Home — Articles

Some entrepreneurs do not conduct their business where they live. If an activity that is not carried out at the place of residence falls under UTII, the entrepreneur may have to register with the Federal Tax Service at the place of business as an imputed person (Clause 1 of Article 83, paragraph 2 of Article 11, paragraph 2 of Article 346.28 Tax Code of the Russian Federation). As a result, he will be registered with two inspectorates: both at the place of residence (where he pays tax under the simplified tax system or personal income tax), and at the place of business (where he pays UTII). When such an entrepreneur hires workers for “imputed” activities or simultaneously for both “imputed” and ordinary activities, he has questions: where and how to pay personal income tax and insurance premiums for these workers and where to submit reports?

Calculation and payment of personal income tax

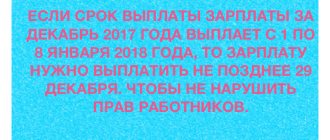

ATTENTION: from January 1, 2021, tax agents are required to transfer calculated and withheld personal income tax no later than the day following the day the income is paid to the taxpayer. Now this is a single rule for all forms of income payments (clause 6 of Article 226 of the Tax Code of the Russian Federation).

And personal income tax withheld from sick leave (including benefits for caring for a sick child) and vacation benefits must be transferred to the budget no later than the last day of the month in which they were paid.

IMPORTANT: There is no need to pay personal income tax on the advance payment.

Calculated using the formula:

Personal income tax = (employee’s monthly income – tax deductions) * 13%

- Tax deductions are an amount that reduces the income on which personal income tax is charged.

- The tax rate on payments to foreign employees is 30%.

- For organizations, dividends paid are also subject to personal income tax at a rate of 13% (since 2015).

Where to pay income tax:

Personal income tax is paid to the tax office with which the employer is registered. On the website of the Federal Tax Service of Russia there is an online service “Determining the details of the Federal Tax Service”, which will help you find out the necessary details.

KBK (code corresponding to a specific type of payment), which is indicated in the payment order, for personal income tax payment in 2021 - 182 1 0100 110.

Payment Features

The employer's obligation is to charge, withhold and transfer to the budget income tax on the earnings of its employees. To the popular question: personal income tax - what tax, federal or regional, there is only one correct answer. Personal income tax – federal payment (Article 13 of the Tax Code of the Russian Federation):

- tax rates are the same in all subjects of the Russian Federation;

- conditions and rules of application cannot be adjusted and clarified by regional authorities;

- all essential rules, the procedure for accrual and withholding are regulated only by the Tax Code.

Taxpayers need to know to which budget personal income tax is paid. Since this is a federal tax, it is subject to transfer in full to the federal budget. At the next stages, all income tax funds received by the state are divided into two parts - 15% and 85%. Most of it is credited to the budgets of the constituent entities of the Russian Federation, the remaining 15% is divided between municipal budgets (Article 56 of the Tax Code of the Russian Federation).

Federal taxes and fees are:

- VAT;

- excise taxes;

- personal income tax;

- income tax;

- mineral extraction tax - mineral extraction tax;

- water tax;

- National tax;

- fees for the use of fauna and aquatic biological resources.

Tax paid early

According to the law, personal income tax must be withheld upon actual payment of income to employees (clause 4 of article 226 of the Tax Code of the Russian Federation). And then transfer it to the budget.

And if you decide to pay personal income tax FROM YOUR OWN FUNDS ahead of time before paying your salary, then this is already a violation (clause 9 of Article 226 of the Tax Code of the Russian Federation), and the transferred amount will not be considered tax paid. That is, such payments cannot be offset “against future accrued personal income tax.”

And then you will have to pay personal income tax again, only according to the rules - when issuing your salary. If this is not done, a fine will be charged - 20% of the untransferred amount (Article 123 of the Tax Code of the Russian Federation), as well as penalties.

That first, early paid amount is positioned as erroneously transferred. It can be returned by writing an application to the Federal Tax Service.

Ivan Klimov

With the transfer of personal income tax and the presentation of information on this tax, everything is different. Entrepreneurs as tax agents are required to transfer personal income tax withheld from employee income to the budget at their place of registration (Clause 1, 7, Article 226 of the Tax Code of the Russian Federation). There you must also submit information about the income of employees in form 2-NDFL (Clause 2 of Article 230 of the Tax Code of the Russian Federation). But, as we have already said, the imputed entrepreneur is simultaneously registered with two tax inspectorates: both at the place of residence and at the place of conducting the “imputed” activity (Clause 1 of Article 83, paragraph 2 of Article 346.28 of the Tax Code of the Russian Federation). And since the Tax Code of the Russian Federation does not stipulate the procedure for transferring personal income tax by imputed workers, it is not clear where to transfer personal income tax withheld from employees engaged only in “imputed” activities or simultaneously in “imputed” and ordinary activities. But what about employees who are simultaneously engaged in activities for which UTII is paid, and in the usual activities that you conduct at your place of residence? Where to transfer personal income tax and submit 2-NDFL certificates for these employees? The Ministry of Finance explained to us that we need to focus on where the employee’s workplace is located.

Memo on transactions with personal income tax

| Calculation of personal income tax | Tax amounts are calculated by tax agents on the date of actual receipt of income, determined in accordance with Article 223 of this Code, on an accrual basis from the beginning of the tax period (clause 3 of Article 226 of the Tax Code of the Russian Federation). |

| Date of actual receipt of income | Clause 2 of Art. 223 of the Code establishes that when receiving income in the form of wages, the date of actual receipt by the taxpayer of such income is the last day of the month for which he was accrued income for work duties performed in accordance with the employment agreement (contract). |

| Personal income tax withholding date | Tax agents, according to clause 4 of Art. 226 of the Code are required to withhold the accrued amount of tax directly from the taxpayer’s income upon actual payment. As for the payment of income in kind and in the form of material benefits, personal income tax must be withheld from any income that was paid to a given individual in cash (but not more than 50% of this amount). |

| Date of personal income tax transfer | From January 1, 2021, tax agents are required to transfer calculated and withheld personal income tax no later than the day following the day of payment of income to the taxpayer (clause 6 of Article 226 of the Tax Code of the Russian Federation).

|

Insurance premiums are transferred at the place of residence

With insurance premiums everything is simple. If you have employees, you pay mandatory contributions (Parts 1, 3, Article 5 of the Federal Law of July 24, 2009 N 212-FZ “On Insurance Contributions...”; Article 6, paragraph 4 of Article 22 of the Federal Law of July 24, 2009 .1998 N 125-FZ “On compulsory social insurance against accidents at work and occupational diseases”): - for yourself; - for the workers. When registering as an individual entrepreneur, the territorial branches of the Pension Fund of the Russian Federation and the compulsory medical insurance fund at your place of residence register you automatically: on the basis of information received from the tax office (Clause 1, Article 11 of the Federal Law of December 15, 2001 N 167-FZ “On Mandatory Pension insurance..."; Article 9.1 of the Law of the Russian Federation of June 28, 1991 N 1499-1 "On medical insurance of citizens...").

But when hiring workers, you yourself must register with extra-budgetary funds at your place of residence, but as an insurer-employer (Clause 1, Article 11 of the Federal Law of December 15, 2001 N 167-FZ; Article 9.1 of the Law of the Russian Federation of June 28, 1991 N 1499-1; clause 3 part 1, part 3 article 2.1, clause 3 part 1 article 2.3 of the Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with motherhood"; Article 6 of the Federal Law of July 24, 1998 N 125-FZ; clause 21 of the Procedure for registration in the territorial bodies of the Pension Fund of the Russian Federation, approved by the Resolution of the Board of the Pension Fund of October 13, 2008 N 296p; clauses 2, 3 of section I, clause 6 of section II of the Procedure for registration in the territorial bodies of the Social Insurance Fund, approved by Order of the Ministry of Health and Social Development of Russia dated December 7, 2009 N 959).

This means that you transfer insurance premiums for all employees (including those employed in “imputed” activities in the municipality) , and not at the place of business (Part 1, Article 3, Article 6 , part 8 of article 15 of the Federal Law of July 24, 2009 N 212-FZ). This was confirmed to us by the FSS of the Russian Federation.

From authoritative sources Leilya Arturovna Khutueva, consultant of the legal support department in the field of budgetary and financial legislation of the Legal Department of the Federal Social Insurance Fund of the Russian Federation “Insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity are transferred to the Social Insurance Fund accounts opened in the territorial bodies of the Federal Treasury. Insureds pay contributions for compulsory social insurance against accidents at work to a single centralized account of the Social Insurance Fund. Bank details of these accounts are communicated to policyholders by the territorial bodies of the FSS of the Russian Federation at the place of their registration. Thus, when an entrepreneur operates at a location other than his place of residence, he pays insurance premiums for employees according to the details that were provided to him by the Social Insurance Fund at his place of residence.”

The Pension Fund of the Russian Federation adheres to a similar position.

From authoritative sources Tamara Nikolaevna Dashina, deputy manager of the branch of the Pension Fund of the Russian Federation for Moscow and the Moscow region “The entrepreneur makes all payments at his place of residence, regardless of whether he pays contributions for himself or for his employees. Accordingly, at his place of residence, he pays contributions for himself as an entrepreneur to one BCC, and for employees as an employer - to another BCC.”

You must also report on insurance premiums for employees to the funds at your place of registration, that is, at your place of residence (Part 9, Article 15 of the Federal Law of July 24, 2009 N 212-FZ; clause 1 of Article 24 of the Federal Law of July 24, 2009. 1998 N 125-FZ).

Tax agent reporting

1) Calculation of 6-NDFL.

On January 1, 2021, Law No. 113-FZ of 05/02/2015 came into force, according to which every employer must submit personal income tax reports quarterly. That is, you need to report no later than the last day of the month following the reporting quarter.

• View a sample of filling out 6-NDFL.

• Read more: Quarterly personal income tax reporting 2021.

2) Certificate 2-NDFL.

It is compiled (based on data in tax registers) for each of its employees and submitted to the tax office once a year no later than April 1, and if it is impossible to withhold personal income tax - before March 1.

ATTENTION: by order of the Federal Tax Service of Russia No. ММВ-7-11/ [email protected] dated October 30, 2015, a new form 2-NDFL was approved. It is valid from December 8, 2015.

How to submit a 2-NDFL certificate:

- On paper - if the number of employees who received income is less than 25 people (from 2021). You can bring it to the tax office in person or send it by registered mail. With this method of reporting, tax officials must draw up in 2 copies a “Protocol for accepting information on the income of individuals for ____ year on paper,” which serves as proof of the fact that 2-NDFL certificates were submitted and that they were accepted from you. The second copy remains with you, do not lose it.

- In electronic form on a flash drive or via the Internet (number of employees more than 25 people). In this case, one file should not contain more than 3,000 documents. If there are more of them, then you need to generate several files. When sending 2-NDFL certificates via the Internet, the tax office must notify you of their receipt within 24 hours. After this, within 10 days the Federal Tax Service will send you a “Protocol for receiving information on the income of individuals.”

Also, together with the 2-NDFL certificate, regardless of the method of submission, a document is attached in 2 copies - Register of information on the income of individuals.

• Download the 2-NDFL certificate form.

• See Instructions for filling out 2-NDFL.

3) Tax accounting register.

Designed for personal data recording for each employee, including individuals under a GPC agreement. Based on this accounting, a 2-NDFL certificate is compiled annually.

Tax registers record income paid to individuals for the year, the amount of tax deductions provided, as well as the amount of personal income tax withheld and paid.

There is no single sample tax register for personal income tax. You must create the form yourself. For this purpose, you can use accounting programs or draw up a personal income tax-1 certificate based on the currently inactive personal income tax certificate.

But the Tax Code defines the mandatory details that must be in personal income tax registers:

- Information allowing identification of the taxpayer (TIN, full name, details of the identity document, citizenship, address of residence in the Russian Federation)

- Type of income paid (code)

- Type and amount of tax deductions provided

- Amounts of income and dates of their payment

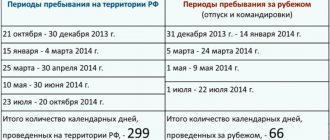

- Taxpayer status (resident / non-resident of the Russian Federation)

- Date of tax withholding and payment, as well as details of the payment document

What are tax deductions and how to apply them

A tax deduction is a part of income on which the state allows you not to pay personal income tax. One of the options for registering it is through the employer. The employee must confirm the right to deduction with documents.

There are quite a few deductions, and each has its own nuances. To figure it out, it’s better to read a separate Lifehacker article about them.

The most common is the standard tax deduction for children: 1,400 rubles per month for the first and second child, 3,000 for the third and each subsequent child. It is valid until the annual income reaches 350 thousand.

Let's say your employee with a salary of 43,745 rubles has one child for whom he wants to receive a deduction. He can do this from January to August - in September his income will exceed 350 thousand. The deduction is subtracted from the amount of income, and tax is calculated from the remainder.

(43 745 − 1 400) × 13% = 5 504,85

If an employee comes in the middle of the year, you need to ask him for a 2-NDFL certificate from his previous place of work to understand whether he still has the right to deductions.

Fines in 2021

1) For each 2-NDFL certificate not submitted on time - a fine of 200 rubles.

1) Violation of the deadlines for filing 6-NDFL - a fine of 1,000 rubles. for each full or partial month. delays.

2) After 10 days of delay in reporting on the calculation of 6-NDFL, the tax inspectorate has the right to suspend transactions on bank accounts and electronic money transfers.

3) For providing false information - a fine of 500 rubles (1 document). But if you independently discover and correct errors in the document in a timely manner before the tax office does, then this fine will not affect you.

Where to transfer personal income tax

If we are talking about an entrepreneur with employees, it depends on the tax regime. Individual entrepreneurs using OSNO, simplified taxation system and unified agricultural tax transfer money to the tax office at the place of registration. Individual entrepreneur on UTII or PSN - at the place of registration. If an entrepreneur operates under several taxation systems and employees are employed in different areas, then deductions for them are sent to different inspectorates.

Organizations pay personal income tax to the tax authority where they are registered. Separate divisions transfer money to “their” tax office. An exception is made if the divisions are located on the territory of the same municipality. Then you can choose one inspection, but the Federal Tax Service must be notified of this intention.

Events Quarter

The form of notification of the impossibility of withholding tax and the amount of tax and the procedure for submitting it to the tax authority are approved by the federal executive body authorized for control and supervision in the field of taxes and fees (clause 5 of Article 226 of the Tax Code of the Russian Federation). Having received such a message (form 2-NDFL), the tax authority itself sends a tax payment notice to the taxpayer (you). If official labor relations have arisen between an employee and an employer, then regular wages for work are calculated, therefore, the employer is obliged to deduct the required payments from it to the state. How much does an employer pay in taxes for an employee in 2021, and to which institutions should he send additional contributions?

What declarations to submit for employees

Declarations for employees are divided into three bodies; we will look at the table where and what to submit.

| Organ | Inspectorate of the Federal Tax Service | FSS | Pension Fund |

| Reporting | • Average number of employees; • 2-NDFL; • 6-NDFL; • Calculation of insurance premiums | • 4-FSS | • SZV-M; • SZV-experience |

Thus, for employees, both for entrepreneurs and for organizations, it is necessary to submit reports to three different bodies:

- Tax office, to which the entrepreneur belongs according to his registration and with which he is registered;

- Social Insurance Fund, which you need to register with if an individual entrepreneur hires employees on his own;

- The Pension Fund of the Russian Federation, in which the individual entrepreneur is registered.

Do individual entrepreneurs need to pay personal income tax for employees?

Income tax is withheld from the employee's earnings on the day the salary is actually issued, and payment is made either on the same day or the next, but not later. The calculation is made upon full payment of wages for the month; when transferring an advance payment, the tax is not calculated. Based on tax registers, a 2-NDFL certificate is drawn up (image 1). It is drawn up for each employee in 2 copies. Attached to it is a register of information on income (image 2), which lists all certificates for citizens with numbers, names and dates of birth.

How often to submit reports

In order to know where and with what frequency to submit reports to the entrepreneur, we have developed a table:

| Where to take it | Tax service | Pension Fund | Social Insurance Fund |

| Frequency of delivery | |||

| Monthly | – | SZV-M | – |

| Every quarter | 6-NDFL and Calculation of insurance premiums | – | 4-FSS |

| Annually | Average number of employees and 2-personal income tax | SZV-STAZH | – |

The table shows that the SVZ-M form is submitted monthly to the Pension, three reports are submitted quarterly - 6-NDFL, RSV and 4-FSS, annually - 2-NDFL and the average payroll.