01/02/2021 When purchasing real estate in 2013 (2012, 2011, 2010 and earlier), property deduction

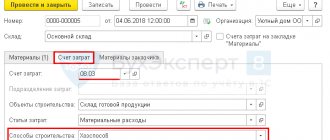

Step-by-step instructions The organization decided to build an additional warehouse for storing finished products on its own. In

In order to implement the Moscow Law of November 5, 2003, dated November 5, 2003

Report on financial results The need to submit a report to the Federal Tax Service and its form are established by three

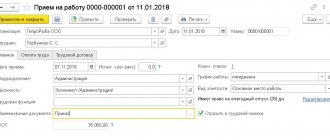

SZV-M report: general description There are a lot of reporting forms in the Pension Fund of Russia, but in 2021

What it is? Repatriation of foreign exchange earnings is the return by a resident of foreign exchange earnings that he

Law No. 290-FZ, which amended Law No. 54-FZ, with its Article 7 (clause 7) allows some

The operation of fixed assets (FPE) in the production and economic activities of any enterprise is inevitably accompanied by their wear and tear, which

An ordinary desk audit of a document submitted upon completion may turn out to be an unpleasant “surprise” for a company or individual entrepreneur.

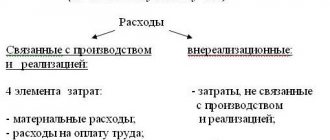

The company incurs various types of expenses to ensure its own functioning. Not all of them have a direct connection