Every year, in March, the accounting department of any enterprise begins to fill out various reports and draw up a balance sheet for the past reporting period. When drawing up a balance sheet, it is necessary to take into account all the nuances of business activity. In this article you will find instructions for line-by-line filling out the general and simplified balance sheet in 2021, you will be able to download these balance sheet forms and receive information on some nuances related to this topic.

Any business activity is invariably accompanied by the formation of various forms of financial statements. The accuracy and correctness of filling out these forms has a direct impact on the success of doing business. After all, errors in accounting lead to sanctions from regulatory authorities. In this article, you will learn the procedure for filling out the 2021 balance sheet, receive information about who must submit a general and who has a simplified balance sheet, what reporting forms are submitted in 2021, as well as the possibility of Form 1 of the 2021 balance sheet.

Financial statements

Almost every enterprise maintains accounting records of business activities: cash books are filled out, receipts and debit orders are issued, pay slips are prepared, and so on. The listed documentation refers to primary accounting tools, and financial statements are prepared on their basis, according to the data they contain.

What are financial statements (BA)? These are documents containing general information about the movement of the company’s finances, as well as about its economic, property and business condition at the current moment.

At each enterprise, the BO is formed taking into account the specifics of production or activity. For example, individual entrepreneurs do not keep accounting records at all and are exempt from this type of reporting. In general cases, when financial statements are mentioned, it usually means: the enterprise’s balance sheet and financial performance statement.

Also, the BO may include explanatory notes to these documents, other reports necessary for complete and reliable accounting, for example, a report on the flow of funds and the like.

For companies that are subject to mandatory auditing, the financial statements also include the auditors' opinion, without which the statements are considered invalid (since the head of the enterprise has the right to sign the balance sheet and financial statements only after the audit opinion has been issued).

Back to contents

Balance sheet

A balance sheet is a document that reflects data on all assets and liabilities of an enterprise.

The assets of an enterprise are all products, raw materials, equipment, tools, movable and immovable property that is in its ownership.

Liabilities are the capital and reserves of the organization, as well as liabilities, that is, those funds that were transferred or lent to the company from suppliers, creditor organizations, and so on. It is assumed that these funds entered the balance sheet of the enterprise for the purchase of elements necessary for production or operation and must be returned within the agreed time frame.

The assets and liabilities in the balance sheet must be equal. Large enterprises with extensive and varied activities can attach other reports to the balance sheet that fully disclose its positions; for small enterprises, only a balance sheet and a statement of financial results may be sufficient for reporting, since all comprehensive information about economic activities will be reflected there.

An example of filling out the BO is drawn up according to form No. 1. The form consists of two pages: on one, assets are indicated in a table, on the other, liabilities (including liabilities) are indicated in a table.

The tables must contain data on three parameters: the current reporting period, at the end of the previous reporting period and at the end of the reporting period preceding the previous one. In empty columns you must put dashes, round all amounts to a whole number (taking into account the selected unit of measurement: thousands or millions).

The balance sheet form is filled out in the following order:

- the header of the document is filled out: the date of drawing up the balance sheet, the name and details of the enterprise are indicated;

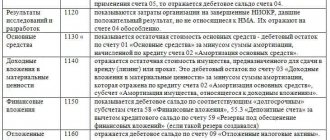

- the asset table is filled in: non-current assets are indicated (intangible, research and development results, exploration assets, profitable investments in tangible assets, fixed assets, profitable investments in tangible assets, financial investments, deferred tax assets), current assets (all inventories, VAT on acquired assets, accounts receivable, financial investments for a period of at least a year, cash and cash equivalents);

- a table of liabilities is filled out in three sections: capital and reserves, long-term liabilities and short-term liabilities;

- The data on assets and liabilities is reconciled: they must match.

If these amounts do not match, the balance will need to be reconciled and rechecked until the amounts agree.

Back to contents

Income statement

The financial results report is maintained in accordance with Form No. 2, approved by the Ministry of Finance of the Russian Federation. The form contains lines and columns that must be filled out in accordance with established requirements.

The procedure for filling out this BO in 2021 is as follows:

- the reporting period is indicated;

- fill out the header - information about the enterprise;

- the unit of measurement is indicated: thousands of rubles or millions;

- the table contains indicators of the enterprise’s income and expenses for all types of activities, taking into account data for the current reporting period and the previous one;

- the table also takes into account tax assets and liabilities; if necessary, a table for deciphering individual profits and losses is filled out;

- the date of preparation of the report is indicated;

- The report is signed by the chief accountant of the enterprise and the head of the enterprise.

Back to contents

Frequency of compilation

An enterprise's financial statements must be prepared at least once a year, since information for this period is submitted to the tax service. Intra-annual or interim reporting periods are also provided: month, quarter, six months, nine months.

Until 2012, all enterprises, along with annual financial statements, were required to submit interim reports to the tax service, but the latest edition of the Law “On Accounting” abolished this requirement. However, the preparation of interim reports within the enterprise is still provided for.

According to federal laws, some enterprises, for example those engaged in insurance activities, must still provide interim accounting reports.

Back to contents

Features of the simplified report

Enterprises under the simplified tax system draw up a simplified version of the balance sheet report. The form for it is approved by Appendix-5 of Order No. 66-MFR, you can download it from the link.

However, the indicators in the report are the same as in the lines of the general version. The difference is that the data that displays the greatest value is taken as a basis. The example below will help you understand the obvious simplicity of the balance sheet for enterprises with the simplified tax system.

An example of filling out a simplified annual balance sheet with explanation

Successful balancing of the accounting department means a decent end to the working year for the enterprise. But only after its acceptance by the control authorities. Therefore, you need to approach the matter responsibly, without stooping to the formula “it will do.”

If you find an error, please select a piece of text and press Ctrl+Enter.

Didn't find the answer to your question? Find out how to solve exactly your problem - fill out the form below or call right now: +7 (ext. 692) (Moscow) +7 (ext. 610) (St. Petersburg) +8 (ext. 926) (Russia) It's fast and free!

Accounting reporting and legislation

The maintenance and preparation of financial statements is regulated at the state level:

- government regulations and presidential decrees;

- orders and regulations of the Ministry of Finance of the Russian Federation; methodological recommendations, letters and manuals of the Ministry of Finance of the Russian Federation and other authorized bodies;

- norms of the Labor, Tax and Civil Codes of the Russian Federation;

- federal laws regulating the activities of individual industries and enterprises.

The main document regulating the maintenance of accounting documents is the Federal Law “On Accounting” No. 402-FZ dated December 6, 2011. At the level within the enterprise, accounting is regulated by local acts, which must reflect the established accounting policy. The accounting policy provides for the procedure and forms of accounting statements, as well as the reporting periods and dates on which it should be formed and provided to management. Accounting policies must be formed in accordance with the requirements of current legislation and cannot conflict with them.

Back to contents

conclusions

The balance sheet of an economic entity is formed based on the results of 2021 in strict accordance with the norms and rules provided for by law.

Compliance with these requirements is necessary when sending financial statements to official structures.

The balance sheet for 2021 is submitted to the tax/statistical authorities no later than the first day of April 2019. Filling out the reporting form in question is carried out according to the itemized breakdown recommended by the Ministry of Finance of the Russian Federation.

General mandatory requirements

In addition to accurately and correctly filling out all the necessary columns in the established forms of accounting documents, you must also take into account that the law also imposes other general requirements for this type of documentation. Namely:

- financial statements must reflect the entirety of the enterprise’s economic activities;

- accounting information must be timely - every fact of economic activity must be immediately reflected in documents;

- The BO must be careful - the creation of hidden reserves and premature recognition of income are not allowed;

- the information in the accounting statements should not be contradictory - the information in the accounting documents at all levels must be the same;

- It is necessary to adhere to the principle of priority of content over form. This means that the activities of an enterprise should be reflected primarily in terms of economic rather than legal content;

- BO must be rational - this means that the number and content of documents must be selected taking into account the specifics of the enterprise and its activities;

- Accounting statements must be consistent. Once adopted, the accounting policy must be maintained from year to year without sudden changes;

- continuity of financial and economic activities of the enterprise;

- financial statements must contain only reliable information; distortion of financial statements, intentional or unintentional, is not permitted. If an unintentional (mechanical or accidental) error is discovered, it is necessary to make appropriate corrections and record them with the date the error was discovered and the signature of the person who corrected it. Intentional distortion threatens the enterprise in general and the chief accountant (as well as the manager, since he is obliged to check the statements) with penalties.

Back to contents

General provisions

What you need to know first when starting to report on your business activities for the year:

- the balance sheet is filled out according to the general scheme, if the company is responsible for undergoing regular mandatory audits, and according to the simplified scheme - for the simplified tax system, as well as small forms of business;

- the simplified scheme is not applicable to small companies that are subject to audit, or are required to indicate additional data in their reporting for the financial assessment of the business;

- reports have specific forms, free samples are not allowed;

- obvious or numerous errors in information lead to penalties from control authorities.

There will be no mistakes if you carefully follow all the rules for filling out the balance sheet established for entrepreneurs this year.