Account 96 is intended to account for reserves for future expenses. The creation of reserves is regulated by PBU 08/2010. This account is used when creating a reserve for:

- Vacation pay.

- For repairs of fixed assets.

- Warranty repair.

- Reward for long service.

Let's look at some of them (below).

The reserve is created to evenly distribute expenses over the period. Account 96 is actively passive. The credit reflects the creation of the reserve, and the debit reflects the use of the reserve. In balance sheet 96, the account (balance) is reflected in the line Estimated liabilities in the liability side of the balance sheet. The formula for calculating the final balance = Credit balance + Credit turnover - debit turnover.

How reserves for future expenses are formed

The organization's reserves for future expenses consist of:

- Upcoming costs of paying vacation pay to employees;

- Costs for current repairs of equipment and fixed assets;

- Costs for warranty service and repairs;

- Other expenses of the organization.

An enterprise has the right to independently establish the procedure for calculating the reserve for paying vacation pay to employees, indicating in its accounting policy, taking into account paragraphs 15 and 16 of PBU 8/2010:

When determining the calculation base of the reserve for the repair of fixed assets or equipment, you need to take into account data on the sale of products in the reporting period, the estimated percentage of defects, statistics in the field of warranty repairs, and so on.

Please note that the annual amount of the reserve for guaranteed repairs should not exceed the arithmetic average of the amount of guaranteed repairs actually performed over the previous three years.

Having determined the annual amount of the reserve, you can calculate the amount of monthly deductions: the annual amount is divided by 12. If the amount of the reserve is deducted once a quarter, then the total annual amount is divided by 4.

The amount exceeding the organization's vacation reserve can be written off against current costs. And the balance of the organization’s vacation reserve can be transferred to the next year.

If the reserve for repairs of fixed assets and equipment is not spent in the current year, then the balance can be closed on account 99.01 “Profits and losses from activities with OSNO:

We also note that in the balance sheet the amount of the reserve is reflected in line 1540 “Reserves for future expenses.”

Which transactions contain debit 96 - credit 96?

Credit account 96 reflects the formation of the reserve, and debit indicates its write-off.

Let's consider the use of accounts Dt 96 - Kt 96 using the example of forming a reserve for upcoming holidays.

IMPORTANT! The vacation reserve includes the amount of vacation pay, compensation for unused vacation and insurance premiums.

Example 1

As of December 31, 2015, the organization created a reserve for vacation pay in 2021. The following amounts were included in the reserve:

- for management personnel - 450,000 rubles;

- for employees involved in production - 280,000 rubles;

- for sales employees - 320,000 rubles.

In its accounting, the organization will reflect the following entries for the accrual of the reserve:

- Dt 26 Kt 96 - reserve for vacations of management personnel 450,000 rubles;

- Dt 20 Kt 96 - reserve for vacations of production employees 280,000 rubles;

- Dt 44 Kt 96 - reserve for vacations of sales department employees 320,000 rubles.

As employees go on vacation, the reserve is written off.

Example 2

Taking into account the conditions of example 1, vacation pay was paid in the 1st quarter of 2021:

- for management personnel - 65,000 rubles;

- for employees involved in production - 20,000 rubles;

- for sales employees - 50,000 rubles.

In this regard, the following entries were recorded in the accounting:

- Dt 96 Kt 70 - accrual of vacation pay at the expense of the formed reserve of management personnel 65,000 rubles;

- Dt 96 Kt 70 - vacation pay for production employees 20,000 rubles;

- Dt 96 Kt 70 - vacation pay of the sales department 50,000 rubles.

In addition, it will be necessary to make an entry for the calculation of insurance premiums from the reserve Dt 96 Kt 69.

For the calculation of vacation pay, see the publication “Calculation of vacation in 2021 - examples and features.”

If the actual amount of vacation pay exceeded the amount of reserved amounts, then there are 2 options for reflecting the write-off of the reserve.

Example 3

In this example, let’s take into account the business operations of examples 1 and 2. In the 2nd quarter of 2021, vacation pay amounted to:

- for management personnel - 80,000 rubles;

- for employees involved in production - 40,000 rubles;

- for sales employees - 280,000 rubles.

The wiring will be as follows:

- Dt 96 Kt 70 - vacation pay for management personnel 80,000 rubles;

- Dt 96 Kt 70 - vacation pay for production employees 40,000 rubles;

- Dt 96 Kt 70 - sales department holiday pay 270,000 (320,000 - 50,000) rub.;

- Dt 96 Kt 69 - insurance premiums.

Option 1: expenses not covered by the reserve will be written off as a debit to the account. 44:

- Dt 44 Kt 70 - excess of the reserve by 10,000 rubles;

- Dt 44 Kt 69 - calculation of insurance premiums from the amount of excess of the reserve.

Option 2: excess reserve is reflected in Dt 97.

- Dt 97 Kt 70 - excess of reserve 10,000 rubles;

- Dt 97 Kt 69 - calculation of insurance premiums from the amount of excess of the reserve.

Account balance 97 will be written off as a debit to the account. 96 after increasing the reserve.

To calculate payments for unused vacation, see the material “How to calculate vacation pay upon dismissal in 2016?”

Postings to account 96

Typical transaction entries for account 96 “Reserves for future expenses” are shown in the table below:

| Dt accounts | CT account | Posting Contents |

| 96 | 70 | The amount of the reserve for payment of accrued vacation workers is reflected |

| 96 | 69 | The amount of accrued social payments is reflected |

| 96 | 76 | The cost of services from third-party companies written off from the organization's reserves is reflected, for example: warranty repairs, warranty service |

| 96 | 91 | The unused amount of the reserve for future expenses is included in other income |

| 08 | 96 | Reflects the amount of the organization's reserve for investments in non-current assets during construction work |

| 20 (23,29) | 96 | The accrued amount of the reserve is included in the costs of the main production (auxiliary production or service production) |

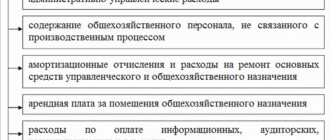

| 25 (26) | 96 | The accrued amount of the reserve is included in general production or general business expenses. |

| 44 | 96 | The accrued amount of the reserve is included in sales expenses |

What does the score 96 reflect?

In accordance with the instructions for the chart of accounts, provided for by the order of the Ministry of Finance of the Russian Federation “On approval of the Chart of Accounts of Accounting” dated October 31, 2000 No. 94n (hereinafter referred to as the Instructions), Dt 96 - Kt 96 are applied for transactions that will be reflected in subsequent periods associated With:

- payment for planned vacations;

- annual payments for length of service;

- production costs incurred in preparation for seasonal production;

- repair of fixed assets;

- warranty repairs;

- other operations provided for in the Instructions.

At the same time, depending on the specifics of the detailing of expenses to the account. 96 the following subaccounts can be opened:

- 96.01 - “Reserve for vacation pay”;

- 96.02 - “Reserves for the payment of remuneration for length of service and based on the results of work for the year”;

- 96.03 - “Reserves for repairs and warranty service”;

- 96.04 - “Other reserves”.

The organization has the right to use any analytics for subaccounts to the account. 96, which must be approved in the working chart of accounts.

Examples of transactions on account 96 in accounting

Let us study in more detail examples of transactions on account 96 “Reserves for future expenses”.

Example 1. Creating a reserve for vacation pay based on wages

The accounting policy of Vesna LLC reflects the creation of a reserve for the payment of vacation pay to employees based on wages. In this case, the reserve is accrued at the end of each month.

To calculate the reserve, we use the formula: (OT + insurance premiums) / 28 * 2.33, where

- 28 – the number of vacation days per year for each employee, according to the collective agreement;

- 2.33 – number of vacation days for 1 month worked.

Hence:

- Insurance premiums - 30.2%;

- Salary in January - 250,000 rubles;

- January reserve: (250,000 + 75,500) / 28 * 2.33;

- Vesna LLC created a reserve for vacation pay in January in the amount of RUB 27,086.

Postings for creating a reserve in Vesna LLC for deferred holidays on account 96:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 20 | 96 | 27 086 | The amount of the reserve for paying vacation pay to employees is reflected | Accounting information |

Example 2. Creating a reserve for vacation pay based on average earnings

The accounting policy of Zima LLC reflects the creation of a reserve for vacation pay based on average earnings and the number of unused vacation days. The salary of employees for the past 2016 was RUB 2,750,000. The rest of the vacation for 2021 is 30 days. The average number of days per month in 2021 is 29.3 days.

To calculate the reserve, we use the formula: (average daily earnings + insurance premiums) * vacation balance.

Reserve calculation:

- Average daily earnings: 2,750,000 / 29.3 / 12 = 7,821.39 rubles;

- Insurance premiums: 7,821.39 * 30.2% = 2,362.06 rubles;

- Reserve as of December 31, 2021: (7,821.39 + 2,362.06) * 30 = RUB 305,503.50

Zima LLC has generated entries to create a reserve for vacations on account 96:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 20 | 96 | 305 503,50 | The amount of the reserve for paying vacation pay to employees is reflected | Accounting information |

Write-off of reserves

Write-off of vacation reserve (example)

In our example, a vacation reserve was created in the amount of 124,900 rubles (100,000+22,000+2900).

During the first month, the amount of expenses for vacations of employees of the production division amounted to 60,000. The amount of contributions to pension insurance for these vacations was 13,200, insurance contributions to the Social Insurance Fund - 1,740.

Postings for writing off the vacation reserve

| Dt | CT | Sum | Operation description |

| 96.1 | 60000 | Vacation accrued to employees | |

| 96.1 | 69.2 | 13200 | Contributions to the Pension Fund have been accrued |

| 96.1 | 69.1 | 1740 | Contributions to the Social Insurance Fund have been accrued |

Postings for writing off the reserve for repairs of fixed assets

The fixed asset was repaired in the amount of 56,000 rubles.

| Dt | CT | Sum | Operation description |

| 96.2 | 10.1 | 31600 | The cost of materials used is written off against the reserve. |

| 96.2 | 20000 | Wage costs written off against the reserve | |

| 96.2 | 69.2 | 4400 | Written off from the PFR accrual reserve |

Reserve for vacation pay

A reserve for vacation pay can be created for:

-On the last day of the month.

-On the last day of the quarter.

-On December 31st of each year.

To calculate the amount of the reserve in accounting, there is no formula (in tax accounting there is a formula for calculating income tax). Let's consider a common formula for calculating the amount of the reserve:

Amount of reserve = (Amount of accrued wages in the current period of a group of employees month, quarter, year + Amount of accrued insurance premiums of a group of employees month, quarter year)*Standard

And in turn, the standard is calculated according to the formula:

Standard = Amount of vacation expenses for the previous year without insurance contributions for a group of employees / Amount of labor expenses for the previous year for a group of employees.

Comments: a group of employees is, for example, labor costs debit 26 for one group, debit 20 for another group.

Postings:

Debit 20,26,44 Credit 96 - A reserve has been created (we see that expenses increase by debit, and the amount of the reserve increases by credit).

Debit 96 Credit 70-Vacation pay accrued at the expense of the reserve. (We see that in the debit of account 96 the reserve decreases, and at the same time the debt to staff for vacation pay increases)

Debit 96 Credit 69-Insurance premiums from vacation pay are accrued at the expense of the reserve.

Account 96: typical entries

The figure below shows accounting account 96 “Reserves for future expenses” and its typical entries. To enlarge the picture, click on it.

Accounting account 96 “Reserves for future expenses.” Postings

| ★ Best-selling book “Accounting from scratch” for dummies (understand how to do accounting in 72 hours) > 8000 books purchased |

Accounting for expenses of an NPO and its property using account 96 “Reserves for future expenses”

I.A. Feldman

,

Ph.D., Professor, Moscow State University of Geodesy and Cartography

Published in the issue: Non-profit organizations in Russia No. 4 / 2004

The main and defining feature of non-profit organizations

(NPOs) is that their statutory activities are not aimed at making a profit (Fig. 1).

This follows from the essence and definition of a non-profit organization

established by Article 50 of the Civil Code of the Russian Federation.

By “statutory activity” NPOs understand the main non-entrepreneurial activity for which the organization was created. Unlike commercial organizations, whose activities are always aimed at making a profit, the statutory activities of NPOs are aimed at achieving public benefits (Article 2 of the Federal Law “On Non-Profit Organizations

”).