Home / Real estate / Purchasing real estate / Buying an apartment / Deduction Back Published: 12/28/2017

In certain situations, government agencies, commercial banks and other structures, along with the necessary documents, ask

Home • Blog • Online cash registers and 54-FZ • Cash register for the simplified tax system in 2021

Commentary to paragraphs 1, 2, 3 of Art. 7 Difference between the requirements of clause 1

Individual entrepreneurs and organizations that are employers are required to transfer insurance contributions (from employee payments

Russian enterprises employ not only Russian citizens, but also foreign migrants. Legal employment

What is considered net profit? In Russian reality, the idea has long been rooted that there is “pure” income

There are often cases when accounting departments accidentally overestimated the amount of a certain tax in transactions and entered

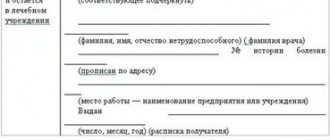

Business lawyer > Labor law > Sick leave, benefits > Error in the name of the organization in

Form P15016: assignment Order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14/ [email protected] approved forms and Requirements