Form P15016: appointment

Order of the Federal Tax Service of Russia dated August 31, 2020 No. ED-7-14/ [email protected] approved the forms and Requirements for filling out documents sent to tax authorities during the state registration of business entities. These forms have different purposes. If a legal entity is registered, then form P11001 is sent to the Federal Tax Service, and if liquidation is carried out, form P15016 is sent. This form has been used since Order No. ED-7-14/ [email protected] into force - November 25, 2020.

The considered form of application R15016 for the liquidation of a legal entity essentially combines the structure of two previously used forms of notification and application for liquidation - R15001 and R16001 (approved by order of the Federal Tax Service of Russia dated January 25, 2012 No. ММВ-7-6 / [email protected] ) .

Let's get acquainted with the features of the new form P15016; we will also provide a sample of filling out the document in this article.

When do new forms come into effect?

The Federal Tax Service order approving the new application forms came into force on November 25, 2020. From this date, documents must be filled out according to the new rules, otherwise registration will be denied. The notification is provided to the registration authority at the location of the company within 3 working days after the decision on liquidation is made, along with the decision itself. Please note that downloading the new form P15001 in Excel is still problematic, although many are accustomed to working with notifications in this program. But you can download it in PDF format, which is recommended for this document by the Federal Tax Service.

ConsultantPlus experts discussed how to fill out an application (notification) about the liquidation of a legal entity using form No. P15016. Use these instructions for free.

How to fill out the application form P15016

The application can be filled out manually or on a computer. All text values are written in capital letters. Completed pages are numbered consecutively. Detailed general rules for filling out an application are given in paragraph 4-24 of the Requirements for filling out.

Form P15016 includes:

- Title page.

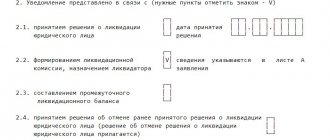

Here you must indicate the OGRN and TIN of the legal entity, as well as the reason code for which notification P15016 is generated. Based on this code, it is determined whether sheet A should be included in the document.

- Leaf A.

It is mandatory to fill out sheet A in application P15016:

- if the Title Page in clause 2 contains code 2 (formation of a liquidation commission, appointment of a liquidator) or 3 (making a decision on liquidation);

- in the event that code 6 is entered, except for an LLC operating on the basis of a standard charter, which provides that each participant in the LLC is its sole executive body (director) and independently acts on its behalf (or that each participant, together with the other participants of the company, exercises the powers of such body (director)).

Let us note that one of the innovations provided for by the form is the possibility of its use at all stages of liquidation. For example, to reflect the extension of the liquidation period of an LLC (indicating code 5 on the Title Page).

If the code is 1, 3 or 5, then the next field indicates the period of liquidation of the company.

Sheet A consists of two pages. The sheet records information about persons who have the right to act on behalf of the company without a power of attorney. Since on one copy of Sheet A it is possible to indicate data for only one individual or legal entity, if it is required to indicate data for several individuals (legal entities), several Sheets A are included in Form P15016.

The sheet (on one or more of its copies) may be marked with a note restricting access to information about a particular specified individual or legal entity.

- Sheet B is filled out if a mark(s) are placed on sheet A regarding access restrictions in relation to an individual or legal entity.

Clause 16 of the Requirements provides a regulatory framework that defines the grounds for appropriate restrictions on access to information about legal entities or citizens specified in clauses 1, 2, 3 of sheet A: Law of 03.08.2018 No. 290-FZ and Decree of the Government of Russia dated 06.06.2019 No. 729. For example, the reason for restricting access to information about a legal entity in the Unified State Register of Legal Entities may be the introduction of international sanctions against it.

- Sheet B reflects information about the individual applicant.

Here they indicate information about an individual representing an organization without a power of attorney (for example, about a director), or on the basis of the authority provided for by federal law or an act of a state or municipal body. Information on Sheets A and B about the same individual who submits and fills out P15016 may thus be duplicated (in this case, it would be a good idea to make sure that they are the same in different sheets so that there are no errors). It is possible to include several sheets B in the application, because There may be several corresponding authorized persons.

On the first page the passport details of the applicant are indicated (clause 2), and on the second page of sheet B in clause 3, they confirm the accuracy of the information specified in the application, the fact that settlements with creditors have been completed, and also certify that settlements with employees in connection with the liquidation of the company have been carried out. This is also one of the innovations in filling out “liquidation” documentation for the Federal Tax Service.

The telephone number and e-mail of the applicant are also indicated here, to which the documentation from the Federal Tax Service is sent electronically. If you enter code 1 in the “issue on paper” field, the Federal Tax Service, having processed the application under consideration, will issue response documentation to the applicant on paper.

Next, the applicant personally enters his last name, first name and patronymic, and puts a personal signature. If the application is sent to the Federal Tax Service electronically, these lines are not filled in, but the applicant will need an enhanced qualified electronic signature.

Clause 4 of sheet B is filled out by a notary or other authorized person who has witnessed the personal signature of the applicant, and his TIN is indicated (subclause 4 of clause 106 of the Requirements approved by the order).

Below is the completed form P15016, a sample document is also available at the link below.

How are they different from previous ones?

There were no significant changes. The main difference between the new forms is that two documents submitted earlier during the liquidation of an organization have been replaced by one. From November 25, 2020, form P16001 was combined with form P15001 into a single notification P15016. A column appeared in it stating that all payments established by labor legislation were made to employees dismissed during liquidation. The form is filled out in one of two ways:

- handwritten - in capital block letters using a black, purple or blue pen (previously only black was allowed);

- on a computer - in black Courier New font, 16-18 points high.

In 2021, the document can be printed on both sides of the sheet. Corrections and blots, as before, are not allowed. If there are grounds, the applicant has the right to restrict access to the information specified in the notification by placing an appropriate note. You can use the new form P15001, which is now designated by the number P15016, on the Internet and fill it out yourself. Or you can contact a specialized office, which will prepare the document for a small fee. After this, all that remains is to have the application certified by a notary and sent to the tax service, enclosing the decision to liquidate the company.

interim liquidation balance sheet sample

Termination of a company's activities and its liquidation is always under the close attention of government agencies. From the moment the liquidation is registered, it will be practically impossible to obtain any satisfaction for the company’s debts. In this regard, the law regulates in detail the liquidation procedure of an LLC, establishing requirements for notifying creditors, publishing a notice of the commenced procedure in the official publication, and reporting the liquidation process to tax authorities. One of the cases when it is necessary to notify the inspectorate is the moment when the interim liquidation balance sheet is approved. Form P15001, a sample of which you will find below, was compiled specifically for such a case.

Form M-15. Invoice for issue of materials to the side

If an enterprise documents the transfer of inventory items using form M-15, this fact is necessarily reflected in the local documentation of the company, which regulates its activities.

Form M-15. Invoice for issue of materials to the side

Important!

The enterprise may not use the M-15 form, and document the movement of inventory items with other documentation.

The document is used to reflect transactions related to the movement of valuables between divisions of one company that are remote from each other. However, the use of the form is not limited to this. The law does not prohibit its use in other cases.

Rules and requirements for filling out forms

All rules and conditions for entering data into new document forms are reflected in Appendix No. 20 to the above-mentioned Order. The main nuances are:

- unity of forms used by all legal entities;

- using capital font to print a document (type – Courier New, size – 18);

- using black ink if filling out the form manually;

- absence of dashes in columns left blank.

When filling out forms, you can use forms developed in Excel or special programs, but they do not always work correctly.

Step-by-step guide to filling out the M-15 waybill

When registering the M-15 consignment note, fill out 2 tables.

| Item no. | Information presented in the first table of the document | Information presented in the second table of the document |

| 1 | Name of the company transferring the goods and materials. | Name of the values to be transferred. |

| 2 | Full or abbreviated name of the branch of the company receiving the goods and materials. | Nomenclature number of valuables. |

| 3 | Date of transportation of goods and materials. | The number of valuables shipped and goods to be transferred. |

| 4 | A document on the basis of which values are transferred. | Price of goods and materials, total amount, including and without VAT. |

| 5 | The intermediary through which the transfer of goods and materials takes place. | Inventory number and passport number. |

| 6 | Responsible for delivery. | Inventory number according to the warehouse file |

| 7 | – | Corresponding accounting accounts. |

Filling out the M-15 invoice begins with affixing the document number, which is assigned based on the company’s local turnover.

Next, you need to reflect the full name of the enterprise and indicate the OKPO code. OKPO is a digital company identifier used to classify companies. This code must be reflected in the constituent documentation of the company.

After filling out the header, the accountant will have to prepare the first table. First of all, the date of preparation of the document is indicated. Next, the operation code is indicated, but only if the enterprise uses a similar system.

The first table also includes information about the name of the structural unit of the company that issues goods and materials, as well as the type of its activity. For example, if valuables are sent from a warehouse, then in the “structural unit” column they write “warehouse”, and in the “type of activity” window - “storage of goods and materials”.

After displaying information about the sender, you must enter information about the recipient and the person responsible for sending the valuables. Only the name of the structural unit and the type of its activity, as well as the digital code of the performer, are indicated, without reference to specific persons.

After the table indicate the number, date of preparation and name of the document that served as the basis for sending the inventory. For example, Ground “Order No. 315 dated August 23, 2021.”

Below enter the full name of the person responsible for receiving the goods and materials, as well as the details of the intermediary who will transport the valuables.

Filling out the main table of form M-15

The second table of the M-15 consignment note form is the main one. It is there that the list of transferred inventory items is reflected. You must approach filling out this part of the document with all responsibility and avoid making stupid mistakes, which could subsequently cause a shortage of valuables.

Each column of the table has its own serial number, and the structure is divided into columns.

- The first column is devoted to reflecting accounting entries for the movement of inventory items. Column 1 indicates the account or subaccount, and the second indicates the analytical accounting code.

- The second column is devoted to reflecting data on transported inventory items. In the third column, you must indicate not only the name of the valuables, but also their brand, variety, and size. The fourth column tells about the item number of the goods.

- The third column includes two columns with serial numbers 5 and 6. It is intended to reflect the unit of measurement of inventory items. The fifth column indicates its code, and the sixth column indicates its name.

- The amount of inventory items is entered in the fourth column. The number of valuables to be sent is indicated in the seventh column, and the goods and materials sent - in the eighth.

- The ninth column indicates the price of inventory items per unit. The next column reflects the amount excluding VAT, and the tenth column includes its application. The eleventh column is general and contains information about the total amount including tax.

- The next column is devoted to information about the numbering of inventory items. Columns 13 and 14 reflect data on the inventory number and passport number, respectively, and the last one – the inventory number according to the warehouse card index.

After the table, the words reflect the number of items sold, their total cost and the amount of VAT. The document is then signed:

- accountant;

- person responsible for sending goods and materials;

- the employee who authorized the transfer of valuables;

- recipient of goods.

Each certifier indicates the position, signs the invoice and affixes a transcript of the signature.

Main changes in applications for registration of legal entities and individual entrepreneurs

In the application form for registration of a legal entity (No. P11001), lines have been added to indicate:

- information about the presence of a legal entity’s name in the languages of the peoples of the Russian Federation and/or in foreign languages;

- numbers of the standard charter of the LLC (if the company will act on the basis of the standard charter);

- information about the existence of a corporate agreement;

- email addresses of a legal entity.

In addition, the names of the columns intended to indicate the address of the organization’s location have been adjusted.

The application form for individual entrepreneur registration (No. P21001) has changed slightly. Here we added a line to indicate the entrepreneur’s email address. In addition, the names of the lines for entering the address of the individual entrepreneur’s place of residence have been adjusted.

Fill out documents for registering an individual entrepreneur in a special service

Invoice form according to form No. M-15 (download)

Invoice M-15 is a unified document, which was approved by the State Statistics Committee decree number 71 of 1997.

Starting from 2013, the documents contained in the album of unified forms, with the exception of primary accounting documentation, are not required for use in the enterprise.

In addition, the company’s accountant can independently develop a document form designed to reflect transactions involving the movement of valuables. The typical form of an interindustry invoice will serve as an example for creating your own document.

Invoice form according to form No. M-15

Invoice form according to form No. M-15 (Part 2)

List of new forms

The commented order approved the following forms:

- No. R11001 “Application for state registration of a legal entity upon creation”;

- No. P12003 “Notification of the start of the reorganization procedure”;

- No. R12016 “Application for state registration in connection with the completion of the reorganization of a legal entity (legal entities)”;

- No. R13014 “Application for state registration of changes made to the constituent document of a legal entity, and (or) on amendments to information about a legal entity contained in the Unified State Register of Legal Entities”;

- No. R15016 “Application (notification) on liquidation of a legal entity”;

- No. R16002 “Application for making an entry into the Unified State Register of Legal Entities regarding the termination of a unitary enterprise, state or municipal institution”;

- No. Р18002 “Application (notification) on state registration of an international company”;

- No. P21001 “Application for state registration of an individual as an individual entrepreneur”;

- No. P24001 “Application for amendments to information about an individual entrepreneur contained in the Unified State Register of Individual Entrepreneurs”;

Submit documents for registering an LLC/IP or making changes to the Unified State Register of Legal Entities/Unified State Register of Individual Entrepreneurs via the Internet

- No. R26001 “Application for state registration of termination by an individual of activities as an individual entrepreneur”;

- No. P24002 “Application for amendments to information about peasant (farm) holdings contained in the Unified State Register of Individual Entrepreneurs”;

- No. R26002 “Application for state registration of termination of a peasant (farm) enterprise.”

Basic rules for issuing an M-15 consignment note

Goskomstat has developed a standard image of the M-15 consignment note. However, businesses do not have to adhere to a unified form. They have the opportunity to develop the form themselves. In addition, it is allowed to be issued in any form.

Despite the fact that the preparation of the M-15 consignment note is not regulated at the legislative level, when developing it, one should adhere to generally accepted standards.

First of all, the document must include:

- full name of the enterprise issuing goods and materials;

- information about the recipient of the goods and materials;

- list of materials to be sent, price and total amount of the invoice;

- date of document preparation.

The invoice is filled out by the accountant, and some items are noted by the storekeeper. The document is drawn up in two copies and signed by the head of the company or the person responsible for the transfer of goods and materials. The recipient also signs his autograph.

The storekeeper receives one copy each, and the second is sent to the buyer or the receiving party.

In what cases is an invoice issued in form M-15?

Form M-15 is issued in several cases:

- When transferring inventory items from one structural unit of an enterprise to another. For example, if valuables are sent from one branch to another, which is located in another city.

- When transferring inventory items between organizations. In this case, execution of the transaction is permissible only if there is a concluded contract between partner firms.

It should be noted that the law does not prohibit the buyer from registering the shipment of goods using Form M-15. However, another unified document called TORG-12 is used everywhere.

Common mistakes

In the process of preparing an invoice in form M-15, compilers make mistakes that are common.

Error 1.

When filling out the invoice in form M-15, warehouse manager Pyotr Valentinovich Grishko indicated the abbreviated name of the enterprise.

Solution 1.

It is recommended to indicate the name of the organization in full in the invoice for the release of goods and materials in form M-15. However, displaying a short name, for example, Les-komplekt LLC, is not a gross mistake.

Error 2.

Les-komplekt LLC shipped 1000 m3 of wood to its subsidiary. During shipment, an M-15 consignment note was drawn up. The accountant did not stamp and sent the paper to the recipient.

Solution 2.

In accordance with the legislation that has come into force, the M-15 consignment note can only be certified by the signatures of responsible persons without the seal of the sender’s organization. This rule has been in effect since 2016.

Error 3.

When drawing up invoice M-15, the warehouse manager did not indicate the basis for the release of goods and materials, since the manager did not issue the document, but conveyed the order in words.

Solution 3.

The invoice in form M-15 must indicate the name, number and date of preparation of the document, which is the basis for the transfer of goods and materials. Otherwise, the invoice is invalid.