Income tax return 2021: form and composition

The form of the document was approved by order of the Federal Tax Service on October 19, 2016 No. ММВ-7-3/ [email protected] You can download the income tax return for 2021 below. This multi-page, universal report is used by enterprises in various industries. The following pages are required to be completed:

- Title page;

- Section 1, which indicates the amount of tax payable;

- Tax calculation on sheet 02 (with appendices to it, which contain all information about the company’s income and expenses for the reporting or tax period).

The remaining pages of the new 2018 income tax return are included in it and are completed only if the company has information to include in them.

Unified simplified declaration and financial statements

If the deadline for submitting reports falls on a non-working (weekend) day, submit it on the first working day following it (clause 47 of PBU 4/99).

March 31, 2021 is Saturday. Therefore, organizations (regardless of the applied taxation regime) must submit financial statements for 2017 to the Federal Tax Service and statistical authorities no later than 04/02/2018.

By the way, with reporting for 2021, the obligation to submit accounting forms to Rosstat is canceled for almost all organizations - you will only need to submit financial statements to the tax office (Federal Law No. 444-FZ of November 28, 2018). However, this will need to be done electronically. However, organizations belonging to small and medium-sized businesses can submit reports for 2021 on paper.

Financial statements for 2021 must be submitted no later than March 31, 2020.

Rules for filling out income tax returns

Along with the approval of the income tax return form, Order No. ММВ-7-3/ [email protected] also established the rules for entering information into it, which covers the composition of the document, general requirements for filling out and the procedure for filling out. The instructions given in Appendix 2 offer step-by-step guidance in drawing up a document on how to fill out an income tax return.

Usually, drawing up a document according to the instructions of the Federal Tax Service does not raise any questions, but there are several nuances that are worth mentioning. For example, page 210 (amount of accrued advances) of sheet 02 of the declaration for the year is filled out differently depending on how the company pays advances:

- if the transfer of monthly advances is carried out before the 28th day, then the amount recorded in lines 180 and 290 of the tax return for the organization’s income tax for 9 months is entered on page 210 of the declaration for the year;

- if the company pays advances on a monthly basis on the actual profit received, then on page 210 indicate the amount of tax on line 180 for 11 months;

- when transferring payments quarterly, page 210 contains information corresponding to the data in line 180 of the income tax return for 9 months.

Filling out the income tax return is carried out on the basis of the company’s financial statements. We invite you to familiarize yourself with the algorithm for drawing up a document using a simple example that demonstrates a step-by-step calculation procedure in accordance with the requirements of tax authorities.

Who fills it out and why?

Form 6-NDFL is a form for calculating generalized amounts of personal income tax calculated and withheld by the tax agent.

The calculation of the amounts of personal income tax calculated and withheld by the tax agent is a document containing generalized information by the tax agent on all individuals who received income from the tax agent (a separate division of the tax agent), on the amounts of income accrued and paid to them, provided tax deductions, calculated and withheld tax amounts, as well as other data serving as the basis for calculating tax.

clause 1 art. 80 of the Tax Code of the Russian Federation

Form 6-NDFL contains generalized information:

- for the calculation period: the number of individuals who received payments and the total amounts of tax withheld, not withheld and returned;

- for each applied rate: the amount of income of all individuals, deductions, taxes, advance payments;

Form 6-NDFL was approved by the Federal Tax Service of the Russian Federation by order dated October 14, 2015 N ММВ-7–11/ [email protected]

In essence, this is a report from tax agents on personal income tax, containing information necessary for a desk audit. Fill out this form when an obligation to withhold and pay personal income tax arises.

Income tax: example of filling out a declaration in 2021

Initial data:

Based on the results of the 1st quarter of 2021, the following income was received:

- from sales – 2400 thousand rubles.

- non-operating – 1000 thousand rubles.

Expenses amounted to:

- for sales – 1060 thousand rubles;

- non-operating – 42 thousand rubles.

Tax rate 20%.

Let's calculate the tax: ((2,400,000 + 1,000,000) – (1,060,000 + 42,000)) x 20% = 459,600 rubles. and draw up a declaration.

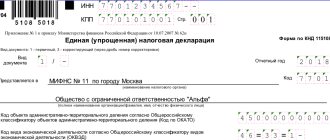

Step 1. Filling out the cover page of the income tax return

Registration of a title means entering all information about the company - basic details and full name. Any form cells that remain unfilled are crossed out. In addition to information about the company, enter:

- Correction number (for the first submission – “0—”, for subsequent submissions – numbered in ascending order – “1—”, “2—”, etc.);

- reporting period code. It depends:

- from the period itself (quarters are encrypted as follows - 21 (1 quarter), 31 (half-year), 33 (9 months), 34 - (year);

- from the payment system. For example, with monthly advance payments, the period code is numbered sequentially from 35 for January to 46 for the year;

- tax office code;

- code at the place of registration. Assigned according to the classification of the company, for example, large companies are coded with the code 213, foreign ones - 245, the majority of domestic companies - 214, etc.;

- OKVED code;

All submitted information is certified by a representative of the taxpayer.

deklaraciya_001-2.jpg

Step 2. Filling out Appendix 1 sheet 02

Despite the fact that the income tax return begins with section 1, in which the tax amount should be entered, it is more convenient to draw up the document from sheet 02, where the tax is calculated. Let's start filling out Appendix 1 of sheet 02 and enter data on income:

In line 010 – total revenue in the amount of 2,400,000 rubles, which consists of

- revenue from sales of manufactured products RUB 2,000,000. (page 011), and

- purchased goods 400,000 rub. (page 012).

Lines 011 to 014 reflect the amounts of revenue by source of income.

Line 040 of the declaration Pr.1 of sheet 02 for income tax is the total for the amount of sales revenue. Next, fill in the lines for the amounts of income from non-operating operations. According to the conditions of the problem, the company received 1,000,000 rubles. as income from previous years (p. 100). Lines 101-106 are intended to decipher income from other activities.

deklaraciya_005-2.jpg

Step 3. Filling out Appendix 2 to sheet 02

Information about expenses (losses) from all types of activities is indicated here. Lines 010-030 reflect the company's direct costs. Lines 040 and 041 are indirect. Line 041 of the income tax return requires special attention. It records costs that are indirectly related to production. It is important to clearly determine whether all of them can be taken into account when calculating income tax (Article 270 of the Tax Code of the Russian Federation).

Lines 200 – 206 are filled in with information about non-operating expenses, and lines 300 – 302 reflect losses equated to non-operating expenses.

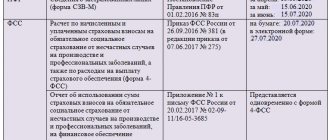

Where to submit the 6-NDFL declaration

Form 6-NDFL is submitted to the tax office at the place of registration.

Other delivery points are established if:

- individual entrepreneurs (hereinafter referred to as individual entrepreneurs) apply certain special tax regimes;

- organizations have separate divisions.

Individual entrepreneurs using special modes

Features of delivery by individual entrepreneurs are shown in the table.

Table: where to submit individual entrepreneurs in special modes

| Special tax regime | Place of submission of 6-NDFL in relation to employees engaged in activities transferred to a special regime | Reasons |

| taxation system for agricultural producers | at the place of registration of the individual entrepreneur | clause 2 art. 230 Tax Code of the Russian Federation |

| simplified taxation system | at the place of registration of the individual entrepreneur | clause 2 art. 230 Tax Code of the Russian Federation |

| taxation system in the form of a single tax on imputed income for certain types of activities (UTII) | at the place of registration of the individual entrepreneur in connection with the implementation of activities subject to a single tax on imputed income for certain types of activities | clause 2 art. 230 Tax Code of the Russian Federation |

| patent tax system | at the place of registration of the individual entrepreneur in connection with the implementation of activities subject to tax paid in connection with the application of the patent taxation system | clause 2 art. 230 Tax Code of the Russian Federation |

Example 1. Individual entrepreneur Petr Ivanovich Nektov lives in the Volkhov district, provides transport services for transporting passengers in the Lodeynopolsky and Volkhov districts. For passenger transportation services, IP Nektov applies UTII in each district. This entrepreneur submits Form 6-NDFL to various tax inspectorates: to the inter-district for the Lodeynopolsky and Podporozhye districts - for workers engaged in transport services in the Lodeynopolsky district; in the Volkhov region - in relation to other workers.

Organizations with separate divisions

Calculation of 6-NDFL for payments made to employees is submitted by:

- Russian organizations (legal entities) with separate divisions: at the place of registration of the parent organizations (for all payments except those made by separate divisions);

- at the place of registration of separate divisions (in relation to payments made to employees of separate divisions);

Example 2. Impulse LLC is registered in the Volkhov region. Since 2017, Impulse LLC has registered a separate division in the village of Domozhirovo, Lodeynopolsky district. For 2021, Impulse LLC submits Form 6-NDFL to various tax inspectorates: in the Volkhov district; to the inter-district in the Lodeynopolsky and Podporozhye districts.

Features of the submission of 6-NDFL by legal entities with separate divisions, in relation to accruals and payments under civil contracts, are shown in the table.

Table: where to submit 6-NDFL for organizations that have entered into civil agreements

| A tax agent who has entered into a civil law agreement and has separate divisions | 6-NDFL in relation to individuals who have received income under civil contracts are submitted to the tax authority at the place of registration | Base |

| Russian organization | separate division that entered into an agreement | clause 2 art. 230 Tax Code of the Russian Federation |

| Russian organization classified as the largest |

| clause 2 art. 230 Tax Code of the Russian Federation |

New from 2021

Successor organizations, if the reorganized organization fails to submit 6-NDFL until the completion of the reorganization, submit a report on this form to the tax office at the place of their registration. This is established by the fifth paragraph of Art. 230 of the Tax Code of the Russian Federation, introduced by Federal Law dated November 27, 2017 N 335-FZ.

deklaraciya_008-2.jpg

Appendix 3 to sheet 02 is drawn up if the company carried out operations to sell property or carried out activities using service industries. It states the revenue generated from the difference between income and costs. There is no such data in the example.

Appendix 4 to sheet 02 is filled out if there are losses from previous years. In the example under consideration there are none, but you should know that the tax base can be reduced by the amount of these losses, but not more than half the original tax base.

Appendix 5 is filled out by companies that have separate divisions in their structure.

Step. 4 Sheet 02 – tax calculation

After filling out the applications for which information is available, we proceed directly to the tax calculation - sheet 02. We will enter:

- in line 010 the amount of sales revenue is RUB 2,400,000.

- in line 020 the amount of non-operating income is 1,000,000 rubles;

- in line 030, the amount of sales expenses is RUB 1,060,000;

- in line 040 the amount of non-operating expenses is 42,000 rubles.

- on page 060 we display the result of the calculations - 2,298,000 rubles.

- There are no specific income excluded from profit in our example, so lines 070 and 080 are crossed out, and the general result is duplicated on page 100;

- there is also no loss reducing the basis, so page 110 is not filled out;

- page 120 reflects the tax base from which the tax is calculated - 2,298,000 rubles.

- lines 140, 150, 160 record the percentage of deductions: 20% - general, 3% - to the federal budget, 17% - to the regional budget;

- line 180 of the income tax return reflects the amount of tax to be transferred - 459,600 rubles, including line 190 - 68,940 rubles. must be listed on FB, on page 200 - 390,660 rubles. This amount is subject to transfer to regional budgets.

New in reporting

In addition to preparing reports on net profit in 2021, entrepreneurs must submit a declaration, which will indicate the amount of income received and the amount of tax transferred. Reporting for 2021 will be accepted in a new form. The annual profit report in 2021 has changed slightly compared to the previous form; the main innovations are given below:

- Lines have been added to the form to display the trade tax, by the amount of which entrepreneurs are allowed to reduce the amount of tax.

- The taxable amount can be reduced by no more than 50% when writing off losses from previous years. But at the same time, all time restrictions have been canceled (previously the period was 10 years).

- For free economic zone entities that charge tax at a reduced rate, a taxpayer attribute was added to the income tax reports for 2018.

- The declaration now has sheet 08, where residents will be able to independently adjust the amounts of tax payments and the tax base.

- Another change concerns foreign companies: sheet 09 was added to the profit reporting for 2021 to display indicators.

Registration and submission of declarations

The 2021 income return will consist of 37 sheets, but taxpayers do not have to complete all pages of the return. Sections in which there is nothing to indicate or intended for certain groups of taxpayers should also be excluded from the document. Submit income tax reports in 2018 within the deadlines established by current legislation.

In the declaration, it is necessary to fill out the title page, subsection 1.1, sheet 02 and its annexes. Subsection 1.2 was created for entities that make advance tax payments on a monthly basis, and subsection 1.3 is filled out by companies paying tax in the form of dividends. In 2021, the submission of income tax reports is carried out by all organizations working on OSNO. If officials submit income tax reports for 2021 according to the calendar, they will not have problems with the Federal Tax Service.

Deadlines for submitting documents

Deadlines for income tax reporting for 2021 have been approved, according to which responsible persons are required to bring a package of documents to the territorial divisions of the Federal Tax Service:

- the deadline for the annual profit report in 2021 is until March 28;

- for 1 sq. – until 04/28/17;

- for 2 sq. – until July 28, 2017;

- for 3 sq. – until October 28, 2017

LLC income tax reporting for 2021 is submitted in electronic format, provided that the company employed more than 100 employees during the year. Otherwise, you can submit a declaration on paper. If financial statements and profit reports are not submitted on time in 2021, penalties will be imposed on the company. Violation of the procedure for submitting documents to the Federal Tax Service is punishable by penalties in the amount of 5% of the tax amount.

Tax rate

In 2021, the income tax reporting rate will be 20%. The bet size remained the same. But as of January 1, 2017, the distribution of profits into the regional and federal parts changed. Thus, starting from 2021, 3% of the amount of taxes paid is transferred to the federal budget, and 17% to the municipal budget.

In the financial statements for 2021, profit is shown in full, but the rate may differ for different organizations. In addition, all income of a legal entity can be divided into two types: taxable and non-taxable. The list of non-taxable income is given in Article 25 of the Tax Code. The following are organizations that apply a zero tax rate:

- institutions carrying out educational or medical activities;

- subjects of social services;

- firms receiving income in the form of interest (details are specified in Article 284 of the Tax Code).

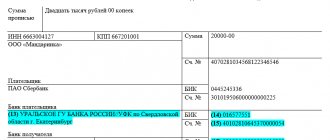

Calculation of tax payment

The calculation of income tax in 2021 in the reporting will be given using the example of Zarya LLC. This organization completed the reporting period with the following indicators:

- sales revenue – 2 million rubles. (including VAT – 300 thousand rubles);

- costs for raw materials and materials - 700 thousand rubles;

- payment of wages to working personnel - 400 thousand rubles;

- insurance payments paid – 104 thousand rubles;

- tax loss of the previous reporting period – 150 thousand rubles.

Let's determine the enterprise's expenses: (700 + 400 + 104) = 1204 thousand rubles.

Let's calculate the profit subject to taxation: (2,000 – 300 – 1204 – 150) = 346 thousand rubles.

Let's determine the amount of income tax in 2021 for reporting to the Federal Tax Service: (346 ˟ 20%) = 69.2 thousand rubles.

Who should you trust to prepare reports in 2021?

Calculation of income tax and submission of reports in 2021 are responsible activities, because the presence of gross errors in the declaration is punishable by penalties from the tax authorities. A delay in filing a declaration or failure to provide a package of documents will lead to problems with the tax authorities. Therefore, it is so important that the accountant carefully study the profit reporting calendar for 2021 and do not lose sight of the deadlines for submitting declarations.

Why should you entrust accounting, preparation of financial statements and profit statements for 2021 to specialists? The business owner must understand that he will be responsible for all mistakes and omissions of the chief accountant. And only after contacting specialists can you be sure that quarterly income tax reports in 2021 will be drawn up correctly and submitted on time. Extensive experience of employees and knowledge of all the intricacies of federal legislation is a key advantage.

We carefully select employees, so we only employ professionals in their field. Our team will help you perform all the necessary calculations and fill out papers for subsequent submission to the Federal Tax Service. We will provide profit reports for 2018 on time, so you will not have to worry about imposing penalties from the Federal Tax Service.

It doesn’t matter to us whether you are an individual entrepreneur or a large company, we will readily take on the accounting of your organization. And if you want to entrust accounting to another accountant, we will upload your information base to you at any time. All services are provided with a guarantee: if violations are revealed during an audit by the tax authorities, we will compensate you for your losses. Our clients are always satisfied with cooperation with us!

deklaraciya_004-2.jpg

Step 5. Filling out section 1 of the income tax return

After the calculations have been carried out, the final final stage begins. For companies that pay advances quarterly, as in our example, subsection 1.1 is intended. Firms making monthly payments fill out subsection 1.2

This subsection 1.1 indicates the BCC for the corresponding budgets and the amount of accrued tax.

deklaraciya_002.jpg

You can check your income tax return, or more precisely, the amounts included in it, using the financial statements, in particular, the income statement.

Having told how to declare income tax and presented a sample of filling out the declaration, we demonstrated the simplest option, with the goal of showing the sequence of document execution. In real life, when filling out a declaration, an accountant is faced with a lot of additional nuances. Therefore, he will have to familiarize himself in more detail with the instructions approved by the Federal Tax Service in order MMV-7-3/ [email protected]