An unpleasant surprise for the buyer is the discrepancy between the quantity of goods according to documents and in fact. There is a violation of the supply contract, what to do in this case? How to correctly register an insufficient volume of goods received? What liability is provided for a negligent supplier? We look at it in this article.

If the shipping agent is not a party to the supply agreement, he cannot be sued for debt collection for short delivery of goods, even if the specified person is responsible for the quality and quantity of the goods supplied by virtue of the agency agreement and a local act mandatory for the agent and the parties to the supply agreement . View the court's opinion

Business Solutions

- shops clothing, shoes, groceries, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

All material assets, which include furniture and household appliances, documents and even office supplies, are subject to recalculation. Depending on whether the organization has been prepared, the audit can be planned (on schedule, once a month) or unscheduled. To draw up a plan, write down a schedule according to which the responsible persons recalculate.

Reasons that may affect the conduct of an unscheduled inventory reconciliation:

- any natural disaster - fire, flood, destruction, as well as fire or flooding caused by workers;

- sale of a company or acquisition of a share, emergence of a new co-founder - any changes at the management level may lead to the need to find out the exact balance;

- theft, suspicion of theft, judicial or investigative proceedings.

Thus, an audit can be initiated for various reasons. But one thing remains mandatory - an order must be issued for the procedure, specifying the date and responsible persons.

How to manage the receipt and consumption of goods in a store

Traditionally, these processes are classified as warehouse accounting operations. MyWarehouse, a cloud service for trade management, allows you not only to accurately track the receipt and consumption of goods in the store , but also to effectively manage the company in general.

In a matter of minutes, you can register the arrival of goods at the warehouse and print all the necessary documents directly from the service. After entering the item into MyWarehouse, the remaining goods will be calculated automatically. You will also be able to quickly place orders with suppliers, store goods in several virtual warehouses, print barcodes and much more.

What is an inventory shortage?

The accounting department of any company is usually afraid of this term because when there is a shortage, it is much more difficult to tie up accounting loose ends than when there is a surplus. But the discovery of a shortage of products or material resources almost always occurs during an inventory of property.

A shortage of goods and materials is the lack of the required amount of money, goods or furniture, items belonging to the organization and recorded in the register. To carry out an audit, everything must first be put on the balance sheet - listed in the accounting documents. Only after these procedures can an inventory be carried out and indicators be verified.

Another feature of this process is the indication of the value of the item. If a computer is lost in a department, then employees who are financially responsible will compensate for the costs of purchasing it. Therefore, in accounting, when making an inventory, cost is always taken into account.

The pharmacy also has its own rules. Despite the fact that medications are purchased at cost, the full retail price may be withheld from the pharmacist or other person responsible for the shortage in the pharmacy when taking inventory of a person. The situation is the same with stores. This is because the shortage is considered a loss - the owner loses not only the purchase price, but also the money that he would have received upon sale.

Shortages include spoiled product, broken items, and broken dishes. Typically, this category is displayed in accounting and is posted as written off as expenses. Sometimes compensation is still required, for example, from waiters for broken glasses, since they are responsible for it. However, if the damaged goods were nevertheless sold, but at a reduced price, the shortage includes the difference between the full and final receipt.

Determination of the amount of shortage (damage)

In order to correctly reflect in accounting the shortage (damage) identified during acceptance of inventory items, for each item of these assets it is necessary to determine:

- total amount of shortage (damage);

- the amount of shortage (spoilage) within the limits of natural loss;

- the amount of shortage (spoilage) in excess of the norms of natural loss.

If the delivery was accompanied by transportation and procurement costs, then in addition it is necessary to calculate:

- the amount of transportation and procurement costs (TPC), which accounts for the total amount of shortage (damage);

- the amount of inventory, which is accounted for by the shortage (damage) within the limits of natural loss;

- the amount of inventory, which is accounted for by shortages (damage) in excess of the norms of natural loss.

The current norms of natural loss are presented in the table.

Calculate the total amount of shortage (damage) using the formula:

| Total amount of shortage (damage) | = | Number of missing (damaged) inventory items (in appropriate units of measurement) | × | Contractual (sales) price of the supplier (excluding VAT) per unit of measurement |

Calculate the amount of shortage (spoilage) within the limits of natural loss norms using the formula:

| The amount of shortage (spoilage) within the limits of natural loss norms | = | Total quantity of inventory items (in appropriate units of measurement) | × | Rate of natural loss (in%) | × | Contractual (sales) price of the supplier (excluding VAT) per unit of measurement |

Calculate the amount of shortage (spoilage) in excess of the norms of natural loss using the formula:

| The amount of shortage (spoilage) in excess of the norms of natural loss | = | Total amount of shortage (damage) | – | The amount of shortage (spoilage) within the limits of natural loss norms |

Calculate the amount of goods and materials, which accounts for the total number of missing (damaged) goods and materials, using the formula:

| The amount of goods and materials, which accounts for the total number of missing (damaged) goods and materials | = | Amount of TZR for this delivery (excluding VAT) | × | Shortage (damage) in natural units of measurement _________________________________ |

| Total quantity of inventory items for a given delivery in natural units of measurement |

Calculate the amount of inventory, which is due to shortage (damage) of goods and materials within the limits of natural loss norms, using the formula:

| The amount of inventory, which is accounted for by the shortage (damage) of goods and materials within the limits of natural loss norms | = | Amount of TZR for this delivery (excluding VAT) | × | Shortage (spoilage) within the limits of natural loss norms in natural units of measurement ________________________________ |

| Total quantity of inventory items for a given delivery in natural units of measurement |

Calculate the amount of inventory, which is due to shortage (damage) of goods and materials in excess of the norms of natural loss, using the formula:

| The amount of inventory, which is accounted for by the shortage (damage) of goods and materials in excess of the norms of natural loss | = | The amount of goods and materials, which accounts for the total number of missing (damaged) goods and materials | – | The amount of inventory, which is accounted for by the shortage (damage) of goods and materials within the limits of natural loss norms |

This procedure follows from the provisions of paragraph 58 and subparagraph “a” of paragraph 234 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n. Prepare the calculation using an accounting certificate.

Reasons for the shortage

The manager should not have a negative and misunderstanding attitude towards inventory, because often people go into the red not because of poor performance of duties, but for reasons that are completely unrelated to the employees themselves. They should be taken into account. Why the balance doesn't work out:

- Theft. Proving it is often quite difficult, especially if there are no CCTV cameras.

- Emergencies - fires, floods, damaged engineering systems (electricity went out for a day, a lot of food in refrigerators spoiled).

- Costs of defects, as well as damage to goods. They don’t charge money for trying on clothes, but while putting them on, they can get dirty or torn. I have to write it off.

- Error during sale. Sometimes products, especially products without a barcode, get mixed up.

- The person who is responsible for the inventory shortage may make a mistake in the calculations and write down the wrong data.

Since all of the above reasons are presented in a different order, you should first analyze what caused the shortage. Usually all responsible persons write explanatory notes for each case.

simplified tax system

The tax base of simplified organizations that pay a single tax on income, expenses in the form of shortages and damage are not reduced (clause 1 of Article 346.14 of the Tax Code of the Russian Federation).

If an organization pays a single tax on the difference between income and expenses, then losses from shortages (spoilage) identified when receiving inventory items should be included in material expenses within the limits of natural loss norms (subclause 5, clause 1, clause 2, article 346.16, subparagraph 2, paragraph 7, article 254 of the Tax Code of the Russian Federation). These expenses reduce the tax base when a shortage (damage) is identified, provided that the materials received were paid for (subclause 1, clause 2, article 346.17 of the Tax Code of the Russian Federation).

Do not take into account shortages (damage) in excess of natural loss norms when calculating the single tax. Submit a claim to the supplier (carrier) for this amount. If the supplier (carrier) acknowledged the claim and returned the excess amount received to the purchasing organization, do not increase the tax base. This amount is not income (Article 41 of the Tax Code of the Russian Federation). It only reduces the receivables that the organization has incurred due to shortages (damage). Therefore, this amount cannot be attributed either to income from sales or to non-operating income (clause 1 of Article 346.15 of the Tax Code of the Russian Federation). This approach is confirmed, for example, by letters from the Federal Tax Service of Russia for Moscow dated September 30, 2005 No. 18-11/3/69747 and dated March 31, 2005 No. 18-11/3/21626.

The procedure for registering a deficit

First, you need to collect all the documents confirming the transactions, including the inventory report and sales receipts. Based on this, a write-off order is drawn up and signed.

Otherwise, if the costs turned out to be too high or a large batch of goods was damaged, an internal investigation is carried out for negligence or theft.

Not everything is taken into account so scrupulously. There are certain categories of goods and materials that are not considered special values due to their cost, so any quantity can be recorded as expenses.

There is another option for registering a deficit - withholding from the culprit. Usually the amount is deducted from his salary. This happens in cases where guilt is proven.

BASIC: income tax

Losses from shortages (spoilage), identified when receiving inventory items within the limits of natural loss norms, are included in material costs under a separate item (subclause 2, clause 7, article 254 of the Tax Code of the Russian Federation). If losses are not classified as direct expenses, take them into account in the period when the shortage (damage) was identified (paragraph 1, paragraph 2, article 318 of the Tax Code of the Russian Federation). If the organization takes them into account as direct expenses, then the profit tax can be reduced only after the products in the cost of which they are taken into account are sold (paragraph 2, paragraph 2, article 318 of the Tax Code of the Russian Federation). The organization independently establishes the list of direct expenses in its accounting policy for tax purposes (paragraph 10, paragraph 1, article 318 of the Tax Code of the Russian Federation).

When calculating income tax, use the same norms of natural loss that are used in accounting (Article 7 of Law No. 58-FZ of June 6, 2005). Do not take into account shortages (damage) in excess of natural loss norms when calculating income tax. Submit a claim to the supplier (carrier) for this amount. If the supplier (carrier) acknowledged the claim and returned the excess amount received to the organization (buyer), do not increase the tax base. This amount is not income (Article 41 of the Tax Code of the Russian Federation). It only reduces the receivables that the organization has incurred due to shortages (damage).

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

Transfer of the certificate of non-delivery to the transport company

The act itself, with all the documents attached to it, is an addition to the claim. A claim to the carrier about a shortage of cargo usually must be written and submitted to transport workers within six months.

The claims procedure for considering disputes arising from transportation is established by law and is mandatory. Appeal to judicial authorities without following the complaint procedure is not allowed.

The legislation also establishes a period for consideration by the carrier of claims received by them. As a rule, this is a thirty-day period of time. If the claim procedure does not bear the expected fruit, the interested party has the right to go to court.

In general, it should be emphasized that finding out who is right and who is wrong when resolving disputes with transport companies is quite a troublesome matter. Therefore, when such situations arise, it is better to use the experience of competent lawyers.

After all, the process of proving various circumstances and drawing up documents requires professionalism and legal knowledge.

How to write off shortages during inventory

Often, deterioration depends on customers, clients or natural wear and tear, time. In such cases, the registration procedure is as follows: you need to accurately calculate the loss expressed in monetary units, and then issue an order according to which this audit result should be included in the category of business expenses. In this case, you should carefully ensure that the monthly amounts do not exceed a certain norm, and also have confirmation in the form of cash receipts and explanatory notes, otherwise you may be charged with embezzlement.

There are predetermined standards, they are also called distribution costs. These include all shortages that were caused by the buyer. Let's give an example: in a grocery store, a client accidentally broke an item; he is not obligated to pay for it. But if the amount of costs exceeds the norm, then you need to look for the culprit. For example, if the entire rack was hit, then perhaps the merchandiser is to blame for not arranging the products according to the rules.

And these requirements are most strictly imposed in government agencies. In a commercial company, managers often turn a blind eye, even when standards are clearly exceeded. But in the government structure, any value is part of the state budget, so the balance there is maintained very strictly. The shortage is seen as causing direct damage to the country. In Soviet times, this could have resulted in capital punishment. If the manager gives an order to write off the shortage based on the inventory results for a larger amount than required, then the fact will be considered as misuse of public funds and embezzlement. There is criminal liability for this.

Accounting

In accounting, reflect the shortage (damage) of inventory items with the following entries:

Debit 94 Credit 60

– the shortage (damage) of goods and materials is reflected within the limits of natural loss;

Debit 10 (15, 41) Credit 94

– the shortage (damage) of goods and materials was written off within the limits of natural loss norms.

For the amount of shortage (damage) in excess of the norms of natural loss, submit a claim to the supplier (carrier). The amount of the claim must include VAT previously claimed by the supplier and inventory items (in the part related to undelivered (damaged) inventory items):

Debit 76 Credit 60

– a claim was made for the amount of the shortage (damage) including VAT and TZR.

This procedure is established by paragraph 59 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

If the supplier (carrier) acknowledges the claim, then he is obliged to return the excess amount received to the bank account of the purchasing organization or offset it against future deliveries (transport services):

Debit 51 (60) Credit 76

– a refund of money (offset) is reflected in connection with the recognition of the claim by the supplier (carrier).

The amount of shortage (damage) is reflected in other expenses if:

- it arose as a result of force majeure;

- the supplier (carrier) refused to compensate for the shortage (damage) and it was not possible to recover compensation through the courts.

In these cases, make the following entries in accounting:

Debit 94 Credit 76

– the shortage (damage) was written off, the claim for which was rejected (arising as a result of force majeure);

Debit 91-2 Credit 94

– the amount of the written-off shortage (damage) is included in other expenses.

This procedure follows from paragraphs 11 and 13 of PBU 10/99 and the Instructions for the chart of accounts.

The procedure for tax accounting of shortages (losses) identified when receiving inventory items depends on the taxation system that the organization uses.

Consequences for the financially responsible person

The person responsible for inventory items writes an explanatory note addressed to his immediate superiors. This document is provided by management within two days from the date of the relevant request, usually it arrives immediately after accounting.

Based on this paper, a decision is made, which consists of writing off the company’s expenses or deducting losses from the employee. The verdict is rendered in accordance with the admission of the share of guilt by the MOL.

Short delivery or non-delivery?

The Civil Code of the Russian Federation, when considering issues of deliveries under relevant contracts, does not explain what exactly is considered a shortfall. Nevertheless, buyers, unfortunately, often encounter this phenomenon in practice. The courts have accumulated enough precedents related to short deliveries, so the following definition has emerged.

Question: What are the features of calculating penalties for short delivery or late delivery of a consignment of goods? View answer

Shortage of goods is a violation by the supplier of the conditions specified in the supply contract or other shipping documents regarding the volume of goods actually delivered. In other words, less goods arrived at the buyer’s warehouse than was indicated:

- in the supply contract;

- on the invoice;

- in the invoice, etc.

IMPORTANT INFORMATION! According to existing judicial precedent, short delivery also includes the inability to sample goods if the supplier is at fault.

A delay in the delivery of all goods or its next batch does not apply to non-delivery - such a violation is called non-delivery .

What is the buyer's procedure if (quantity discrepancy) is detected upon acceptance of the goods

How to recover the shortfall from the guilty parties

The consequences can be serious, including criminal penalties + compensation for costs. Most often, management positions and senior accountants are sanctioned. The level of financial responsibility is discussed during employment and specified in the contract. Sometimes the responsibility may be collective or partial. Then the shortage is removed from all employees.

The deficit is withheld from wages. First, the result of the inspection and a conclusion on it from management with a decision on penalties are provided. Then this amount is deducted from the next paycheck. If the culprit at this moment goes through the dismissal procedure, then the debt is deducted from the last salary. If an employee refuses to pay the funds, he can be held accountable through the court.

What other documents can be drawn up upon acceptance of goods?

When accepting goods, an authorized employee must check their quantity and quality. Based on the results of the inspection, one of the following documents is drawn up:

- An acceptance certificate is drawn up if no inconsistencies or complaints have been identified.

- A return certificate is drawn up if all or most of the product is damaged.

- The shortage report is filled out when there is a shortfall.

- A surplus act is drawn up if the buyer wants to take the surplus for himself.

All documents must be drawn up according to strict standards. At the same time, the reasons for drawing up the document are clearly indicated.

Bookmarked: 0

Explanatory: how to reflect the shortage

In the document, the financially responsible person indicates, in addition to his personal data:

- when the incident occurred;

- a detailed description of the event - what happened, for what reasons, whose fault;

- the sequence of one’s own actions is an attempt to prevent an incident.

You must sign, initial and date the explanatory note.

A sample of its preparation

General information

If during the acceptance of commercial cargo (unloading a container or wagon) a shortage of goods is detected, a special document is drawn up - a statement of shortage of goods. The act is necessary to record the violation, which in turn will provide compensation for the company’s losses.

However, the document itself does not talk about any payments - only about what is missing and about the carrier.

The act is filled out by a commission that consists of representatives of both parties: the supplier and the recipient. If this is not possible and the cargo arrived unaccompanied, the shortage report is filled out only by the recipients. Once completed, a copy is sent to the supplier by email or registered mail.

Shortage order

Based on the explanatory note, a decision must be made:

- the employee is guilty;

- innocent;

- it is necessary to assemble a commission to investigate.

As a result, a paper must be written to confirm one of the three intentions. It states:

- a brief description of the situation;

- persons involved;

- resolution.

Drafting sample

How to compose correctly

There is an official accounting form for the act of shortage of goods - TORG-2 (for imported products - TORG-3). The form of this form consists of four sheets and is adapted to describe the shortage in as much detail as possible, which is both an advantage and a disadvantage.

Expert opinion

Semenov Alexander Vladimirovich

Legal consultant with 10 years of experience. Specializes in the field of civil law. Member of the Bar Association.

Not everyone is comfortable using such a sample. Therefore, if it does not suit your goals, you can create your own: the law does not prohibit this.

The main thing is to create the right structure. If you want to create your own product shortage report template, follow the following scheme:

- The header of the document is reserved for the addressee’s details: the name of the company (or full name of the supplier) and the address to which the act should be delivered;

- After the header comes the name of the act and begins its factual part with a detailed description of what happened;

- At the bottom there are places for signatures of all commission members.

Shortage in stock

Warehouses have a constant flow of inventory items, so goods are often lost here. Let's figure out why this happens.

Causes

- Lost documents or filled them out incorrectly. The invoice arrived, they issued the commodity units according to it, but did not put it in the book.

- Lack of equipment, poor accounting conditions.

- Unforeseen factors that led to damage.

- Theft.

What to do

It is worth conducting an investigation according to the above standards, that is, start by obtaining explanatory notes, then issue an order. On its basis, make either a write-off as an expense or a recovery from the culprit. We also recommend installing CCTV cameras to monitor possible acts of theft.

Identification of shortages (damage) of goods and materials

If the actual quantity (quality, assortment) of goods and materials does not correspond to the supplier’s documents, then a special commission must accept them. Upon acceptance, you must draw up an act in form No. M-7, approved by Decree of the State Statistics Committee of Russia dated October 30, 1997 No. 71a. It should indicate the quantity and cost of missing (damaged) inventory items. The act of acceptance of materials in Form No. M-7 is the basis for making claims against the supplier or carrier and for reflecting shortages in accounting. This procedure for documenting shortages is established by instructions approved by Resolution of the State Statistics Committee of Russia dated October 30, 1997 No. 71a.

Business Solutions

- the shops

clothes, shoes, products, toys, cosmetics, appliances Read more

- warehouses

material, in-production, sales and transport organizations Read more

- marking

tobacco, shoes, consumer goods, medicines Read more

- production

meat, procurement, machining, assembly and installation Read more

- rfid

radio frequency identification of inventory items More details

- egais

automation of accounting operations with alcoholic beverages Read more

How to avoid

We recommend keeping records using special devices and programs. Based on them, lists and documents are independently generated. This greatly simplifies all warehouse activities – deliveries and shipments. You can order such equipment and software at.

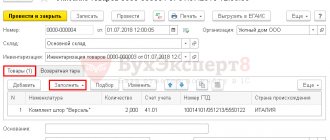

If your enterprise uses “1C: Accounting” in any delivery, “1C: UPP” or 1C for a construction organization, and you plan to carry out inventory only on barcodes (you will not use RFID), then a special driver for inventory is completely suitable for you from Cleverens, the delivery package of which includes all the programs and processing necessary both for printing labels and for working with the data collection terminal.

If you are using 1C, but you plan to implement RFID, then another program is suitable for you - Cleverence: Property Accounting. Also, there are software products for stores and warehouses that will help optimize and automate inventory accounting, as well as eliminate cases of shortages during inventory.

See how Shop 15 helps automate the inventory process in a chain of building materials hypermarkets. As a result of implementation, the process became much simpler and made it possible to abandon the involvement of outsourcing companies.

What should a buyer do if he discovers a shortage?

While checking the invoices and counting the cargo, the buyer discovered a discrepancy. There is a shortage of supplies. How to properly file this violation?

- Fixing shortfalls. The first step is to document the detected discrepancy between the quantity of goods and the numbers in the accompanying documents. This is done using a specialized act, which is drawn up by representatives of the buyer and supplier. If it is impossible to attract a supplier (for example, the cargo is delivered by a transport company), it is better to foresee this situation in advance and stipulate in the supply agreement the possibility of registering shortages with the participation of an independent person. Standard forms of acts:

- TORG-2 – for receiving domestic goods;

- TORG-3 – used for goods from import suppliers;

- M-7 – acceptance of materials.

- Mark on the invoice. The fact of short delivery must be noted in the shipping document. If there are several items in the invoice, a mark should be placed only in those lines where the goods are missing, and at the end it should be noted that there are no discrepancies for the remaining items. The invoice should also indicate the number of the completed non-delivery report.

- Drawing up a letter of claim. In a more or less free form, a claim document is drawn up, which indicates data on shortfalls: the name and quantity of goods under the contract and in fact, the number of the drawn up report. The claim is sent to the supplier within the period specified in the agreement, or as soon as possible upon discovery of a shortfall. The claim must also indicate one of the following requirements or an acceptable combination of them:

- refusal of a shipment of goods with a detected shortage with the return of money prepaid for it;

- reimbursement of funds for the purchase of the missing quantity of goods from another supplier;

- delivery of the missing quantity within the agreed time frame;

- revision of the quantity of goods in the accompanying documents and the supply agreement (the buyer agrees to a reduced batch with recalculation of the cost).

- Supplier response. Depends on the requirement expressed by the buyer:

- if the buyer refuses the transaction, it is necessary to return the money already paid for the goods;

- You will also have to transfer money in the event of a claim for compensation for shortfalls;

- when a replenishment or revision of the batch size is required, the supplier will need to change the invoices, certify them with the signatures of management and mark the date of correction (the invoices themselves do not need to be corrected, since there is a statement of shortfall, the number of which is entered in them when recording).

- Last resort. If there is no response from the supplier within a month (or other agreed period) after sending the claim, you need to file a lawsuit for underdelivery - it should be considered within 3 months. Further contact with enforcement services may be required.

If the shortfall was not discovered immediately, the form of the report may be free (for example, the total number of packages was recalculated, and when they were opened, it turned out that some packages were incomplete). In this case, it is necessary to prove that upon acceptance it was not possible to check the actual quantity of the goods.

FOR YOUR INFORMATION! To additionally document the fact of underdelivery, it is recommended to photograph the invoices, as well as the goods, if this shows underdelivery (incomplete containers, cargo that can be counted in the photo, etc.).

Is it possible to force a supplier to deliver goods?

As a general rule, the supplier cannot be forced to deliver the goods. This depends on whether the goods supplied are (1) an individually defined thing or (2) a thing with generic characteristics.

(1) An individually defined thing is a one-of-a-kind thing; it has characteristics that distinguish it from other such things: cultural and historical value, personal value, registration. For example, a truck with the VIN code, Serov’s painting “Girl with Peaches”, etc.

If the thing is individually defined, unique, then the buyer has the right to demand that the supplier (seller) be forced to supply such goods (Article 463 of the Civil Code of the Russian Federation).

(2) A thing that has generic characteristics is a thing that can be replaced by another thing of the same kind. For example, sand, concrete blocks, spare parts, tiles, etc. It doesn’t matter how rare and irreplaceable the product is - the main thing is that it is not registered and does not have historical or cultural value.

If this is a thing defined by generic characteristics, then the buyer does not have the right to demand delivery of such goods - the civil code does not provide for such a measure of protection for the buyer.

Liability of the supplier who committed the violation

If a shortfall is identified and recorded, the supplier is guilty of improper performance of the contract and one of the following forms of property liability may be applied to him:

Shortage of goods is a violation by the supplier of the terms of delivery regarding the quantity of goods or names of goods.

It is necessary to distinguish short delivery from: non-delivery of goods, late delivery, violation of conditions on completeness and assortment - since in each of these cases there are different consequences of violation.