A power of attorney with the right to transfer is a document that contains the possibility of transferring rights

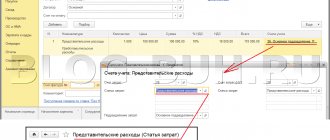

Why divide expenses into direct and indirect? When calculating income tax, direct and

Almost every organization has motor vehicles as part of its fixed assets, often more than one or two

SZV-M - report on insured persons (employees). Its form is approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 83p

How to process salary payments In order to calculate salaries, the accountant uses the T-51 statement, or

New ERSV form from 2021 The Federal Tax Service has approved a new form for calculating insurance premiums,

Why compare income based on profit and VAT? The answer is very simple - it does

As you know, construction and installation work for one’s own consumption is subject to VAT. It would seem to calculate the tax

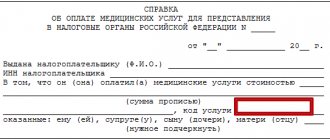

Tax return 3-NDFL is needed not only for paying tax on the income received by individuals,

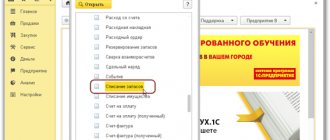

Every year, in March, the accounting department of any enterprise begins to fill out various reports and draw up a balance sheet.