When carrying out delivery and carry-out retail trade, persons wishing to switch to paying a single tax on imputed income are registered as a taxpayer of a single tax on imputed income with the tax office at the location of the organization or at the place of residence of the individual entrepreneur. To do this, they must submit an application for registration to the inspectorate within five days from the date of commencement of business activities. The inspectorate also issues a notification about registration as a single tax payer on imputed income within five days from the date of receipt of the taxpayer’s application.

Important

The tax period for the single tax on imputed income is a quarter.

Characteristics of trading operations

In peddling trade, the seller is in direct contact with the buyer. This type of trade includes trade from hands, trays, baskets and hand carts. This is stated in paragraph 18 of Article 346.27 of the Tax Code of the Russian Federation.

In distribution trade, goods are sold through specialized vehicles, as well as mobile equipment used only with transport. This type of trade includes trade using a car, a car shop, a car shop, a toner, a trailer, a mobile vending machine. This follows from paragraph 17 of Article 346.27 of the Tax Code of the Russian Federation.

Situation: are there any restrictions on the types of goods sold during delivery (distribution) trade for the purpose of applying UTII?

Yes, they do exist.

Despite the fact that Chapter 26.3 of the Tax Code of the Russian Federation does not establish such restrictions, when conducting retail trade outside of stationary retail facilities, the sale of:

- food products (except for ice cream, soft drinks, confectionery and bakery products in manufacturer's packaging);

- medicines;

- products made of precious metals and precious stones;

- weapons and ammunition for them;

- copies of audiovisual works and phonograms;

- programs for electronic computers and databases.

These restrictions are established by paragraph 4 of the Rules, approved by Decree of the Government of the Russian Federation of January 19, 1998 No. 55.

Thus, peddling and delivery trade in these goods is prohibited and, therefore, as an independent type of activity cannot be transferred to UTII. This special regime can only be applied if such goods are sold through a stationary retail chain.

UTII: implementation of delivery and distribution trade

Tax inspectorate specialists considered that home delivery sales of vacuum cleaners, which are technically complex household goods, cannot be classified as a type of business activity transferred under UTII. In the case under consideration, the retail purchase and sale agreement was concluded on the premises. Demonstration vacuum cleaners were accounted for separately from goods to be sold. The conclusion of the contract and the transfer of the goods to the buyer were carried out simultaneously; the buyer inspected the goods he was purchasing, and not a sample of the goods. The taxpayer did not process the purchase of vacuum cleaners in the office, did not issue the goods from the warehouse, and did not deliver the goods upon pre-order to the buyer’s address. The court emphasized that the norms of tax legislation are formulated without reservations excluding trade in technically complex household appliances from the scope of application of UTII. Therefore, such a situation is possible.

Trading of own-produced products from a tray does not apply to peddling trade

Retail trade is one of the types of retail trade. In accordance with Art. 346.27 of the Tax Code of the Russian Federation, retail trade is a business activity related to the trade of goods (including in cash, as well as using payment cards) on the basis of retail purchase and sale contracts. This type of business activity does not include the sale of excisable goods, food and drinks, including alcoholic beverages, both in the manufacturer’s packaging and packaging, and without such packaging and packaging, in bars, restaurants, cafes and other public catering facilities, unclaimed things in pawnshops, gas, trucks and special vehicles, trailers, semi-trailers, trailers, buses of any type, goods according to samples and catalogs outside the stationary distribution network (including in the form of postal items (parcel trade), as well as through teleshopping, telephone communications and computer networks), transfer of medicines on preferential (free) prescriptions, as well as products of our own production (manufacturing). Thus, the sale of products of one's own production is not retail trade.

If the seller provides services for the delivery of goods chosen by the buyer, this is not carry-out trade

In accordance with Part 1 of Art. 499 of the Civil Code of the Russian Federation, in the case where a retail purchase and sale agreement is concluded with the condition of delivery of goods to the buyer, the seller is obliged to deliver the goods to the buyer within the prescribed period at the place specified by the buyer, and if it is not specified, then at the buyer’s place of residence. According to clause 74 of GOST R 51303-2013. National standard of the Russian Federation. Trade. Terms and definitions approved by Order of Rosstandart dated August 28, 2013 N 582-st, retail trade is retail trade carried out outside a stationary retail network through direct contact between the seller and the buyer at home, in institutions, organizations, enterprises, transport or on the street. That is, with peddling trade, direct contact between the seller and the buyer is necessary, while the seller offers his goods to an indefinite number of people.

The desire to purchase a product arises at the moment the seller offers the product. Thus, delivery of goods to the location of the goods is not retail trade, but retail trade with the condition of its delivery to the buyer. This conclusion is also confirmed by materials from judicial practice (for example, Decision of the Emelyanovsky District Court of the Krasnoyarsk Territory dated September 23, 2010 N 12-130/2010).

If you do not find the information you need on this page, try using the site search:

Physical indicator

When calculating UTII from retail or delivery trade facilities, use a physical indicator - the number of employees including individual entrepreneurs (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). The basic profitability for this type of activity is 4,500 rubles. per month from each employee (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). How to calculate the number of personnel, see How to determine the number of employees working in activities subject to UTII.

When calculating UTII when selling goods through other objects of a non-stationary trading network, use the physical indicators “trading place”, “vending machine” or “area of trading place” (clause 3 of Article 346.29 of the Tax Code of the Russian Federation). In this case, the physical indicator “vending machine” must be used regardless of what category the vending machines belong to: stationary or mobile. Such clarifications are contained in letters of the Ministry of Finance of Russia dated May 13, 2011 No. 03-11-10/24 and dated March 28, 2011 No. 03-11-11/72.

Features of away trade from a mobile shop

- Firstly, there is a very low entrance ticket to business and, accordingly, low risks;

- Secondly, this is a relatively simple type of business;

- Thirdly, the mobile nature of the auto shop makes it easy to change less profitable places of trade to more profitable ones.

At the same time, the auto trade receives the largest income on the days of city and rural fairs. And it is the presence of “wheels” that allows the retail outlet to move throughout the region and participate in as many fairs as possible. Under successful circumstances, the payback period for a business can be only 6 - 12 months.

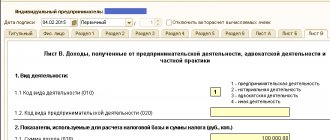

The tax base

To calculate UTII, first determine the tax base for the reporting quarter. For carry-out and delivery trade, use the formula:

| Tax base for UTII for the quarter | = | Basic profitability per month (RUB 4,500) | × | Average number of employees for the first month of the quarter | + | Average number of employees for the second month of the quarter | + | Average number of employees for the third month of the quarter | × | K1 | × | K2 |

When retailing through other objects of a non-stationary retail network, calculate the tax base for UTII in the following order.

For retail spaces with an area of less than 5 square meters. m, determine the tax base for the quarter using the formula:

| Tax base for UTII for the quarter, calculated by the number of retail locations | = | Basic profitability per month (RUB 9,000) | × | Number of trading places used for purchase and sale transactions in the first month of the quarter | + | Number of trading places used for purchase and sale transactions in the second month of the quarter | + | Number of trading places used for purchase and sale transactions in the third month of the quarter | × | K1 | × | K2 |

For retail spaces with an area of more than 5 square meters. m, determine the tax base for the quarter using the formula:

| Tax base for UTII for the quarter, calculated by the area of retail outlets | = | Basic profitability per month (RUB 1,800) | × | The area of retail spaces used for purchase and sale transactions in the first month of the quarter | + | The area of retail spaces used for purchase and sale transactions in the second month of the quarter | + | The area of retail spaces used for purchase and sale transactions in the third month of the quarter | × | K1 | × | K2 |

When selling goods through vending machines, determine the tax base for the quarter using the formula:

| Tax base for UTII for the quarter, calculated by the number of vending machines | = | Basic profitability per month (RUB 4,500) | × | Number of vending machines used to sell goods in the first month of the quarter | + | Number of vending machines used to sell goods in the second month of the quarter | + | Number of vending machines used to sell goods in the third month of the quarter | × | K1 | × | K2 |

In this case, the values of the K2 coefficient should be applied depending on the category of vending machines used. For stationary vending machines, the coefficients established for stationary retail chain facilities are applied. Adjust the basic profitability of mobile vending machines taking into account the K2 coefficient established for non-stationary retail facilities. This is stated in the letter of the Ministry of Finance of Russia dated June 9, 2011 No. 03-11-09/35, addressed to the Federal Tax Service of Russia.

The values of physical indicators - the average number of employees and the area of retail outlets - are included in the calculation of UTII rounded to whole units (Clause 11 of Article 346.29 of the Tax Code of the Russian Federation). When rounding the size of physical indicators, discard values less than 0.5 units, and round 0.5 units or more to a whole unit (letter of the Ministry of Finance of Russia dated June 16, 2009 No. 03-11-11/111).

Individual entrepreneur without a cash register in 2021 - in what cases is it possible

How will retail trade operate without cash register equipment? Under what conditions does an individual entrepreneur have the right to work and make cash payments with a buyer without a cash register? When can you work for the simplified tax system or for UTII without a cash register? All of the above issues are discussed in detail in this article.

Does an individual entrepreneur have the right to conduct cash payments with a buyer without cash register equipment in 2021?

Working without a cash register (KKM) in 2021 is possible for an entrepreneur if he:

- pays a single tax on imputed income (UTII) to the budget;

- instead of issuing receipts for goods to the buyer, he makes payments using strict reporting forms (SSR);

- trade is carried out in several types of business activities, for which the Tax Code of the Russian Federation and the laws of the Russian Federation allow doing business without a cash register in 2021;

- works in remote or hard-to-reach places.

For the extreme case of working without operating cash register equipment, there are some nuances.

Regional administration officials determine the degree of remoteness of the territory - the settlement in which the individual entrepreneur can trade, and establish a special list of such points. At the same time, individual entrepreneurs are prohibited from working without cash register equipment in cities and regional centers.

Individual entrepreneur trading without operating cash register equipment in 2021

The list of activities in which an individual entrepreneur has the right to trade without using cash register equipment is limited.

An individual entrepreneur may not use cash register equipment in the following cases:

- if the individual entrepreneur sells ice cream at a kiosk;

- has the right to trade in dairy products, beer and kvass drinks, sunflower oil, fish products and kerosene, which are located in tanks;

- sells various products in a school or student canteen;

- sells tea on the train;

- works at a kiosk if newspapers and magazine issues account for at least 50% of turnover. In this case, revenue from the sale of such products must be taken into account separately.

The list of additional commercial products that an individual entrepreneur has the right to trade is determined by regional authorities;

- sells lottery tickets and postage stamps at face value;

- is engaged in the sale of tickets for travel on trams and trolleybuses;

- sells religious books in a church or other religious place.

Individual entrepreneurs have the right to trade without cash register equipment at exhibitions or markets. At the same time, individual entrepreneurs are prohibited from selling products in containers and pavilions.

If an individual entrepreneur owns a car shop (tonar), a car shop, or a van (trailer), in this case it is necessary to install cash register equipment.

When trading apples from a truck, the individual entrepreneur may not use, but only after passing an inspection by auditors, this truck for the safety of the goods.

If an individual entrepreneur sells vegetable products and watermelons, then he has the right not to operate cash register equipment.

Without operating cash register equipment, an individual entrepreneur can sell from trays or baskets that are covered with plastic film or tarpaulin. At the same time, if an individual entrepreneur sells technically complex goods from a tray, then he must use a cash register.

If an individual entrepreneur sells goods that must be kept in special storage conditions, then in this case it is also necessary to use cash register equipment. For example, an individual entrepreneur has the right to sell potatoes without cash register. However, when selling frozen fish, an individual entrepreneur must use a cash register.

In addition, an individual entrepreneur may not use cash register equipment, working on a patent tax system. When working on a patent, an individual entrepreneur can, for example, sell services in a sales area with an area of 50 square meters. m. maximum.

At the same time, individual entrepreneurs who sell retail also have the right to work on a patent.

As a result, without using a cash register, an entrepreneur can do business in a stationary retail outlet, the sales area of which is 50 square meters. m. maximum or no trading floor at all, as well as in non-stationary trading premises.

If an individual entrepreneur makes payments in cash on UTII

If a businessman pays UTII, then he also has the right to work and make cash payments with the buyer without a cash register. In this case, an individual entrepreneur can sell products without operating a cash register in a pavilion whose sales area is 150 square meters. m. maximum.

https://www.youtube.com/watch?v=6qqK0CEzPG8

Also, a businessman may not use the cash register in the following situations:

- in stationary retail premises that do not have a sales area;

- in a commercial non-stationary premises that is not used when working on a patent.

Individual entrepreneurs who own a public catering establishment that does not have a sales area or whose area is 150 square meters may not use a cash register. m. maximum.

In addition, without operating cash register equipment, an individual entrepreneur can sell services to the public, but when making payments to a client, the entrepreneur must use strict reporting forms.

As a result, when trading without cash register equipment on UTII, the individual entrepreneur, at the buyer’s request, must issue him a check for the goods, a receipt or a document according to which he can accept cash from the client for a service or product.

Settlements with the buyer using the simplified tax system and cash register: is it necessary to use a cash register in 2021?

Federal Law No. 54 of May 22, 2003 reflects the rules for using cash register machines, on which individual entrepreneurs make payments in cash or using a bank card.

According to the law, an individual entrepreneur must operate cash register equipment if he settles with a client using a bank card or cash when selling goods, performing work or providing services.

However, there are several nuances:

- if the individual entrepreneur carries out all payments through a current account. However, he does not use cash. In this case, the individual entrepreneur has the right not to use the cash register.

However, in this case, the question arises: are all individual entrepreneurs ready for such payment conditions under which it is not possible to purchase goods for cash? In particular, trading with individuals using non-cash payments is difficult;

- When providing certain services to the population, an individual entrepreneur may not operate a cash register, but is required to issue strict reporting forms. How an individual entrepreneur can work with such a payment document is written in detail in various legal acts that regulate their accounting, procedure, form, features of their storage and destruction;

- if the individual entrepreneur works in a hard-to-reach place. The list of remote areas and cities was approved by the State Duma of the Russian Federation;.

- if the individual entrepreneur works in a pharmacy and paramedic station in the village;

- if the individual entrepreneur is engaged in some specific types of activities. For example, it accepts raw materials for recycling and glass containers from the population (except scrap metal);

The entire list of individual types of activities can be read in Art. 2 of the above law.

The result is that the type of organizational and legal form and the use of the simplified tax system can be ignored when deciding whether an individual entrepreneur should use a cash register. In this case, you should pay attention to the type and location of a certain type of activity;

- If an individual entrepreneur pays tax under UTII or under a patent, then the use of cash register equipment is not considered mandatory. However, the client has the right to demand, and the individual entrepreneur is obliged to give a receipt for the goods or a similar document.

If an individual entrepreneur falls into one of the above exceptions, then there is no need to buy a cash register and register it officially. For other individual entrepreneurs working on the simplified tax system, this is a mandatory condition.

Change in physical indicator

If during the quarter the number of retail locations increased or decreased, take into account the changes from the beginning of the month in which they occurred (clause 9 of Article 346.29 of the Tax Code of the Russian Federation).

If an organization began or stopped using UTII during the quarter (for example, from February 20), then the tax base must be determined taking into account the actual duration of activities on UTII for the month in which the organization was registered (deregistered) as a single payer tax For more information about this, see How to calculate UTII.

Punishment for violating established rules

As a general rule, the regular carrying out of trading activities is considered entrepreneurship. Regularity means triple retail or wholesale sales.

For violation of current legislation, the participant in the trading procedure will have to pay a fine, the amount of which in 2021 will be:

- 2000 rubles – in relation to an individual conducting trading activities;

- 10,000 rubles – in relation to each official who committed a violation;

- 20,000 – unregistered individual entrepreneurs;

- 30,000 rubles – legal entities registered with the Federal Tax Service.

As for carrying out one-time unauthorized trade, the fine will be one and a half thousand rubles. For repeated violations, the person will have to pay a fine of double the amount . These penalties are applied within the framework of the Code of Administrative Offences.

Another significant point to pay attention to is the attraction of hired workers. So, in the case of hiring people who will work in a trade stall, it is additionally necessary to prepare reports for the Pension Fund and the Social Insurance Service . Involving persons without registration is a risk and another basis for legal punishment.

Cost issues

The specificity of outbound trade and accounting of operations is such that the cost of goods is written off simultaneously with the accrual of revenue. The write-off procedure is determined by the method of accounting for goods by an individual entrepreneur or a company. Current legislation allows products for retail sale to be accounted for at purchase and sale prices.

Keeping records of the sales price involves the use of 42 accounts. It reflects the trade margin. The latter is installed when purchasing the product. When accounting using account 42, the following entries are made:

- write-off of the cost of products sold at sales prices;

- reflection of the reversal of the trade margin.

When working using this method, the accountant will have to determine the amount and the average percentage of the markup.

There are several methods for writing off goods, for example, by unit cost, by average cost. It is not necessary to use one method for all products. Each product group may provide its own optimal evaluation method. This decision needs to be fixed in the accounting policy.

How to conclude an agreement to participate in the fair

To streamline small retail trade, city authorities hold fairs. They are paid and free. Often, organizers allow even individuals to trade at fairs without registering a business.

The annual fair plan is published on the administration website. The entrepreneur submits an application in advance and receives a place. The organizer concludes an agreement for participation in the fair. Most likely, the participant will be asked for quality certificates for the goods, and if they plan to sell food, medical books.

In Moscow, fairs are organized by the State Budgetary Institution “Moscow Fairs”. The list of fairs for 2021 is here, and the conditions for participation are here.

You can find your city’s fair plan in a search engine using the query “fair plan for 2021” + city.

yurburo61.ru

I found a supplier who buys Christmas trees and popular toys like “Paw Patrol” in China and sells them in small wholesale quantities here. The supplier's price is low, allowing for a good markup. In addition, I decided to buy tinsel, toys, and souvenir dishes from two wholesale sites. I plan to sell through social networks and have found a place on the market. I rent an indoor space for a month. The questions are: Do I need a certificate for artificial Christmas trees and garlands from China? The supplier doesn't have it. Do I need a certificate for toys from China? The supplier doesn't have it. I have an individual entrepreneur without the right to lease (online trading).

Who supervises

The authorities controlling street trading include:

- Sanitary and epidemiological station, it checks the compliance of food products with accepted storage standards and conditions of sale: if they are expired or the goods are stored improperly, for example, on the floor and not on shelves.

- Employees of Rospotrebnadzor and the police can draw up administrative protocols on the imposition of penalties in case of violation of trade rules, and the tax inspectorate monitors the registration and availability of permission for this type of business activity.

Sales of food products

Recently, fast food stalls, such as hot dogs and tea, have become widespread. But to organize such trading activities, you need to go through a number of approvals: at the sanitary and epidemiological station about the compliance of the premises and equipment with established standards, obtaining medical books for employees and sanitary passports for products.

You also need permission from the fire inspectorate; it must issue an order on the possibility of organizing a retail outlet in a certain area, that is, practically permitting economic activity. They come to the local government with all the necessary documents and ask for permission to sell the product group of goods to the public.