Legislative and regulatory acts

The Labor Code of the Russian Federation states that an employee is entitled to compensation for the use of a personal vehicle for the needs of the employer. This is stated in Article 188. Such use can be one-time or on an ongoing basis. Compensation is issued to cover the costs of using the machine. This:

- purchase of gasoline;

- maintenance and repair;

- depreciation.

Such payments do not relate to wages. They have a different purpose that is not related to the employee’s performance of official duties. These payments are designed to compensate for transportation costs incurred by the employee in connection with the performance of work duties. The procedure, amount and terms of payments are fixed in the employment agreement.

Important! The Labor Code stipulates the use of personal transport with the consent of the employer. The presence of such will confirm the concluded agreement between the employee and the organization. It is possible to provide a car for free use at the discretion of the employee.

Accountants who have to conduct settlements with the employee and the tax service, in addition to the Tax Code, should study Government Resolution No. “On establishing standards for organizations’ expenses for the payment of compensation.”

Article 188 of the Labor Code of the Russian Federation “Reimbursement of expenses when using the employee’s personal property”

Decree of the Government of the Russian Federation dated 02/08/2002 N 92 “On establishing standards for the expenses of organizations for the payment of compensation for the use of personal cars and motorcycles for business trips, within which, when determining the tax base for the income tax of organizations, such expenses are classified as other expenses associated with production and sales"

In what cases is compensation paid for the use of a personal car?

In modern conditions, there are a large number of professions associated with traveling on work matters. Even in such a profession as an accountant, there is often a need to travel to various authorities.

Positions such as manager, sales representative, insurance agent and many other specialties require quick movement from point A to point B. At the same time, the employer company itself often does not have company cars. In this regard, for some positions, when hiring, a condition is prescribed that you have your own car.

That is why organizations very often provide compensation for expenses that an employee will incur when using his personal car if it is involved in performing work duties.

In addition to ordinary employees, the director can also use his car in the interests of the company. The same compensation is provided for him as for other employees.

Car expenses include:

- Fuel for refueling

- Depreciation amount

- Repair and maintenance costs

- Car washing during working hours and other similar expenses

Article 188 of the Labor Code of the Russian Federation provides for the use of a personal car by an employee and establishes the need to pay compensation in this case.

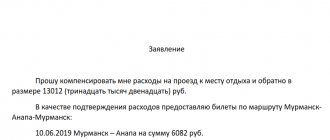

In order to secure the employee’s desire to receive compensation, he must write a statement to his employer. A photocopy of the vehicle registration certificate must be attached to it. You must provide the employer with the original certificate to compare it with a copy.

Compensation is provided only to those employees who need to travel for work purposes. Moreover, the head of the company independently determines the circle of those who will receive such compensation.

The ability to reimburse expenses should be reflected in the organization’s internal documents.

Coverage Agreement

This document is drawn up in the interests of the employee. It confirms the agreement between him and the employer. The document reflects the following information:

- machine characteristics;

- amount and timing of payments.

Sometimes employers do not offer to draw up an agreement, making do with drawing up an order. The employee must read the order against signature. It is preferable to draw up an agreement. This document will help protect the rights of the employee in the event of controversial situations.

Sample agreement to cover expenses for the use of a personal car

When drawing up a written agreement, it is important to indicate the amount of compensation and its type. A separate line includes payments that compensate for the costs of gasoline and maintenance. The legislation does not provide for standards stipulating the amount of compensation. These issues are resolved individually at the enterprise. The Ministry of Finance and the tax services recommend taking into account the frequency of use of the vehicle when making calculations.

Read also: Taxes of self-employed citizens in 2021

When calculating tax payments, the period of use of the car and how worn it is are taken into account. Examples you can take as an example:

- The amount of payments is calculated based on the average cost of payment for 1 km of taxi accepted in the city.

- Take the calculated amount of depreciation charges as a basis.

Important! You can roughly calculate the amount of depreciation by dividing the market value of the car by its useful life.

"troika" rushes to discounts

At the beginning of the new year 2021, tariffs for public transport have undergone changes. The price increase affected almost all categories of travel cards.

The only exceptions were monthly passes for daytime students, as well as tariffs for 1 or 2 trips, which are considered the least profitable and unclaimed by those who constantly use public transport. Major tariff changes At the end of the year, an official representative of the Department of Transport announced a price increase of 3.8%.

For comparison, last year prices increased by about 7.5%, so the fare for Troika card holders last year increased by 4 rubles (from 31 to 35), since the beginning of this year the trip costs 36 rubles (the increase was 2. 9 %). Benefits for students remain.

What does employee car compensation consist of?

The amount must cover the employee’s expenses for:

- depreciation;

- fuels and lubricants;

- Maintenance.

When calculating the amount of compensation, tax authorities recommend taking into account the following parameters:

- degree of wear;

- period of use;

- frequency of use.

Important! When calculating the amount of compensation, you should take into account how many days per month the employee uses the machine. If daily, then it would be wiser to set a fixed payment. For irregular use, the amount may be floating, depending on the number of days of use.

Varlamov.ru

- A “Single” ticket without a travel limit for 1, 3 and 7 days is valid from the moment of the first pass; you must start using it no later than 10 days from the date of sale (including the day of sale).

- Tickets for 30, 90 and 365 days, as well as for 60 trips, are sold only on the Troika transport card and are valid from the moment of registration on the card.

*Valid only on the territory of zone A and inside the Zelenograd Autonomous Okrug. Tickets for one trip that can be purchased from the driver (the price is indicated in rubles) Tickets that can be purchased from the driver in zone A Tickets that can be purchased from the driver in zone B Single Bus within zone B Single 55 rubles. (valid for 5 days) 40 rub. (valid for 5 days) 55 rub. (validity period - 5 days) Cashless payment at the validator (PayPass, PayWave, ApplePay, etc.) 1 trip 40 rubles.

Determining the amount of compensation

Accountants who calculate and transfer compensation to an employee will take into account the amount of payments specified in the agreement.

Documented costs are taken into account. For example, the employment agreement provides for a monthly compensation amount of 6,000 rubles. Gasoline costs are paid separately. The employee provides monthly receipts to the accounting department for the purchase of gasoline at gas stations. Thus, the amount of gasoline costs is added to the monthly payment of 6,000 rubles. The total amount will be transferred to the employee as compensation.

If there are vacation days in a month, the amount of monthly fixed compensation will be reduced based on the number of vacation days. Compensation will not be paid for the time spent on sick leave.

Traveling by public transport on a business trip

Important But if you take a ticket to the first station in Moscow - the Trikotazhnaya platform, and then get out and buy another ticket to Tsaritsyn, then the first pass costs 61 rubles. 50 kopecks, the second - 32 rubles, total - 93 rubles. 50 kopecks Benefit - 70.5 rubles. It's all about the pricing features of transregional routes. If you buy a ticket for a route passing through different regions, and Moscow and the region are different subjects of the Federation, then in this case a fee is charged for each zone. It costs about 20 rubles. 50 kopecks There are eight zones from Snegiri to Tsaritsino. InfoIf you buy two tickets in different regions, then the first one is paid according to zones, and the second one at a single tariff, which is established for travel around Moscow. In the capital, there is a single cost for a trip by train - 32 rubles.

for any distance on one train for at least five zones. The only inconvenience is the need to travel by two trains.

How to confirm compensation

To confirm the legitimacy of accrued compensation, the following documents are provided:

- Agreement between employee and organization. Attached to the employment contract.

- A document confirming the ownership of personal transport.

- Travel and route sheets, magazines.

- Receipts and receipts for the purchase of consumables.

- Methodology for calculating payments.

- Employee reports.

Important! The report forms provided by the employee must be based on the model approved by the head of the organization.

Sample order for approval of the list of employees who have a traveling nature of work

—————————————————————————¬ ¦ Limited Liability Company "Voskhod" ¦ ¦ ¦ ¦ Order N 213/к ¦ ¦ on approval of the list of employees with traveling nature of the work ¦ ¦ ¦ ¦g. Moscow March 1, 2012¦ ¦ ¦ ¦ Guided by job descriptions NN 51 and 64, ¦ ¦ I ORDER: ¦ ¦ ¦ ¦ To approve the list of employees with a traveling nature of work, who will be paid compensation for travel in accordance with employment contracts and Art. 168.1 Labor Code of the Russian Federation: ¦ ¦ ¦——T—————————T—————————————¬¦ ¦¦N p/p¦ Position ¦ Full name . ¦¦ ¦+——+—————————+—————————————+¦ ¦¦1 ¦Courier ¦Vasiliev A.P. ¦¦ ¦+——+—————————+—————————————+¦ ¦¦… ¦… ¦… ¦¦

¦+——+—————————+—————————————+¦ ¦¦10 ¦Sales Manager ¦Surkov P.A. ¦¦ ¦L——+—————————+—————————————¦ ¦ ¦ ¦ General Director Veselkin V.I. Veselkin¦ L——————————————————————————

Drawing

Compensation implies that money is given for expenses actually incurred by the employee. This means that he must draw up an advance report and attach travel documents to it, for example for a month. The organization can issue money both upon submission of the report, and in advance - before the beginning of the month.

An important point. Compensation for travel expenses is paid to employees with traveling duties, and the latter must be confirmed in the job description.

Tax accounting

Compensations are not subject to personal income tax. This is stated in letter No. 03-04-06/22274 of the Ministry of Finance, Order of Rostrud No. 17-3/B-291.

When calculating income tax, the amount of compensation is partially taken into account. The calculation is carried out using established standards and is “tied” to engine volume:

- 1200 rub. standard for passenger cars with engines up to 2000 cc. m.;

- 1500 rub. standard for an engine over 200 cc. m.

The calculation is the same for organizations with regular and simplified taxation systems.

Read also: The right to sign primary documents

The tax service may complain about the inclusion of a fixed monthly payment in expenses and, in addition, payment of expenses for fuel and lubricants. The service considers gasoline costs already included in the monthly fixed payment.

Compensation is reflected in the expense item after it is paid.

You can use an employee’s car for work purposes by concluding a rental agreement. Under such an agreement, only the vehicle is transferred for use; the owner does not provide vehicle maintenance services. The contract is accompanied by a transfer act describing the characteristics and cost of the machine. It is reflected on the company's balance sheet as a leased asset. The fee for use is established by agreement of the parties. It makes more sense to choose hourly rather than fixed payment. This way, the owner will not have to pay for hours of downtime, for example, if the employee is on sick leave or on vacation.

When used on a rental basis, the organization's expenses will include expenses for gasoline and car maintenance, for its repair, washing and parking. All these costs are written off as enterprise expenses. Personal income tax is withheld from the rent; the tenant company is the tax agent. This position is reflected in the letter of the Ministry of Finance No. 03-04-06/33598. But in this case you will not have to pay insurance premiums. After all, contracts for the transfer of property for use are not subject to contributions for injuries and insurance.

Important! If an employee uses a car by proxy, he can rent it out under an agreement with the permission of the owner. To do this, the power of attorney must contain a line stating the person’s right to enter into a lease agreement on behalf of the owner. The owner will receive rental income.

Comparison table on the advantages and disadvantages of renting or compensation

| Comparison | According to the lease agreement | With compensation |

| From a tax perspective | The organization reflects payments under the lease agreement as an expense item. This is relevant both for the simplified taxation system and for the general | The legislation provides standards depending on engine size. Passenger cars are regulated by organizations with both general and simplified taxation systems. For trucks: with OSNO the payment is written off as an expense in full; with a simplified system it cannot be written off as an expense |

| Inclusion of expenses for fuel and lubricants and gasoline in payments | By renting a car, the organization bears the costs of maintenance and the purchase of gasoline and fuels. Therefore, such expenses can be taken into account in expenses | According to the letter from the Ministry of Finance, the amount of compensation already includes the cost of gasoline and fuel. Including such payments in expenses in excess of a fixed rate may lead to questions from the tax authorities. |

| Presence or absence of personal income tax and insurance contributions | Personal income tax must be deducted from rental payments. This type of payment is exempt from insurance premiums | Personal income tax and insurance premiums are not provided. The compensation paid must correspond to the amount specified in the agreement |

| If the employee is not the owner of the vehicle and uses the car by proxy | To draw up a rental agreement, the consent of the car owner is required. If his personal presence is impossible, the user’s power of attorney must indicate the right to conclude a lease agreement | In this case, compensation cannot be included in expenses. In this case, insurance premiums and personal income tax will have to be calculated |

Read also: Calculation of the average number of employees

Letter of the Ministry of Finance dated April 20, 2015 No. 03-04-06/22274 “On the exemption from personal income tax for reimbursement of employee expenses associated with the use of his personal property”

Other cases when the employer pays for the trip

The issue of transporting employees to and from work is not regulated by labor legislation, but many employers pay for travel for employees on their own initiative. And if such a clause is provided for in an employment or collective agreement, then, on the basis of clause 26 of Art. 270 of the Tax Code of the Russian Federation, the organization will have the right not to take these expenses into account when determining the taxable base for income tax. The employer most often delivers personnel using its own or rented transport, when the possibility of delivery by public transport is absent or difficult due to the remoteness of production or the peculiarities of the work schedule. But sometimes employees are simply paid monetary compensation for travel to and from work by public transport.

Documents for processing compensation

To apply for compensation you will need the following documents:

- A documented agreement that reflects the timing of payment and the amount of compensation. The calculation method can be indicated here.

- Documents confirming that the employee is the owner of the car.

- Order from the boss on the calculation of compensation.

Sample order for compensation - Receipts and checks confirming the amounts declared by the employee. These are receipts for payment for gasoline, receipts for payment for repairs, and others.

The amount of compensation is not limited by law. But the amount that an organization can write off as expenses is limited by regulations.

Features of reimbursement of expenses when using your own machine

First, you need to remember that such expenses are compensated only for those who actively use a car in their work. This applies to both business trips and travel during the work shift.

In order to receive compensation, you must write a statement to your employer. All documents for the car must be attached to it. You will have to prepare travel vouchers (the Ministry of Finance still insists on this) and collect receipts for all expenses incurred.

The final amount of monetary compensation for expenses incurred is determined by the head of the organization in agreement with the employee.

In order to use your machine for work and receive compensation, you must issue an order.

If the car is registered not to the employee, but to another person, then it can be used by proxy. This will not affect compensation in any way.

State Unitary Enterprise "Mosgortrans"

- cost of services for issuing travel tickets;

- expenses for bedding on trains;

- the cost of travel to the place (station, pier, airport) of departure on a business trip (from the place of return from a business trip), if it is located outside the locality where the employee works.

This is stated in paragraphs 11, 12, and 22 of the Regulations approved by Decree of the Government of the Russian Federation of October 13, 2008 No. 749. From the situation of Sergei Razgulin, Actual State Advisor of the Russian Federation, 3rd class. How to take into account when taxing the expenses of an employee traveling by public transport to time of business trip (from the place of residence in a hotel to the location of the organization to which he is sent) The costs of an employee’s travel on public transport in the city where he is sent can be taken into account when taxing profits.

Accounting

Reflect the amount of compensation on account 73 “Settlements with personnel for other operations.” When calculating compensation, make a note:

Debit 26 (44, 08...) Credit 73

– compensation for expenses associated with the purchase of travel tickets has been accrued.

Reflect the payment of compensation as follows:

Debit 73 Credit 50

– the ticket has been paid for.

When issuing cash from the cash register, draw up a cash receipt order in form No. KO-2, approved by Resolution of the State Statistics Committee of Russia dated August 18, 1998 No. 88.

If an organization purchases tickets centrally (by bank transfer or through an accountable person), then before issuing them to employees, the tickets must be credited to the balance sheet. Travel tickets are monetary documents. Therefore, in accounting, reflect their receipt on account 50-3 subaccount “Travel Documents” (Instructions for the chart of accounts):

Debit 50-3 subaccount “Travel documents” Credit 60 (76)

– travel tickets purchased at the transport agency are credited to the cash desk;

Debit 50-3 subaccount “Travel documents” Credit 71

– travel tickets purchased through an accountable person (based on an advance report) are credited to the cash desk.

Reflect the write-off of travel tickets by posting:

Debit 26 (44...) Credit 50-3 subaccount “Travel documents”

– the cost of used travel tickets has been written off.

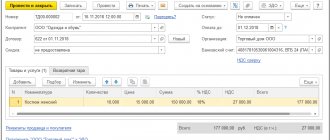

An example of reflecting in accounting the costs of purchasing travel tickets for employees

On March 1, Torgovaya LLC, through an accountable entity, purchased a single travel ticket for 60 trips worth 1,300 rubles. According to the rules established by the organization, purchased tickets are stored at the organization's box office and issued to employees when they travel around the city for official purposes.

The list of employees who have the right to use travel tickets is approved by order of the head of the organization. The Hermes cashier records the issuance and return of travel tickets in a special statement. When travel tickets expire, their value is written off as expenses.

On March 1, an employee of the organization A.S. Kondratiev was issued a travel ticket. The employee returned the used ticket at the end of the month.

The following entries were made in the organization's records.

March 1:

Debit 71 Credit 50 – 1300 rub. – issued on account for the purchase of a monthly travel ticket (based on a cash receipt order);

Debit 50-3 subaccount “Travel documents” Credit 71 – 1300 rub. – the travel ticket has been credited to the cash desk (based on the advance report);

Debit 71 Credit 50-3 subaccount “Travel documents” – 1300 rubles. – a travel ticket was issued to the employee.

March 31:

Debit 50-3 subaccount “Travel documents” Credit 71 – 1300 rub. – the travel ticket was returned by the employee;

Debit 44 Credit 50-3 subaccount “Travel documents” – 1300 rubles. – the cost of the used travel ticket has been written off.