Personal income tax is a special tax - it is transferred to the budget from the amount of income of an individual. This

Free legal consultation online The involvement of lawyers in legal disputes is due to the need to fully protect personal

All the necessary information about the number of working days, days off and holidays, about working standards

Who should pay VAT. Can an individual entrepreneur work with tax? This is an indirect federal tax

We send you on vacation - you need an order When granting leave to an employee, you need to remember to make an order.

Home / Labor Law / Payment and Benefits / Compensation Back Published: 05/28/2016 Time

Why do you need a job description? The activities of any organization begin with determining its structure (division

Taxpayers submitted reports for 2015 and for the first quarter of 2016. And right away

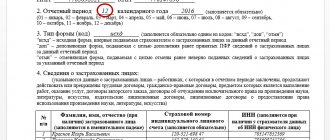

The SZV-M form was adopted in 2021 by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p dated 02/01/16. Abbreviation

Home / Vehicles Back Published: 08/19/2020 Reading time: 4 min 0 269