When calculating vacation pay to employees, situations arise that require recalculation. The reason for the recalculation may be an accountant's error when recalling an employee from vacation or, conversely, an extension of vacation days, including due to sick leave while there.

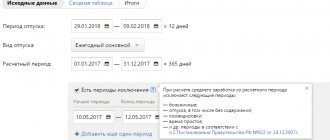

The 1C: ZUP 3.1 program, of course, provides the opportunity to recalculate vacation pay. The procedure for this depends on whether the recalculation is made in the current month or in the next billing period.

Position of official departments

The ambiguity in the accruals was due to the fact that the regulatory documents do not have the concept of “non-working days”. Accordingly, it was not specified whether payments for this period should be taken into account in calculating average earnings or not. Before the official letter of the Ministry of Labor No. 14-1/B-585, issued on May 18, 2020, it was explained on the Rostrud website that non-working days are not excluded from the calculation period, and payments made are taken into account when calculating vacation pay. However, later officials came to a unanimous opposite opinion:

- wages for non-working paid days should not be included in the calculation of average earnings;

- the billing period is reduced by non-working paid days.

The Ministry of Labor explains this decision by the fact that payment for non-working periods is other cases of release from work with retention of salary, excluded from the calculation, according to paragraphs. “e” clause 5 “Regulations on the procedure for calculating the average salary” (approved by Government Decree No. 922 of December 24, 2007). Thus, employers who previously used the Rostrud methodology will be faced with the need to recalculate vacation pay for 2021.

Refund of unused vacation days

When recalculating, the employee's unused vacation days are returned. From the payslip and in the recalculation document itself, it is clear that the days are marked in red and have a minus sign. To monitor these changes using reports, open the “Salary - Personnel Reports” section and find “Certificate of Vacation Balances”. You can also read a detailed article about vacation balances in 1C 8.3 ZUP 3.1 on our website.

Fig. 12 Report on the use of vacations

The report reflects information about accumulated vacation days that have already been used, and when vacation days are returned, those returned after recalculation.

Order expert advice on recalculating vacation pay in 1C: ZUP

For employee Vankov A.M. after the document-correction and vacation recalculation, the return of vacation days is reflected: +9.

Fig. 13 Refund of vacation days

Using this report, the accountant can control vacation days.

Recommended calculation procedure

The calculation algorithm itself has not changed. The calculation stages consist of the following steps:

- the number of calendar days in the billing period (RP) is determined, that is, for the 12 calendar months preceding the month the vacation began. In this case, excluded days are deducted (for example, vacation at your own expense, business trip, downtime, temporary disability, etc.). If the month is fully worked, the average monthly number of calendar days is used in the calculation - 29.3 (Article 139 of the Labor Code of the Russian Federation), for months not fully worked, paid days are calculated proportionally;

- the income taken into account is summed up (amounts not related to remuneration for labor or calculated based on average earnings are not included);

- The average daily earnings are determined by dividing the amount of income by the number of days in the RP;

- the number of vacation days is multiplied by the average daily earnings - the amount of vacation pay is obtained.

When paying, the accounting department withholds personal income tax from vacation payments.

The only new rule that needs to be taken into account if the employer decides to be guided by the opinion of the Ministry of Labor is to exclude from the calculation of average earnings days and payments falling during the non-working period from March 30 to May 8, 2021.

An example of vacation pay recalculation for April 2021.

The salary of mechanic Smirnov is 18,000 rubles. On March 30 and 31, Smirnov, like all company employees, did not work. For the entire period from April 1, 2021 to March 31, 2021, earnings were accrued to him in full (including for non-working days on March 30 and 31). In April 2021, Smirnov goes on vacation for 28 days.

How the company initially accrued vacation pay to the employee (according to Rostrud’s methodology):

- salary for RP: 18,000 x 12 months. =216,000 rub.;

- average daily earnings: 216,000 / 12 months. / 29.3 = 614.33 rubles;

- vacation pay: 614.33 x 28 days. = 17,201.24 rubles;

- personal income tax withheld 13%: 17201.24 x 13% = 2236 rubles;

- Smirnov was given the amount of vacation pay in hand: 17,201.24 – 2236 = 14,965.24 rubles.

In May, the accounting department had to recalculate vacation pay for April after the Ministry of Labor issued clarifications:

- Non-working days are excluded from the RP - March 30 and 31; accordingly, the number of calendar days for calculating the average salary will change:

29.3 x 11 months. + 29.3 /31 days (calendar days in March) x 29 days. (worked by Smirnov in March 2021) = 349.7 days;

- The salary taken into account will decrease by the amount for 2 non-working days:

18,000 x 11 months + 18,000 / 21 work. days March x 19 working hours days in March = 214,285.71 rubles;

- Smirnov’s average daily earnings will be:

214 285, 71 rub. / 349.7 = 612.77 rub.

- employee's vacation pay: 612.77 x 28 = 17,157.56 rubles;

- Personal income tax on recalculated vacation pay will decrease: RUB 17,157.56. x 13% = 2230 rub. (i.e. 6 rubles were withheld excessively);

- The employee should have received: 17,157.56 – 2230 = 14,927.56 rubles.

Thus, Smirnov’s vacation pay became less: instead of 14,927.56 rubles. he received 14,965.24 rubles. The overpayment amounted to: 14,965.24 – 14,927.56 = 37.68 rubles.

As a result of recalculation of vacation pay for April, May, June 2021, the amount may not only decrease, but also increase. This will happen if accruals for March, April, May (specifically for the non-working period) have become smaller, for example, due to the lack of bonuses. Therefore, it is impossible to say for sure who will win in the end - the employee or the company. The amount of charges depends on each specific case. We described earlier in our article how to correct errors in the case of incorrectly accrued vacation pay.

Calculation of payment

If employees did not get sick, went on vacation and returned from them at strictly scheduled times, and salaries remained unchanged, the work of an accountant would be much easier.

In this case, RH is calculated using the generally accepted formula RH = SDZS*KD, where:

- SDZS – average daily earnings of an employee;

- KD – duration of vacation in days according to the calendar.

Please note that holidays extend the leave, but are not subject to payment. An employee who went on leave on the first of March for the fourteenth day of work will return to work on the sixteenth.

On March 8th, he will rest “for free”, on an equal basis with other employees.

But life situations rarely correspond to patterns, and all the reasons described above will make certain adjustments to the methods for calculating OM.

What is taken into account?

Any changes in at least one of the formula factors are taken into account:

- Reducing vacation (recalling an employee ahead of schedule).

- Dismissal of an employee who has not worked for a year but has used his vacation in advance.

- Changes to the SDZS: salary increases, payment of an annual bonus, etc.

- Indexation coefficient (with an increase in tariffs and salaries).

According to the labor legislation of our country, all well-deserved monetary remuneration must be paid to the employee, and those received but not worked out must be returned to the company’s cash desk.

But there are situations when an employee is not obliged to return to the company payments received for time not worked:

- upon liquidation of the organization and termination of activities by the employer;

- in case of staff reduction;

- in the absence of the opportunity to work the required time (conscription into the army, loss of ability to work, etc.);

- due to emergencies (natural disasters, military operations, etc.);

- having been reinstated through the court or labor inspectorate;

- in case of death of the employer, if he is an individual, and, of course, the employee himself.

In all other cases, the employer has the right to recalculate the compulsory salary and recover the “overpayment” from the resigning employee’s calculated payments, or in court.

Who does not need recalculation of vacation pay for April, May, June

Recalculation will not be required for companies and individual entrepreneurs that continued to work during the period of self-isolation from March 30 to May 8, 2021. After all, employees received wages, these days were actually fully worked, and accordingly, vacation pay was accrued correctly.

Employees who worked remotely during the self-isolation period will also have vacation without recalculation of vacation pay.

The employer may not make a recalculation if the interests of the employees are not affected - that is, in the case when the vacation pay turned out to be more than if the non-working period was excluded. However, in this case, there may be risks of illegally accounting for expenses in the taxable base for income tax or under the simplified tax system “income minus expenses.”

Terms and features of payment of vacation benefits in accordance with the Labor Code of the Russian Federation

Therefore, it is optimal to accrue and pay vacation pay 3 days before the start date of the vacation. Despite the fact that the above-mentioned article of the law does not specify the status (calendar or working) of these three days, there is a special letter from Rostrud (No. 1693-6-1 dated July 30, 2014), according to which the counting must be carried out in calendar days. Three calendar days before the start of the vacation, benefits must be paid. Administrative liability for an employer who has not notified an employee of the vacation entitled to him by law or who has committed such a violation of the Labor Code of the Russian Federation as failure to pay vacation pay on time is provided for in Art.

5.27 Code of Administrative Offenses of the Russian Federation: for officials, a warning or a fine from 1 to 5 thousand.

How will recalculation of vacation pay affect personal income tax?

Additional payment for vacation pay is subject to personal income tax in accordance with the general procedure. The tax is charged on the difference between the previously accrued amount and the recalculated amount.

Example

From May 12 to May 31, 2021, the company has extended paid non-working days for all employees, because... In the region of operation, the self-isolation regime was extended until the end of May. According to the vacation schedule, engineer Mikhailov’s annual vacation begins on June 1, 2021. Vacation pay was accrued to him in advance in the amount of 25,260 rubles. When transferring, personal income tax was withheld at 13% - 3284 rubles. Mikhailov received 21,976 rubles in his hands.

Based on clarifications from the Ministry of Labor, the company recalculated vacation pay for June 2021, excluding the paid non-working period. As a result, the amount of the engineer’s vacation pay increased and amounted to 26,120 rubles.

Amount to be paid additionally: 26,120 – 25,260 = 860 rubles. It was decided to transfer it to the employee’s card. When paying, the company withheld personal income tax of 13%, taking into account the previously withheld tax:

26,120 x 13% - 3284 = 112 rubles.

As a result of the recalculation of vacation pay for June, Mikhailov received an additional 748 rubles. (860 -112). The company transferred the tax on May 29, 2020 in the total amount: 3284 + 112 = 3396 rubles.

The deadline for transferring personal income tax on vacation pay is the last day of the month in which they are paid to the employee (clause 6 of Article 226 of the Tax Code of the Russian Federation). Therefore, when transferring tax, the payment document indicates the month when the company pays the surcharge. For example, if, when recalculating vacation pay for May, the company paid the difference to an employee in June, the tax on this difference must be transferred by the end of June.

It is more difficult to reduce the amount of vacation pay. In this case, an overpayment occurs - both for vacation pay and personal income tax. It can be taken into account when withholding overpaid funds from the employee, which can only be done with the written consent (application) of the employee. Overpayment of personal income tax can either be returned to the employee upon his application, or offset against future periods.

Method 3: excluding the last month

Vacation pay is first calculated without taking into account the salary for the last month of the pay period. When the month ends, recalculation and additional payment are made. This method is optimal when the salary has a variable part, for example, it consists of a salary and a monthly bonus, the amount of which is unknown until the end of the month.

Let's assume that the employee's earnings are a small salary and a percentage of sales (the main part). On July 26, the accountant will calculate and pay him vacation pay based on average earnings for August 2021 - June 2020. When the income for July is known, he will make an additional payment.

How to calculate vacation pay if there is a day off during the vacation period, for example, May 1? Find out the answer to this question from a calculated example from ConsultantPlus experts by receiving a free trial access.

Now you know how to correctly calculate vacation pay from the 1st. It remains to figure out what to do with taxes in each of these cases.