Accounting for tools, fixtures and low-value equipment is kept in a separate sub-account.

Accounting is organized in the same way as accounting for materials in a warehouse. Accounting for tools, devices and equipment in use is organized in different ways in workshops. To account for tools (devices) issued to a worker from the shop storeroom for short-term use, a tool mark is used, which is returned to the worker when the tools are handed over to the storekeeper.

Certificate of write-off of a tool that has become unusable

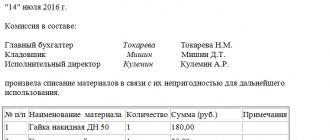

The act on write-off of inventory and household supplies in the form 421-APK is intended to formalize the write-off of small inventory and other household supplies upon their complete or partial liquidation due to wear and tear and loss of their consumer properties or upon expiration of the established service life and inexpediency (economic, physical, etc.). etc.) their further use. The same document serves as the basis for recording returnable waste or items for disposal received during the liquidation of inventory and household supplies (scrap metal, rags, firewood, tools and other items that have become unusable, etc.).

The report is drawn up by the commission for each case of industrial and household equipment and other household supplies that have become unusable at the relevant places of their operation (departments, farms, teams, workshops, etc.). The commission includes the head of the on-farm unit, the financially responsible person and other employees associated with the operation of these items. The act must indicate the full names of the disposed items, quantity, price, amount, reasons for disposal and methods of destruction of the named items so that during the re-inventory they are not presented in place of new items.

On the back of the act is a calculation of the results of the liquidation of written-off items.

In this case, returnable waste (scrap metal, firewood, rags, etc.) is subject to capitalization as material assets received from the liquidation of the corresponding inventory items and household supplies.

The act is checked by the chief accountant (especially from the standpoint of the legality of writing off items and posting returnable waste) and approved by the head of the farm, after which the accounting department makes all the necessary entries in the accounting accounts based on the document.

We recommend reading: Obtaining a residence permit for a child of a Russian citizen

Contents Hello, help me find information about the correct write-off of gasoline used in lawn mowers, on the basis of which the documents. The legislation has developed standards for fuel write-off only for motor vehicles.

Getting rid of unnecessary assets

The manager to whom the employee using hand tools is subordinate must ensure systematic control:

• ensuring that employees comply with safety rules when working with tools;

• for the use of work clothes, safety shoes and personal protective equipment; ● for compliance of the tool with safety requirements.

1.4. Workers who have received a hand tool for everyday use for individual or team use are responsible for its correct use and timely rejection.

1.5. The hand tools used must meet the following requirements:

• handles of impact tools - hammers, sledgehammers - must be made of dry hard and tough wood, smoothly processed and securely fastened;

• the handles of hammers and sledgehammers must be straight and oval in cross-section. The handles should thicken somewhat towards the free end (except for sledgehammers) so that when swinging and hitting the tools, the handle does not slip out of the hands. In sledgehammers, the handle tapers somewhat towards the free end. The axis of the handle must be perpendicular to the longitudinal axis of the tool;

• for reliable fastening of the hammer and sledgehammer, the handle is wedged from the end with metal and jagged wedges. Wedges for securing the tool to the handles should be made of mild steel;

• the heads of hammers and sledgehammers must have a smooth, slightly convex surface without warps, chips, gouges, cracks and burrs.

1.6. Impact hand tools (chisels, bits, notches, cores, etc.) must have:

• smooth back part without cracks, burrs, hardening and bevels;

• side edges without burrs and sharp corners.

Handles mounted on the pointed tail ends of the tool must have bandage rings.

1.7. The chisel should not be shorter than 150 mm, the length of its extended part should be 60-70 mm. The tip of the chisel should be sharpened at an angle of 65-70 degrees, the cutting edge should be a straight or slightly convex line, and the side edges where the hand grips them should not have sharp edges.

1.8. Wrenches must be marked and match the size of the nuts and bolt heads. The jaws of the wrenches must be parallel. The working surfaces of the wrenches should not be chipped and the handles should not have burrs. Extending wrenches by attaching a second wrench or pipe is prohibited.

1.9. For screwdrivers, the blade should fit into the slot of the screw head without any gap.

1.10. Tools with insulating handles (pliers, pliers, side and end cutters, etc.) must have dielectric covers or coatings without damage (delamination, swelling, cracks) and fit tightly to the handles.

1.11. The crowbars should be straight, with pointed ends drawn out.

1.12.Handles, files, scrapers, etc., mounted on pointed tail ends, are equipped with bandage (tightening) rings.

1.13.When working near electrical installations and other live objects, insulated or non-conductive plumbing tools must be used.

1.14.When working near flammable or explosive substances, in an atmosphere with the presence of vapors or dust of these substances, plumbing tools that do not generate sparks must be used.

When working at heights, it is necessary to carry assembly tools in bags or pouches attached to a safety belt.

Date added: 2015-10-01; | Copyright infringement

Recommended content:

Related information:

Search on the site:

Guillotine shears, being complex technical equipment, are often subject to breakdowns. Some of the faults can be eliminated literally in a matter of minutes on site, having the necessary qualifications and knowledge. Others require professional repairs by contractors, often at a hefty cost.

The most common cause of failure of guillotine shears is violation of operating rules:

- overload of scissors;

- work on time exceeding the standard period;

- cutting metal with a thickness exceeding the permissible parameters according to the instructions;

- incorrect setting and adjustment of parameters by a workshop worker.

If you cut a sheet of metal that is too thick, there is a high chance that the knives may become bent.

Write-off of a tool that has become unusable

› The MB-5 act is endorsed by the head of the tool department and submitted to the central tool warehouse (CIS), which issues the workshop tools (devices) of the same name, brand and size according to the act without issuing invoices for release of form M-11 and limit-fence cards.

After the tools are issued by the warehouse, the act is transferred to the accounting department, where, according to these acts, the tools are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops. Instruments issued by the warehouse in the order of exchange according to acts are not reflected in the storage cards for distributing storerooms. [13] It is used to formalize the write-off of tools (devices) that have become unusable and exchange them for suitable ones at those enterprises where accounting is carried out using the exchange (working) fund method.

According to the act, the unusable instrument is handed over to the storage room for scrap. The act is endorsed by the head of the tool or planning department and submitted to the central tool warehouse (CIS), which issues tools (devices) to the workshop of the same name, brand and size according to the act without issuing requirements and limit cards.

After the warehouse issues the tools (devices), the act is transferred to the accounting department, where, according to these acts, the tools (devices) are written off from the warehouse, without reflecting their movement through the dispensing storerooms of the workshops.

Tools (devices) issued by the warehouse in the order of exchange according to acts are not reflected in the registration cards of distribution pantries. All this is done without passing through dispensing pantries in the company’s scattered workshops.

The document must be filled out clearly according to the instructions in accordance with the assigned fields. For current repairs As confirmation of the validity of writing off materials for current repairs, an inspection report of the premises to be repaired is drawn up, indicating the indications. The list of upcoming works is approved by the manager.

Based on the list, a repair estimate is prepared, which shows the required amount of materials. Cost indicators are conditional.

Write-off of a tool that has become unusable

A full explanation on the topic: “writing off a tool that has become unusable” from a professional lawyer with answers to all your questions. Contents Any production process is accompanied by the acquisition, storage and use of material assets, which include tools.

After completing the service life established by the manufacturer, they lose their functionality. Due to the active use of equipment to ensure production of products, premature wear is possible. Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use.

If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed. All material assets of a business entity are taken into account in its financial documentation.

Therefore, it is impossible to simply throw away an item that is unusable. At the first inventory of valuables, a shortage will be identified, and the chief accountant will be presented with claims about the unreliability of accounting records.

Instruments that have become unusable must be removed from the register through write-off. The procedure is regulated by the norms of legal sources. Its competent implementation eliminates inconsistencies in various reporting forms. In order to prevent theft of the enterprise's property, to implement the write-off procedure it is necessary to involve a group of specialists assigned to the commission by administrative documentation.

It is formed from the chairman of the commission and its members. Representatives of the organization document the fact that it is impossible to further use the tools due to their damage, as well as the amount of equipment that is subject to write-off.

A mandatory element of the write-off procedure is the drawing up of an appropriate act indicating the fact of the event and the justified reasons for its initiation. The number of instruments and their identifying information are displayed in the receipt documentation.

Nuances

To facilitate accounting and ensure the absence of claims from the inspecting authorized bodies, in the act, the name of the written-off object should be indicated in accordance with the identification displayed in the receipt papers. It is important to indicate the purpose of the instrument being written off, as well as its analytical accounting number. The act can be generated in the form of a summary statement, in which data is displayed only upon actual write-off. The date of deregistration is determined not by the date of registration of the statement, but by its actual parameter.

Write-off of materials that have become unusable

Free consultation by phone Contents

What the inspectorate will be able to request from auditors From 2021

a new article will appear in the Tax Code. 93.2, which will oblige auditors to provide the tax service with information and documents relating to companies that were audited.

What is this innovation connected with and how does it threaten organizations? → Accounting consultations → Inventories Updated: June 6, 2021 Organizations often face a situation where their inventories or valuables become unusable or are used in production (for example, raw materials).

In this case, the law requires organizations to deregister these values.

To do this, an act of writing off material assets is drawn up, a sample of which is given in this article. The organization’s material assets include:

- raw materials;

- finished products.

- stocks;

- unfinished production;

The write-off of material assets means the documented removal of material assets from the organization’s records. The need to write off material assets most often arises in connection with the following circumstances:

- loss of quality as a result, for example, of a flood or fire;

- putting raw materials into production;

- end of service life;

- incurring losses in connection with the maintenance of material assets.

- breaking;

- wear;

These circumstances are usually identified by persons responsible for material assets in the organization. In all cases, accounting for such material assets is unprofitable for the organization and entails additional costs. In addition, failure to write off material assets can become a basis for abuse by persons directly working with the assets. Before the manager makes a decision to write off, a special commission carries out its work.

Features of accounting for low value under the simplified tax system. Differences from OSNO

Since the low value property is not included in fixed assets, it can be written off as expenses according to the simplified tax system. But this can only be done after the IBP has been put into operation. The cost of only those SBPs that actually participate in the production process is subject to write-off.

For example, when purchasing a refrigerator to ensure the storage of finished products, its cost is included in expenses under the simplified tax system. When it is purchased for a household room, then the presence of its cost in expenses is unjustified. The table shows the differences in accounting for low value under the OSNO and the simplified tax system:

| Conditions for IBE | BASIC | simplified tax system |

| Accounting | On the account 10 plus off-balance sheet accounting | — |

| Time to write off expenses | Immediately upon admission | After commissioning |

| Inclusion in expenses depending on place of use | There are no restrictions. The entire cost is written off as expenses, regardless of where the low value is used - in production or in providing quality working conditions for workers | A prerequisite is direct use in the manufacturing process (reasonable costs) |

The legislation does not force simplifiers to keep accounting records. But this does not apply to fixed assets and intangible assets. Therefore, low value items, for example, stationery, are not reflected in any accounts.

Reason for writing off a tool that has become unusable

Any production process is accompanied by the acquisition, storage and use of material assets, which include tools. After completing the service life established by the manufacturer, they lose their functionality.

Due to the active use of equipment to ensure production of products, premature wear is possible.

Accidents and natural disasters can also cause equipment to become dilapidated or unsuitable for further use. If the instrument cannot be restored, then its further storage and recording on the balance sheet is meaningless, which should be the reason for initiating an action to write off the object. It must be properly documented and executed.

Equipment write-off act is a document that is drawn up by several persons and confirms the fact that the equipment has been written off. All organizations are faced with the need to write off old equipment. Write-off of a tool that has become unusable The Equipment Write-Off Certificate is a document that is drawn up by several persons and confirms the fact that the equipment has been written off.

All organizations are faced with the need to write off old equipment.

Computers, office equipment and other property must be disposed of according to a write-off report. Correct write-off requires an expert opinion on the condition of the equipment, which contains an assessment confirming the impossibility of further use.

A specially created commission or an invited expert organization draws up a technical inspection report, on the basis of which it is possible to write off fixed assets from the balance sheet and dispose of them. Property tax has to be paid for equipment that has not been written off but is out of order or obsolete. You can write off fixed assets gradually - through depreciation, but there is a shorter way - drawing up an equipment write-off act.

It is recommended to write off material assets that: Every year, the head of the organization must issue an order appointing a commission to write off fixed assets.