4.3 average of 53 ratings Create, save and display acts for free on our website.

Financial assistance at work Such payments to employees have no connection with their position

Every year, thousands of Russian taxpayers fill out and submit VAT returns. Unfortunately, but not always

In the vastness of the legislation of the Russian Federation, the agency agreement was regulated less than two decades ago. However, his

How to correct reports already submitted to the fund without a fine or claims from inspectors

Home / Labor Law / Payment and Benefits / Wages Back Published: 12/31/2020

Is it possible to apply UTII and a patent at the same time? The Tax Code allows business entities to combine different

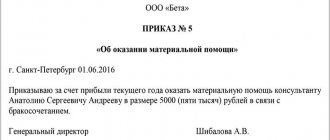

If circumstances arise due to which the employee cannot work, the employer, by law,

Home / Taxes / What is VAT and when does it increase to 20 percent?

Tax Code >> Chapter 26.2 Article 346.11 General provisions Article 346.12 Taxpayers Article 346.13