As always, we will try to answer the question “How to Reflect Maternity Benefits in the RSV 2020”. You can also consult with lawyers for free online directly on the website without leaving your home.

On the title page of the single calculation we indicate information about the organization: INN and KPP (reflected on all pages of the report), name, economic activity code, full name. manager, phone number. In the “Adjustment number” field we put “0” if we provide a single report for the first time during the reporting period, or we set the next adjustment number. We indicate the Federal Tax Service code and location code.

Taxable and non-taxable payments

Payments made by the employer to employees are divided into taxable, non-taxable or partially taxable.

The nature of the reflection of compensation in the calculation of insurance premiums depends on this factor. Contributions are subject to those payments that are provided for in an employment, author's, or civil law contract: this is payment for the performance of labor duties specified in the contract, bonuses for production purposes.

The object of taxation of contributions does not arise:

- for payments not related to the concluded contract (for example, when providing financial assistance in connection with the death of a close relative);

- for payments reimbursed by the Social Insurance Fund (maternity benefits, temporary disability benefits, child care benefits up to one and a half years old).

Subsistence allowances and financial assistance provided for in an employment or collective agreement are partially subject to contributions.

Note! Starting with the reporting campaign for 2020, a new form is used, approved. by order of the Federal Tax Service of Russia dated October 15, 2020 No. ED-7-11/ [email protected]

ConsultantPlus experts explained in detail what changes have been made to the form. Get free demo access to K+ and go to the review material to find out all the details of the innovations.

Let's look at examples of how various payments are reflected in the report.

Where are subsidies received for wages shown in the RSV?

For April and May 2021, in accordance with Decree of the Government of the Russian Federation dated April 24, 2020 No. 576, the state issued subsidies to small and medium-sized businesses as one of the support measures. The main purpose of such assistance is to compensate for the costs of economic entities, including remuneration of workers.

This phrase confused many inexperienced accountants who decided to show the received subsidy in the calculation of insurance premiums. However, you shouldn't do this. After all, the object of taxation, as we have already said, is the accrued remuneration in favor of the employee.

Attention! Receiving a subsidy, the amount of which, although calculated taking into account the working personnel, is not subject to taxation. Insurance premiums need to be calculated only after they have been accrued and paid to the employee.

Salaries are reflected in the standard manner in all sections - 1 and 3 of the calculation, both in the total amount of payments (lines 050 of Appendix 1, 040 of Appendix 2 and 140 of Appendix 3), and in the base for contributions (lines 050 of Appendix 1 and 2 and line 150 section 3).

Table 2 in 4-FSS: rules for filling out in 2021

And the updated form 4-FSS should have been used by policyholders starting with the report for 9 months of 2021 (FSS Information dated June 30, 2020). Let us recall that the June updates to form 4-FSS provided for the following changes: on the title page, after the “OKVED” field, the “Budgetary Organization” field was added. In this field, budgetary organizations must indicate the source of funding (1 - Federal budget, 2 - Budget of a constituent entity of the Russian Federation, 3 - Municipal budget 4 - Mixed financing)

Hospital benefits reimbursed by the Social Insurance Fund

Let's look at benefits paid on the basis of certificates of incapacity for work, for registration in the early stages of pregnancy, one-time benefits for the birth of a child, for caring for a child up to one and a half years old, which are not subject to insurance contributions.

In general cases, all these benefits are either reimbursed to the employer by social insurance, or paid directly to the employee himself, bypassing the employer. The only exception is three days of temporary disability benefits - they are paid by the employer from his own funds.

Note! In certain cases, for example during quarantine (disability reason code - 03), all days are paid by the Social Insurance Fund.

The payment amount for three days will fall into subsections 1.1, 1.2 and Appendix 2. In all specified parts of the report, this amount should be reflected in the lines:

- with the total amount of payments - line 030 of subsections 1.1 and 1.2 and line 020 of Appendix 2;

- amounts not subject to contribution - lines 040 and 030, respectively.

Thus, payment of benefits from the employer’s funds—line 050 of the specified sections—should not be included in the calculation base.

In section 3, sick leave at the expense of the employer is shown in the total amount of payments in favor of the individual (line 140).

Reflection in the calculation of the amounts reimbursed by the fund depends on the participation of the constituent entity of the Russian Federation in the FSS project.

The region is participating in a pilot project

In the region participating in the pilot project, the Social Insurance Fund directly transfers money to a person upon the occurrence of an insured event, but only after receiving all the necessary documents from the employer. In this regard, the latter does not make any payments (except for the first three days of sick leave).

In Appendix 2, in the “Payment attribute” field, code “1” is indicated, which determines participation in the project.

In this case, benefits do not fall into the DAM, lines 070 and 080 of Appendix 2 are not filled out and, accordingly, decoding from Appendixes 3 and 4 is not required. Also, these payments will not fall into section 3.

Note! If a region joins the project in the middle of the year, for example, from July 1, it is allowed to fill out the indicated lines and sections with the amounts of benefits related to the pre-pilot period.

The region does not participate in the FSS pilot project

If the credit system continues to operate in the region, then all social insurance payments should be reflected in subsections 1.1, 1.2 and Annex 2 in the same way as benefits for the first three days of sick leave paid for by the employer. In Appendix 2, in the “Payment attribute” field, code “2” is entered, implying the use of an offset system:

In addition, there are nuances in filling out Appendix 2, and there is also a need to fill out Appendixes 3 and 4.

In the RSV, temporary disability benefits, maternity benefits and child care amounts paid to employees must be reflected in line 070 “Expenses incurred for payment of insurance coverage” of Appendix 2. This means that these amounts are subject to reimbursement from the Social Insurance Fund.

In line 080, the amounts will be reflected if the Social Insurance Fund provided compensation during the reporting period.

Line 090 is calculated taking into account calculated contributions, as well as amounts subject to reimbursement and already reimbursed by the fund. The formula is as follows (all lines refer to Appendix 2):

Line 090 = Line 060 – Line 070 + Line 080.

Important! The transfer of contributions by the policyholder to the state treasury during the reporting period is not taken into account in the calculation of the line 090 indicator.

Filling out line 070 of Appendix 2 automatically involves filling out Appendix 3 or 4 of the calculation of insurance premiums, which will decipher the specified line.

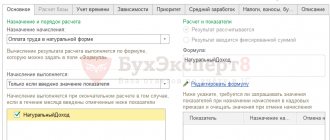

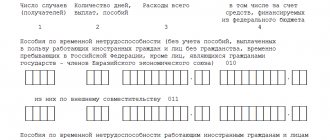

So, if we are talking about payment for sick leave due to illness, then lines 010, 011, 020, 021 of Appendix 3 of the RSV are filled in - the number of days (payments) of benefits, the number of cases, the total amount paid and the allocated amount from the federal budget. Separately, benefits paid to part-time workers, foreigners and stateless persons are distinguished, and sick leave paid to part-time workers are also distinguished from the latter.

When paying benefits related to maternity leave, lines 030 (B&R benefit with allocation of part-time workers - 031), 040 (for registration in the early stages of pregnancy), 050 (one-time payment for the birth of a child), 060 (for child care, with broken down: for the first - 061, for the second and subsequent ones - 062).

Appendix 4 is completed if reimbursement of benefits is financed from the federal budget.

ATTENTION! From reporting for the 1st quarter of 2021, code 2 in the “payment attribute” field no longer applies, because All regions of the Russian Federation are switching to direct payments from the Social Insurance Fund.

Who submits the RSV

First, let's decide who is required to submit the calculation. All legal entities and entrepreneurs with employees must submit it. Departments submit the form if they themselves calculate salaries and transfer contributions. Accordingly, calculations are required from all policyholders who employ insured persons. Main groups of insured persons:

- employees who have entered into fixed-term and open-ended employment contracts with the organization;

- contractors - individuals performing work on the basis of construction contracts or service agreements;

- general director, if he is the sole founder of the enterprise.

Even if there was no activity at the enterprise during the reporting period, the calculation is still submitted to the Federal Tax Service. If payments to individuals were not made, there were no movements in the accounts, then a zero report is sent to the Federal Tax Service.

If the number of individuals who received payments and other remuneration in the reporting period is more than 10 people (please note, the number is taken into account for the entire reporting period, and not according to the actual presence of employees at the time of preparation and submission of the report), then, according to clause 10 of Art. 431 of the Tax Code of the Russian Federation, such an organization must submit the calculation in electronic form and send it via the Internet. Employers with 10 or fewer employees may submit a paper report.

Where to show benefits for up to three years in the RSV

Employees on parental leave for up to three years must be taken into account when indicating the number in Appendices 1 and 2 to Section 1 (line 010). After all, they do not cease to be insured persons. If the employee did not receive contributions subject to contributions, then he will not be included in line 020 of subsections 1.1 and 1.2 and line 015 of Appendix 2.

The benefit for up to one and a half years is reimbursed by social insurance. We described above how to reflect it. Now let’s find out what to do with payments made to employees on parental leave for one and a half to three years.

If an employer, on its own initiative, pays an employee additional funds related to parental leave for up to three years, then they will form a base for all types of contributions.

How to fill out the erv correctly if there were payments according to the bir example

The next payment that needs to be reflected in the third schedule is the monthly child care allowance. To do this, we will use lines 060 and 061, since according to the conditions of the example, the baby is our first. Column 1 is formatted similarly to all previous ones; we will not dwell on it.

We recommend reading: If the Apartment Was Purchased In 2021 Sold In 2021 Is It Necessary To Submit 3 Personal Income Tax

How to fill out the erv correctly if there were payments on bir examples

The sheet is intended for calculating additional social contributions for civilian pilots and coal miners. In the section you need to indicate the number of insured employees, the amount of payments, the taxable base and the amount of contributions;

The sheet is intended for calculating additional social contributions for civilian pilots and coal miners. In the section you need to indicate the number of insured employees, the amount of payments, the taxable base and the amount of contributions;

The sheet is used by non-profit organizations on the simplified tax system that are engaged in socially significant activities in accordance with subparagraph. 7 clause 1 art. 427 Tax Code of the Russian Federation. The use of preferential types of insurance is permitted if income from these types of activities, as well as targeted revenues and grants, is at least 70% of total income;

Appendix 3 to Section 1

All organizations and entrepreneurs that use hired labor in their activities are required to submit the DAM. The report must be submitted for each quarter, even if no activity was carried out and no salaries were accrued.

Now let's look at the step-by-step filling out of the RSV-1 form for the 1st quarter of 2021 using an example. Fines for RSV-1 in 2021 For failure to provide a single insurance calculation or violation of deadlines, administrative liability and penalties are provided.

How to reflect severance pay and other payments upon dismissal in the RSV

The dismissal of employees in general cases is accompanied by the issuance or transfer of funds in the form of wages for time worked and compensation for unused vacation. Both of these payments are subject to insurance premiums. Therefore, both wages and compensation for unused vacation in the DAM will be included in full in all sections 1, 2, 3, where contributions are calculated, and will form the basis for them.

Certain situations, such as dismissal due to staff reduction or liquidation of an organization, oblige the employer to make additional payments, such as:

- severance pay;

- compensation for early dismissal;

- average earnings for the period of employment within three months;

- compensation upon dismissal of a director or chief accountant.

If the amount of these payments (with the exception of clause 2, which is completely not subject to contributions) does not exceed three or in some cases six times the average earnings, they are not subject to contributions. The amount exceeding the specified limit will go into the base for calculating contributions - lines 050 of subsections 1.1 and 1.2 and line 040 of Appendix 2.

In section 3 of the DAM, severance pay in case of layoffs and other similar payments are reflected in the total amount - line 140, and inclusion in the base (line 150) depends on compliance with the above conditions.

The ready-made K+ solution will help you deal with the taxation of all payments related to dismissal due to staff reduction. Get trial online access to the system and study all the latest data.

Do I need to reflect the funeral benefit in the RSV 2021?

Another payment from social insurance is the so-called funeral benefit. This benefit is available to those employees whose minor family members or family members who worked for the same employer have died (in accordance with the Temporary Rules approved by Resolution of the Federal Social Insurance Fund of Russia dated February 22, 1996 No. 16). The benefit is paid on the condition that the employee (relative of the deceased) bears funeral expenses at his own expense.

Note! The employer has the right to reimburse expenses directly to the funeral service instead of benefits. In this case, these expenses will not fall into the DAM.

The funeral benefit paid and reimbursed by social insurance in the RSV is reflected in line 070 of Appendix 2 to Section 1.

The decoding of this line is given in Appendix 3, line 090.

From February 2021, the limit on this payment is 6,124.86 rubles, adjusted by the regional coefficient.

If the employer decides, on its own initiative or on the basis of labor/collective agreements, to provide financial assistance to an employee in connection with the death of a family member, then such payment is not subject to contributions. It is included in the DAM, but is excluded from the base for each type of contribution. But financial assistance paid in connection with the death of other relatives of the employee who are not considered family members is subject to contributions as standard financial assistance.

How to show in the RSV amounts paid to the heirs of a deceased employee

In the event of the death of an employee of the organization, all amounts of remuneration accrued in his favor are transferred to his heirs. Here questions may arise regarding the calculation of contributions from such payments and their reflection in the calculation.

If the salary is accrued before the date of death, then it is clearly subject to contributions and, accordingly, falls into the DAM in the general manner.

If the accruals were made later, then there is no object for taxation of contributions, since the employment contract terminates due to the death of the employee. However, supervisors in the field may have a different point of view. Therefore, in order to further defend one’s interests, it is better not to include such amounts, for example, compensation accrued after a sad event for the unused vacation of a deceased employee, in the DAM at all on the basis of paragraphs. 1 and 2 tbsp. 420 Tax Code of the Russian Federation.

Results

The calculation of insurance premiums for payments other than wages is completed taking into account how social insurance contributions are calculated in each specific case.

If contributions are calculated on the full amount of the payment, then it will be included in both the total amount and the contribution base. This applies to all significant parts of the report: subsections 1.1, 1.2, appendix 2, section 3.

If the payment is not subject to contributions, then it is excluded from the base. In case of partial taxation of the payment with insurance premiums, only the taxable part of such payment will be included in the base.

Sources:

- Tax Code of the Russian Federation

- Resolution of the FSS of Russia dated February 22, 1996 No. 16

- Decree of the Government of the Russian Federation dated 02/08/2002 No. 92

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Example of filling out the Calculation

The report is filled out with a cumulative total from the beginning of the year. The amounts of income and contributions are reflected in a breakdown for each month of the last quarter, in total for the last quarter and in total from the beginning of the year. Personalized data for each insured individual is displayed separately - full name, passport details, date of birth, amount of income and contributions to pension insurance with a monthly breakdown.

Related publications

The RSV 2021 form was approved by the Federal Tax Service by order dated October 10, 2016 No. ММВ-7-11/ [email protected] , it is required for preparation by all policyholders. The report is intended to provide a detailed reflection of information on accrued income in favor of insured persons with Russian or foreign citizenship, calculated and paid amounts of insurance premiums (by types of such payments). The document is submitted to the Federal Tax Service, since the administrator of insurance contributions from 2020 is the tax service (an exception is made for contributions for injuries, they do not appear in the DAM, they should be reported to the Social Insurance Fund).

- organizations, individual entrepreneurs that pay employees salaries based on employment contracts;

- business entities making payments to contractors for work on the basis of civil contracts;

- Peasant farms - in terms of payments to employees and the head of the farm;

- organizations/individual entrepreneurs transferring payments to individuals for rent of premises, property, etc.

In this case, the filling order is also observed and the above formula is used. Regardless of the period for which the Social Insurance Fund reimburses costs, for the previous quarter or for the previous year, this must be reflected in the calculation directly in the month of receipt.

Sample of filling out the DAM with compensation from the Social Insurance Fund

The order of the Federal Tax Service, according to which it is planned to introduce a new form of the DAM, does not provide for any changes in terms of the obligations of business entities to submit a report. This means that in 2020 the general rules for submitting documents will remain the same.

- General information about the policyholder.

- Calculation of pension insurance contributions (subsection 1.1).

- Calculation of medical insurance premiums (subsection 1.2).

- Calculation of social insurance contributions.

- Costs for social insurance contributions such as temporary disability and maternity.

- Information about payments that were financed by the federal budget.

- Personalized information about insured persons.

Section 3 contains information about each insured person for whom contributions are calculated and paid by the enterprise. The data contains personal information and includes calculations for individual and total amounts. Along with the sections, a title page must also be filled out, on which information about the organization, the number of sheets and information about the reporting period are indicated. Each calculation page indicates the policyholder’s TIN and KPP.