What should be included in the advance report?

Is it generally necessary to accompany the expense report with any documents?

Clause 6.3 of the instruction of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U states that the corresponding report must be presented to an accountant or manager, but it does not specify which ones. Clause 26 of the regulations on business trips, approved by Decree of the Government of the Russian Federation dated October 13, 2008 No. 749, states that upon returning from a business trip, a company employee must submit an advance report to the employer and attach to it documents confirming the rental of housing, travel expenses and other items.

It is necessary to attach documents to the advance report that confirm that the employee spent the funds issued correctly. Apart from the specified requirement of the legislator, there are other reasons for this. In particular, amounts issued to an employee on account and used by him for the purposes agreed upon at the time of issuance can be accepted by the employing company to reduce the tax base (if they are available in the completeness required by law, papers are needed confirming both the fact of payment for goods or services and their receipt).

CLARIFICATIONS from ConsultantPlus: Is it possible to take into account an advance report with a sales receipt, but without a cash receipt? Study the material by getting trial access to the K+ system for free.

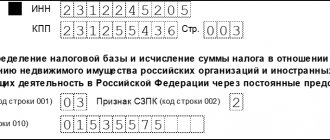

The main regulations establishing the need to generate advance reports do not say anything about the fact that cash receipts must be attached to the relevant document. At the same time, it should be noted that in the structure of the AO-1 form, proposed by Decree of the State Statistics Committee of the Russian Federation dated 01.08.2001 No. 55 as a unified form for drawing up an advance report (as well as in its analogue used for budgetary institutions - form 0504505, approved by order Ministry of Finance of the Russian Federation dated March 30, 2015 No. 52n), there are columns where you need to enter information about documents confirming expenses. In form AO-1 it is necessary to record the name of these documents, their numbers and dates, in form 0504505 - numbers, dates, as well as the content of expenses.

Read more about filling out the AO-1 form in the article .

NOTE! Currently, most sellers must use online cash register systems and issue buyers a cash register receipt that meets all the requirements of the Law “On Cash Register Systems” dated May 22, 2003 No. 54-FZ. Only persons exempt from the use of cash register systems can work without a cash register and issue other payment documents. If the seller ignores his cash obligation, he breaks the law, not the buyer. Therefore, the buyer should not bear the negative consequences of not having a cash register receipt, and is also not obliged (and does not have the opportunity) to check whether the seller does not use the cash register lawfully and issues him another document. Therefore, you can now attach any of the following documents confirming payment to the advance report. But it should be remembered that this is associated with certain risks. Mainly in terms of confirming expenses for tax purposes.

So, the documents that contain the necessary primary details (number, date, content of expenses), in addition to the cash receipt, include:

- strict reporting form (including, for example, an air ticket);

- PKO receipt;

- sales receipt.

Let's consider what the requirements for the execution of each of the mentioned documents are.

Purchases from the public

Accountable money can be used to pay an individual who is not registered as an entrepreneur. Let's give examples: purchase of agricultural products from the population, road transportation, accommodation in the private sector during a business trip. In such cases, the expenses of the accountable person will be certified by the citizen’s receipt of the money. A legal entity is mentioned in it, if only the “accountable” acts on the basis of a power of attorney.

The receipt is drawn up according to the rules established by Law N 129-FZ for primary accounting documents. In relation to the citizen who received the payment, indicate: last name, first name, patronymic, name and details of the identity document, address of residence and Taxpayer Identification Number (if available).

If the “accountable” pays for work or services on his own behalf, then he has no right to withhold personal income tax from the citizen’s income. After all, only organizations or individual entrepreneurs can act as a tax agent (Clause 1, Article 226 of the Tax Code of the Russian Federation). But it seems possible that the approval of the expense report is tantamount to an admission that the citizen received income as a result of his relationship with the company. In this case, the company has an obligation to calculate the tax and inform the tax authority that it cannot be withheld (clause 5 of Article 226 of the Tax Code of the Russian Federation). For example , a business traveler can pay for an overnight stay with a local resident. From the point of view of initial documentation, this will be a “pure” transaction between citizens.

Advance report without cash receipt: attach PKO receipt

An advance report without a cash receipt can also be supplemented with receipts for cash receipt orders.

The PKO, like the BSO, consists of 2 elements - the main part and the tear-off receipt. The employee who paid for goods or services with accountable funds is given the second element. This is what needs to be attached to the expense report.

It is important that the PKO receipt meets the following basic requirements:

- the supplier's seal (if any) must be affixed simultaneously on both elements of the PQS - thus, approximately half of it will be visible on the receipt;

- in the “Amount” column of the PKO receipt, the amount of funds should be recorded in numbers, in the column below - in words.

One more nuance: PKOs must be drawn up exclusively according to the KO-1 form, which was put into circulation by the State Statistics Committee by Resolution No. 88 dated August 18, 1998. Therefore, before taking the PKO receipt, it is advisable for the employee to make sure that the original order contains a mark indicating that the document complies with the form KO-1.

And most importantly: the receipt for the PKO only confirms the fact of payment. Using it to confirm the type of expenses, for example, the name of purchased goods and materials or services, is problematic. Therefore, in addition to the receipt to the recipient, a document indicating the type of expenses incurred must be attached to the advance report: invoice, act, etc.

For an example of form KO-1, see the material “Cash receipt order - form and sample”.

Do I need to run a cash receipt at the online checkout when making an advance payment (advance payment) for goods?

First of all, Article 487 of the Civil Code of the Russian Federation provides for the possibility of making an advance payment under any purchase and sale agreement. Thus, an advance payment (or advance payment) can be made, including for the purposes of a retail purchase and sale agreement.

- on the basis of clause 1 of Article 1.2 of the new edition of No. 54-FZ, cash register equipment must be used throughout the entire territory of the Russian Federation. This requirement applies to any organizations and entrepreneurs, except in cases where No. 54-FZ itself provides for exceptions (in accordance with its Article 2);

- The obligation to use cash register systems applies only to cash payments and (or) payments using electronic means of payment. Moreover, the calculations themselves must be made only in the currency of the Russian Federation - in rubles. As for payments in foreign currency, based on Article 14 of the Federal Law of the Russian Federation No. 173-FZ of December 10, 2003. “On Currency Regulation and Currency Control”, currency transactions are carried out only in non-cash form, with some exceptions, which are also specified in Article 14 of the same law;

- the new edition of No. 54-FZ (Article 1.1) clarifies what kind of calculations cash register equipment should always be used for, in particular, for goods sold, work performed and services provided. Except for certain cases in which the use of CCT is not required;

- In addition, the new edition of No. 54-FZ clearly indicates the presence of exceptions for which the right not to apply CCP is provided - through Article 2 of the law. And this article does not mention the possibility of not punching a cash receipt in case of making an advance payment (advance payment).

Also read: Statute of limitations for writing off accounts receivable

We supplement the advance report with a sales receipt

Another possible scenario for justifying expenses for reporting funds is the use of a sales receipt as a document supplementing the expense report. A sales receipt can be made an attachment to the JSC if it confirms the fact of concluding an agreement and the fact of payment (Article 493 of the Civil Code of the Russian Federation, letters of the Ministry of Finance dated 08/16/2017 No. 03-01-15/52653, dated 05/06/2015 No. 03-11-06 /2/26028).

There is no legislatively approved form for a sales receipt, but there are requirements for details. It should contain:

- serial number, date of compilation;

- name of the company or full name of an individual entrepreneur - supplier of goods or services;

- supplier's tax identification number;

- a list of goods and services paid for by the employee with accountable funds, their quantity;

- the amount that the employee deposited into the supplier’s cash desk in rubles;

- position, full name, initials of the employee who issued the sales receipt, his signature.

As a rule, a sales receipt contains a complete statement of paid goods and materials, which means that it is not required to supplement it with an invoice.

Is it possible to take into account the costs of purchasing goods for income tax if the sales receipt attached to the advance report has defects, for example, it is missing a number? You will find the answer to this question from expert practitioners in ConsultantPlus. Get trial access to the system for free and proceed to the material.

Normative base

Federal Law No. 192-FZ dated 07/03/2018 “On amendments to certain legislative acts of the Russian Federation”

Letter of the Ministry of Finance No. 03-03-06/1/10344 dated 02/18/2019 “On confirmation of expenses for income tax purposes with a cash receipt”

Directive of the Bank of Russia No. 3210-U dated March 11, 2014 “On the procedure for conducting cash transactions by legal entities and the simplified procedure for conducting cash transactions by individual entrepreneurs and small businesses”

Starting from July 2021, according to Art. 1 of Law No. 192-FZ of July 3, 2018, if goods are purchased for an organization or individual entrepreneur, the electronic fiscal cash receipt (FKCH) must contain the buyer’s TIN, customs declaration number, country of origin of the goods and the amount of excise tax. It is allowed to be used as an appendix to the advance report - as stated in the letter of the Ministry of Finance No. 03-03-06/1/10344 dated 02/18/2019.

In this case, the paper receipt confirming the expenses is signed by the seller as the responsible person. Additional information required for reporting in accordance with Art. 1 of Law No. 192-FZ dated July 3, 2018 and letter of the Ministry of Finance No. 03-01-15/75371 dated October 19, 2018, are displayed in the fiscal document if goods are purchased on behalf of a company or individual entrepreneur. Without this data, the Ministry of Finance believes (letter No. 03-03-07/74934 dated September 30, 2019), the FCC does not have the right to justify the “economic feasibility of the fact of economic activity.”

IMPORTANT!

Organizations and individual entrepreneurs on OSN, STS and UTII that provide services to the population, instead of filled out strict reporting forms, are now required to issue FKCH to recipients of services.

Results

The preparation of an advance report must be accompanied by the attachment of documents confirming the expenses incurred. Such documents can be not only cash receipts, but also BSO, receipt for PKO and sales receipts. The registration of the PKO takes place on an approved form, and there are certain requirements for the details of the BSO and sales receipts that do not have such forms.

Sources:

- Federal Law of May 22, 2003 No. 54-FZ

- Directive of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

BSO when providing services

Strict reporting forms (SRF) are allowed to be used exclusively in the provision of services to the public (clause 2 of Article 2 of Law No. 54-FZ). For this reason, it is unacceptable to indicate on the form that the service was provided to a legal entity or individual entrepreneur. The customer of the service can only be a citizen who does not carry out entrepreneurial activities. Otherwise, the BSO is not a document that meets the requirements of Russian legislation (clause 1 of Article 252 of the Tax Code of the Russian Federation).

But a citizen indicated as a customer and consumer of a service may be an accountable person of the organization. Then he needs to make sure that it is clear from the BSO that the service was provided in the interests of the employer.

For example , when repairing a laptop belonging to an organization, the BSO must provide data that allows you to uniquely identify this object.

The most important question for an accountant is: in connection with which services is it allowed to use BSO? The Ministry of Finance of Russia in Letter dated January 27, 2009 N 03-01-15/1-29 explained that the right to use BSO applies to all services in accordance with the All-Russian Classifier of Services to the Population OK 002-93 (OKUN), approved by the Resolution of the State Standard of Russia dated June 28 1993 N 163. In this case, the strict reporting form must relate to a specific, specific service named in the Classifier.

Railway

If an employee used railway transport (train) with an electronic ticket, then he must go through electronic registration. There will be a note about this on the ticket “Electronic registration completed.” If there is no mark, expenses cannot be accepted.

Taxi

Taxi expenses are also subject to documentary confirmation. But most often the trip is arranged through an application on the phone. In this case, you need an electronic check. It can be obtained directly through the application.

But tax authorities believe that a primary document with a signature is needed (letter from the Ministry of Finance dated September 12, 2018 No. 03-03-06/1/65357). That's why:

- In addition to the check, the employee should ask the driver for a receipt with his signature;

- Keep in mind that some taxi services offer to deliver a signed receipt to the company's address;

- Ask the employee to also print out your travel itinerary from the app. This will confirm her production purpose for the trip.

Travel documents

Airplane

To confirm your flight, you will need not only the ticket itself, but also your boarding pass. It is given to the passenger upon check-in for the flight. It must contain an inspection mark (letter of the Ministry of Finance dated 06/06/2017 No. 03-03-06/1/35214). This is confirmation that the employee actually boarded the plane. The coupon can be issued electronically (Order of the Ministry of Transport dated January 14, 2019 No. 7). You can receive it, for example, by email or keep it on your smartphone.

In this case, ask the employee to print out the coupon. Otherwise, the company risks losing expenses, and the employee’s personal income tax will be withheld from the cost of the ticket.

Understanding the new reporting rules

If an employee raised his own funds to meet the needs of the organization, he must also draw up a reporting statement. The employee writes an application for reimbursement of the money spent by him, the manager accepts, reviews and approves it. Then, an order is issued to reimburse the money spent.

- The employee submits to the accounting department an order for the issuance of money against a report signed by the head of the institution in any form.

- Accountable persons, the changes of 2021 approved this innovation, may now have debt on previously issued advances. But before issuing, you need to make a complete reconciliation of mutual settlements with him.

- The employee provides an advance report no later than 3 working days after the date established in the order. All available documents confirming expenses must be attached to the advance report. Unspent money is returned to the organization's cash desk (the accountant creates a cash receipt order).

- An accountant or cashier checks the received expense report and primary documents to ensure they are filled out correctly. The inspection period is set independently by each institution through local regulations.

Form AO-1

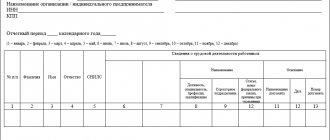

In the left table, the reporting employee enters information about the funds issued, in particular, indicates the total amount, as well as information about the currency in which it was issued (if currencies of other countries are used). Below is the amount of the balance or overspending.

- information about the organization that issued the money,

- the employee who received them,

- exact amount of funds

- the purposes for which they were intended.

- The expenses incurred are also reflected here, along with all supporting documents. In addition, the report contains the signatures of the accounting employees who issued the money and accepted the balance, as well as the employee for whom the accountable funds were registered.

Basic Concepts

- Name of the organization (can be abbreviated).

- The actual address of the purchase, that is, the address of the organization.

- TIN.

- Number order of CCP.

- Serial number of the check.

- The date and time the product or service was purchased.

- Number of units purchased.

- Price per unit of goods.

- Total purchase amount.

- If available, quantity and amount of discount.

- Amount received for payment.

- PCC or check authentication code.

- Information about VAT payment, which distinguishes it from the previous type of check.

Filling rules

A sales receipt is issued exclusively at the request of the client himself, as evidenced by Federal Law-54 and is one of the basic ones. The specific moment when the client can request this document is also indicated - after the direct purchase of a product or service.

The current version of the document you are interested in is available only in the commercial version of the GARANT system. You can purchase a document for 54 rubles or get full access to the GARANT system free of charge for 3 days. The GARANT system has been produced since 1990. and its partners are members of the Russian Association of Legal Information GARANT.