SZV-M - report on insured persons (employees). Its form was approved by Resolution of the Pension Fund Board No. 83p dated February 1, 2016. Policyholders are required to submit the report. They are employers who use hired labor in their activities.

These include:

- Russian companies and their divisions;

- foreign companies and their divisions;

- individual entrepreneurs (IP);

- lawyers, notaries, detectives, and other persons engaged in private practice.

SZV-M includes information about employees with whom employment agreements of any kind have been concluded (employment contracts, civil contracts, and so on). Under these agreements, there might not have been any payments in the reporting period (month), but they continued to be valid. That is, the report indicates the data of all employees with whom employment agreements have been concluded and continue to be valid. If the company only has a general director on staff, his details are indicated in the SZV-M form.

Individual entrepreneurs, enterprises/organizations/firms, and persons engaged in private practice who do not use hired labor in their activities are exempt from reporting. That is, they do not have employment contracts or other agreements with employees.

The following information is indicated in the SZV-M form:

- details of the policyholder (registration number in the Pension Fund of Russia, name, checkpoint, tax identification number);

- reporting period (month and year);

- form type;

- information about the insured persons (TIN, SNILS, full names of employees).

The form type could be:

- Ref. — the initial one, which is submitted based on the results of the reporting period;

- Add. — supplementary, provided for the purpose of adding additional information to the submitted report;

- Rel. — canceling, with the help of which the policyholder can cancel previously provided information about the insured persons.

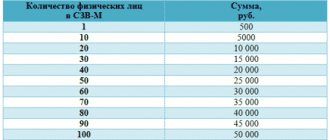

SZV-M is submitted monthly before the 15th day of the month following the reporting month. Penalties are provided for failure to comply with reporting deadlines and for providing false information. Their amount is 500.00 rubles for each insured person.

If the policyholder was unable to avoid administrative liability, he must pay a fine based on the received claim. What details should I include in the payment order? Let's look at it in detail in the article.

When paying a fine to the Pension Fund, the status of the payer

In connection with the transfer of control over the funds of insurance funds, except for contributions for injuries, to the Federal Tax Service from October 2, 2021, a specialist needs to pay attention to changes in payment codes for insurance premiums administered by the tax office. Step 12: Fill in the fields TIN, KPP, name, payment details, contribution amount. Step 13: Click “next”, “generate payment order”.

- 06 - this code is provided for participants in foreign economic activity - legal entities (except for the recipient of international mail).

- 03 - it is indicated in the payment order by the federal postal service organization when drawing up an order to transfer money for each payment by an individual (except for payment of customs duties);

How to fill out a payment order for fines (nuances)

- In detail 105, OKTMO is filled in - the code of the territory of the municipality where funds from paying fines are collected.

- Requisite 106 - value of the payment basis - 2 letters. In case of payment of a fine, the letters TR are used (which means a requirement when the tax office issued this document under Article 69, 101.3 of the Tax Code of the Russian Federation).

- Props 107 (tax period) has a value of 0.

- Detail 108 indicates the requirement number; the symbol No. does not need to be inserted.

- Indicator 109 contains the date of the document, the number of which is reflected in detail 108, in the format “DD.MM.YYYY”.

- Detail 110 has not been filled in since January 1, 2015 (this is due to the fact that clause 11 of Order No. 107n was canceled by Order of the Ministry of Finance No. 126n dated October 30, 2014).

- The “Code” detail indicates a unique accrual identifier (UIN); it must be contained in the tax demand that it made for payment of fines. If this code is not present, then 0 is entered.

- The “Purpose of payment” detail must contain the following information: type of payment and its basis.

- Details “Payment order” — 5.

- Props 101:

- when paying fines for yourself: 01 - for legal entities, 09 - for individual entrepreneurs;

- for payments made as a tax agent: 02.

Fines and penalties for taxes and fees

If a request for payment of a fine or penalty is received, it may contain a UIN (unique accrual identifier), which must be indicated in the “Code” field. If there is no requirement with UIN, then 0 is entered in this field.

OKTMO is indicated as usual, as when paying taxes. In field 106, the basis for the payment is selected: if there is a requirement from the tax authority, put TR, if there is no requirement, then put ZD. The number and date of the request are indicated in fields 108-109 of the payment order; if there is no request, zeros are entered in the fields. In field 107 “Tax period indicator” the payment deadline specified in the request is entered. If there is no requirement, then this field is also set to 0.

KBK, if it is not specified in the requirement, you need to look for it yourself. Keep in mind that the BCC is taken not from the period for which you pay the fine or penalty, but from the BCC of the year in which you pay it. Those. when paying fines and penalties in 2015, you must take the KBK from the list of codes for 2015.

The tax inspectorate can impose fines both under the Tax Code and under the Code of Administrative Offenses (CAO). The principle of filling out a payment order is the same, only the KBK is different.

KBC for penalties and fines in accordance with the Tax Code

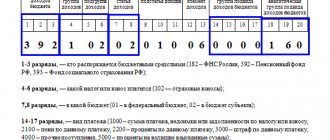

* Penalties (Article 75 of the Tax Code) for late payment and fines for non-payment of tax (Article 122 of the Tax Code) - BCC of a tax for which the payment deadline was violated, but in categories 14-17 of the BCC, instead of 1000, 2100 (penalties) or 3000 (fine) are indicated.

Example: KBK transport tax 182 1 06 04011 02 1000 110, penalties for this tax are paid to KBK 182 1 06 04011 02 2100 110, and the fine is paid to KBK 182 1 06 04011 02 3000 110

* Fines for failure to submit a tax return on time (Article 119 of the Tax Code) - BCC are indicated on the same principle as for penalties for late payment of tax. Those. The KBK of the tax for which the declaration is submitted is taken and 3000 is entered in the 14-17 category.

Where to pay a fine for failure to submit a certificate of registration in 2020

The Pension Fund recalled the details for payment of penalties by companies and entrepreneurs in Moscow and the Moscow region for failure to submit (late submission) of information in the SZV-M form. The BCC for both Moscow and Moscow region employers is the same - 392 1 1600 140. As for other details, employers registered in Moscow fill out the “penalty” payment as follows: INN 7703363868, KPP 770301001; Recipient of the Federal Financial Inspectorate for Moscow (for the State Pension Fund Branch for the city of Moscow)

What mandatory details must an entrepreneur fill out: If the TIN is not provided, this is not considered a fundamental error and is quite acceptable. But it is still advisable to fill out a separate column provided in SZV-M for TINs known for at least several employees.

Payment of a fine to the Pension Fund in 2021 for SSV m

Federal Law No. 27 on individual accounting in the compulsory pension insurance system determines the amount of penalties that threaten each employer who untimely or incompletely submits personalized information about his employees to the Pension Fund. The fine for failure to submit the SZV-M form on time is 500 rubles for each employee.

We recommend reading: Benefits for Large Families in 2021 Novokuznetsk

The PFR branch in Moscow and the region reminded policyholders of what details need to be indicated in the payment order for the payment of this fine. Payers registered in Moscow indicate the following recipient details:

- KBK 392 1 1600 140;

- TIN 7703363868, checkpoint 770301001;

- recipient of the Federal Financial Inspectorate for Moscow (for the GU-Branch of the Pension Fund for the city of Moscow)

How to Pay a PFR Fine for SZVM Payment Order 2021

It is impossible to give a resigning employee a copy of SZV-M. According to the law on personal accounting, when dismissing an employee, the employer is obliged to give him copies of personalized reports (in particular, SZV-M and SZV-STAZH). However, these reporting forms are list-based, i.e. contain information about all employees. This means transferring a copy of such a report to one employee means disclosing the personal data of other employees.

- For the payment of penalties and fines for late payments, the Pension Fund also provides separate codes for the period 2021 and 2021;

- Fixed payments (for individual entrepreneurs without employees) for the time before and after 01/01/2021. are listed under various BCCs.

Payment of a fine to the Pension Fund payment order sample 2021

From 2021, the fund has the right to fine the policyholder 1,000 rubles if the SZV-M is submitted on paper instead of an electronic report (Part 4, Article 17 of Federal Law No. 27-FZ of April 1, 1996). Home News 10.26.2020 For being late in submitting the SZV-M or including false information in it, a fine is imposed (Art.

Therefore, if technical problems arise with banks, it is recommended that employers-legal entities indicate status “01” in the payment document, and individual entrepreneurs paying contributions for employees are allowed to use status “09”, which is indicated when an individual entrepreneur transfers contributions for himself (letters from the Federal Tax Service of Russia dated 15.02 .2020 No. ZN-3-1/, dated 02/08/2020 No. ZN-4-1/, dated 02/03/2020 No. ZN-4-1/).

Fine for late submission of reports to the Pension Fund in 2021

- If a violation is detected, an employee of the territorial body of the Pension Fund draws up a report. The act must be signed by an authorized employee of the Pension Fund of Russia and the policyholder (representative of the policyholder). If the policyholder (the policyholder's representative) refuses to sign the act, a note about this is made in the act.

- The certificate must be delivered to the policyholder within 5 days in one of the following ways:

- personally against signature

- by registered mail (the date of receipt will be considered the 6th day from the date of dispatch)

- in electronic form via telecommunications channels (TCS).

Penalties for late submission of reports to the Pension Fund of the Russian Federation can be imposed under the legislation on personalized accounting and under Article 15.33.2 of the Code of Administrative Offenses of the Russian Federation. In the latter case, for violation of deadlines for submitting reports to the Pension Fund of Russia, an administrative fine is imposed on officials in the amount of 300 to 500 rubles. In this article we will talk about the fine for late submission of reports to the Pension Fund in 2021, and consider the calculation procedure.

Which branch should I pay the fine to?

The decision on punishment for violation of deadlines is made by the regional branch of the Pension Fund, to which the employer submits reports. Having received a decision, the question arises of how to pay the Pension Fund fine for SZV-M or for violating the delivery of other personal reporting documents. To do this, you need to create a payment order and send it to the bank for execution. If this is not done voluntarily, the Fund has the right to collect penalties in court and write off funds from the current account without acceptance.

To collect the payment, you need to find out the current account of the Pension Fund of the regional branch that collected the penalties. To do this, you need to go to the official website of the Pension Fund.

How to make a payment for a fine to the tax office

The fine is paid to the same branch of the Federal Tax Service as the tax itself. This means that the name of the recipient, his BIC, correspondent account and current account will remain “standard”. If the transfer is made for the first time, the details can be clarified at the tax office or on its official website.

Art. 114 of the Tax Code of the Russian Federation states that, based on the results of control measures carried out, the Federal Tax Service has the right to impose monetary sanctions on taxpayers who do not fulfill their obligations properly. If they are not transferred voluntarily, the fiscal authorities will direct the collection to the accounts of the company or citizen, and then to his property. To avoid disputes and problems, you need to know how to fill out a payment form for a fine to the tax office according to the current 2020 sample.

Payment of a fine to the Pension Fund sample payment form

Comment: Banks refused to process payment orders with status “14” and “08”, and it was decided to indicate status “01” for legal entities, starting from January 1, 2020. Info To find out these details, you can contact your tax office, use the “Address and payment details of your inspection” service on the Federal Tax Service website nalog.ru or use the Accountant Directory on our website. One of the important indicators

After all, the organization had enough time to prepare and submit the SZV-M on time (resolution of the Thirteenth Arbitration Court of Appeal dated April 19, 2020 No. A56-70942/2016). Other penalties for failure to submit the SZV-M in 2021. Penalty for failure to submit the SZV-M in electronic form. If a company submits information for 25 or more persons, then the report must be in electronic form (clause

We recommend reading: Find a financial manager in bankruptcy of individuals

Documentation of the offense

All of the above documents are drawn up in accordance with the forms approved by the Pension Fund of the Russian Federation in Resolution of the Pension Fund of the Russian Federation dated November 23, 2016 No. 1058p and which came into force on May 21, 2021.

So, this resolution, for example, approved: (click to expand)

- form of the act on the detected offense;

- form of decision to hold the insured liable;

- form of decision to refuse to hold the insured liable;

- Form for requesting payment of a fine for violating the deadlines for submitting reports to the Pension Fund.

How to issue a payment order to the Pension Fund of Russia

New filling standards are prescribed in the order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n (as amended on January 1, 2020). According to these rules, payments for insurance contributions to the Pension Fund must be drawn up in the same way as for taxes paid, only the purpose of the payment and the BCC changes. We will tell you further about how a payment order is executed in the Pension Fund of Russia in 2021.

The formal type of payment order is set forth in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. From 01/01/2020, on the basis of Article 34 of the Tax Code of the Russian Federation, payments that were previously accepted by the territorial bodies of the Pension Fund of the Russian Federation are now sent to local tax inspectorates. Budgetary organizations fill it out without fail.

The most common questions that we solve within 1 hour:

- When checking, an error occurs 30,40, 50

- Can't send report, report won't generate

- An unnecessary, fired employee was included in the report

- We will put employee handbooks and documents in order to correctly fill out electronic work books

- We will check and synchronize records in the documents Hiring, Personnel Transfer, Dismissal, etc.

- Let's connect to electronic work books

Get a consultation Order setting up SZV

Fine for SZV-M for late delivery in 2020

Both legal entities and individual entrepreneurs are required to provide a report form such as SZV-M if they have employment relationships with individuals, or if they make payments to individuals on other grounds. Reporting is submitted every month by the 15th day of the month following the reporting month. In case of violation of this deadline, the Pension Fund of the Russian Federation imposes quite significant amounts of fines.

All questions regarding personalized accounting, as well as the procedure and deadlines for submitting reports within the framework of such accounting, are regulated by Law 27-FZ “On individual (personalized) accounting in the OPS system.” According to Art. 17 of this act, a fine is provided for policyholders for late submission of the SZV-M report.

Payment order fine incomplete svm

In some regions, the fund issues fines to companies that updated their calculations after the deadline. If you find an error in one of the previous SZV-M reports, it is safer to check with your Pension Fund office to see if the amendment will be accepted without a fine.

Officials for this violation (directors and chief accountants) can also be fined under administrative article 15.33.2 of the Code of Administrative Offenses of the Russian Federation in the amount of 300 to 500 rubles. Let us remind you that from this year the deadline for submitting the SZV-M has changed. If in 2021 it was set on the 10th day of the month following the reporting month, then starting from January 1, 2021 it was increased by 5 days - until the 15th day (clause 2.2 of Article 11 of Law No. 27-FZ).

Sample payment slip for paying a fine to the Pension Fund in 2021

- Field 101 - code "01" - taxpayer status.

- 4 - date of formation of the PP in the format DD.MM.YY.

- Cell 6 - status “01”, in 7 and 8 - the amount in words and numbers, respectively.

- 16 - abbreviated name of the FC body, in brackets - the name of the Federal Tax Service.

- 61 - INN IFTS.

- 103 - checkpoint of the Federal Tax Service.

- In fields 13, 14, 15 and 17 - bank details of the Federal Tax Service.

- 104 - new KBK.

- 105 - seven-digit OKTMO.

- 106 - basis for payment.

An account can be opened in any bank in the world. Below we will consider several basic terms used in the article: Payer A person who wants to transfer funds to a recipient Recipient A person who receives funds from a payer Cashless payment A special type of payments that are made without human assistance, that is, in the form of magnetic reading, movement of electronic messages and so on PFR Pension Fund of the Russian Federation When making payments, the Bank must, on the instructions of the payer, transfer a certain amount of money to the account indicated by the payer in any bank. The deadline for transferring money is determined by law.

Payment order to the Pension Fund (form and sample)

In 2021, big changes came into force regarding payment orders; from now on, control over payment and submission of reports on contributions to the Pension Fund belongs to the tax service, which means sending documents and money is now also carried out to the Federal Tax Service (at the place of registration of the entrepreneur or at the location of the LLC and separate departments). Already from January 1, 2020. compulsory contributions (including those paid for periods ending before this day) must be transferred with the designation in the payment slip of the tax authorities. Calculations (including updated) for insurance payments for 2010-2016. sent to the Pension Fund and the Social Insurance Fund according to the requirements of the laws that were in force at that time. Read also the article: → “We issue a payment order in a new way.”

Let's use the previous example, only now imagine that in April 2021, Alfa JSC discovered an error in calculating the amounts of insurance premiums for 2021. After filling out the updated calculation, it became clear that the debt to the Pension Fund was equal to 6,554 rubles. In this case, the payment document will look like this: