The SZV-M form was adopted in 2021 by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p dated 02/01/16. The abbreviation means that this is information about earnings (remuneration), which is submitted monthly.

Thanks to this form, the fund receives up-to-date information about working pensioners. Those of them who are still working do not have the right to count on indexation; for the rest of them, the state must provide it in connection with dismissal.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to find out how to solve your particular problem , contact a consultant:

8 (800) 700 95 53

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FREE !

The deadlines for submitting information have changed compared to 2021. The amendments were made by Law No. 250-FZ of 07/03/16. In 2021, SZV-M must be submitted by the 15th, but this can be done ahead of schedule.

Watershed Report

The question of whether it is possible to submit the SZV-M for December 2017 ahead of schedule is now very important for people responsible for submitting reports. And that's why. The fact is that a number of new factors are at work:

- due to objective circumstances, the early delivery of SZV-M for December 2021 falls already in 2021;

- The standard deadlines for submitting SZV-M for December 2017 fall in the period immediately after the New Year holidays, during which no one does reporting (as a rule).

Now we’ll figure out whether it’s possible to submit the SZV-M for December 2017 in advance and tell you about the change in the general submission deadline from the December report.

Who should submit the report?

All employers submit a new report to the Pension Fund. It includes information about employees from whose income insurance payments are transferred. It does not matter what type of contract the employment relationship is formalized.

The form includes employees who worked during the reporting period, were hired or fired. Persons who were on sick leave, maternity leave, or vacation for the entire period, i.e., who actually did not work, are also included in SZV-M.

If a company does not have employees, then it does not have to submit a report. A blank form does not contain any information and the Pension Fund is not needed. If there is a single founder on staff who has an income, he submits the SZV-M for himself, i.e. the table of the form will consist of one line.

According to the letter of the Pension Fund of the Russian Federation No. 08-22/6356 dated 05/06/16, the founding director in one person is allowed not to be included in SZV-M if an agreement has not been drawn up with him and he does not have any payments. In this case, the report can be submitted, and the Pension Fund will accept it.

If the entrepreneur did not hire workers, he does not rent out the SZV-M.

Separate departments of the company, which have a separate bank account, balance sheet and staff, must submit the SZV-M separately from the parent organization to the Pension Fund of the Russian Federation at the place of registration. Information is provided on workers of a specific separate unit. The form reflects the TIN of the main company and the KPP of the division.

So, the report is provided:

- legal entities and their separate departments;

- entrepreneurs;

- persons conducting private practice for their employees.

If contracts were concluded with employees, but the company did not conduct any activities and did not pay wages, it must still report under SZV-M.

Persons working under civil law agreements are included in the form if they received remuneration in the reporting period and contributions were deducted from it.

SZV-M also includes citizens working under the following contracts:

- author's order;

- alienation of the sole right to creation;

- licensed publishing;

- the right to apply the brainchild of science, culture, art, etc.;

- transfer of management rights.

The employee responsible for registration and delivery of SZV-M is appointed by the head of the company. Usually these functions are performed by one of the accountants or personnel officers. Both have access to personal data about personnel and the necessary programs for compiling and transmitting information.

Form SZV-M

Is it possible to take SZV-M early?

Let us immediately note that the current legislation and changes since 2017 do not in any way regulate the question of whether it is possible to submit the SZV-M report ahead of schedule. Including for December 2021.

In our opinion, it is quite possible to pass the SZV-M ahead of schedule. That is, already in December. There is no need to wait until January and the end of the New Year and Christmas celebrations. True, it cannot be said that absolutely all branches of the fund welcome this approach. Therefore, it is better to clarify this point in advance. Although they definitely can’t ban it.

However, when submitting the SZV-M for December 2021 early, there is always a small chance that the already submitted report will need to be clarified. This may happen if the composition of the declared insured persons changes sharply: expands or contracts. For example, in the last days of December a new person will be hired when the SZV-M for December 2017 has already been submitted ahead of schedule. And such cases cannot be excluded. And this will require clarification.

If you are still wondering whether it is possible to submit the SZV-M for December 2017 earlier, and do not want to risk or run into making adjustments or clarifications to the December report, send the completed SZV-M report for December on the first working day of January 2021 - 9th.

And do not forget that through electronic channels the SZV-M report for December 2021 will certainly reach the inspectors faster than by regular mail. Therefore, there is every chance to get everything done on the very last working days of December 2021.

Also see “SZV-M can be passed early.”

How and where to take SZV-M in 2021

The rule remains unchanged from 2021. If a company or individual entrepreneur has 25 employees or more, the report must be submitted in electronic format with an enhanced qualified electronic signature. If 24 or less, you can pass on paper. For both options, the deadlines are the same - until the 15th day of the month following the reporting month. For an incorrect report form, you will be fined 1,000 rubles, so do not forget to switch to electronic format when you hire your twenty-fifth employee.

In Kontur.Accounting, you can automatically generate an electronic SZV-M and quickly send it if data on employees was previously entered into the system.

The SZV-M must be submitted at the place of residence of the individual entrepreneur or at the place of registration of the company. If the organization has separate divisions with employees, submit a report at the location of the division. However, if the OP does not have its own account or the salaries of its employees come from the head office, data on the employees of such a unit must be included in the general report for the parent organization.

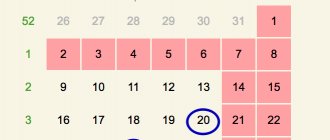

New deadlines for delivery of SZV-M for December

When to take SZV-M for December 2021? Have new deadlines for the delivery of SZV-M been approved for 2021? The answer is no, there are no new deadlines. The deadline for submitting SZV-M for December 2021 is January 15, Monday. Accordingly, those who do not plan to submit the SZV-M for December 2021 ahead of schedule need to set themselves to January 15, 2021 as the last day for submitting the report for December.

Please note: if the delivery of SZV-M for December 2021 occurs later than January 15, 2021, the organization or individual entrepreneur may be fined 500 rubles. Moreover, for each employee declared in the SZV-M form for December 2017 .

SZV-M for December 2021 must be submitted NO LATER than January 15, 2018!

Report submission deadlines in 2021

In 2021, policyholders will submit a report on pension contributions to the tax authorities. According to the Federal Tax Service, the accrued amounts are distributed among the personal accounts of employees.

Starting this year, employers submit to the Pension Fund annual information on length of service and SZV-M information, which is provided for each month before the 15th of the following month. Last year, the deadline for submission was the 10th, legislators increased the time for preparing information by 5 days.

The deadline for submitting the form is regulated by Art. 11 of Law No. 27-FZ, corresponding changes were made to it by Law No. 250-FZ of 07/03/16. If the deadline for submitting the SZV-M coincides with a weekend or holiday, it is automatically postponed to the next weekday.

The deadlines for submitting the form are indicated in the table:

| Period | Deadline |

| For January | 15.02.17 |

| For February | 15.03.17 |

| For March | 17.04.17 |

| April | 15.05.17 |

| May | 15.06.17 |

| June | 17.07.17 |

| July | 15.08.17 |

| August | 15.09.17 |

| September | 16.10.17 |

| October | 15.11.17 |

| November | 15.12.17 |

| December | 15.01.18 |

The postponement of deadlines for submitting information in May, June and September is due to the fact that the 15th falls on a non-working day.

Is it possible to take SZV-M earlier: new restrictions for files

The electronic version of the SZV-M form was approved by Resolution of the Board of the Pension Fund of the Russian Federation dated December 7, 2016 No. 1077p. To pass the SZV-M early for December 2021, only this is suitable. If you send a different format for December, refusal to accept it will be quite legal.

Please note that there is a limitation in the specified format: the reporting period must be less than or equal to the month for which the program checks the report!

This was necessary because some accountants carelessly took the SZV-M two or more months in advance. And the program accepted these reports. As a result, it turned out that the report was submitted for the next month. And for the one for which the deadline had arrived, the company never reported. This won't happen now!

EXAMPLE In December 2021, the company will be able to submit the SZV-M for December 2021 and the report for November ahead of schedule. And for January 2021 – no longer.

To prepare SZV-M for December 2021, the fund advises downloading the “SPU_ORB” program for free on its official website www.pfrf.ru in the “Insurers” section.

Before sending SZV-M for December 2021 to the fund, do not forget to check the file with the report through:

- CheckPFR program;

- module for checking SZV-M forms before sending them to the Pension Fund.

These programs can be found in the same section of the official website of the Pension Fund.

If the number of people included in the report is 25 or more, you are required to submit the form electronically. If the number of employees whose data is included in the document does not exceed 24 people, you have the right to report on paper.

Read also

20.09.2016

What information needs to be submitted to the Pension Fund?

From the beginning of 2021, policyholders are required to submit SZV-M to the Pension Fund. It is provided monthly until the 15th of the following month.

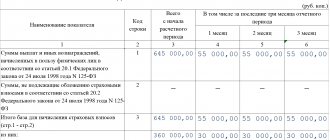

The set of forms that must be submitted to the Pension Fund from 2021 has been adjusted due to the transfer of control functions to the tax service.

The report on insurance premiums is now submitted to the Federal Tax Service by the end of the month following the reporting period.

Policyholders must still submit the following reports to the Pension Fund:

- clarification on RSV-1 for quarters until 2021;

- SZV-STAGE - information about the length of service of workers, submitted a year before March 1, the first report must be submitted for 2021 before March 1, 2020;

- information about SZV-M employees—for each month until the 15th of the following month;

- form for establishing a pension - within 3 days from the moment the employee who submitted the application contacts the employer;

- register of DSV-Z employees for whom additional savings contributions and employer fees are transferred - within 20 days after the end of the quarter;

- application for reimbursement of overpayments incurred before 2021.

Companies with up to 25 employees have the right to submit reports on paper; if the number of workers is larger, electronic submission of documents is required. For failure to comply with this requirement, a penalty of 1 thousand rubles is provided.

Instructions for filling out section III of the SZV-M report

In section 3, you must indicate the type code of the transmitted report. It can take 3 values:

- “output” - the original form that the enterprise submits for the specified reporting period for the first time;

- “additional” is a complementary form. This code must be specified if the original report has already been submitted, but it needs to be corrected. For example, a new employee appeared or incorrect data was submitted for him;

- “cancel” is a canceling form. This code should be used if any employees need to be completely excluded from the original report submitted. For example, the report contains data on an employee who quit and no longer worked in the current period.

Sample of filling out section III

How to reduce the fine?

These legislative norms do not imply mitigating circumstances for Pension Fund fines that would ensure their cancellation or reduction. However, if controversial issues arise, the employer has the right to appeal the decision of the Pension Fund of Russia by contacting the courts.

To do this, you will need to submit a statement of claim to the court and:

- Demand recognition of part of the fine wrongfully imposed by the Pension Fund.

- Reduce the amount of the penalty to the level shown in the resolution.

- To substantiate the complaint, it is necessary to present, with reference to the 5th paragraph of the resolution of the Constitutional Court of the Russian Federation No. 2-P dated January 19, 2016, arguments explaining the failure to report by the fact that this is the first case, and that the overdue time is short, etc.

If a fine is imposed on the entire number of personnel, when mistakes are made in relation to some employees, then this must be reflected in the claim, attaching a copy of C3B-M and in the request stating that the penalty is overestimated and needs to be reduced. To do this, similar court decisions in favor of the employer can be cited.

Instructions for filling out section I of the SZV-M report

The form consists of 4 sections, each of which is required to be completed. The filling instructions will help you figure it out. In section 1 the following details of the policyholder should be indicated:

- registration number in the Pension Fund of Russia. It is indicated in the notification from the Pension Fund received upon registration. You can also find it out at the local branch of the Pension Fund of Russia, the tax office, or on the website nalog.ru

- name (short);

- in the “TIN” field, you should indicate the code in accordance with the received certificate of registration with the tax authority;

- Individual entrepreneurs do not fill out the “Checkpoint” field. When filling out the form, organizations indicate the checkpoint that was received from the Federal Tax Service at their location (separate units indicate the checkpoint at their location).

Sample of filling out section I

The legislative framework

The penalty for not submitting the SZV-M report on time is regulated by Law No. 27-FZ of April 1, 2016 “On individual (personalized) accounting ...” in Art. 17, which states that each employer, if the SZV-M report is not submitted on time or is not provided in full, is subject to a financial penalty equal to 500 rubles for each employee.

At the same time, paragraph 5 of the reasoning section of the resolution of the Constitutional Court of the Russian Federation No. 2-P dated January 19, 2016 sets out the basis for reducing the amount of penalties.

A fine for failure to report SZV-M in 2021 can be imposed not only on the institution, but also on the head of the company or other official responsible for reporting and providing correct information. In this option, the amount of collection can range from 300 to 500 rubles, and if electronic reporting is disrupted, the fine can be 1000 rubles.

What sections are included in SZV-M in 2021

There are four sections in total in the report. What should they contain?

- Section 1 : details of the policyholder are entered here: name of the organization, registration number of the organization in the Pension Fund, INN, KPP.

- Section 2 : information about the reporting period. Here you need to indicate the code of the month for which you are submitting the calculation. The numbering is standard - from “01” for January to “12” for December.

- Section 3 : select the type of form (original, supplementary or canceling). We talked about what codes to indicate above.

- Section 4 : information about all insured employees is entered - full name, SNILS and INN.

How and when to adjust SZV-M in 2021

In response to the SZV-M report, you may be sent a notification with an error code of 50, 20 or 30. Code 50 means that the report was not accepted. Code 30 and 20 - which is partially accepted. In total, the Fund can identify 14 errors; they are listed in Table 7 of the Resolution of the Pension Fund Board dated December 7, 2016 No. 1077p.

Each error has its own correction rules. In response to error 50, you need to submit the report again, and for shortcomings identified by codes 20 and 30, send a supplementary report. In order to correct the error, you have 5 working days from the date of receipt of the notification.

SZV-M reports are divided into three types: initial (code “iskhd”), supplementary (code “add”) and o). The original one is submitted for the first time, the supplementary one - if the original report needs to be supplemented with previously unsubmitted information that needs to be taken into account in the report, and the canceled one - if you made a mistake and want to cancel the previously submitted incorrect information.

Code 30 appears if you incorrectly entered your SNILS number, full name, and ILS status. To correct error code 30, first submit a cancellation form for those employees for whom there were errors in the report. The information must be in its original form (with errors). And then submit a supplementary form for these employees with corrected information.

Code 20 is indicated when there is no TIN in the SZV-M or there is an error in it, submit a supplementary form with the corrected taxpayer number.

If the Pension Fund sends you a notification of an error, you can submit a supplementary report within 5 days only for those employees listed in the notification. It does not matter who found the error first - you or the Foundation. For each employee for whom data has not been submitted, you will be fined 500 rubles. In addition, the director can also receive a fine - from 300 to 500 rubles.

Common mistakes when filling out SZV-M

| Error | It should be | How to fix |

| There is no information about the insured person | When filling out the form, you must indicate all employees with whom an employment contract or civil service agreement has been concluded (even if the person worked for only one day). Information must also be submitted if there have been no accruals or payments to the employee at the Pension Fund of the Russian Federation, but he has not been fired. | Supplementary reporting is submitted, which indicates those employees who were not reflected in the original form. In the third section we put the form code “ADP”. |

| There is an extra employee present | The presence of records of redundant employees (for example, fired) is equivalent to false information. | A cancellation form must be provided indicating only the excess employees. In the third section we put the form code “OTMN”. |

| Incorrect employee tax identification number | Although the absence of the TIN itself when filling out the form will not be an error, nevertheless, if it is indicated, enter it correctly. | Two forms are provided at the same time: a cancellation form - for an employee with an incorrect TIN and, along with it, a supplementary one, in which the correct information is indicated. |

| Incorrect SNILS of an employee | As with the TIN, the absence of a code is not an error, but incorrect information can result in a fine. | If the report is not accepted, it must be corrected and resubmitted as outgoing. If only correct information is accepted, corrections are provided to employees with errors in a supplementary form. |

| Incorrect reporting period | You must enter the correct month and year code. | It is necessary to re-submit the form with the status “outgoing”, correctly indicating the reporting period. |