Almost every organization has motor transport as part of its fixed assets, often more than one or two types. This means that it is necessary to periodically buy spare parts; in addition, they may appear as a result of disassembling a decommissioned car.

How to post these funds through accounting and reflect them on the balance sheet or off-balance sheet accounts? You can do this automatically through the 1-C program, you just need to remember the important nuances. Let's find out in the article.

What are the features of accounting for fuel, lubricants, tires and spare parts in road transport?

Features of replacing spare parts of fixed assets

The installation of new parts, assemblies, and spare parts on the fixed asset (OS) is carried out to replace failed worn out elements. When replacing spare parts, the OS characteristics remain unchanged, the cost does not increase. The purpose of repair work is to eliminate malfunctions and implement preventive measures to replace worn parts.

Repair work is carried out on our own (self-employed) or with the involvement of contractors (service centers). Regardless of the method of carrying out repairs, the enterprise must develop a document flow.

For each fixed asset, the procedure and frequency of conducting are approved: (click to expand)

- Preventive measures.

- Routine maintenance.

- Medium repair (for vehicles).

- Major renovation.

Control over the condition of the operating system and repairs is carried out by a commission permanently operating at the enterprise. Enterprises that have not approved the list of spare parts to be replaced carry out repairs based on the defective list. The document is used to write off parts and approve a repair plan.

Purchase and sale of spare parts

After purchasing spare parts, inventory items are received and placed in a warehouse for storage. Receipts are accounted for on the basis of primary documents.

| Documentation | Application procedure |

| Agreement | The form of delivery, purchase and sale is used |

| Waybill | Confirms the shipment of goods and materials |

| Invoice TORG-12 | Used to obtain information about inventory items - nomenclature, quantity, parameters and confirmation of transfer |

| Advance report | Used to document purchases made by an accountable person |

| Payment documents - orders, BSO, receipts, checks, PKO | Confirm the fact of payment for the supply, which is a prerequisite for accounting for costs in enterprises with the cash method of accounting for income and expenses |

The sale of spare parts is carried out as part of normal business or as part of the sale of surplus stock. When selling goods and materials:

- Documents similar to the purchase process are used.

- Enterprises using OSNO or simplified tax system take the cost of acquisition into account as expenses. Sales are made to wholesale or retail customers.

- When organizations sell spare parts on UTII, sales are made only to retail customers.

The sale of spare parts is carried out by enterprises that have declared trade in non-food products as part of their activities.

Where can a legal entity get spare parts?

Since the maintenance of motor vehicles is a constant cost item, organizations enter into contracts for the supply of spare parts with one or more suppliers. Commercial organizations use conventional supply contracts. If we are talking about transport of budgetary organizations, then the regulations for the supply of spare parts are written out in the following legislative acts:

- Federal Law No. 44 - for government institutions;

- Federal Law No. 223 - for autonomous organizations;

- Through subsidies or income from related activities (in accordance with the provisions of the above-mentioned Federal Laws) - for the public sector.

Question: An organization whose main activity is wholesale and retail trade in spare parts for cars, as a result of an inventory, identified illiquid goods. How to reflect its write-off and disposal costs in accounting and tax accounting? Based on the inventory results, illiquid spare parts with a book value of RUB 150,000 were identified. The organization’s commission drew up an act in which the above goods were recognized as illiquid due to long-term storage and loss of marketability. The costs of disposal (removal to landfill) provided by a third party amounted to RUB 12,000. (including VAT 2,000 rubles). View answer

Depending on the volume of future orders, they can be made with a single supplier or with a group, which must be chosen freely or competitively (through a competition, auction, comparison of commercial offers, etc.).

IMPORTANT! You can buy spare parts for a company from one supplier for an amount of no more than 100 thousand rubles, if the quantity purchased is relatively small - less than 2 million rubles are spent on them during the year. or 5% of all purchases.

Accounting for receipt of spare parts for storage: postings

Analytical accounting of spare parts is carried out within the nomenclature (homogeneous groups) at the cost of acquisition. The basis for obtaining credentials is the invoice.

Example of spare parts receipt

Planer LLC has a car on its balance sheet that is used for business purposes. To carry out a medium repair, the purchase of a gearbox is required in the amount of 25,700 rubles, including VAT of 3,920.34 rubles. The following entries are made in the company's accounting:

- The supply of spare parts is reflected: Dt 10/5 Kt 60 in the amount of 21,779.66 rubles;

- The VAT presented by the supplier is taken into account: Dt 19 Kt 60 in the amount of 3,920.34 rubles;

- Payment to the supplier is taken into account: Dt 60 Kt 51 in the amount of 25,700 rubles.

Warehouse accounting is carried out using materials accounting cards No. M-17 in manual or electronic form. A special need for maintaining cards arises when an organization uses an exchange fund of spare parts that are repaired and subsequently installed on the operating system.

Enterprises independently determine the list of accounting documents for inventory items. A number of organizations with small warehouse receipts and issues keep a log of the movement of spare parts. If there is automated accounting, the journal is not used.

Spare parts accounting registers for OS repairs

In accounting, the movement of spare parts is reflected in account 10. Sub-accounts are opened to the account to account for new parts (5), failed spare parts (6), materials transferred to the contractor for repairs (7).

In budget accounting, account 09 is used to obtain information about spare parts issued to replace worn-out ones. The organization must approve the list of parts accounted for in the account. The service life of spare parts is less than the service life of the property, which requires accounting for replaced parts that do not change the original cost. When transferring a spare part for repairs on your own or with the help of contractors, the cost is debited from the account and taken into account on the balance sheet.

WE EQUIP THE BOX

So, we decided that there should be a warehouse and a spare parts department. And the need for these units is not discussed. Looking ahead a little, let's assume that the appropriate areas are prepared and there is staff. Where to begin?

Of course, from system support. Because without it it is impossible to take almost a single step. To create and maintain a database - and without it today normal work with a large range of spare parts is completely unthinkable - it is necessary to equip the warehouse and the corresponding department with computer equipment. You won’t keep records using the old-fashioned method - through a paper file cabinet?

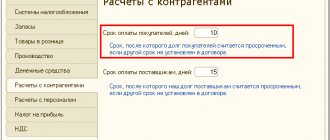

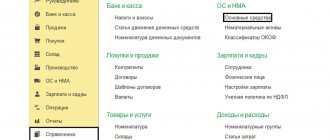

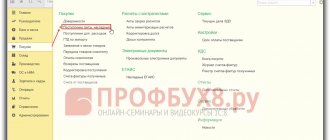

General databases are quite large, and in order to competently, clearly and quickly process all kinds of queries on this database, both computer hardware and software for it must meet the modern level. Moreover, simply purchasing it is not enough; a local network is a necessary component of the system. As for software, today the most common product suitable for our purposes is 1C or 1C Rarus software. Recently, new developments from other companies have appeared, but they have not yet been tested in practice, so we believe that it is premature to talk about them in more or less detail.

The main disadvantage of this software product is its own high cost and the cost of technical support. If the technical center does not have its own system administrator who can correct and debug the program in a timely manner, then due to each failure you will have to contact the developer company. And this is wasted time and, accordingly, money.

Some companies are developing their own products. This seems to be convenient, as it provides a certain independence from “outsiders.” However, the flip side of this coin is the need to maintain your own staff of programmers, which means additional costs. It is very important that the selected software product has the ability to be upgraded, otherwise in a couple of years it will simply become outdated, and off to new expenses.

In addition to the above, the spare parts department must be provided with the necessary documentation and spare parts catalogs. This is one of the main problems, but if the company is an official dealer of a car plant, then the plant is obliged to provide documentation either under the contract or for money, it all depends on how the contract is drawn up. But small companies have it worse - they themselves have to search, purchase, and obtain documentation by any means. However, the money spent on this will subsequently bring only profit.

Modern non-traditional technologies - the Internet, for example, can be a good addition to internal system support. One of the options for expanding the scope of services for clients is to provide them with the necessary information through the World Wide Web. Many people are now trying not to sit on the phone, calling companies to see if they have the parts they are interested in and the services they provide, but are trying to get as much information about the company as possible from its website. A company’s website is its business card on the Internet, and the more solid and rich it is, the more likely it is that the client will definitely contact this company.

The main thing in this matter is technical support and constant updating of the site. Because outdated and inaccurate information can play the opposite role - the role of anti-advertising.

And finally, the last thing in terms of system support. Both in the process of initial filling and in the course of further work to maintain the necessary stock of the warehouse, everyone, as a rule, is faced with another problem, which can be called fundamental. This is the determination of the exact part identification number for the order. Without accurate information about the part, an order is impossible, delivery of the required part to the technical center, as well as retail sales is impossible. Why does a customer need a part that doesn’t fit his car?

This situation can be resolved. It is enough to stock up on modern catalogs of spare parts, which need to be periodically updated as new models are released by a particular manufacturer. Typically, updates occur at least once every six months, and maybe once a quarter, it depends on the volume of car production by the manufacturer and the speed of updating the model range.

Catalogs are located on different media. These are electronic EPC catalogs on CDs, microfiche - a more outdated version, and, of course, good old, time-tested printed catalogs. Having more detailed information on all the machines of the manufacturer that a particular dealer works with will allow him to avoid mistakes when ordering parts, and, accordingly, financial losses, because often an incorrectly ordered part costs much more than all the catalogs combined. For example, an air conditioning compressor for a new Japanese car can cost from 800 to 1500 dollars, and the cost of an updated catalog may not exceed 30-100 USD. Think for yourself, decide for yourself whether to have it or not.

Accounting for write-off of spare parts for repairs

Write-off of parts is carried out on the basis of form M-11 or a record of the consumption of materials in card No. M-17. Before writing off spare parts, the commission draws up a free-form defective statement.

Using the statement, the following are determined: (click to expand)

- Identification and state of the object.

- Measures necessary to maintain the operating condition of the OS object, including a list of parts to be replaced.

- The amount required to replace parts.

- The reasons that caused the need for repairs.

The document is signed by the commission members and the director. The presence of a statement allows you to confirm the economic feasibility of the repair and separate the purpose of the work from modernization or restoration.

The importance of separating modernization from repair is determined by the taxation procedure. Costs associated with OS repairs are included in current expenses. To carry out planned repairs, a reserve is created at the enterprise. The cost of the reserve is determined separately for low-value and high-value types of repairs. The enterprise must establish an amount above which repairs are defined as costly.

Write-off of inventories (defects, losses)

Please note that the document “ Write-off of inventories”

"(in case of shortage) can be created on the basis of the document "

Inventory of inventories

", this has already been described earlier.

The current section will describe the normal creation of an Inventory Write-off

.

Create a document “ Write-off of inventories”

» Via the “All functions...” menu.

In the open list window, click on the “Create” button.

Fill in the necessary details in the document header and the “Inventory” tabular section.

Record, conduct.

Carrying out repairs with installation of spare parts on vehicles

Replacement of vehicle parts is carried out under warranty or upon expiration of its validity. According to para. 9 tbsp. 346.27 of the Tax Code of the Russian Federation, replacement of parts under warranty does not apply to repair work. Warranty services are paid by the manufacturer and cannot be included in expenses even if there are additional costs.

After the warranty expires, the vehicle is repaired in-house or at a service center. The document flow in both cases is different.

| Operation | Economic method | Third-party organizations |

| Appointment of a commission to oversee repairs | Required | Required |

| Drawing up a defect sheet | Required | Required |

| Purchasing spare parts | The purchase is carried out in-house | Spare parts are purchased by a service center or enterprise |

| Installation certificate | Issued by the enterprise | A two-sided acceptance certificate is drawn up |

| Repair costs | Cost of spare parts, wages for repairmen, taxes on wages | Cost of spare parts and services |

An example of vehicle repair operations

Mimosa LLC, a commercial company, has a Gazelle vehicle on its balance sheet. There is no repair team at the enterprise; replacement of spare parts is carried out by a contractor - a service center. The organization's commission determined the need to replace the battery. The spare part was purchased at retail for the amount of 8,554 rubles; the cost of the work was 3,000 rubles. The following entries are made in the organization's accounting:

- The spare part purchased by the accountable person was capitalized: Dt 10/5 Kt 71 in the amount of 8,554 rubles;

- The transfer of spare parts to the contractor is reflected: Dt 10/7 Kt 10/5 in the amount of 8,554 rubles;

- The spare part was written off on the basis of the work completion certificate: Dt 44 Kt 10/7 in the amount of 8,554 rubles;

- The accounting for the contractor's services is reflected: Dt 44 Kt 60 in the amount of 3,000 rubles.

When carrying out repair work on your own, it is necessary to draw up an act for writing off spare parts. The form of the act is developed by the enterprise independently and approved by internal regulations. The document must be signed by the storekeeper, a representative of the repair team, a commission with approval by the manager.

Accounting for spare parts obtained as a result of dismantling

Receipt of spare parts can be made as a result of dismantling the OS. Parts suitable for further use arise when a fixed asset is written off as a result of its becoming inoperative or as a result of replacement with new ones. Parts replaced as part of current or other types of repairs are not written off and must be returned to the warehouse.

Further movement of the spare part requires an assessment by the commission. Materials suitable for further use are subject to repair and storage in a warehouse. Registration is carried out at the market value approved by the commission. Completely failed spare parts are activated and subsequently sold as scrap or disposed of. The form of the act is arbitrary and is drawn up by a commission.

Write-off of inventories (into production)

Create a document “ Write-off of inventories”

» Via the “All functions...” menu.

In the open list window, click on the “Create” button.

Fill in the necessary details in the document header and the “Inventory” tabular section.

Record, conduct.

Accounting for spare parts costing over 40,000 rubles

A number of types of equipment have expensive spare parts. Purchasing parts for further replacement of failed ones after they are received into the warehouse. In accounting, there is a limit for property within 40,000 rubles, above which a durable asset is classified as fixed assets.

At the same time, the assignment of a spare part to a fixed asset cannot be made due to the absence of the main condition - independent operation. The spare part is an integral part of the fixed asset and is not used separately to conduct business. When an expensive spare part arrives at the warehouse, accounting is identical to the registration of standard inventory transactions.

Capitalization of inventories (from production)

Create a document “ Capitalization of Inventory”

» Via the “All functions...” menu.

In the open list window, click on the “Create” button.

Fill in the necessary details in the document header and the “Inventory” tabular section.

Record, conduct. There is no printed form, therefore, documents are not processed.

Incorrect actions to record transactions with spare parts

Common mistakes in spare parts accounting

| Operation | Wrong position | Correct position |

| The cost of the fixed asset after replacing the spare part | Increases | The cost of the OS does not increase while the functions remain unchanged |

| Drawing up an installation certificate | Not compiled | Drawing up an act is mandatory to confirm expenses |

| Returning the replaced spare part to the warehouse | Not produced | A part replaced during repair must be returned to the warehouse |

The order of movement of materials follows the same principles, regardless of the size of the enterprise or the number of objects.