Compensation to an employee for the use of his personal property is discussed in Article 188 of the Labor Code of the Russian Federation. Moreover, the specialist must use the car with the consent (knowledge) of the employer and in the interests of the latter. The agreement must be formalized in writing, for example, in an additional agreement to the employment contract. Otherwise, the employee will not be able to claim compensation. It is useless to turn to the servants of Themis for help (appeal rulings of the St. Petersburg City Court dated April 5, 2018 No. 33-7704/2018, Perm Regional Court dated August 16, 2017 No. 33-8949/2017 and the Moscow City Court dated November 14, 2014 No. 33- 23925/2014).

Moreover, the employer has the right to prohibit employees from using personal transport when performing work duties. If an individual is provided with everything necessary for work, compensation can definitely be forgotten (Appeal ruling of the Moscow City Court dated 04/08/2015 No. 33-11579/2015).

It’s another matter if the necessary conditions were not created for the specialist, and therefore he had to spend money. In this case, the court may oblige the employer to pay compensation to the employee, even in the absence of a written agreement on it (Appeal ruling of the Volgograd Regional Court dated July 11, 2013 No. 33-7602/2013).

Personal income tax

Compensation payments (compensation for the use of a car and the amount of reimbursement of expenses associated with its use) are not subject to personal income tax within the limits established by current legislation (clause 3 of article 217 of the Tax Code of the Russian Federation, article 188 of the Labor Code of the Russian Federation).

Situation: is an organization obliged to apply the norms provided for by Decree of the Government of the Russian Federation of February 8, 2002 No. 92 when calculating personal income tax on compensation for the use of a personal car?

Answer: no, you are not obliged to.

All types of compensation payments (within the limits of the norms) established in accordance with the law and related to the performance of labor duties are exempt from personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation). Chapter 23 of the Tax Code of the Russian Federation does not establish compensation standards for the use of an employee’s personal car. Therefore, in this situation, the organization should be guided by the provisions of the Labor Code of the Russian Federation.

Article 188 of the Labor Code of the Russian Federation, which obliges the organization to pay compensation to employees for the use of personal property, does not contain any restrictions regarding their amount. It only says that the amount of reimbursement for expenses associated with the use of an employee’s property is determined by agreement of the parties to the employment contract. Thus, compensation for the use of an employee’s personal car does not need to be subject to personal income tax up to the amount specified in the written agreement between the employee and the employer.

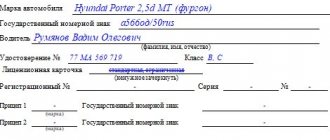

In this case, the organization must document the validity of the appointment and the amount of compensation for the use of the employee’s personal car, as well as the fact that he incurred expenses. In particular, you need to have the following documents:

- confirming the organization’s need to use an employee’s car;

- evidence that the car belongs to this employee (for example, a copy of the vehicle passport (PTS));

- justifying the calculation of the amount of compensation (for example, an order assigning compensation). Determine the amount of compensation for each employee based on the brand and price of fuel per liter, fuel consumption per 100 km, number of working days in a month, vehicle mileage;

- confirming the actual use of the car in the interests of the organization (for example, orders, waybills);

- expense reports, cash receipts, etc.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated June 28, 2012 No. 03-03-06/1/326, dated March 24, 2010 No. 03-04-06/6-47, dated December 23, 2009 No. 03- 04-07-01/387 (brought to the attention of the tax inspectorates by letter of the Federal Tax Service of Russia dated January 27, 2010 No. MN-17-3/15).

This approach is confirmed by arbitration practice (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated January 30, 2007 No. 10627/06, FAS of the Ural District dated March 18, 2008 No. Ф09-511/08-С2, North Caucasus District dated 17 April 2007 No. F08-4799/2006, Volga District dated August 19, 2008 No. A06-6865/07, dated April 10, 2007 No. A72-7503/06-7/283, Northwestern District dated January 23 2006 No. A26-6101/2005-210).

Situation: is it necessary to withhold personal income tax from the amount of compensation payments (compensation for the use of a car and the amount of reimbursement for expenses associated with its use) if an employee drives a car that is registered to another person?

Answer: yes, it is necessary.

All types of compensation payments established by law, related, in particular, to the performance of work duties by an employee (clause 3 of Article 217 of the Tax Code of the Russian Federation) are exempt from personal income tax.

According to Article 188 of the Labor Code of the Russian Federation, compensation is paid to the employee for the use of a personal car in the interests of the employer, and expenses associated with its use are also reimbursed (in the amount established by agreement of the parties to the employment contract). Compensation payments for the use of property that does not belong to the employee are not provided for by the Labor Code of the Russian Federation.

Thus, the compensation payment is considered legally established and, accordingly, is not subject to personal income tax only if the car is the personal property of the employee. This, in turn, implies that the car is owned by the person. If an employee drives a car registered to another person, then such a vehicle is not considered his personal property, and the amount of compensation payment is subject to personal income tax on a general basis.

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated May 3, 2012 No. 03-03-06/2/49, dated February 21, 2012 No. 03-04-06/3-42, dated September 21, 2011 No. 03- 04-06/6-228 and the Federal Tax Service of Russia dated October 25, 2012 No. ED-4-3/18123.

However, there is an exception to this order. It concerns the case when the car is jointly owned by an employee and another person. This situation may arise, for example, if the car is joint property of the spouses. As a general rule, property acquired by spouses during marriage is their joint property, unless otherwise established by agreement between them (Clause 1, Article 256 of the Civil Code of the Russian Federation, Article 34 of the Family Code of the Russian Federation). And in this case, the employee driving the car, which is jointly owned, is one of the owners of the car, that is, the car is considered his personal property. Accordingly, the amount of compensation payment for the use of the car is exempt from personal income tax on the basis of paragraph 3 of Article 217 of the Tax Code of the Russian Federation. Such clarifications are contained in the letter of the Ministry of Finance of Russia dated May 3, 2012 No. 03-03-06/2/49.

Advice: there are arguments in favor of organizations not withholding personal income tax from the amount of compensation payments if an employee drives a car registered to another person, and in other cases. They are as follows.

The concept of personal property is absent in the legislation. Therefore, the personal property of an employee can be recognized as property that belongs to him on any legal basis. A person (organization) has the right to issue a power of attorney to an employee to drive a car. A power of attorney is a written authority issued by one person to another for representation before third parties (Clause 1 of Article 185 of the Civil Code of the Russian Federation). Therefore, it can be recognized as the legal basis for ownership of the vehicle. That is, a car that a person uses by proxy can be considered his personal property. Since the employee uses the car in the interests of the organization, compensation payments for the operation of a car driven by proxy are not subject to personal income tax (clause 3 of Article 217 of the Tax Code of the Russian Federation). The legitimacy of this approach is also confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the Ural District dated April 22, 2014 No. F09-1388/14).

In this case, the organization must document the validity of the appointment and the amount of compensation payments for the use of the employee’s personal car, as well as the fact that the employee incurred expenses.

Following this position in practice, check whether the payments made to the employee are truly compensation. For example, this condition is not met when the power of attorney is issued to the employee by the employing organization, which is the owner of the car and bears the costs of its maintenance and operation. If the organization makes any payments to the employee for the use of the car, then personal income tax must be withheld from these payments. This is explained by the fact that the employee is not entitled to compensation at all, since he does not incur any expenses. This conclusion follows from the totality of the provisions of Articles 164 and 188 of the Labor Code of the Russian Federation. Accordingly, payments to the employee will not be considered compensation.

This is evidenced by arbitration practice:

| Details of the court decision | Court verdict |

| Resolution of the Federal Antimonopoly Service of the Volga District dated May 30, 2012 No. A12-15477/2011 | The company had the right to declare the costs of compensation amounts for used personal vehicles; there was no mandatory condition for maintaining waybills. |

| Resolution of the Federal Antimonopoly Service of the Moscow District dated December 19, 2011 No. A40-152815/10-116-694 | The tax authority's arguments about the need to keep records of business trips and issue waybills were rightfully rejected by the courts, since the issuance of waybills when using personal cars is not provided for by current legislation. |

| Resolution of the Federal Antimonopoly Service of the West Siberian District dated January 19, 2009 No. F04-8171/2008(18850-A70-40) | The Inspectorate’s argument about the need in the case under consideration to have waybills is normatively unfounded. |

Insurance premiums

The standards established by law must also be taken into account when calculating:

- contributions to compulsory pension (social, medical) insurance;

- contributions for insurance against accidents and occupational diseases.

Within their limits, compensation for the use of an employee’s personal car is not subject to insurance premiums (subparagraph “and” paragraph 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 10, subparagraph 2, paragraph 1 of Art. 20.2 of the Law of July 24, 1998 No. 125-FZ).

The norms provided for by Decree of the Government of the Russian Federation of February 8, 2002 No. 92 are intended only for calculating income tax. Therefore, in order to calculate contributions, apply the standards established in accordance with Article 188 of the Labor Code of the Russian Federation. Namely: the amount of compensation agreed upon by the parties to the employment (collective) agreement. Within these limits, insurance premiums do not need to be charged on compensation for the use of an employee’s personal car. In this case, the amount of compensation will not be subject to contributions only if the use of the car is related to the employee’s performance of his job duties (traveling nature of work, official purposes) (subclause “and” clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 10, sub-clause 2, clause 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

A similar point of view is reflected in the letter of the Ministry of Health and Social Development of Russia dated March 12, 2010 No. 550-19, paragraph 3 of the letter of the Ministry of Health and Social Development of Russia dated August 6, 2010 No. 2538-19.

Situation: is it necessary to charge insurance premiums on the amount of compensation for the use of a car and the amount of reimbursement of expenses associated with this if the employee does not drive his own car?

Answer: yes, it is necessary.

Compensation for the use of a car and related expenses is not subject to insurance premiums only when the car is owned by the employee. That is, the title and vehicle registration certificate are issued to him, and not to someone else. And the employee submitted copies of such documents to the accounting department.

The fact is that all types of compensation payments established by law, related, in particular, to the employee’s performance of work duties, are exempt from insurance contributions (sub-clause “and” clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212 -FZ, paragraph 10 subparagraph 2 clause 1 article 20.2 of the Law of July 24, 1998 No. 125-FZ).

The procedure for paying compensation for the use of employee property (including a car) is established by Article 188 of the Labor Code of the Russian Federation. It says here that for the use of a personal car in the interests of the employer, the employee is paid compensation, and the expenses associated with its use are also reimbursed. The amount of such compensation is specified in the employment contract. But compensation payments for the use of property that does not belong to the employee are not provided for by the Labor Code.

It turns out that the compensation payment is considered legally established and, accordingly, is not subject to insurance premiums only if the car is the personal property of the employee. This, in turn, implies that the car is owned by a person (including jointly, for example, with a spouse), which is documented (for example, copies of the title and vehicle registration certificate).

When an employee drives a car that is registered to another person, such a vehicle is not considered his personal property. This means that the amount of compensation payment is subject to insurance premiums.

Similar conclusions follow from the letter of the Ministry of Labor of Russia dated February 26, 2014 No. 17-3/B-92 and paragraph 3 of the letter of the Ministry of Health and Social Development of Russia dated August 6, 2010 No. 2538-19.

Advice: insurance premiums may not be charged on the amount of compensation paid, even if the employee drives a car registered to another person. But in this case, be prepared for disputes with inspectors. The following arguments will help here.

The concept of “personal property” is absent in the legislation. Therefore, any property that belongs to a person on any legal basis can be recognized as such. Such a basis may also be a power of attorney to drive a car. After all, this is a document that confirms in writing a person’s authority in relation to a thing (clause 1 of Article 185 of the Civil Code of the Russian Federation). That is, the car transferred to the employee by proxy is actually in his possession and use.

And since the employee uses the car in the interests of the organization, compensation payments for operating the car under a power of attorney are not subject to insurance premiums (subclause “and” clause 2, part 1, article 9 of the Law of July 24, 2009 No. 212-FZ, paragraph 10 subparagraph 2, paragraph 1, article 20.2 of the Law of July 24, 1998 No. 125-FZ).

The legitimacy of this position is confirmed by arbitration practice (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated January 24, 2014 No. VAS-4/14, the resolution of the Federal Antimonopoly Service of the Ural District dated September 23, 2013 No. F09-9554/13, dated May 29, 2013 No. F09-4358/13, Volga District dated October 9, 2012 No. A12-2881/2012).

In this case, the organization must document the amount of compensation payments, their validity, as well as the fact that the employee actually incurred expenses.

In this case, the organization can:

- use the employee's car for business purposes;

- rent a car with crew;

- rent a car without a crew;

- draw up a contract for free use (loan).

Let's consider the procedure for accounting for compensation payments for the use of an employee's personal transport for business purposes.

Income tax

Compensation for the use of an employee’s personal car for business trips will reduce taxable profit only within the limits established by Decree of the Government of the Russian Federation of February 8, 2002 No. 92. Compensation within the limits is included in other expenses associated with production and sales (subclause 11 Clause 1 of Article 264 of the Tax Code of the Russian Federation).

Cost standards for payment of compensation are established depending on the engine size of a passenger car. If the engine capacity is less than 2000 cc. cm (inclusive), then the compensation rate will be 1200 rubles. per month. If the engine capacity is over 2000 cc. cm – 1500 rub. per month. For motorcycles, the monthly compensation rate is set at 600 rubles.

Amounts of compensation exceeding the standards established by Decree of the Government of the Russian Federation of February 8, 2002 No. 92 cannot be included in expenses. Consequently, they do not reduce taxable profit (clause 38, article 270 of the Tax Code of the Russian Federation). In accounting, the amount of compensation is recognized as expenses in full. Because of this, a permanent difference and a permanent tax liability will arise (clauses 4 and 7 of PBU 18/02).

Situation: is it possible to take into account compensation for the use of an employee’s personal truck (minibus) when calculating income tax?

Answer: yes, you can.

For the use of an employee’s personal property for official purposes, the organization must pay him compensation (Article 188 of the Labor Code of the Russian Federation). This rule fully applies not only to cars, but also to trucks.

In relation to passenger cars, compensation for their use for business purposes is taken into account when calculating income tax within the limits of the norms.

The costs of paying compensation for the use of personal trucks (minibuses) of employees are not provided for in Chapter 25 of the Tax Code of the Russian Federation.

However, the list of other expenses associated with production and (or) sales is open (Article 264 of the Tax Code of the Russian Federation). Therefore, if all necessary conditions are met, compensation to employees for the use of their personal trucks (minibuses) for business purposes can be taken into account when calculating income tax in full (subclause 49, clause 1, article 264 of the Tax Code of the Russian Federation). That is, in the amounts agreed upon by the parties to the labor (collective) agreement (Article 188 of the Labor Code of the Russian Federation).

This conclusion follows from letters of the Ministry of Finance of Russia dated March 18, 2010 No. 03-03-06/1/150, dated August 15, 2005 No. 03-03-02/61.

It should be noted that with regard to compensation for the use of a minibus, the Russian Ministry of Finance indicated that subparagraph 11 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation allows only compensation for the use of an employee’s personal car to be included in expenses (letter of the Russian Ministry of Finance dated April 24, 2008 No. 03 -03-06/1/293). At the same time, the letter does not say anything about the possibility of taking into account compensation for the use of a minibus in expenses on the basis of subparagraph 49 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

However, in connection with the release of later clarifications from the financial department, which allows compensation for the use of modes of transport other than passenger cars to be taken into account in expenses (letter dated March 18, 2010 No. 03-03-06/1/150), when attributing them to compensation expenses for the use of a minibus, the organization can be guided by them.

Advice: when using an employee’s personal car, the organization also has the right to enter into a vehicle rental agreement with him. In this case, instead of compensation, the employee will need to pay rent. It will completely reduce taxable profit (subclause 10, clause 1, article 264 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 24, 2008 No. 03-03-06/1/293).

Situation: is it possible to take into account the costs of purchasing fuel and lubricants when taxing profits if the organization reimburses them to the employee in addition to compensation for the use of a personal car?

Answer: no, you can't.

The standards approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92 already include compensation for all costs arising during operation (wear, fuel, lubricants, maintenance, repairs). Therefore, an organization that, in addition to paying compensation according to these standards, also reimburses an employee for the cost of fuel and lubricants, does not have the right to take into account the costs of purchasing fuel and lubricants when taxing profits.

Similar conclusions are contained in letters of the Ministry of Finance of Russia dated September 23, 2013 No. 03-03-06/1/39239, Federal Tax Service of Russia for Moscow dated March 4, 2011 No. 16-15/020447). This position is supported by some arbitration courts (see, for example, the ruling of the Supreme Arbitration Court of the Russian Federation dated January 29, 2009 No. VAS-495/09, the resolution of the Federal Antimonopoly Service of the Ural District dated December 8, 2008 No. F09-9153/08-S3).

Advice: to take into account the costs of fuel and lubricants when calculating your income tax, instead of paying compensation, enter into a vehicle rental agreement with your employee.

In this case, the costs of fuel and lubricants can be included in expenses when taxing profits, both when they are included in the rent, and when they are paid separately (letters of the Ministry of Finance of Russia dated February 13, 2007 No. 03-03-06/1/81, dated November 29, 2006 No. 03-03-04/1/806). The legitimacy of this approach is confirmed by arbitration practice (see, for example, the resolution of the Federal Antimonopoly Service of the North-Western District dated February 20, 2006 No. A44-3149/2005-9).

Situation: can compensation for the use of an employee’s car be taken into account when calculating income tax if the car is registered to another person?

The answer to this question depends on who the car is registered to.

As a general rule, subclause 11 of clause 1 of Article 264 of the Tax Code of the Russian Federation allows you to reduce taxable profit by the amount of compensation for the use of an employee’s personal car (within the limits of the norms approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92).

If the car is jointly owned by an employee and another person, the amount of compensation can be taken into account when calculating income tax. This situation may arise, for example, if the car is joint property of the spouses. As a general rule, property acquired by spouses during marriage is their joint property, unless otherwise established by agreement between them (Clause 1, Article 256 of the Civil Code of the Russian Federation, Article 34 of the Family Code of the Russian Federation). And in this case, the employee driving the car is one of the owners of the car, that is, the car is considered his personal property. And, accordingly, the norms of subparagraph 11 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation clearly apply to the amount of compensation for its use. Similar conclusions follow from letters of the Ministry of Finance of Russia dated December 5, 2012 No. 03-03-06/1/629 and dated May 3, 2012 No. 03-03-06/2/49.

The car can be registered to the employing organization, which is the owner of the car and bears the costs of its maintenance and operation. If an organization makes any payments to an employee for the use of a car, do not take such payments into account when calculating income tax. This is explained by the fact that in this case the employee is not entitled to compensation at all, since he does not incur any expenses. This conclusion follows from the totality of the provisions of Articles 164 and 188 of the Labor Code of the Russian Federation. Accordingly, the payment to the employee will not be considered compensation.

The question of whether compensation for the use of a car in other cases can be taken into account when calculating income tax is controversial.

According to experts from the Ministry of Finance of Russia, for the purposes of Chapter 25 of the Tax Code of the Russian Federation, only property that an employee owns by right of ownership is recognized as personal property. That is, it is possible to reduce taxable profit by the amount of compensation for the use of an employee’s personal car if the person is its owner. Accordingly, compensation that an organization pays to an employee who drives a car that is registered to another person (except for the case where the employee owns the car as joint property) cannot be taken into account when taxing profits. Such conclusions follow from letters of the Ministry of Finance of Russia dated December 5, 2012 No. 03-03-06/1/629, dated May 3, 2012 No. 03-03-06/2/49, dated March 18, 2010 No. 03- 03-06/1/150.

At the same time, Chapter 25 of the Tax Code of the Russian Federation does not contain requirements that the employee be the owner of the car. The concept of personal property is absent in the legislation. Therefore, the personal property of an employee can be recognized as property that belongs to him on any legal basis. A person (organization) has the right to issue a power of attorney to an employee to drive a car. A power of attorney is a written authority issued by one person to another for representation before third parties (Clause 1 of Article 185 of the Civil Code of the Russian Federation). Therefore, it can be recognized as the legal basis for ownership of the vehicle. That is, a car that a person uses by proxy can be considered his personal property. Since the employee uses the car in the interests of the organization, compensation payments for the operation of the car can be taken into account when taxing profits (within the limits of the norms approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92). But if the conditions provided for in Article 252 of the Tax Code of the Russian Federation are met:

- compensation must be economically justified. It can only be taken into account if the employee’s work involves traveling;

- compensation must be documented. To do this, it must be paid on the basis of an order from the head of the organization, which specifies the amount of compensation.

Previously, specialists from the financial department recognized the possibility of taking into account compensation in expenses if an employee uses a car by proxy (without putting forward conditions regarding ownership) (letter of the Ministry of Finance of Russia dated December 27, 2010 No. 03-03-06/1/812). A similar position is reflected in the letter of the Federal Tax Service of Russia for Moscow dated January 13, 2012 No. 20-15/001797.

Taking into account the later position of the Russian Ministry of Finance, risks may arise when including in tax expenses amounts of compensation for an employee who drives a car registered to another person (and is not the owner of the car). Arbitration practice on this issue has not yet developed.

Compensation amount

As already noted, the amount of compensation taken into account for the purpose of calculating income tax is standardized.

Since the normalized value, as a rule, does not cover the actual expenses incurred by the employee, the question arises: is it possible to take into account the costs associated with refueling a vehicle with fuel and lubricants, routine repairs in excess of the compensation amount? In the Determination of the Supreme Arbitration Court of the Russian Federation dated January 29, 2009 No. VAS-495/09, the judges concluded that compensation of expenses reimburses the costs of operating a passenger car: the amount of wear and tear, the cost of fuels and lubricants, maintenance and routine repairs. Thus, the amount of compensation established by law already takes into account the reimbursement of the full amount of costs arising during operation. This position is shared by the Ministry of Finance of the Russian Federation (Letter dated September 23, 2013 No. 03-03-06/1/39239) and the Federal Tax Service of the Russian Federation for Moscow (Letter dated February 22, 2007 No. 20-12/016776).

ACCOUNTING SERVICES

Point at which expenses are recognized

Both under the accrual method and under the cash method, the moment of recognition in tax accounting of expenses in the form of compensation for the use of a personal car will be the date of transfer of money from the current account (payment from the cash register) (subclause 4, clause 7, article 272, clause 3, art. 273 of the Tax Code of the Russian Federation).

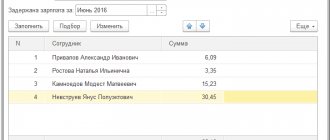

An example of how expenses for payment of compensation for the use of an employee’s personal car for business trips are reflected in taxation

The organization applies a general taxation system. To calculate income tax, the organization uses the standards approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92.

In April, employee of Alfa CJSC A.S. Kondratiev was accrued and paid compensation for the use of his personal car for business trips.

The amount of compensation is 3000 rubles. per month. The amount of compensation is set taking into account the employee’s expenses for maintaining a car, purchasing gasoline, etc. (order on the assignment of compensation). The car's engine capacity is 2500 cubic meters. cm.

Alpha pays income tax monthly and uses the accrual method.

The compensation rate for cars with an engine capacity of more than 2000 cc. cm is 1500 rub. per month (Resolution of the Government of the Russian Federation of February 8, 2002 No. 92). Up to this amount, compensation will reduce the organization's taxable income. Excess amount of compensation in the amount of 1500 rubles. (3000 rubles – 1500 rubles) will not affect the calculation of income tax.

When calculating personal income tax, the Alpha accountant does not apply the norms of Decree of the Government of the Russian Federation of February 8, 2002 No. 92. Therefore, the entire amount of compensation (3,000 rubles) is not subject to personal income tax.

Compensation within the amounts established by the order (3000 rubles/month) is not subject to contributions for compulsory pension (social, medical) insurance and insurance against accidents and occupational diseases.

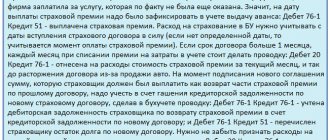

In April, Alpha’s accountant made the following accounting entries:

Debit 26 Credit 73 – 3000 rub. – compensation has been accrued for the use of a car for business trips;

Debit 99 subaccount “Continuous tax liabilities” Credit 68 subaccount “Calculations for income tax” - 300 rubles. (RUB 1,500 × 20%) – reflects a permanent tax liability that arose due to the excess of the amount of compensation over the norms established by law for calculating income tax.

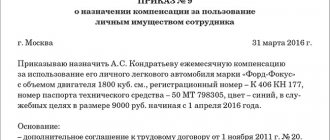

Order to pay compensation for the use of a personal car

To calculate and pay compensation, it is not enough to receive an application from the employee. The head of the company must issue an appropriate order. Such a document is drawn up in any form, taking into account all the required details.

An integral part of the order is its number and date.

After this, it is written down on the basis of which the order was drawn up. Most often, Article 188 of the Labor Code of the Russian Federation and the details of the employment contract or additional agreement to it are prescribed here.

Next, point by point, you need to write down in detail the total amount of compensation per month. What kind of machine is used in the work and its main characteristics. For what expenses is compensation calculated? On what day is the payment made and under what conditions?

At the bottom is the signature of the director, the accounting employee and the employee himself.

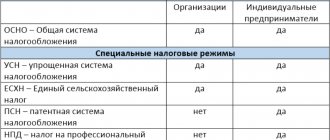

simplified tax system

If an organization has chosen income as the object of taxation, then the costs of paying compensation for the use of an employee’s personal car do not reduce the single tax. With this object of taxation, no expenses are taken into account, including expenses for salaries and other payments to employees of the organization (clause 1 of Article 346.18 of the Tax Code of the Russian Federation).

Simplified organizations that pay a single tax on the difference between income and expenses can include compensation for the use of an employee’s personal car as an expense that reduces the tax base. But only within the limits established by the Government of the Russian Federation. This is stated in subparagraph 12 of paragraph 1 of Article 346.16 of the Tax Code of the Russian Federation. Recognize costs only after they have actually been paid (clause 2 of Article 346.17 of the Tax Code of the Russian Federation).

The maximum amount of compensation that can be taken into account when taxing organizations on a simplified basis is established by Decree of the Government of the Russian Federation of February 8, 2002 No. 92. The cost norms for payment of compensation depend on the engine size of the passenger car. If the engine capacity is less than 2000 cc. cm (inclusive), then the compensation rate will be 1200 rubles. per month. If the engine capacity is over 2000 cc. cm – 1500 rub. per month.

Amounts of compensation exceeding these standards cannot be included in the organization’s expenses. Consequently, they will not reduce the tax base for the single tax during simplification (clause 1 of Article 346.16 of the Tax Code of the Russian Federation).

Similar conclusions are contained in the letter of the Ministry of Finance of Russia dated January 31, 2013 No. 03-11-11/38.

Situation: is it possible to take into account compensation for the use of an employee’s personal truck when calculating the single tax on the difference between income and expenses? The organization applies simplification.

Answer: no, you can't.

The list of expenses that reduce the tax base for the single tax is closed (clause 1 of Article 346.16 of the Tax Code of the Russian Federation). It allows you to take into account for taxation only those compensations that are paid for the use of personal cars and motorcycles (within the limits established by Decree of the Government of the Russian Federation of February 8, 2002 No. 92). Reimbursement for the use of personal trucks cannot be included in expenses.

Advice: to pay an employee money for the use of his personal truck, enter into a vehicle rental agreement with him. In this case, instead of compensation, the employee will need to pay rent. It will completely reduce the taxable income of the organization (subclause 4, clause 1, article 346.16 of the Tax Code of the Russian Federation).

Situation: when calculating the single tax on the difference between income and expenses, is it possible to take into account compensation for the use of an employee’s car if the car is registered to another person?

Answer: no, you can't.

Subclause 12 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation allows you to reduce the tax base for the single tax by the amount of compensation for the use of an employee’s personal car (within the limits of the norms approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92).

If the car is jointly owned by an employee and another person, then the amount of compensation can be taken into account when calculating the single tax. This situation may arise, for example, if the car is joint property of the spouses. As a general rule, property acquired by spouses during marriage is their joint property, unless otherwise established by agreement between them (Clause 1, Article 256 of the Civil Code of the Russian Federation, Article 34 of the Family Code of the Russian Federation). And in this case, the employee is one of the owners of the car, that is, the car is considered his personal property. And, accordingly, the norms of subclause 12 of clause 1 of Article 346.16 of the Tax Code of the Russian Federation clearly apply to the amount of compensation for its use. Similar conclusions follow from letters of the Ministry of Finance of Russia dated December 5, 2012 No. 03-03-06/1/629 and dated May 3, 2012 No. 03-03-06/2/49.

The car can be registered to the employing organization, which is the owner of the car and bears the costs of its maintenance and operation. If the organization makes any payments to the employee for the use of the car, then do not take such payments into account when calculating the single tax. This is explained by the fact that in this case the employee is not entitled to compensation at all, since he does not incur any expenses. This conclusion follows from the totality of the provisions of Articles 164 and 188 of the Labor Code of the Russian Federation. Accordingly, the payment to the employee will not be considered compensation.

The question of whether compensation for the use of a car in other cases can be taken into account when calculating the single tax is controversial.

According to experts from the Russian Ministry of Finance, only property that an employee owns by right of ownership is recognized as personal property. That is, it is possible to reduce income by the amount of compensation for the use of an employee’s personal car if the person is its owner. Accordingly, the compensation that an organization pays to an employee driving a car that is registered to another person (except for the case where the employee owns the car as joint property) cannot be taken into account when calculating the single tax. Such conclusions follow from letters of the Ministry of Finance of Russia dated December 5, 2012 No. 03-03-06/1/629, dated May 3, 2012 No. 03-03-06/2/49 and dated March 18, 2010 No. 03- 03-06/1/150.

At the same time, Chapter 26.2 of the Tax Code of the Russian Federation does not contain requirements that the employee be the owner of the car. The concept of personal property is absent in the legislation. Therefore, the personal property of an employee can be recognized as property that belongs to him on any legal basis. A person (organization) has the right to issue a power of attorney to an employee to drive a car. A power of attorney is a written authority issued by one person to another for representation before third parties (Clause 1 of Article 185 of the Civil Code of the Russian Federation). Therefore, it can be recognized as the legal basis for ownership of the vehicle. That is, a car that a person uses by proxy can be considered his personal property. Since the employee uses the car in the interests of the organization, compensation payments for the operation of the car can be taken into account when calculating the single tax (within the limits of the norms approved by Decree of the Government of the Russian Federation of February 8, 2002 No. 92), but subject to the conditions provided for in paragraph 2 of Article 346.16 and Article 252 of the Tax Code of the Russian Federation:

- compensation must be economically justified. It can only be taken into account if the employee’s work involves traveling;

- compensation must be documented. To do this, it must be paid on the basis of an order from the head of the organization, which specifies the amount of compensation.

Previously, specialists from the financial department recognized the possibility of taking into account compensation in expenses if an employee uses a car by proxy (without putting forward conditions regarding ownership) (letter of the Ministry of Finance of Russia dated December 27, 2010 No. 03-03-06/1/812). A similar position is reflected in the letter of the Federal Tax Service of Russia for Moscow dated January 13, 2012 No. 20-15/001797.

Taking into account the later position of the Russian Ministry of Finance, risks may arise when including in tax expenses amounts of compensation for an employee who drives a car registered to another person (and is not the owner of the car). Arbitration practice on this issue has not yet developed.

Despite the fact that the above letters are addressed to income tax payers, the conclusions drawn in them can also be extended to simplified organizations (the norms of subclause 12 of clause 1 of Article 346.16 are similar to the wording of subclause 11 of clause 1 of Article 264 of the Tax Code of the Russian Federation).

The need to issue waybills

The Tax Code of the Russian Federation does not directly require the issuance of waybills for payment of compensation for the use of an employee’s personal car for business purposes.

However, in order to recognize expenses, it is necessary to comply with the general principle of documentary evidence and economic justification of expenses (Article 252 of the Tax Code of the Russian Federation).

Many letters from the Ministry of Finance of the Russian Federation and the Federal Tax Service of the Russian Federation are devoted to the issue of the need to issue waybills when paying compensation to workers. Thus, according to the regulatory authorities (Letters of the Ministry of Finance of the Russian Federation dated September 23, 2013 No. 03-03-06/1/39406, dated April 13, 2007 No. 14-05-07/6, dated December 29, 2006 No. 03 -05-02-04/192, dated November 16, 2006, No. 03-03-02/275, Federal Tax Service of the Russian Federation for Moscow, dated January 13, 2012, No. 20-15/ [email protected] , dated February 22, 2007 No. 20-12/016776, dated September 20, 2005 No. 20-12/66690), the organization must keep records of business trips in travel vouchers. It is the waybills that confirm the actual use of property in the interests of the employer (Letter of the Ministry of Finance of the Russian Federation dated June 27, 2013 No. 03-04-05/24421).

Indeed, the manager’s order to establish compensation payments in itself is not a primary accounting document (Article 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”) and it will not be enough to confirm the costs actually incurred by the employee. But, if the taxpayer has other documents confirming expenses (for example, employee reports with attached checks, a log of business trips indicating the time, purpose of the trip, etc.), then the absence of waybills will not be grounds for refusal to recognize compensation expenses.

DRAFTING A CONTRACT AGREEMENT

Civil relations

The rights of ownership, use and disposal of property belong to the owner of this property. The owner has the right to transfer to other persons the rights of ownership, use and disposal of property, while remaining the owner of this property (clauses 1, 2 of Article 209 of the Civil Code of the Russian Federation).

In this case, the employee uses a car transferred to him by the owner on the basis of a power of attorney. A power of attorney is recognized as a written authority issued by one person to another person for representation before third parties (Clause 1 of Article 185 of the Civil Code of the Russian Federation). The issuance of a power of attorney for the right to use and dispose of a car does not lead to the transfer of ownership of the car to the person to whom the power of attorney was issued. This follows from paragraph 2 of Art. 218 of the Civil Code of the Russian Federation.

Accounting

The organization's expenses associated with the use of an employee's car for official (administrative) purposes are taken into account as expenses for ordinary activities in the amounts payable to the employee (clauses 5, 6, 7, 16 of the Accounting Regulations "Organization's Expenses" PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n). This expense is recognized in the reporting period for which compensation is paid (clause 18 of PBU 10/99).

Insurance premiums accrued on the amount of compensation for the use of a passenger car for business purposes are also recognized as expenses for ordinary activities on the date of their accrual (clauses 5, 7, paragraph 4, clause 8 of PBU 10/99).

Accounting records for reflecting the transactions under consideration are made in the manner prescribed by the Instructions for the application of the Chart of Accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n, and are shown in the table of transactions.