At the end of the reporting period, companies are required to prepare and submit annual financial statements to regulatory authorities. In what composition and by what deadline do I need to submit annual financial statements for 2021?

ACCOUNTING SERVICES

The preparation of financial statements begins with checking the correctness of the generated turnovers and balances in the accounting accounts.

In one of the articles “Priority tasks by January 1, 2021,” we present the main activities that an accountant needs to carry out before preparing financial statements.

Important! If the turnover is formed in accordance with current accounting standards and the company’s accounting policies, and the accounting program provides the necessary detail of accounts, then the preparation of financial statements is, in fact, a technical work.

In addition, in many 1C software products there is an express check of accounting and analysis of the state of accounting. One of the purposes of such checks is to analyze accounting results, the presence of account balances that must be distributed, etc.

However, in a number of non-standard, complex business transactions, it would be useful for an accountant to trace the movement in the accounts of synthetic and analytical accounting and the correctness of the formation of the corresponding line of accounting statements.

RESTORATION OF ACCOUNTING

Composition of the annual financial statements for 2021

The main reports are:

- balance sheet of the enterprise (form No. 1), which gives a general idea of the balances of property, capital and liabilities at the end of the reporting year in comparison with the balances at the beginning. The document is generated in a table, the left side of which contains information about existing assets, and the right side – about their sources. A prerequisite for the formation of a balance sheet is the equality of the parts of the table.

For example, the property in total terms on the balance sheet asset amounted to 12,000 thousand rubles, which means that the balance sheet liability should be the same amount, ensuring that the cost of the property is covered by capital (own and borrowed) and debt to creditors;

- financial results statement (FPR) – form No. 2, which explains to the user what financial flows the company has from different types of activities, and also reflects the total result of the company’s work for the year as a whole. The amounts of profit/loss in the financial financial statements must be correlated with the balance sheet data. For example, the amount of retained earnings in the balance sheet should be equal to the amount of net profit in the general financial market if profits were not distributed in the year.

The annual reporting package is supplemented by annexes to the main forms:

- Form No. 3 – “Report on Changes in Capital” (OIC), detailing the dynamics of changes in all types of capital in the company in the reporting and preceding years. The information in the OIC also corresponds to the balance sheet data on the availability of equity capital, formed in the 3rd section. Thus, lines 3300, 3200, 3100 of the OIC for the corresponding periods and types of capital should be equal to balance sheet lines 1310, 1320, 1350, 1370, 1300;

- Form No. 4 “Cash Flow Statement” (CFDS), reflecting the amount of reserves of cash and cash equivalents quickly converted into money in the company at the beginning and end of the reporting year;

- For non-profit enterprises, a report on targeted financing (form No. 6) is mandatory.

A separate document to the reporting package includes appendices (form No. 5) that decipher the balance sheet and financial information data. Although this document is not officially included in the financial statements, it is often necessary to convey to the regulatory authorities the main details of the company's activities. The reporting and explanations to it are supplemented, which provide an objective assessment of the financial and property status of the company, general information and analysis of the most important indicators.

All reporting forms are approved by Order of the Ministry of Finance of the Russian Federation No. 66n dated July 2, 2010 (as amended on March 6, 2018). It also defines the recommendations and procedure for filling out financial statements, and also presents simplified versions of the balance sheet and financial statements, filled in with grouped values without item-by-item differentiation of data, as should be done when generating familiar reporting documents.

OKVED codes in the financial statements for 2021 are reflected in accordance with the OK 029-2014 classifier (Rosstandart order No. 14-st dated January 31, 2014).

Where is a sample of filling out the balance sheet for 2020-2021

The 2020-2021 balance sheet form can be downloaded from our website using the link below:

The balance sheet form can also be found, filled out and sent to its destination on the Federal Tax Service website, in the taxpayer’s personal account.

Filling out the balance sheet form for 2021 in 2021 must take into account data from the accounting accounts and obey the following rules:

- When generating a report, the reporting period is a year. Interim reporting is prepared only by decision of management or owners.

- An approved form is used, which, if deeper detail is necessary, can be supplemented with new lines.

- The form provides for the reflection of indicators for the current year and for the previous 2 years.

- The balance sheet should include indicators in a net valuation, that is, cleared of regulatory values (for example, depreciation of fixed assets).

- Debit and credit balances for accounts in the balance sheet are shown in detail if the net valuation rule does not apply to these accounts. In a net valuation, property is reflected in the asset at its book value, that is, fixed assets and intangible assets - at the residual value, and inventory and materials - at the cost minus reserves (if they are formed).

- Interest on long-term loans should be shown as part of short-term debt, and interest on financial investments should be shown as part of settlements with the counterparty.

- The issue of reducing the debt to customers from whom an advance was received by the amount of VAT accrued on these advances is decided by the reporting preparer independently.

- A separate column provides links to explanations, disclosing information, etc.

For an example of compiling a balance sheet, see ConsultantPlus by receiving trial demo access to the K+ system for free (click on the link below):

Accounting statements for 2021: who submits them

All legal entities maintain accounting and submit annual reports based on it. This requirement does not apply to individual entrepreneurs - they are completely exempted by the legislator from these responsibilities (subject to keeping records of income and expenses - Article 6 of Law No. 402-FZ of December 6, 2011). We also note that credit institutions and public sector enterprises report using other reporting forms.

At the end of the year, most companies present a full package of these reporting documents. Moreover, if the financial statements of an LLC are presented with this list, then joint-stock companies must attach to the set of reports an auditor’s report confirming the reliability of the given indicators.

Representatives of small businesses - companies with up to 100 employees and a revenue turnover of up to 800 million rubles. per year, has the right to keep simplified records, i.e. submit only simplified balance sheets and financial statements. Small companies may not prepare other forms of reporting. If the activities of such a company are based on the use of targeted budget revenues, then a report on targeted financing is added to the main package of annual reporting. Read more about accounting for small businesses here.

What kind of reporting is established for business entities and citizens?

The obligation to submit reports to various government bodies may be imposed by law:

- For legal entities.

- On IP.

- For individuals not registered as individual entrepreneurs.

The first 2 categories of reporting preparers are business entities; they may be required to submit documents to government agencies that can be classified into the following main categories:

- reporting on commercial and property taxes, accounting indicators;

- personal income tax reporting;

- reporting on contributions;

- statistical reporting.

Individuals who are not registered as individual entrepreneurs are generally exempt from preparing these types of reports. But in practice, citizens need to provide certain reporting documents. Later in the article we will study this feature in more detail, but for now we will focus on determining the deadlines for submitting reports by persons for whom such an obligation is established by default.

A convenient format for presenting deadlines for submitting reports in 2021 is a table. Let us therefore consider in tabular form the deadlines for submitting these categories of reports to government agencies. Let's start studying the accountant's calendar for 2021 in terms of reporting deadlines with information on the provision of reports on commercial, property taxes and accounting indicators.

Deadlines for submitting accounting reports for 2021

The legislator has allowed 3 months after the end of the financial year to prepare accounting reports in both full and simplified form, approve them and submit them to regulatory authorities. Those. All reporting forms for 2021 must be submitted no later than March 31, 2021. But given that this day falls on a Sunday, the last day for submitting financial statements for 2018 will be April 1.

Both in the Federal Tax Service and in the Rosstat department, accounting reports 2018 can be submitted both in paper and electronic format, the number of company personnel does not play a role in this case.

Contribution reporting

Now about the deadlines for submitting reports in 2021 on contributions to state funds by individual entrepreneurs and legal entities. In all cases, it is provided by entities that make payments to individuals under employment or civil contracts.

| Reporting type (form) | Rent (can rent) | Due date in 2021 | Notes | |

| IP | Legal entity | |||

| Unified calculation of insurance premiums | Yes | Yes | Until January 30 For the reporting period - until the 30th day of the month after it | For rent to the Federal Tax Service |

| SZV-M | Yes | Yes | For December 2021 - until January 15 For the reporting month - before the 15th day of the month after it | For rent to the Pension Fund |

| SZV-STAZH + ODV-1 | Yes | Yes | Until March 1 | |

| SZV-TD | Yes | Yes | For December 2021 - until January 15 For the reporting month - before the 15th day of the month after it Upon dismissal and hiring - no later than the next day | |

| 4-FSS | Yes | Yes | Until January 20 For the reporting period - until the 20th day of the month after it | For rent at FSS On paper |

| Until January 25 For the reporting period - until the 25th day of the month after it | For rent at FSS Electronic | |||

Approval of accounting records

The prepared financial statements are signed by the head of the company. Let us remember that it becomes legally significant and actually drawn up only after approval by the top management, for example, by a meeting of shareholders.

The date of approval of the financial statements is indicated in the title of the balance sheet. The legislator has established the deadlines possible for holding a meeting of shareholders - a JSC has the right to hold it no earlier than 2 months after the end of the financial year - from March 1 to June 30 (Article of the Law on JSC dated December 26, 1995 No. 208-FZ). For LLCs, the period for holding a general meeting of participants is set from March 1 to April 30 after the reporting year (Article of the Law on LLCs dated 02/08/1998 No. 14-FZ). The exact deadlines are established by the charters of the companies.

Increase in minimum wage

From January 1, 2021, the minimum wage increased to 9,489 rubles ( Law No. 421-FZ dated December 28, 2017 ). In this regard, employers need to adjust their local regulations and increase wages for employees who are tied to the minimum wage. It is necessary to issue a corresponding order and make changes to the staffing table.

If an employee is paid a salary below the minimum wage, liability will arise under clause 5.27 of the Administrative Code. It involves a fine of 30,000-50,000 rubles.

Publicity of financial statements

Since the company’s reporting must be open to all users (participants, creditors, partners, credit institutions, current and potential investors), the legislator in PBU 4/99 (clause 47) established the obligation to publish it.

Organizations whose publication of information about their activities is mandatory include joint-stock companies, credit institutions, insurance companies, LLCs that issue bonds and other securities. The deadline for publication of accounting (financial) statements for 2021 is no later than June 1, 2021.

New KBK

Some BCCs have changed - they were approved by Orders of the Ministry of Finance dated 06/06/2017 No. 84n and 06/09/2017 No. 87n . We have collected them in the following table.

Table 1. New KBK in 2021

| KBK | Decoding |

| For excise taxes on tobacco products | |

| 182 1 0300 110 | e-Sigs |

| 182 1 0300 110 | liquids with nicotine |

| 182 1 0300 110 | tobacco that is intended to be consumed by heating |

| For income tax on interest on Russian bonds | |

| 182 1 0100 110 | income tax |

| 182 1 0100 110 | penalties |

| 182 1 0100 110 | fines |

| For resort fee* | |

| 000 1 1500 140 (the first three values are the revenue administrator code) | |

*Resort fees will be introduced in some regions of the Russian Federation no earlier than May 1, 2021. The fee is no more than 50 rubles per tourist per day ( Law No. 214-FZ dated July 29, 2017 ).

New profit declaration

The income tax return has been changed from reporting for 2021.

That is, now you will need to report for the year using a new declaration form. The draft changes are available on the website regulation.gov.ru. There are no major changes expected, so this declaration is unlikely to cause any difficulties. The 2021 tax amendments will mainly be taken into account. In particular, a rule appears in the declaration: it is possible to reduce the profit base for losses of previous years only within 50 percent. Also, sheets for consolidated groups of companies and controlled organizations will be updated.

New form of property tax declaration

For 2021, you will need to submit a new property tax return form. The form and procedure for filling it out were approved by order of the Federal Tax Service of Russia dated March 31, 2021 No. ММВ-7-21/ [email protected] , which came into force on June 13, 2021.

The new declaration now includes section 2.1 “Information on real estate objects taxed at the average annual value.” It provides lines for entering the cadastral number, OKOF code, and the residual value of the real estate property.

Structure, structure and content

As mentioned earlier, a tabular format is provided for the official balance sheet of a business entity. How many sections does the report include?

This table is divided into two main sections – assets and liabilities. In turn, assets include 2 sections, liabilities - 3.

In this case, the main requirement for compilation is: the total value of all assets equals the total value of all liabilities.

What 5 sections does the balance sheet consist of:

- Fixed assets.

- Current assets.

- Capital and reserves.

- Long term duties.

- Short-term liabilities.

The characteristics of the structure and principles of constructing an accounting report are discussed in more detail below.

What does the asset division consist of?

The assets of an economic entity reflect the type structure and book value of the property that is under the control of this entity, used in its activities, and capable of generating future benefits.

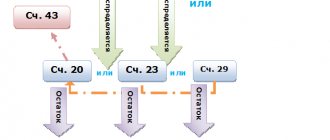

The active part of the balance sheet includes data from two sections:

- Fixed assets. This section reflects the structure and valuation of the company's property used by it for a long time (more than twelve months counted from the balance sheet date). The cost of some types of such property is gradually transferred in parts to the financial results of the company (through depreciation).

- Current (current) assets. Their structure changes frequently and significantly (over a period not exceeding twelve months, counted from the balance sheet date), and the cost of certain types of such assets, as a rule, is taken into account one-time in the financial result.

What is included in liabilities?

Liabilities demonstrate the type structure and book value of those sources of financing through which the organization acquires (forms) the above assets. The composition of liabilities is characterized by three main sections:

- Capital and formed reserves of the enterprise. These are the so-called own funds of a business entity, which fully correspond in value to the value of its net assets.

- Long-term obligations of a business entity, clearly reflecting the type structure and valuation of its debt, which has existed for quite a long time. The validity period of such obligations is more than twelve months, counted from the balance sheet date.

- Current (short-term) liabilities demonstrating the structure and valuation of the most dynamic part of the company's balance sheet debt. The structure and valuation of a company's current debts change over a period not exceeding twelve months from the balance sheet date.

Sections and articles with codes and decoding of lines for accounting accounts

Structure in table form:

Rules for forming indicators

The basic rules for filling out the annual balance sheet compiled by a business entity are established by specific norms of the current legislation and boil down to strict compliance with the following requirements:

- Compiled on the basis of reliable accounting information.

- Formation of the necessary data in accordance with the norms of generally accepted accounting provisions and the requirements of the accounting policy of the company itself.

- Reliability, accuracy, completeness of the data used.

- If an organization has branches, a single (general) balance sheet is always prepared for the entire company.

- Neutrality of balance sheet data, their correlation with information from previous reporting periods.

- The principle of materiality must be taken into account when highlighting individual items in certain sections of the report under consideration.

- Calendar year is the official reporting period.

- There should be a clear distinction between long-term (more than twelve months) and short-term (less than twelve months) assets/liabilities.

- If accounting provisions do not provide for offset between individual items, it should not be performed.

- Property is assessed at net cost, which implies the deduction of items of a corrective (regulatory) nature.

The information in the annual reporting must be confirmed by the corresponding audit (inventory).

How to check the correctness of the design?

The reliability of the generated reporting is verified by an external audit, as a result of which it is either confirmed or refuted.

The expert-auditor's opinion is one of the mandatory annexes to the annual balance sheet sent to official structures (instances). However, such an audit is not required for all business entities, but only for those organizations for which the mandatory nature of this procedure is established by current legislation.

Another significant nuance is that the auditor’s opinion on the balance sheet must be provided only to the statistical agency when sending annual reports.

The Tax Service does not yet require an audit opinion when submitting reports for the past 2021.

New transport tax return

A new form must be submitted for transport tax reporting for 2021. It was approved by order of the Federal Tax Service of Russia dated December 5, 2016 No. ММВ-7-21/ [email protected]

The new declaration form now has special lines where you need to indicate the amount of the “Platonic” fee, by which the transport tax can be reduced from January 1, 2021. In section 2 of the declaration, you must indicate in separate lines: “Date of registration of the vehicle”; “Date of termination of registration of the vehicle (deregistration)” and “Year of manufacture of the vehicle.”

Results of intellectual activity

Minor changes affected income accounting. Now they do not have to include property rights to the results of intellectual activity that were identified during the inventory in the period from January 1, 2021 to December 31, 2021. Amendments to Article 251 of the Tax Code were introduced by Law No. 166-FZ of July 18, 2021 .

In addition, from the beginning of this year, instead of sending a report on R&D to the Federal Tax Service, it will be necessary to place data in GIS. Tax authorities will have to be notified of this using a specially designed form.