Commentary to paragraphs 1, 2, 3 of Art. 7

The difference between the requirements of paragraphs 1 - 3 of Art. 7 of the new Law on Accounting from similar provisions, paragraphs 1 - 2 of Art. 6 of the former Accounting Law, in our opinion, seems fundamental. Previously, all options for organizing accounting could, in principle, be used in any organization. In total, there were four options to choose from:

- establish an accounting service as a structural unit headed by a chief accountant;

- add an accountant position to the staff;

- transfer on a contractual basis the maintenance of accounting to a centralized accounting department, a specialized organization or a specialist accountant;

- maintain accounting records personally.

Moreover, in the previous Law on Accounting there were no recommendations or prohibitions on the use of this or that accounting organization scheme. Only clause 7 of the Regulations on accounting and financial reporting in the Russian Federation (approved by Order of the Ministry of Finance of Russia dated July 29, 1998 N 34n) was recommended to be applied in organizations related to small businesses in all cases except the first. Now an almost unambiguous rule has been established, according to which:

- individual entrepreneurs without forming a legal entity keep records independently;

- small and medium-sized businesses can keep records independently, can organize an accounting service headed by a chief accountant, or delegate accounting responsibilities to third-party organizations (under an outsourcing agreement or similar);

- all other business entities assign corresponding responsibilities to the chief accountant or engage third-party specialized organizations to perform his functions.

An indication of the possibility of assigning accounting responsibilities to another person of the economic entity, in our opinion, can hardly be implemented in practice. This provision presupposes the assignment of the duties of the chief accountant to an employee of the administration (administration, management) of an economic entity without releasing the employee from performing the functions of the main position. In this case, a problem may arise regarding the quality of performance of duties in two positions, since the work of the chief accountant is very significantly limited by the timing of the performance of individual functions (preparation and submission of reports, receiving cash to pay wages to employees, preparing inventory and participating in it, etc. ). In addition, a conflict of interests at the management level of an economic entity is very likely.

Responsibility of the chief accountant

Of course, speaking about the rights and responsibilities of the chief accountant, we must not forget about his main responsibility - for the proper performance of official duties. All possible types and sanctions are given in the table below.

See also the article “Who is responsible for organizing accounting?”

| Responsibility | Types of violations | Forms |

| Disciplinary | Violation of labor discipline, and sometimes unprofessionalism (clause 9, part 1, article 81 of the Labor Code of the Russian Federation) | Reprimand, reprimand, dismissal |

| Material (Article 238 of the Labor Code of the Russian Federation) | Direct effective damage caused to the employer (real decrease in the employer’s property or deterioration in its condition) | Depending on the amount of damage |

| Administrative (regulated by a number of articles of Chapter 15 of the Code of Administrative Offenses of the Russian Federation) |

See also: “What an accountant can be fined for in 2019.” |

|

| Criminal liability | Occurs if the company evades taxes on a large and especially large scale for 3 years | Depending on the amount of damage (from a fine to imprisonment) |

Is it possible to hold the chief accountant, who is temporarily entrusted with the duties of the general director, liable for an industrial accident? The answer to this question is revealed by labor inspector in the Kirov region A. A. Berdyanskikh. Get trial access to the ConsultantPlus system and find out the controller’s opinion for free.

Commentary to paragraph 4 of Art. 7

The norm of paragraph 4 of Art. 7 can also be considered a perfect legislative innovation. This is probably the first time that federal law has defined qualification requirements for employees applying for a specific position.

It is noteworthy that these requirements apply to a very limited range of business entities, as a rule, only to those organizations whose shares (or other forms of capital participation, as well as debt obligations) can be traded on the organized securities market. Taking into account the general concept of the new Accounting Law (which prioritizes the assessment of the financial condition of an economic entity), it can be assumed that the subsequent development of the regulatory framework will move in a direction focused on the requests of external users of accounting statements - mainly potential investors, including foreign ones.

Despite the fact that the qualification requirements for the chief accountant are formulated extremely specifically, there is a certain contradiction in the text of the norm in clause 4.

Thus, from the text of paragraph 1 we can conclude that the lack of higher professional education is an obstacle to a specialist filling the position of chief accountant. A pp. 2, paragraph 4 allows for this possibility - if there is appropriate work experience related to accounting, preparation of accounting (financial) statements or auditing activities. True, this subclause clarifies that this means higher professional education in the specialty of accounting and auditing. However, in our opinion, additional clarification will be needed on this matter. Moreover, the problem may not be resolved by simple explanations. Taking into account the norm of paragraph 5 of Art. 7 of the new Accounting Law, such issues should be resolved at the legislative level. That is, it is very likely that there will be a need to amend the Law.

From this point of view, the establishment of specific requirements for specialists applying for the position of chief accountant looks like an additional measure to protect the interests of these potential investors.

Please note that in accordance with paragraph 2 of Art. 30 of the new Law on Accounting, provisions of paragraph 4 of Art. 7 do not apply to persons who, as of the date of entry into force of the Law, are entrusted with maintaining accounting records.

Thus, if after January 1, 2013 it turns out that the chief accountant of an open joint-stock company or a non-state pension fund does not have a professional education or has an outstanding criminal record, this fact cannot serve as a basis for terminating the employment contract.

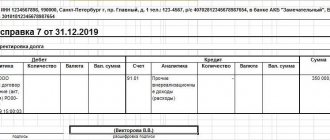

Instructions for filling out a simplified balance sheet 2021

The simplified balance sheet contains the same indicators as the general one. The only difference is that these indicators have a more aggregated reflection, that is, the indicator with the highest specific weight is reflected in the line.

You can download the simplified balance sheet form here (Appendix No. 5 to Order 66n).

Column “Asset”, row:

- Tangible non-current assets. This reflects the amounts of fixed assets and capital investments in them that have not yet been completed;

- Intangible, financial and other non-current assets. Financial investments with a long-term perspective and intangible assets are reflected. Additionally, it is necessary to reflect the results of developments and research, unfinished investments in them, as well as in intangible assets;

- Inventories. Account balances are reflected, similarly to the usual balance sheet form;

- Cash and cash equivalents. Similar to the usual form of balance sheet;

- Financial and other current assets. Information about other assets is displayed, including accounts receivable and short-term investments of financial assets;

- Balance. The sum of all rows in the Asset column.

Column “Passive”, row:

- Capital and reserves. It is necessary to display the authorized capital (if formed, then additional and reserve), revaluation of fixed intangible assets, uncovered loss (retained earnings). Additionally – shares of the founders (shareholders’ shares), purchased from them for cancellation;

- Long-term borrowed funds. Amounts of long-term loans and credits.

- Short-term borrowed funds. Amounts of short-term loans and credits.

- Accounts payable. Similar to the general balance sheet form;

- Other short-term liabilities. Amounts of short-term debt to creditors that were not included in the previous lines of the “Liability” column;

- Balance. The sum of the rows in the “Passive” column.

Commentary to paragraph 5 of Art. 7

Norm clause 5 art. 7 of the Accounting Law allows for at least two interpretations.

On the one hand, it can be assumed that we are only talking about additional requirements for chief accountants of organizations listed in paragraph 4 of Art. 7. On the other hand, precisely the fact that clause 4 specifies an almost exhaustive list of economic entities that must comply with established criteria when concluding employment contracts with chief accountants gives grounds for a different interpretation: expanding the list of economic entities for which these requirements are mandatory , is also possible subject to the introduction of appropriate changes and additions to the legislation on accounting (including the possibility of establishing similar requirements for specialists in other federal laws).

From such an interpretation, in particular, it follows that organizations not directly specified in paragraph 4 of Art. 7 of the new Law on Accounting, formally do not have the right to refuse to hire an applicant (for the position of chief accountant) due to his lack of higher professional education or due to the presence of an unexpunged or unexpunged criminal record. At the same time, the list of such economic entities automatically includes all state and municipal institutions, public legal entities, etc. The presence of criteria similar to those specified in paragraph 4 in the relevant industry, departmental, regional or local regulations in this case can already be appealed as contrary to federal legislation.

Accounting principles

Accounting principles are the basic rules of accounting. The principles are a general direction of movement and allow us to specify and clarify the accounting procedure in certain conditions, but are not specific practical examples of actions.

Thus, the following fundamental principles of accounting are distinguished:

- the principle of property separation (the assets and liabilities of an organization must be taken into account separately from the assets and liabilities of its owners and other organizations);

- the principle of going concern (the organization does not anticipate its liquidation or significant reduction in activities in the foreseeable future, therefore liquidation assessments are not applied);

- the principle of consistency in the application of accounting policies (the organization’s accounting policies are applied from year to year, there is no need to re-approve it annually, you can only make changes and additions if justified);

- the principle of temporary certainty of facts of economic activity.

Commentary to paragraph 6 of Art. 7

Norm clause 6 art. 7 of the new Accounting Law applies to all economic entities without exception. Thus, it is assumed that organizations not named in paragraph 4 of Art. 7, may enter into employment contracts with persons who do not have a sufficient level of education or practical experience (as well as those who have unexpunged and unexpunged convictions), but do not have the right to enter into an outsourcing agreement with such persons.

From the above, it can be assumed with a high probability that the scope of outsourcing agreements with the entry into force of the new Accounting Law may narrow significantly. The main reason will not be the lack of employees with the necessary qualifications and experience in organizations providing accounting services (and the elimination of individuals applying for the provision of such services without sufficient grounds), but purely economic reasons - since the cost of such services may be significantly higher amounts of remuneration for a full-time employee who does not have the required work experience and education and for this reason cannot qualify for high salaries.

Persons mentioned in paragraph 2 of Art. 30 of the new Law on Accounting, and in this case an exception was made: the provisions of paragraph 6 of Art. 7 do not apply to persons who, as of the date of entry into force of this document, are entrusted with accounting.

In our opinion, this exception will not have practical significance. The cited norm applies to newly concluded contracts, as well as to contracts to which significant changes are made. Even where the contract for the provision of accounting services is concluded for a long period, the entry into force of the new Accounting Law will most likely require a complete review of its provisions (in particular, the scope of services provided and their nature). Under these conditions, the re-conclusion of the contract (or its extension on significantly changed terms) can hardly be considered legal.

Instructions for filling out the enterprise balance sheet 2021 with explanation

You can download Form 1 of the general balance sheet here (Appendix No. 1 to Order 66n).

Column “Asset”, section I “Non-current assets”, line:

- Intangible assets = Debit 04 – Credit 05;

- Research and development result = Debit 04;

- Intangible search assets = Debit 08 (subaccount for accounting for expenses for IR costs). The line is filled in only by enterprises using natural resources. The information contained should reflect the costs of resource development;

- Material search assets = Debit 08 (subaccount for accounting for expenses for MP costs). The line is filled in only by enterprises using natural resources. The information contained should reflect the costs of resource development;

- Fixed assets = Debit 01 – Credit 02 + Debit 08 (sub-account for accounting for fixed assets not put into operation);

- Income investments in material assets = Debit 03 – Credit 02 (sub-account for accounting for depreciation of property related to income investments);

- Financial investments = Debit 58 + Debit 55 (sub-account “Deposit accounts”) + Debit 73 (sub-account “Settlements on loans granted”) – Credit 59 (sub-account “Accounting for provisions for long-term financial liabilities”);

- Deferred tax asset = Debit 09;

- Other non-current assets = amounts for non-current assets that were not included in the previous lines of section I;

- Total for section I = the sum of the indicators of the previous lines.

Column “Asset”, section II “Current assets”, line:

- Inventory = Debit 41 – Credit 42 + Debit 15 + Debit 16 – Credit 14 + Debit 97 + sum of debit account balances 10, 11, 43, 45, 20, 21, 23, 29, 44;

- VAT on purchased assets = Debit 19;

- Accounts receivable = Debit 62 + Debit 60 + Debit 68 + Debit 69 + Debit 70 + Debit 71 + Debit 73 (excluding interest-bearing loans) + Debit 75 + Debit 76 – Credit 63;

- Financial investments (excluding cash equivalents) = Debit 58 + Debit 55 (sub-account “Deposit accounts”) + Debit 73 (sub-account “Settlements on loans granted”) – Credit 59;

- Cash and cash equivalents = Debit 50 + Debit 51 + Debit 52 + Debit 55 + Debit 57 – Debit 55 (sub-account “Deposit accounts”);

- Other current assets = amounts for current assets that were not included in the previous lines of section II;

- Total for section II = the sum of the indicators of the previous lines of section II;

- Balance = the sum of the indicators in the lines “Total for Section I” and “Total for Section II”.

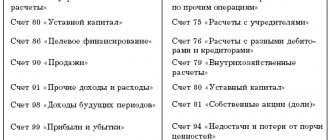

Column “Liability”, section III “Capital and reserves”, line:

- Authorized capital = Loan 80;

- Own shares purchased from shareholders = Debit 81;

- Revaluation of non-current assets = Credit 83 (sub-account for the amounts of revaluation of fixed assets and intangible assets);

- Additional capital (without revaluation) = Credit 83 (excluding amounts of additional valuation of fixed assets and intangible assets);

- Reserve capital = Credit 82;

- Retained earnings (uncovered loss) = Credit 84;

- Section III Total = Sum of Section III lines.

Column “Liabilities”, section IV “Long-term liabilities”, line:

- Borrowed funds = Loan 67 (accrued interest with a repayment period of less than 1 year);

- Deferred tax liability = Credit 77;

- Estimated liabilities = Credit 96 (only for liabilities with a useful life of more than 1 year);

- Other liabilities = amounts of long-term debt to creditors that were not included in the previous lines of section IV;

- Section IV Total = the sum of the lines in Section IV.

Column “Liabilities”, section V “Short-term liabilities”, line:

- Borrowed funds = Loan 66 + Loan 67 (accrued interest with a repayment period of more than 1 year);

- Accounts payable = Credit 60 + Credit 62 + Credit 68 + Credit 69 + Credit 70 + Credit 71 + Credit 73 + Credit 75 (short-term debt only) + Credit 76;

- Deferred income = Credit 98 + Credit 86;

- Estimated liabilities = Credit 96 (only liabilities over 1 year);

- Other liabilities = amounts of short-term debt to creditors that were not included in the previous lines of Section V;

- Section V Total = sum of Section V lines;

- Balance = sum of the lines “Total for Section III”, “Total for Section IV”, “Total for Section V”

Regulatory regulation of accounting

402-FZ is used in the management of budgetary assets and liabilities of the Russian Federation, regions and municipalities, and the implementation of operations that change them. Its provisions also apply when reporting on income and expense items. The articles of the act are used when carrying out activities related to the preparation of documentation by the trustee for material assets transferred to him, as well as when maintaining, by one of the participants in a simple partnership, reporting on material assets and related objects. The requirements of the law are applied to accounting during the execution of an agreement on the division of production, unless otherwise provided for in Federal Law No. 225.