Home / Taxes / What is VAT and when does it increase to 20 percent? / VAT object

Back

Published: December 28, 2017

Reading time: 4 min

0

181

The imposition of value added tax on the provision of transport services is regulated by the Tax Code of the Russian Federation. The taxation procedure depends on the type of services provided, their geography and the specific conditions prescribed by law that determine the specific rate for different types of activities.

- VAT rate 0%

- VAT rate 10%

- VAT rate 18%

- Exemption from VAT

List of works with a rate of 0%

Transport services

VAT

at a rate of 0% on the grounds listed in clause 1 of Art. 164 Tax Code of the Russian Federation:

- location of loading/unloading points outside the territory of Russia (this condition applies to all types of transport: sea, river, air, rail and road);

- transportation of natural resources (oil, gas) in Russia and abroad;

- transport services for goods in transit;

- cargo and passenger transportation with points of departure and destination outside the country;

- turnover from commuter trains (until December 2016);

- air transportation from the territory of Crimea and Sevastopol until December 31, 2015.

For services provided outside the territory of Russia, legislation establishes requirements for the submission of documents (copies) confirming the right to a zero rate:

- contracts certifying the terms of the transaction;

- a certified list or the shipping documents themselves;

- customs documents or their signed list.

The specified package must be submitted to the tax authorities no later than 180 days from the date of passage of transport documents through customs, this is stated in paragraph 9 of Art. 165 Tax Code of the Russian Federation. If there is no confirmation of the right to a zero rate, the taxpayer will have to pay VAT at the usual rate of 18%.

Accountant's Directory

CIMA.ru Forum > Financial management and accounting > Tax planning > how to become a VAT payer for cargo transportation

View full version: how to become a VAT payer for cargo transportation

Hello! Question for thought. The company is engaged in cargo transportation and pays UTII from this type of activity because...

100% fits under this taxation system, namely, the company has 4 employees and has 3 vehicles (all trucks), as we all remember, the form of payment and the status of the customer does not matter.

An interesting customer has appeared on the horizon, one who works with VAT and without VAT

refuses to work.

Legal issues

Who thinks that as an enterprise it is possible to work with VAT during cargo transportation of this kind.

Sincerely. Novel.

Alexander Markianov

02.03.2007, 13:23

> Question for thought. The company is engaged in cargo transportation and > pays UTII from this type of activity because

100% fits > this taxation system, namely, the company employs > 4 employees and has 3 vehicles (all trucks), as we all remember > the form of payment and the status of the customer does not matter.

An interesting customer has appeared on the horizon > who works with VAT, and refuses to work without VAT >. Who thinks that as an enterprise it is possible to > work with VAT for cargo transportation of this kind. There are two options: 1.

Create a VAT-inclusive intermediary company - a bridge between you and the client 2. Explain to the client that if you have input VAT, your prices will increase by the amount of VAT plus the costs of maintaining additional accounting. Therefore, there is no point in insisting on input VAT

- only the client will lose.

Galia Barzanina

02.03.2007, 14:35

>> Question for thought. The company is engaged in cargo transportation and >> pays UTII from this type of activity because it is 100% compliant with >> this taxation system, namely, the company has >> 4 employees and has 3 cars (all trucks), like all of us >> We remember the form of payment and the status of the customer does not matter.

An interesting customer has appeared on the >> horizon who works with VAT, >> and refuses to work without VAT. Who thinks that as an enterprise >> it is possible to work with VAT for cargo transportation of this kind. > > There are two options: > 1. Create a VAT intermediary company - a layer between you and the client > 2.

Explain to the client that if you have input VAT, your > prices will increase by the amount of VAT plus the costs of maintaining > additional accounting. Therefore, there is no point in insisting on input VAT > only the client will lose. I believe that the option of creating a gasket company is slippery, because... Either this is a one-day company, or it has a large amount of VAT to pay.

Offering the client an increase in tariffs for maintaining additional accounting records is also not correct, because the tariff will be inflated and the client will go to another company. I propose to conclude an agreement for the rental of vehicles (together with the driver) - this is an activity subject to VAT, so you will issue invoices with VAT.

But in this work scheme, you will need to calculate how much VAT you have to reimburse (for services that you yourself receive) and how much VAT you will pay. In addition, when working with transactions subject to and not subject to VAT, all “incoming” VAT must be

divide in the same proportions.

02.03.2007, 14:51

I don't think so! Offer a discount from the list price of 18% - and it's a deal.

Andrey Savinov

02.03.2007, 16:14

Option to buy/rent 18 more cars and you are out of UTII. Another option is not to provide transport services but to rent out

car with crew for rent (Article 632 of the Civil Code of the Russian Federation).

Alexander Markianov

02.03.2007, 19:14

Dear Galia! You wrote: >> There are two options: >> 1. Create a VAT-compliant intermediary company - a bridge between you and >> the client >> 2. Explain to the client that if you have input VAT, then your >> prices will increase by the amount of VAT plus the costs of maintaining >> additional accounting. Therefore, there is no point in insisting on input >> VAT - only the client will lose.

> > I believe that the option of creating a gasket company is slippery, because > either this is a one-day company, or it has a large amount of VAT to pay. > Offering the client an increase in tariffs for maintaining additional accounting records is also > not correct, because the tariff will be inflated and the client will move to another > company.

> I propose to conclude an agreement for the rental of vehicles (together with > the driver) - this is an activity subject to VAT, so you will > issue invoices with VAT. But in this scheme of work you > will need to calculate how much VAT you have to reimburse > (for services that you yourself receive) and how much VAT you will > pay.

In addition, when working with operations subject to and > not subject to VAT, all “incoming” VAT must be divided in the same > proportions. In the version you propose, the VAT will be no less, the whole difference is that you do not need to create a separate company.

Offering the client an increase in tariffs is just right as a tactical move, allowing you to prove to the client that input VAT will be included in the price in any case and therefore insist on availability

input VAT is pointless - the work will not become more profitable for the client.

Galia Barzanina

03.03.2007, 16:14

>> I believe that the option of creating a gasket company is slippery, because >> either this is a one-day company, or it has a large amount of VAT to pay. >> Offering the client an increase in tariffs for maintaining additional accounting records is also >> not correct, because the tariff will be inflated and the client will go to another >> company.

>> I propose to conclude an agreement for the rental of vehicles (together >> with the driver) - this is an activity subject to VAT, so you will >> issue invoices with VAT. But in this scheme of work you >> will need to calculate how much VAT you have to reimburse >> (for services that you yourself receive) and how much VAT you will pay >> it will turn out.

In addition, when working with operations subject to and >> not subject to VAT, all “incoming” VAT must be divided in the same >> proportions. > > In the version you propose, the VAT will be no less, the whole > difference is that there is no need to create a separate company.

> Offering the client an increase in tariffs is just right as a tactical move to prove to the client that input VAT will be included in the price anyway and therefore insisting on the presence of input VAT is pointless - the work will not become more profitable for the client. Of course, I agree with you that VAT is the same, but have you ever had to prove the main account.

someone else's organization its position? In my experience, this is very difficult, and it’s easier to complete something at home, satisfy the client’s wishes and happily receive income from a new client for a long time. Moreover, you can “close” your profit; a fully functioning organization always has input VAT, so VAT is added to

the payment will always be less.

VAT when transporting goods. transportation VAT

Specialists responsible for organizing transportation in export and import directions often face a lack of knowledge related to the field of accounting. Are freight forwarding services (for simplicity let's call them transport services) subject to value added tax (VAT)? What VAT rate applies to transport services?

Transport services are always subject to VAT. Different rates may be applied to them - 0% or 18%, depending on whether the goods cross the border of the Russian Federation.

What is the procedure for assessing VAT on transport services?

In other words, transportation is carried out within Russia, or in export or import directions.

In case of transportation within the territory of the Russian Federation, VAT of 18% is applied to the entire cost of transportation.

Therefore, if your company is on the traditional tax system, pay attention to the choice of counterparty - the services of an individual, individual entrepreneur or organization working under the “simplified tax system” will be more expensive by exactly the amount of VAT that you will not be able to present for payment. In the case of an individual, you will be the tax agent for the payment of income tax.

Another thing is transportation in export and import directions. Various tax regimes apply to them, and by understanding them you can significantly reduce the tax burden on your business.

Import transportation is entirely subject to VAT at a rate of 0%, but you can ask the forwarder to split the invoice into two parts: before and after the Russian border.

This will allow you to save on the customs value of the goods, which includes the cost of transportation to the place of customs clearance, and reduce the amount of VAT paid upon import.

Special conditions apply when importing goods from countries of the Customs Union. You can read more about them in the “Transportation from Belarus” section.

Transport services for export are similarly subject to VAT at a rate of 0%.

See also:

When transporting cargo from the territory of the Customs Union, it is not always possible to apply zero VAT

Due to the crisis, companies are cooperating with the countries of the Customs Union: how not to get confused in taxes

Rosalina Lakhman expert of the Russian Tax Courier magazine

In the invoice for a Belarusian buyer, you can indicate the branch checkpoint

Delivery from Kazakhstan to the EU: it will not be possible to pay VAT at a rate of 0%

Export to Belarus is safer to confirm the CMR invoice

Due to the unstable situation in the international market and sanctions of European states, many Russian companies are actively cooperating with the states of the Republic of Belarus and the Republic of Kazakhstan (read more below).

Source: https://1atc.ru/nds-na-transportnye-uslugi/

When do you need to pay 10% of the cost of transport work?

For Russian air carriers in the period from 04/07/2015 to 12/31/2017, a preferential VAT regime of 10% was established. It was introduced by paragraphs. 1 and 6 tbsp. 3 Federal Law “On Amendments to Ch. 21 Tax Code of the Russian Federation" dated 04/06/2015 No. 83-FZ.

For air traffic with Sevastopol and the territory of Crimea, in terms of VAT, transport services

had an even stronger relaxation - a 0% rate. However, it was in force from 03/18/2014 to 12/31/2015. Starting this year, this region is subject to a 10% tax rate.

Working as an individual entrepreneur with VAT: pros and cons

An entrepreneur has the right to independently establish the optimal taxation regime for his activities. Often individual entrepreneurs use special regimes, for example, simplified taxation system, PSN and UTII, which allow them not to pay value added taxes. However, in some cases, a fee has to be paid, or the individual entrepreneur must work for OSNO, if the use of special regimes is prohibited.

The rate for this payment may vary depending on what transactions are carried out. If an entrepreneur works for OSNO, he must keep a book of purchases and sales. Payments are settled every quarter. A person must file their taxes on time.

There are some pros and cons of working with VAT. Main advantages for individual entrepreneurs:

- Possibility of cooperation with large contractors.

- Possibility of tax deduction.

The main disadvantage of working with this fee on OSNO is the complex calculation. But if you work without this payment, the businessman becomes less competitive, and there is a risk that potential partners will refuse to work together. Entrepreneurs on OSNO are often more thoroughly checked by tax authorities.

Cases of application of the standard rate of 18%

With the exception of the above situations, paragraph 3 of Art. 164 of the Tax Code of the Russian Federation obliges all taxpayers, when using the main tax collection system, to impose VAT on transport services

at the rate of 18%.

With regard to transportation for foreign companies that do not have branches in Russia, but transport goods from points of departure and destination on its territory, domestic carriers are required to pay tax at the usual rate of 18% (subclause 4.1, clause 1, article 148 of the Tax Code of the Russian Federation). Foreign carriers providing services to domestic companies within the country pay tax under the same conditions.

IMPORTANT! In such situations, an enterprise using the services of foreign companies acts as a tax agent. The basis for this is that the place where the service is provided will be determined by the customer, and accordingly, taxes must be transferred to the budget of the Russian Federation.

Transportation can be carried out either as part of a regular sales contract or as the subject of a separate transaction for an intermediary company. The subtlety is that it is impossible to deduct VAT from such transactions if it is paid in full by the buyer of the product. As a substantiation of this point of view, one can cite the letter of the Ministry of Finance of Russia dated 02/06/2013 No. 03-07-11/2568. The intermediary uses only the amount of his remuneration as a tax base (letter of the Ministry of Finance of Russia dated December 29, 2012 No. 03-07-15/161).

When carrying out intermediary operations in the field of freight and passenger transport, the seller is also a service provider, and therefore he must issue a separate invoice not only for his own product sold, but also for the transport work performed. Moreover, in line 2 of the specified document, he must write down as the service provider the transport company that actually provides it, and not the name of his company. This is clearly stated in the rules for filling out invoices.

Even if, when fulfilling an intermediary contract, an enterprise acting on a simplified taxation system acts as an agent, it is still responsible for calculating and transferring VAT to the budget.

Purpose and contents of the account

An invoice is the basis for payment for products or services provided by an entrepreneur or legal entity. The form contains details for transferring money to the seller. The payment document can be issued to a partner with whom a contractual relationship has been concluded or without one.

Sample payment form

The document must contain the following materials:

- information about the seller (name of individual entrepreneur, address, individual tax number, checkpoint);

- information about the buyer (name of individual entrepreneur, organization, address information, tax number, checkpoint);

- shipped products and services, their quantitative characteristics, price;

- amount to be paid;

- bank account details of the supplier for transferring money;

- date of creation of the form.

Which transport services are exempt from VAT?

As it says sub. 5 clause 1.1 art. 148 of the Tax Code of the Russian Federation, if the point of departure and the point of acceptance of cargo is located outside the territory of Russia, transportation operations are not subject to taxation and are not included in the VAT calculation base. In Art. 149 of the Tax Code of the Russian Federation, a similar benefit applies to the transportation of passengers by public transport.

The VAT benefit fully applies to carriers under simplified tax regimes. So, in Art. 346.11 of the Tax Code of the Russian Federation clearly states that there is no obligation for payers of the simplified tax system to calculate and pay VAT. In such a situation, transport services of entrepreneurs and companies are not subject to taxation.

Subject to compliance with the requirements of sub. 5 p. 2 art. 346.26 of the Tax Code of the Russian Federation, namely, if they own no more than 20 units of equipment, carriers are allowed to calculate and pay a single tax on imputed income. By selling UTII, the company is also exempt from obligations to pay VAT.

Tax system for cargo transportation for individual entrepreneurs and LLCs, how to work with VAT

To optimize VAT, different taxation systems are provided that reduce the fiscal burden - simplified tax system, PSN and UTII. The concept of freight transportation implies the delivery and transfer by the carrier of cargo to the specified address under contracts. To run a freight transportation business as an individual entrepreneur or LLC, all you need to do is register and select a mode.

To determine the tax system, you need to take into account the scale of the business, the number of vehicles used, and the amount of revenue. One of the popular taxation systems is the simplified tax system. It provides for payment of income tax at 6% or income minus expenses at a rate of 15%.

The UTII system is used if the number of vehicles is no more than 20. If there are several OKVEDs, separate accounting will be required. There should be no more than 100 hired personnel.

The PSN system is used exclusively by individual entrepreneurs. Before working as an individual entrepreneur with VAT or an organization, you need to carefully analyze the advantages and disadvantages of different systems in order to choose the appropriate option.

It is necessary to take into account such parameters as restrictions on the number of vehicles (they are not on the simplified tax system and PSN), the period of validity (the simplified tax system is without restrictions). It is necessary to take into account the presence of restrictions on the region of operation, number of people, and annual revenue.

***

The list of works performed by transport companies is quite wide. The tax rate and the availability of the object of taxation largely depend on where the consumer of the service is located (outside or on the territory of the Russian Federation).

When providing transport services, it is possible to use tax rates of 0, 10 and 18%. The use of a rate other than 18%, or a complete exemption from the calculation and payment of tax, must be documented by the enterprise.

Similar articles

- Features of taxation of consulting services VAT

- UTII: cargo transportation and transport services in 2021

- In what cases are educational services not subject to VAT?

- VAT rates on food products - list of products

- Provision of transport services OKVED

Bill payment deadlines

How long does it take to pay for goods? The period during which the money must be received by the seller is fixed in the contract or indicated in the official document for payment. The transaction is not canceled or adjusted by the service provider until the end of the repayment period.

Additional Information! Payments can be made in cashless form. When transferring money, it may turn out that an error was made when filling out the form. The parties extend the contractual relationship. The seller is notified by the other party to the transaction that the payment document is incorrect.

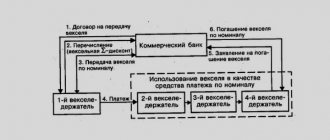

Intermediary activities of the forwarder

When a freight forwarder engages third parties to perform work, such work is of an intermediary nature. Therefore, the work of the forwarder in such cases is regulated by the rules on commission and agency relations. Freight forwarders have the right to issue clients the necessary documents, including invoices with an allocated VAT amount.

In order to confirm the intermediary nature of forwarding activities, the following conditions must be met:

- Drawing up an agreement that indicates on whose behalf subsequent contracts for the transportation of goods are concluded - on behalf of the client himself or the forwarder. Separately, it is worth specifying the expected amount of remuneration for the services offered. Independently taking on additional functions without notifying the client may not be considered an intermediary activity.

- In addition to the contract, it is necessary to have forwarding documents, such as: an order to the forwarder indicating the fulfillment of conditions and work within the framework of the transportation of goods, a receipt confirming the fact of acceptance and transfer of goods, warehouse records for the shipment of goods.