In certain situations, government agencies, commercial banks and other structures, along with the necessary documents, ask citizens to provide a certificate in form 2-NDFL for a certain period. The certificate contains information about the individual’s income, accrued, withheld and transferred tax. For a certificate, an employee turns to his employer (individual entrepreneur or organization), and he, in turn, is obliged to prepare and issue it.

Tax period for personal income tax Art. 216 of the Tax Code of the Russian Federation recognizes the calendar year. It is for a full year that certificates are submitted to the tax office, and for what periods can an employer issue a 2-NDFL certificate at the request of an employee?

Who issues the 2-NDFL certificate

In paragraph 3 of Art.

230 of the Tax Code of the Russian Federation states that a certificate of income and deductions from them is issued at the request of an individual by a tax agent. The certificate is issued according to form 2-NDFL approved by the fiscal department. Since 2021, the form from the Federal Tax Service order dated October 2, 2018 No. ММВ-7-11/ [email protected] . Note that the new Order establishes two forms: one for submission to the tax office (Appendix No. 1), the second for issuance to employees (Appendix No. 5). Make no mistake! Read about the differences between certificates and the procedure for their preparation here.

ATTENTION! For income for 2021, the 2-NDFL tax certificate has been cancelled. Information from the certificate will be submitted as part of 6-NDFL. See here for details.

2-NDFL certificates issued to employees in 2021 - 2021 can be found at our link below:

K+ system experts have prepared a sample certificate of income and personal income tax amounts for 2021. Get free trial access to the system and proceed to the sample.

The tax agent for the employee is the employer, who withholds taxes from his salary and other payments and transfers them to the budget. At the same time, not only legal entities, but also other employers (self-employed persons, as well as individuals who are not among the self-employed) can act as a tax agent for an employee.

The tax agent for military personnel is the state, since the contract for military service is concluded on its behalf. Accordingly, military personnel will be able to obtain a certificate of their income and deductions from the Unified Settlement Center (SCC) of the Russian Ministry of Defense.

To whom is the certificate provided and within what time frame?

A certificate in form 2-NDFL is submitted by the tax agent:

- In relation to tax withheld from an individual - annually to the Federal Tax Service (no later than March 1 of the year following the reporting year). Certificates are prepared for each employee who was paid income during the calendar year. If an employee worked during the tax period in several divisions of one enterprise, then to fill out form 2-NDFL you should use the recommendations from the letter of the Ministry of Finance of Russia dated July 23, 2013 No. 03-02-08/28888.

- In relation to the tax that the employer was unable to withhold from an individual - annually to the Federal Tax Service (no later than March 1 of the year following the reporting year).

IMPORTANT! Officials have reduced the deadline for submitting 2-personal income tax with sign 1 by 1 month. Now, regardless of the established criteria, the form must be submitted by March 1st. For the report for 2021, the deadline will not be postponed, because... 03/01/2021 - working Monday. For details, see the material “The deadline for submitting 6-NDFL and 2-NDFL has been shortened.”

To learn about the consequences of failure to submit a certificate to the tax authority, read the article “What is the responsibility for failure to submit 2-NDFL?” .

- At the request of the employee an unlimited number of times, and the employer cannot deny the employee his right (letter of the Federal Tax Service of Moscow dated February 24, 2011 No. 20-14/3/16873). The employee may also require several original certificates to be provided at once.

ATTENTION! 2-NDFL for an employee can be certified with an electronic signature. Read more here.

In Art. 230 of the Tax Code of the Russian Federation does not stipulate the period for issuing a certificate after the employee’s application. At the same time, in Art. 62 of the Labor Code of the Russian Federation for issuing a salary certificate establishes a three-day period from the date of receipt of the employee’s written application.

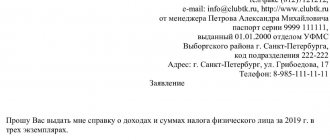

Does this mean that in order to obtain a certificate it is necessary to write an application? Not always. Some employers issue such documents at the employee’s verbal request, as well as upon dismissal - without reminders (in accordance with Article 84.1 of the Labor Code of the Russian Federation). If the enterprise is large or the employer has taken the position that nothing will be provided without an application, you should write a petition in any form.

In the application, it is important to correctly indicate your personal data, as well as the period (measured in years) for which the certificate is required. The certificate must be issued as many times as necessary upon the employee’s request within a three-year period for which his income is taken into account.

How long does it take to issue 2-NDFL to a resigning employee, as well as to an individual (not your employee) who received income from you, ConsultantPlus experts told. Proceed to the explanations by signing up for a free trial access to the system.

For what purposes may an employee need 2-NDFL?

An employee may need a certificate of income and deductions from them in form 2-NDFL in the following situations:

- to obtain a loan, obtain a mortgage;

- to fill out the 3-NDFL declaration;

- when applying for a new job;

- for registration of unemployment benefits, pensions;

- to receive government financial assistance;

- for obtaining a visa;

- in other situations.

For information about documents that may be needed when filing an income tax return, read the material “What documents are needed to file a 3-NDFL declaration?” .

For the bank

Most often, 2-NDFL is requested by the bank if the employee is seriously concerned about borrowing money. The credit institution is interested in the integrity and constancy of the client, in his responsibility and solvency.

It is clear that if you have extensive work experience in one place and a high “white” salary, then there will be more trust in you as a borrower. Therefore, when receiving a mortgage loan or car loan, the bank may require a certificate for six months, a year, or even for the last two years from the place of work. Moreover, it has been noted: the larger the package of necessary documents a bank requires, the higher its requirements for various types of official certificates and the lower the interest rate. Thus, the bank insures itself and its risks.

What to do if the employer refuses to issue a certificate

Rarely, but there are still situations when an employer refuses to issue a 2-NDFL certificate to a dismissed employee. Most often, due to the fact that the company has problems with tax accounting. In this case, the employee will need to comply with all the rules of the law in order to achieve his goal.

You will have to write a statement in writing and send it to the employer. It is preferable to send such an application by a valuable letter - then you will have an inventory of the attachment with a mark from the postal operator. If within the established period (three days from the date of receipt of the application by the employer) the certificate is not provided, you can contact the labor inspectorate directly with a complaint about the inaction of company officials.

To learn about the consequences of not issuing a certificate to an employee, read the material “The employee was not issued a 2-NDFL certificate? Wait for the trial .

How long is the certificate valid?

In fact, it is not clearly established for what period the document issued by the employer is valid. Since the information reflected in it serves as confirmation that:

- The citizen worked at this enterprise for quite a long time.

- The employee was paid a salary.

- Taxes were withheld on time.

Banks have the right to set the terms when this document is valid, for example, this period can be equal to either 10 days or a month. This is not a violation.

It is worth noting that employers do not always reflect actual information about the amount of wages in the document. It is recommended to monitor this, because the size of the loan issued and the reduction in the interest rate depend on the size of the indicated income.

What to do if the company is liquidated

Another rather problematic situation cannot be excluded when, at the time of applying for a certificate, the enterprise is no longer functioning (liquidated) and information about it is excluded from the Unified State Register of Legal Entities. There are several ways to obtain a 2-NDFL certificate in such a situation.

So, if a new employer requires a certificate, he sends a request to the Pension Fund branch and the local Federal Tax Service explaining the reasons for this need. A certificate may be required for the correct application of standard deductions or the calculation of vacation and sick pay, when information about deductions made by the previous employer is indispensable.

In response to this request, information will be provided on income and deductions from it for a specific individual for the requested period. Also, the insured person himself can independently send a request to the Pension Fund of the Russian Federation in the form approved by Order of the Ministry of Health and Social Development dated January 24, 2011 No. 21n.

In addition, an individual can independently obtain the necessary information about accrued and paid personal income tax through his personal account on the website of the Federal Tax Service of Russia.

Validity

The bank determines the borrower's solvency at the time of his application for a housing loan. Therefore, if a person took out a certificate in January, but submitted documents for a mortgage only in the summer, then, most likely, it will no longer be valid for the bank. The borrower will have to apply for it again.

If the tax certificate is valid for 1 year, then banks have other requirements in this regard. You can find out exactly how long the document will be valid by personally contacting the credit manager or calling the bank’s hotline.

Certificate 2-NDFL from individual entrepreneur

The procedure for issuing a 2-NDFL certificate by an individual entrepreneur employer is no different from that generally accepted for tax agents - legal entities, since an individual entrepreneur, when paying remuneration to an individual, also withholds tax from it and transfers it to the budget. It is this information that is entered into the certificate.

See also the article “Do I need to pay personal income tax on an advance and when?” .

Individual entrepreneurs usually do not provide themselves with a certificate of income in the approved form. This possibility is not mentioned anywhere in the tax legislation. At the same time, filling out such a form and signing it yourself will not be a violation.

The features of the 2-NDFL certificate for individual entrepreneurs are discussed in this article.

But in many situations, an entrepreneur needs only a copy of a declaration that reflects the entrepreneur’s real income (this is not suitable for individual entrepreneurs working on UTII or a patent), an extract from the book of income and expenses, from the cash book, or copies of primary documents confirming the receipt of income.

ATTENTION! Starting from 2021, UTII has been cancelled.

Why you shouldn't falsify documents

There are often advertisements on the Internet for the sale of ready-made income certificates.

Purchasing such a document is illegal. Bank security can easily recognize a fake form. It is enough to make a request to the employer, call the accounting department, and check what is written in the certificate with real numbers. At best, you will be denied a loan. You risk getting blacklisted by financial organizations and ruining your credit history. After this, further contacts to the bank are pointless.

In the worst case, you will face criminal liability. Therefore, such a purchase faces a prison term.

If there is a delay in payment of wages

Due to the fact that in accordance with paragraph 4 of Art. 226 of the Tax Code of the Russian Federation, accrued personal income tax cannot be withheld until the employee’s salary is paid; there are particular difficulties with entering data related to accrued but not yet paid income into the 2-NDFL certificate.

According to the tax authorities, voiced in the letter of the Federal Tax Service dated October 7, 2013 No. BS-4-11 / [email protected] , if income for the previous tax period at the time of drawing up the certificate has not yet been paid, then they, as well as the withholding of taxes from them, are 2- Personal income tax should not be reflected. True, according to the letter of the law, the date of actual receipt of income in the form of wages is the last day of the month for which this income was accrued (clause 2 of Article 223 of the Tax Code of the Russian Federation).

Let's sum it up

You can take advantage of the right to receive a tax deduction due to the fact that you are a citizen of our country and have it from the very beginning. You can return funds when purchasing real estate, paying for educational services, undergoing expensive or simply paid treatment , etc. However, to do this, in any case, you will have to collect a significant number of documents, the list of which will necessarily include a 2-NDFL certificate.

Be sure to check whether all the information specified in the certificate is true; even experienced accounting workers can make mistakes when compiling it

When you receive it, do not forget to check whether the information given in the document is true, whether there are corrections in the paper, or any marks or additions that should not be there according to the rules, and whether all seals and signatures have been affixed. In general, take control of the situation into your own hands and quickly get the desired document.

Where can an unemployed person or a pensioner get a certificate?

An unemployed person can receive a certificate of income received in the form of unemployment benefits at the employment center. All you have to do is submit an application and then pick up the completed certificate. But this will not be Form 2-NDFL. If an individual has not worked for more than three years and is not registered with the employment center, then there is simply nowhere for him to get a certificate of income, because officially there was none.

If a non-working person had income from other sources, it is necessary to report them by indicating in the 3-NDFL declaration. In addition, you will need to calculate the tax yourself and transfer it to the budget. In this case, evidence of income received and taxes paid on it will be a copy of the tax return.

Pensioners receiving payments from non-state pension funds can request 2-NDFL from the local branch of their fund. But disabled citizens who receive state pensions will not be able to obtain such a certificate from the Pension Fund of the Russian Federation, since such pensions are not subject to personal income tax.

What's new in the procedure for obtaining a certificate

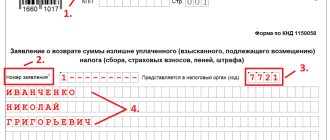

As mentioned above, starting from 2021, 2-NDFL is issued on a new form. Or rather, on two forms:

- The first - it is now called 2-NDFL - is used for submission to the Federal Tax Service.

It has a new structure: it consists of some kind of title page, three sections and one appendix. At the very beginning of the document, information about the tax agent is provided, in section 1 - information about the individual in respect of whom the certificate is being filled out, in section 2 - information about the total amount of income, tax base and personal income tax, in section 3 - deductions provided by the agent: standard, social and property, and the appendix provides a breakdown of income and deductions by month.

- The second form, which is issued to the employee, is simply called “Certificate of income and tax amounts of an individual” (without the usual “2-NDFL”). It almost completely repeats the previous form (from the order of the Federal Tax Service dated October 30, 2015 No. ММВ-7-11/ [email protected] ).

For income for 2021, 2-NDFL as an independent report has been cancelled.

Correction of data for reference

If inaccuracies are discovered (during a tax or independent audit), the tax agent must provide an updated version of the certificate to the Federal Tax Service. And do this as soon as possible so as not to become liable for distortion of information submitted to the Federal Tax Service (Article 126.1 of the Tax Code of the Russian Federation). Corrections made before the violation is discovered by the tax authority will relieve liability.

See also:

- “Indicate the new or old surname of the employee in the correcting 2-NDFL?”;

- “How to submit 2-NDFL if the employee does not have a TIN?”

In addition, the correct version of the certificate must be given to the employee.

Non-taxable income should not be included in the certificate. If a mistake was made when preparing the original certificate, the employer should correct this violation.

If the changes are related to the recalculation of personal income tax in the direction of increasing tax liabilities, then the amended certificate does not indicate the tax overpaid by the tax agent, but not withheld from the employee, since the Federal Tax Service of Russia does not consider such an overpayment as tax.

If the previous certificate indicated the tax withheld in excess from the employee, and it was subsequently returned to the individual, then the correct amount must be indicated in the new certificate. After discovering an error in the form of excessively withheld personal income tax, the refund must be made within 3 months.

For information on how refunds are made, read the article “How to return excessively withheld personal income tax to an employee .