Deadlines for transferring personal income tax In response to the request of the tax agent, the drafters of the Letter indicated that according to the line

Tax status of the employee A tax resident for tax purposes is a person located in Russia

How the financial result is reflected - postings The loss in accounting (hereinafter referred to as accounting) is determined by

Does the LLC providing training pay VAT? And the organization can also apply a VAT exemption

Labor legislation guarantees full and timely payment of wages to employed citizens. In this case, payment

Home / Taxes / What is VAT and when does it increase to 20 percent?

What business trip expenses are subject to reimbursement under the provisions of Art. 265 of the Tax Code of the Russian Federation, expenses incurred by an employee

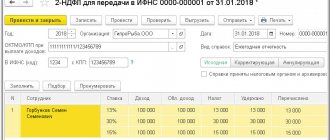

Quarterly report Form 6-NDFL is a quarterly report on personal income tax

Source number 1 - MDS 81.35-2004 When determining the cost of equipment, furniture and inventory in

Home — Articles When your organization opens a separate division (hereinafter referred to as SB) in another