What is gratuitous receipt? The considered method of acquiring a fixed asset relieves the recipient from paying the cost

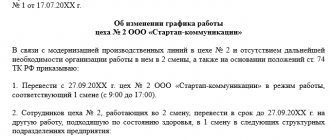

When hired, each employee must be familiarized with the collective agreement and established rules

Regardless of whether you register as an individual entrepreneur or open an LLC,

Tax authorities, within their competence, are authorized to carry out tax control activities such as inspection.

In the context of globalization and open borders, foreign business trips of employees of Russian government agencies and commercial

Application for Unified Agricultural Tax when creating a peasant farm In order to tax peasant farms according to Unified Agricultural Tax,

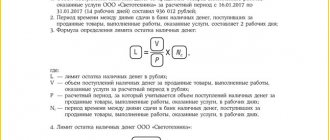

Most commercial enterprises constantly work with cash and undertake to transfer the profits received on time

As a general rule, processed primary documents that relate to a specific accounting register (for example, cash,

What is considered a sale Goods are considered sold if the ownership of them has transferred from the seller

Let's consider the features of reflecting an advance invoice from a supplier in 1C and accepting VAT for deduction