What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, income received during the month and expenses that the company incurred in the same period , and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no .

Calculation by categories of this fund is also submitted to the Pension Fund.

If your company operates in a general taxation system , reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method .

The only difference will be in the timing of reporting.

Information on remuneration is presented in the following documents:

Payroll fund: calculation formula.

What is needed for this? The issue of calculating the wage fund and the formula for calculating it is very relevant for modern companies, since the salary component is part of the cost of production, goods and services (and, often, this is a significant share), and, therefore, it affects the final result of the functioning of the company. In turn, excessive hyper-economy on the size of the payroll is dangerous because it makes it difficult for employees to receive a decent profit.

So, part 6 of Art. 136 of the Labor Code of the Russian Federation indicates that wages must be paid at least once every half month. That is, the salary payment schedule must include at least two dates of the month. Which ones specifically? Each organization decides this independently, prescribing a salary payment calendar in the internal labor regulations, collective or labor agreements. If the day on which the payment of salaries to employees is scheduled coincides with a weekend or holiday, then the employer should pay the day before.

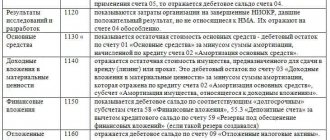

Labor costs in the balance sheet line

- on line 2220, they also take into account the salaries of administrative and management personnel, if the accounting policy stipulates that the company at the end of each reporting period writes off such expenses directly to the “Cost of Sales” subaccount of account 90.

Name of indicator Code For 2014 For 2013 Total by elements 5660 58,070 78,170 Actual cost of goods purchased for resale 5665 18,260 14,248 Change in balances (increase [-], decrease [+]): work in progress, 5670 (4452 ) finished products, etc. 5680 2890

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, the income received during the month and the expenses that the company incurred in the same period are recorded, and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no separate form for the health insurance fund.

Calculation by categories of this fund is also submitted to the Pension Fund.

If this month your individual entrepreneur suffered losses, for example, income was 10 thousand rubles, and expenses were 15 thousand, in the “difference” line, indicate 1% of the amount received, the minimum profit, or simply “zero”.

If your company operates under the general taxation system, reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method.

The only difference will be in the timing of reporting.

The employer must pay 26% of the payroll, 13% (personal income tax) - the employee from his income.

Reflection of salary transactions in reporting

- ” onclick=”window.open(this.href,'win2′,'status=no,toolbar=no,scrollbars=yes,titlebar=no,menubar=no,resizable=yes,width=640,height=480,directories =no,location=no'); return false;” rel=”nofollow”> Print

The annual financial statements consist of a balance sheet, a statement of financial results and appendices thereto. This is stated in Part 1 of Article 14 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ).

This requirement also complies with the norms of paragraph 5 of PBU 4/99 and subparagraphs “a”, “b”, “c” of paragraph 30 of the Regulations on Accounting and Financial Reporting... approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n. However, in the last two documents, instead of a statement of financial results, a profit and loss statement is indicated.

A similar name was used in the order of the Ministry of Finance of Russia dated July 2, 2010 No. 66n “On the forms of financial statements of organizations” (hereinafter referred to as order No. 66n).

This difference can be explained by the fact that Law No. 402-FZ was adopted later than the mentioned regulatory documents. Therefore, for example, in the order of the Ministry of Agriculture of Russia dated December 12, 2014 No. 497 “On approval of reporting forms for 2014” (hereinafter referred to as Order of the Ministry of Agriculture No. 497) a new name was used - a report on financial results.

And recently, officials corrected this discrepancy (Order of the Russian Ministry of Finance dated April 6, 2015 No. 57n). In a number of accounting provisions and in Order No. 66n, the words “profits and losses” are now replaced by “financial result”, and the expression “small businesses” by “organizations that have the right to use simplified accounting methods.”

However, in agriculture, it is small businesses that generate reporting using a simplified system. To do this, they use the following rules (clause 6 of order No. 66n):

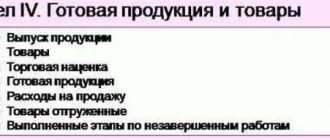

- the balance sheet and profit and loss account include indicators only for groups of items;

- The appendices provide only the most important information, without knowledge of which it is impossible to assess the financial results of activities.

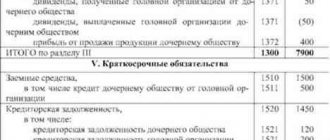

In the balance sheet, payables for wages, listed at the end of the reporting period on account 70, are reflected on line 1520 (hereinafter, the digital code is indicated in accordance with Appendix No. 4 to Order No. 66n) of Section V “Short-term liabilities” of the balance sheet. This will take into account all amounts of accrued but not paid wages, bonuses, etc.

However, this does not apply to the amounts of depositors that are recorded on account 76: they are reflected on line 1550 of Section V of the balance sheet. In addition, if a company creates a reserve for vacation pay under account 96 and at the end of the reporting period it has a balance of reserved amounts, then it must be shown on line 1540 of Section V of the balance sheet.

Moving on to the financial results statement, we note the following:

- line 2210 of this report reflects business expenses - this can be the amount of remuneration of those employees who are engaged in the sale of produced agricultural products;

- on line 2220, they also take into account the salaries of administrative and management personnel, if the accounting policy stipulates that the company at the end of each reporting period writes off such expenses directly to the “Cost of Sales” subaccount of account 90.

The transferred salary is reflected in line 4122 of the cash flow statement. In the attachment to letter No. 07-04-18/01 dated January 29, 2014, specialists from the Russian Ministry of Finance noted that wage payments are shown together with deductions. As an example, they gave the amounts:

Reflection of salary transactions in reporting

- ” onclick=”window.open(this.href,'win2′,'status=no,toolbar=no,scrollbars=yes,titlebar=no,menubar=no,resizable=yes,width=640,height=480,directories =no,location=no'); return false;” rel=”nofollow”> Print

The annual financial statements consist of a balance sheet, a statement of financial results and appendices thereto. This is stated in Part 1 of Article 14 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ).

This requirement also complies with the norms of paragraph 5 of PBU 4/99 and subparagraphs “a”, “b”, “c” of paragraph 30 of the Regulations on Accounting and Financial Reporting... approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n. However, in the last two documents, instead of a statement of financial results, a profit and loss statement is indicated.

wage fund in the balance sheet line

In the section Accounting, Audit, Taxes, to the question: Tell me, in what application form to the balance sheet for 2011 can I find the annual payroll? given by the author Oksana Rogozhnikova is in the cash flow statement (Form No. 4, line 160 for wages) - this is cash issued for salaries.

(This is not an accrued payroll.) These figures are not in the balance sheet. You can look... in the FSS forms.. Pen. fund You can see f. No. 5. The section “Expenses for ordinary activities” lists the organization’s expenses, grouped by elements: material costs, labor costs, social contributions, depreciation, and other costs. It should be borne in mind that the indicated elements reflect the organization’s costs associated with the write-off of inventories for the purpose of production, performance of work, provision of services, accounted wages for work performed, services rendered, accrued depreciation, etc.

Deadlines

The deadlines for submitting mandatory reporting on the wage fund are established by regulatory government bodies. Typically, reporting is submitted based on the following results:

- next quarter;

- calendar year.

Note:

When preparing reports on payroll, it is necessary to draw up a tax return for the Unified Social Tax no later than 30.03 of the year following the reporting period.

When preparing and submitting reports, the company goes through the following stages:

- The accountant sends regulatory documents establishing the form of the report and including instructions for generating reports in the automation department.

- Technicians update and customize reporting forms.

- The accountant prepares, consolidates and verifies data for reporting.

- The accountant generates reports for the current reporting period.

- The accountant checks the accuracy of the generated reports.

- The accountant prints a set number of copies of reports.

- Prepared reports undergo a second review cycle.

- The accountant submits reports signed by clients to regulatory authorities.

- The enterprise receives reports with a mark from the regulatory authority on delivery.

To summarize, we note that payroll is a fixed salary for employees.

The employer must pay 26% of the payroll, 13% (personal income tax) - the employee from his income.

Payroll reporting is almost the same for all small businesses, regardless of the form of organization.

Only the tax regimes differ, but this difference is insignificant.

What documents are used

Information on remuneration is presented in the following documents:

- balance sheet (form No. 1) with annex (form No. 5);

- reports on income and expenses (form No. 2), on the flow of funds (form No. 4), on the intended use of money (form No. 6), etc.

How is the wage fund reflected on the balance sheet?

Salary accrual in accounting is displayed using the entry:

- Dt cch. (debit account) 20 “Main production” ( 25 “General production expenses”, 44 “Sales expenses”, etc.),

- K-t sch.

What kind of reporting is submitted?

If you are an individual entrepreneur and work in a simplified taxation system, filing payroll reports will not be particularly difficult.

Income and expenses of the wage fund are traditionally reflected in the corresponding book.

In the seventh column of the document, the income received during the month and the expenses that the company incurred in the same period are recorded, and the resulting difference is taken into account.

The book is submitted for control in December of each financial year.

Quarterly reporting on payroll involves filling out forms from the social insurance fund and pension fund. But there is no separate form for the health insurance fund.

Calculation by categories of this fund is also submitted to the Pension Fund.

If this month your individual entrepreneur suffered losses, for example, income was 10 thousand rubles, and expenses were 15 thousand, in the “difference” line, indicate 1% of the amount received, the minimum profit, or simply “zero”.

If your company operates under the general taxation system, reporting will be more difficult.

You will have to draw up a balance sheet, report on funds received and losses incurred, and at the end of the reporting period, submit an appendix to the balance sheet, reports on the flow of money and the intended use of all funds.

When reporting wages, you can use the same forms as individual entrepreneurs working under a simplified method.

The only difference will be in the timing of reporting.

Labor costs in the balance sheet line

– the cost of materials used for the administrative and general economic needs of the organization (paragraph 4, paragraph 2 of PBU 5/01);

– cost of containers and packaging, cost of container materials intended for repair of containers (clauses 160, 161 of the Guidelines for accounting of inventories);

– purchased energy of all types (electric, thermal, compressed air, cold and other types), spent on technological, energy, motor and other production and economic needs of the organization (clause 20 of the Methodological Recommendations for Accounting in Agricultural Organizations, clause 4.4. 2 Instructions for the composition, accounting and calculation of costs included in the cost of transportation (work, services) of road transport enterprises (approved.

Accounting for production costs and sales costs (accounts 20 – 29, 44)” of the Guide to Information Security “Correspondence of invoices”

This is interesting: Principles of compulsory social insurance

Section “Material costs” of the Information Security Guide “Correspondence of invoices”

3.5.6.1.2. What accounting data is used to fill out line 5610 “Material costs”

When filling out line 5610, data on debit turnover for the reporting year is used in the accounts of production costs and sales expenses (20 “Main production”, 23 “Auxiliary production”, 25 “General production expenses”, 26 “General expenses”, 28 “Defects”) in production”, 29 “Service production and facilities”, 44 “Sales expenses”) in correspondence with accounts 10 “Materials”, 60 “Settlements with suppliers and contractors”, 76 “Settlements with various debtors and creditors”, 94 “Shortages and losses from damage to valuables”, etc.

The amount of depreciation of an item of fixed assets as a result of revaluation is included in the financial result as other expenses. The amount of depreciation of an object of fixed assets is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this object carried out in previous reporting periods. The excess of the amount of depreciation of an object over the amount of its revaluation, credited to the organization's additional capital as a result of revaluation carried out in previous reporting periods, is charged to the account of retained earnings (uncovered loss).

When an item of fixed assets is disposed of, the amount of its revaluation is transferred from the organization's additional capital to the organization's retained earnings.

The amount of additional valuation of intangible assets as a result of revaluation is credited to the additional capital of the organization.

Optimization of deductions from payroll

There are ways to reduce payroll taxes without exposing yourself to the risk of tax crimes and payment evasion. This happens by transferring wages to other forms that are subject to lower tax rates. One of the alternatives to the so-called white schemes is to register an employee as an individual entrepreneur with a simplified tax system at a rate of 6% . An agreement on the performance of work is concluded with the individual entrepreneur and a payment for the performance is transferred. Savings are achieved by reducing the tax rate , as well as the obligation of individual entrepreneurs to transfer mandatory contributions to the Pension Fund and the Compulsory Medical Insurance Fund. In order not to raise unnecessary questions from the tax service, an individual entrepreneur must conduct business independently, without hired labor . Otherwise, the same problem will arise as the company where the individual entrepreneur actually works. Another way is to concentrate the bulk of the payroll on one employee . Most often this is the director. For payments of more than 711,000 rubles per year, reduced insurance premium rates apply. However, the issue of subsequent distribution of money remains in shadow schemes. In conclusion, I would like to remind you that insurance premiums are subject to transfer to the appropriate funds monthly until the 15th of the next month. If the last day of the deadline for transferring contributions turns out to be a weekend or holiday, the deadline is the next closest working day. Contributions accrued but not transferred on time are considered arrears , on which penalties . In pursuit of reducing the tax burden, you should not get carried away with “gray” schemes .

Labor costs in the balance sheet line

- on line 2220, they also take into account the salaries of administrative and management personnel, if the accounting policy stipulates that the company at the end of each reporting period writes off such expenses directly to the “Cost of Sales” subaccount of account 90.

Applications and explanations

In the notes to the balance sheet and income statement, companies disclose information in the form of separate reports:

- about changes in capital;

- about cash flow.

The latest report in accordance with paragraph 29 of PBU 4/99 must characterize changes in the financial position of the company for current, investment and financial activities.

Remuneration of employees, as well as payments in their favor to third parties, are classified as current operations (subclause “d” of paragraph.

Personal income tax

The wage fund includes taxes. The main feature of these contributions is that they are paid from the amount of the salary accrued to a specific employee, i.e. actually reduce it. The personal income tax rate is 13% . Transferred to the Federal Tax Service on the day the salary is paid. For workers with children , fixed tax deductions are available. Since 2012, their sizes have been:

- for the first child 1400 rubles;

- for the second child 1400 rubles;

- for the third and subsequent 3000 rubles. This rate is also valid for disabled .

The beginning of this deduction is the month of birth or adoption of the child. The end of the deduction is considered to be the end of the year in which the child reaches the age of 18 . Or, if the child continues to study at a university, until he reaches the age of 24 years . Standard deductions are also available to special categories of citizens : heroes of Russia and the USSR, participants in military operations, disabled people, persons caught in the radiation zone, etc. Tax deduction is an amount deducted from wages before personal income tax is withheld from it. An employee has the opportunity to reduce the amount of tax only on the basis of an application. According to paragraph 4 of Article 218 of the Tax Code, a deduction from the beginning of the year is made until the total amount of wages paid does not exceed 280,000 rubles . Calculation example Let's take the same workers, adding some clarifications. Kuznetsov A.T. has three children aged 28, 25 and 14 years old, Ivanov P.N. is the sole guardian of a disabled child , Kovaleva M.S. has no children . Calculations are made as follows:

- Kuznetsov A.T. - (30,000 - 1,400)*13/100 = 3,718 rubles. In this case, the deduction is provided only for the third child. In October, the total salary for 10 months will be 300,000 rubles; no deduction will be made until the end of the year.

- Ivanov P.N. - (50,000 - 6,000)*13/100 = 5,720 rubles. The deduction is due at an increased rate - 3,000 rubles and in double amount. In June, the total salary for 6 months will be 300,000 rubles; there will be no tax deduction until the end of the period.

- Kovaleva M.S. — 120,000*13/100 = 15,600 rubles.

Labor costs in the balance sheet

Methodological recommendations for accounting of production costs and calculating production costs in agricultural organizations), or be included in the cost of production (work, services) for the relevant cost elements (material, labor costs, etc.) (Methodological recommendations for the application of the Chart of Accounts of Enterprises and organizations of the agro-industrial complex).

In the latter case, when filling out line 5630, you should take into account the debit turnover on account 28 in terms of costs in the form of contributions for social needs.

In general, the indicator in the column “For the previous year” on line 5630 is transferred from table 6 of the Explanations to the Balance Sheet and the Statement of Financial Results for this previous year.

3.5.6.3.3.

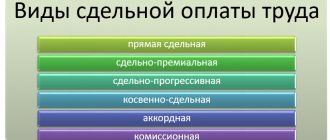

Direct and additional

Typically, the wage fund is divided into direct and additional. Indicators are calculated for the year. Direct consists of actual wages (in some areas it is called salary), i.e. this is the amount that the employee receives for the time worked, as well as the amount of vacation pay. The additional fund consists of several items:

- bonuses;

- temporary disability payments;

- payment for food, travel and other services to employees.

Insurance premiums are calculated on the entire amount of staff income and are indicated separately. To calculate the direct and additional wage fund, we will take as an example the above-described employees of Ekran LLC.

| Job title | Straight | Additional | Insurance premiums (30%) | Total |

| Executive Director | 1028000 | 80000 | 332400 | 14404000 |

| Sales Manager | 514000 | 50000 | 169200 | 733200 |

| Loader | 175000 | 20000 | 58500 | 253500 |

The direct fund consists of the annual tariff rate and vacation pay. For a sales manager, the annual tariff is 484,000 rubles, vacation pay is 30,000 rubles. The sales manager's additional

No regulatory document gives a clear answer to the question of what is included in the wage fund. However, every entrepreneur with a staff is faced with the need to plan a payroll for the next year. Determining the personnel costs borne by the employer in the selected period, regardless of the reasons for which these payments were accrued, is an integral part of enterprise management. The wage fund is forced to be reasonably necessary for the normal operation of the enterprise. The surplus falls on the cost of production, reduces profits, and reduces profitability. At the same time, the lack of payroll, especially at the time of inflation , provokes a reduction in wages and leads to an increase in the so-called “turnover” of personnel, the weakening of the workforce and even conflicts, including strikes . In addition to wages, the entrepreneur makes contributions to the tax service, the Federal Compulsory Medical Insurance Fund, the Pension Fund and the Social Insurance Fund (social payments). Payroll taxes are the most important category in the Russian taxation system. Let's take a closer look at each of these payments.

Labor costs in the balance sheet line RB

Indicators of lines 5660 – 5680 of table 6 of the Explanations to the Balance Sheet and the Statement of Financial Results (fragment of table 6 of the Explanations).

Name of indicator Code For 2014 For 2013 Total by elements 5660 58,070 78,170 Actual cost of goods purchased for resale 5665 18,260 14,248 Change in balances (increase [-], decrease [+]): work in progress, 5670 (4452 ) finished products, etc. 5680 2890

Solution

Expenses for ordinary activities for 2014

- Turnover in the debit of account 26, analytical account for accounting for deductions for social needs

- Turnover in the debit of account 29, analytical account for accounting for deductions for social needs

- Turnover in the debit of account 44, analytical account for accounting for deductions for social needs

Fragment of Table 6 Explanations for 2013:

Name of indicator Code For 2013 For 2012 Contributions for social needs 5630 7718

Solution

In accounting, the list of costs included in a particular element is determined by the organization independently (taking into account industry specifics). The selected option is fixed in the accounting policy.

This is interesting: Improving the conditions of service and living conditions of military personnel

In order to generate information about the costs of the reporting period, debit turnovers are used in the production cost (sales expenses) accounts. In this case, internal turnover between the accounts of production costs (sales expenses), as well as turnover associated with the transfer of finished products and goods for the needs of own production, service farms, etc. (hereinafter referred to as internal turnover ) should not be taken into account.

Recalculation of the value of banknotes at the organization's cash desk and funds in bank accounts (bank deposits), expressed in foreign currency, can also be carried out as the exchange rate changes.

To prepare financial statements, the value of assets and liabilities is recalculated into rubles at the rate in effect at the reporting date.

Cash equivalents are cash and highly liquid financial investments that can be easily converted into a known amount of cash and that are subject to an insignificant risk of changes in value.

This division is required for the correct formation of the cost of sales, as well as the formation of other company expenses not related to core activities.

After the organization has accrued wages, it is required to withhold personal income tax and make posting D70 - K68. If there are any other deductions, then they must also be carried out.

The employee receives the amount minus personal income tax, the advance received and other deductions, if any (alimony, for example).

The procedure for reflecting data on the number and wages of employees

State educational institution of higher professional education “Belgorod State University”

Balance sheet structure

Each part of the balance sheet groups assets and liabilities into sections. So, on the left side there are two sections - non-current and current assets, and the right side consists of three sections, separately combining capital and reserves, long-term as well as short-term liabilities.

In turn, the positions in each section are encoded with special four-digit codes established by Appendix No. 4 to Order No. 66n. Encryption of lines is necessary in reporting submitted to regulatory authorities - the legislator approved this procedure in order to systematize statistical data when generating information in general for an industry, region or country. A balance sheet compiled to review results within an enterprise may not contain codes - there is no need for them, but it is more convenient to generate a report and post accounting data, correlating them with the code number. Let's figure out how the current balance line codes are deciphered, what information is grouped in each of them, and how the indicators are formed.

D/t 10 + D/t 15 + D/t 16 (or – K/t 16) + D/t 20 + D/t 21 + D/t 23 + D/t 28 + D/t 29 + D/ t 41+ D/t 43 – K/t 42– K/t 14 + D/t 44 + D/t 45

Average monthly salary per employee

The average monthly salary per employee is an indicator that is used by the tax service as one of the criteria for self-assessment of risks by taxpayers.

The tax authorities usually come to the attention of companies in which this indicator is below the average level in the region for the industry, type of economic activity, or beyond the threshold limits of the subsistence level.

If the taxpayer’s tax burden turns out to be below its average level for business entities in a particular industry (type of economic activity), then in this case the tax authorities call representatives of the organization to salary commissions.

Let us note that tax inspectors interfere in the non-tax affairs of companies not because they are worried about the income of the population, but because fiscal officials are trying in this way to identify organizations that pay salaries “in envelopes.”

Let us note that tax inspectors interfere in the non-tax affairs of companies not because they are worried about the income of the population, but because fiscal officials are trying in this way to identify organizations that pay salaries “in envelopes.”

When a delay may occur

The legislator has established that salaries must be paid in installments at least 2 times a month with approximately equal time intervals. The parts of the salary, including compensation and salary, should also be approximately equal to each other.

Based on the results of work, only bonuses are paid, so they can be accrued for 1 or several months at once, for a year. When receiving wages in cash, employees sign the pay slip; if it is transferred to bank cards, documents are requested from the bank to confirm payment.

The specific numbers when the employer provides for payments, he indicates in the internal Labor Regulations and contracts concluded with employees. Therefore, wages at a particular enterprise must be paid on time, and if these days fall on weekends or holidays, then the day before. For the payment of vacation pay, the deadline is 3 days before the start of the vacation, and settlement pay on the day of dismissal.

Debt in insurance premiums most often arises as a result of accounting errors and misinterpretation of innovations in this area.

How to act if a debt arises in a bank is explained in detail in the article at this link.

Wage arrears can be current, the payment period of which has not yet arrived, but it has already been accrued, and overdue, when the numbers (for example, 1 and 15) provided for by the internal documents of the enterprise are missed. Personal income tax is already included in the salary when it is calculated.

Overdue wages will include the balances of wages that the employer has not paid as of the reporting date, minus those paid (advances). If there is arrears in wages that come from the budget, then all organizations will be in arrears at the same time, regardless of the items for which financing is provided.

Although the employer must pay wages after 14–16 days . i.e. 2 times a month, he can legally do this no later than 7 days after the end of the time interval.

From the moment the reporting date for payment was missed, the debt will be considered overdue, i.e. on the next day. Regardless of whether wages at the enterprise have not been paid in whole or in part, the entire balance of the debt will be attributed to the arrears on the balance sheet.

A delay in payment can occur for various reasons, but the main one is considered to be the company’s lack of funds, when receivables are high and counterparties do not return funds for a long time.

In another case, a large amount of accounts payable has formed and needs to be repaid urgently, as well as other cases. At the same time, according to the balance sheet, salaries are accrued on time, but they do not reach the employees. If the salary is paid later than the terms stipulated by the employment contract and legislative acts, or is not paid at all, this indicates a violation of the Labor Code by the employer.

If we are talking about regular bonuses, then the employer could violate labor laws and not pay them. When he decided not to pay the bonus to the employee and did not properly record the fact of violation of discipline in the documents, this will also be a violation; according to the law, the employee is entitled to payment. In this case, the court recognizes that the employer did not have the right to deprive the employee of a bonus or reduce its size, and therefore is obliged to return the debt for the bonus and material compensation for its delay.

The legislator has established that in any case, if there is a delay in payment of wages, the employer has committed a violation and must bear financial responsibility, because the fact of non-payment of wages to employees cannot depend on:

- selfish intent or not of the employer;

- the presence or absence of funds in the company’s account;

- problems with cash in the bank;

- illnesses of accounting workers or cashiers;

- other factors.

Summary

There are many types of wages, depending on the qualifications of employees, working hours, working conditions, rest periods and other factors. wage fund Wages are classified based on minimum and actual tariffs. In some regions, there are territorial coefficients that increase the wage fund from 15 to 100%. For example, the Ural coefficient is 15%. It is also worth remembering that there is a minimum level of employee benefits established by law and 30% of insurance premiums must be charged on all staff income. With the right approach to the wage fund and constant monitoring of wages, it is possible to effectively stimulate employees , while at the same time leaving reserves for the growth of staff income.

We welcome your comments!

Write-off

If the employee has not requested a salary within 3 years, the amount is written off (Article 196 of the Civil Code of the Russian Federation regulates the general limitation period).

The documentary basis for this is a written order from the head of the enterprise and the final data of the inventory check.

It is important to know: the deposited salary is written off as expenses after 3 years .

Having received information about a violation of the employer’s payment obligations, the employee can file a claim with the court to resolve the labor dispute under the Labor Code in accordance with 392 of the Labor Code of the Russian Federation within 3 months.

If you write off the debt at an earlier date, tax authorities will have questions for the employer. There may be charges of lack of proper accounting, concealment of income and a fine.

Off-balance sheet account 007 records debts that are unrealistic for collection (within 5 years). If the debtor's financial situation changes, it becomes possible to demand fulfillment of obligations.

Movement of wages: how to do it correctly?

Debit 51 – Credit 50 – salary funds are deposited and sent back to the bank. Debit 70 – Credit 76.4 – deposit of the amount of salary arrears. Debit 76.4 – Credit 50 or 51 – deposited salary paid.

Analytics of account 76.4 is carried out for each unpaid amount in the book of accounting for deposited amounts. Order of the Ministry of Finance of the Russian Federation No. 173n in Appendix 5 describes the procedure for entering values and entries.

All about economics

This line shows the organization’s short-term accounts payable (clause 19 of PBU 4/99), the repayment period of which does not exceed 12 months after the reporting date.

What is included in short-term accounts payable?

According to line 1520 “Accounts payable” in section. V of the Balance Sheet provides information on the following types of short-term accounts payable.

- Accounts payable to suppliers and contractors, which are recorded on account 60 “Settlements with suppliers and contractors” in amounts recognized by the organization as correct (Instructions for using the Chart of Accounts, clause 73 of the Regulations on Accounting and Financial Reporting).

In particular, account 60 reflects the organization’s debt:

— for acquired material assets (including uninvoiced deliveries);

- for accepted work performed;

- for services consumed;

— on bills of exchange issued to suppliers and contractors;

- on commercial loans received from suppliers and contractors.

The amount of debt on commercial loans is formed by both the amount of the principal debt and the amount of interest due at the end of the reporting period in accordance with the terms of the agreements (clause 1 of PBU 15/2008, clause 73 of the Regulations on Accounting and Financial Reporting).

If the agreement for the acquisition of an asset (performance of work, provision of services) provides for a deferred (installment) payment and the fee for a commercial loan is not separately established, then its amount, taken into account in the price of the agreement, is determined by the organization independently. This amount, being the economic content of interest payable to the lender (creditor), is recognized in accounting evenly until the end of the deferment period (installment plan) in the manner prescribed by PBU 15/2008 (Appendix to the Letter of the Ministry of Finance of Russia dated 06.02.2015 N 07- 04-06/5027).

- Accounts payable to employees of the organization, which can be accounted for in the following accounting accounts:

- 70 “Settlements with personnel for wages” - in terms of accrued but not paid wages, bonuses, benefits, amounts of distributed income due to the founders - employees of the organization, etc.;

— 71 “Settlements with accountable persons” — regarding the amounts of overexpenditure on advance reports not reimbursed to employees;

- 73 “Settlements with personnel for other operations” - in terms of accrued but not paid compensation to employees for the use of personal property, amounts of financial assistance, moral damage, etc.;

- 76 “Settlements with various debtors and creditors”, subaccount 76-4 “Settlements on deposited amounts” - in terms of accrued but not paid due to the non-appearance of recipients of wages (Instructions for using the Chart of Accounts).

- Accounts payable for compulsory social insurance, including arrears of contributions, taking into account fines and penalties accrued for payment to state extra-budgetary funds. These types of debt are accounted for in account 69 “Calculations for social insurance and security” (Instructions for using the Chart of Accounts).

- Accounts payable for taxes and fees, which may include the following types of debt (Articles 13, 14, 15, 75, 114 of the Tax Code of the Russian Federation, paragraph 2, paragraph 23 of PBU 18/02):

— on payment of income tax;

- payment of property tax;

- payment of transport tax;

- on payment of land tax;

— on payment of other taxes and fees;

- for payment of penalties and fines accrued to the taxpayer.

These types of debt are accounted for on account 68 “Calculations for taxes and fees” (Instructions for using the Chart of Accounts).

- Accounts payable to buyers and customers, which arises in the event of receiving an advance (advance payment) for the supply of products, goods (performance of work, provision of services) and includes debt on commercial loans. The specified debt is reflected in the credit of account 62 “Settlements with buyers and customers”.

- Accounts payable for non-state pension provision for employees of the organization, recorded in account 69 “Calculations for social insurance and security”.

- Accounts payable to the founders (participants) for the payment of the actual value of the share (market value of the shares) upon leaving the company, as well as for the payment of income in the form of distributed profits, accounted for in account 75 “Settlements with founders”.

Debt to the founders for the payment of income arises on the date the general meeting of participants (founders, shareholders or the owner of the enterprise’s property) made a decision on the distribution of profits (clause 1, article 28 of Law No. 14-FZ, clauses 1, 3, article 42 of the Law N 208-FZ, paragraphs 1, 2 of Article 17 of Law N 161-FZ).

In accounting, the distribution of profit at the end of the year refers to the category of events after the reporting date, indicating the economic conditions in which the organization conducts its activities that arose after the reporting date. Such an event after the reporting date is disclosed in the Notes to the Balance Sheet and the Statement of Financial Results for the reporting year. At the same time, in the reporting period for which income is distributed, no entries are made in accounting (synthetic and analytical) accounting. When an event occurs after the reporting date in the accounting of the period following the reporting one, in general order an entry is made reflecting this event (clauses 3, 5, 10 of PBU 7/98).

In this regard, the debt to pay income in the form of distributed profit (both at the end of the year and when making interim payments) is shown in the accounting records as of the date the corresponding decision is made.

If, in connection with an increase in the authorized capital, funds and other property were received from shareholders (participants), but on the reporting date the corresponding changes in the constituent documents were not registered, then the value of this property reflected in the credit of account 75, subaccount 75-1 “Settlements on deposits in authorized (share) capital” is not included in the accounts payable indicator on line 1520 section. V of the Balance Sheet, but is reflected separately as a separate item in Section. III “Capital and reserves” (Appendix to the Letter of the Ministry of Finance of Russia dated 02/06/2015 N 07-04-06/5027).

- Other accounts payable for property and personal insurance, for claims, for amounts erroneously credited to the organization’s accounts, for rent, for license fees, for customs duties, for settlements with the principal and other types of debt not mentioned above. The specified types of accounts payable are reflected in the credit of account 76 “Settlements with various debtors and creditors.”

What accounting data is used when filling out line 1520 “Accounts payable”?

When filling out this line of the Balance Sheet, data on credit balances as of the reporting date is used (clauses 73, 74 of the Regulations on Accounting and Financial Reporting):

— on account 60 (in terms of short-term accounts payable);

- according to accounts 70, 71, 73;

— on account 69 (in terms of short-term accounts payable);

— on account 68 (in terms of short-term accounts payable);

— on account 62 (in terms of short-term accounts payable);

- according to the account 75, sub-account 75-2;

— on account 76 (in terms of short-term accounts payable).

According to the clarifications of the Ministry of Finance of Russia, when an organization receives payment, partial payment towards the organization's upcoming deliveries of goods (performance of work, provision of services, transfer of property rights), accounts payable are reflected in the balance sheet as assessed minus the amount of VAT payable (paid) to the budget (Letter Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01).

Line 1520 “Accounts payable” = Credit balances in terms of short-term accounts payable on accounts 60.62. If an organization has accounts payable on accounts 62, 76 in the amount of the prepayment received, including VAT, then when determining the indicator of line 1520 it is necessary to reduce credit balances on these accounts for the corresponding VAT amounts (Letter of the Ministry of Finance of Russia dated 01/09/2013 N 07-02-18/01), 76,68,69,70,71,73, subaccount 75-2

Attention!

Attention!

Accounts payable expressed in foreign currency (including those payable in rubles), for reflection in the financial statements, are recalculated into rubles at the rate in effect on the reporting date (clauses 1, 5, 7, 8 PBU 3/2006).

The exception is accounts payable arising in connection with the receipt of an advance payment, prepayment or deposit. Such accounts payable are shown in the financial statements at the exchange rate on the date of receipt of funds (clauses 9, 10 of PBU 3/2006).

Organizations independently determine the detail of the indicator on line 1520 “Accounts payable”. For example, the balance sheet may separately contain information about the organization’s short-term accounts payable to suppliers and contractors, to buyers and customers for the amounts of advances received (prepayments), to the organization’s personnel, to the budget for the payment of taxes and fees, as well as to extra-budgetary funds, if such information is recognized by the organization as significant (paragraph 2 of clause 11 of PBU 4/99, clause 3 of Order of the Ministry of Finance of Russia N 66n, Letter of the Ministry of Finance of Russia dated January 27, 2012 N 07-02-18/01). The organization’s decision on whether an indicator is significant depends on the assessment of the indicator, its nature, and the specific circumstances of its occurrence. That is, when preparing financial statements, materiality is determined by a combination of qualitative and quantitative factors (Letter of the Ministry of Finance of Russia dated January 24, 2011 N 07-02-18/01).

Indicators on line 1520 “Accounts payable” as of December 31 of the previous year and as of December 31 of the year preceding the previous year are transferred from the Balance Sheet for the previous year. If the indicator of line 1520 as of the reporting date is formed according to other rules, then the indicators as of December 31 of the previous year and as of December 31 of the year preceding the previous one must be adjusted as if they were determined according to the same rules as the indicator for reporting date. In other words, the comparability of comparative indicators must be ensured (paragraph 2, clause 10 of PBU 4/99).

The “Explanations” column provides an indication of the disclosure of this indicator. If an organization draws up Explanations to the Balance Sheet and the Statement of Financial Results according to the forms contained in the Example of Explanations given in Appendix No. 3 to Order of the Ministry of Finance of Russia No. 66n, then in the column “Explanations” on line 1520 “Accounts payable” tables 5.3 are indicated “ Availability and movement of accounts payable" and 5.4 "Overdue accounts payable", which disclose the indicators of line 1520 of the Balance Sheet.

Example of filling out line 1520 “Accounts payable”

Indicators for accounts 60, 70, 71, 76, 69, 68, 62, 75 (there is no credit balance for account 73): rub.