When carrying out delivery and peddling retail trade, persons wishing to switch to paying a single tax

Tax Code >> Chapter 30 Article 372 General provisions Article 373 Taxpayers Article 374

Questions discussed in the material: What laws regulate the taxation system of a non-profit organization? What are the features of taxation?

Hello, dear readers! As soon as an individual entrepreneur has concluded a civil or employment contract with

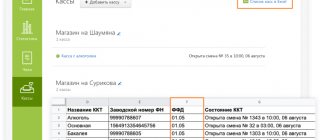

From July 1, 2021, all organizations are subject to a common taxation system and a simplified tax system, and

Transport tax rates in Moscow in the table Rules for collecting tax fees for transport in

As always, we will try to answer the question “How to Reflect Maternity Pay in the RSV 2020”. A

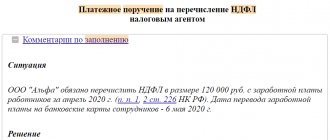

What to consider when filling out payments to the budget from 2021 According to the order of the Ministry of Finance dated

Home — Articles Some entrepreneurs do not conduct their business where they live. If the activity

Compensation to an employee for the use of his personal property is discussed in Article 188 of the Labor Code of the Russian Federation.