- Reports submitted late (were calculated at the maximum up to RUR 150,000)

In July 2021, an “amnesty” was announced for those who were late with reporting for 2014-2016 on any system - simplified tax system, OSNO, UTII, unified agricultural tax, etc. The maximum fine will be removed (PFR letter dated July 10, 2021 No. NP-30- 26/9994) if you submit a declaration, even late.

The Pension Fund of the Russian Federation in connection with requests from PFR branches regarding the possibility of reforming obligations for insurance contributions calculated on the basis of 8 minimum wages for periods expired before 01/01/2017, taking into account the provisions of Article 20 of Federal Law dated 07/03/2016 N 250-FZ “On amendments to certain legislative acts of the Russian Federation and the recognition as invalid of certain legislative acts (provisions of legislative acts) of the Russian Federation in connection with the adoption of the Federal Law “On amendments to parts one and two of the Tax Code of the Russian Federation in connection with the transfer of powers to tax authorities on the administration of insurance contributions for compulsory pension, social and health insurance” reports the following.

Based on this norm, and also taking into account that Law No. 212-FZ does not provide for the right of the body monitoring the payment of insurance premiums to recalculate obligations formed in accordance with Part 11 of Article 14 of Law No. 212-FZ, we believe that the territorial bodies of the Pension Fund of the Russian Federation do not have grounds for reformation of obligations for insurance premiums in the event that payers of insurance premiums submit information about income to the tax authorities after the end of the billing period and receive from the tax authorities the relevant information about income after sending the payer of insurance premiums a request for payment of arrears on insurance premiums, penalties and fines in the amount based on 8 minimum wages.

If the payer of insurance premiums submitted information about income to the tax authority before the end of the billing period, but was not transferred to the territorial body of the Pension Fund by the tax authority, we consider it appropriate to reformulate the obligations in relation to the specified payer of insurance premiums.

Deputy Chairman of the Board

On the simplified tax system, income minus expenses of an individual entrepreneur can be calculated as this contribution from the difference between income and expenses (determination of the Supreme Court of the Russian Federation dated April 18, 2017 No. 304-KG16-16937).

There are also recommendations from the Ministry of Labor, according to which individual entrepreneurs using a simplified system can take into account the amount of expenses when calculating the additional contribution (letter of the Ministry of Labor dated July 31, 2017 No. 17-4/10/B-5861).

Contributions can be returned for the last three years - from 2014 to 2016.

Accounting for “expenses” on OSNO (it was believed that the amount cannot be reduced by expenses).

Costs can be taken into account on the basis of this resolution No. 27-P KS.

Contributions can be returned for the last three years - from 2014 to 2016.

You can also calculate this percentage using online accounting 333 RUR/month. There is a free period for a month. You can calculate and generate receipts/payments during this period.

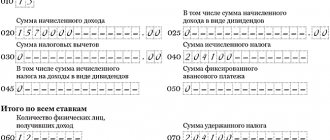

How to fill out Form 23 PFR

Form 23 of the Pension Fund of the Russian Federation is now in use; it has been in force since February 2016 and is called “Application for the return of the amount of overpaid insurance premiums, penalties, and fines.” It was approved by resolution of the Pension Fund Board of December 22, 2015 No. 511p.

Funds that were overpaid by an organization (IP) to the Pension Fund of the Russian Federation and the Federal Compulsory Medical Insurance Fund can only be returned upon the payer’s statement about the resulting overpayment. If a fund employee has identified a paid surplus, the Pension Fund must inform the policyholder about this within 10 days. After which a joint reconciliation is carried out, in which each party reflects its data. Based on its results, the overpayment will be confirmed, or an updated calculation will be required.

To return overpaid funds to the Pension Fund, you must prepare an application in paper or electronic form by filling out Form 23 of the Pension Fund (the form can be downloaded below).

An application is submitted to the territorial branch of the Pension Fund of the Russian Federation at the place of registration of the payer of contributions within three years from the date of payment of the amount that resulted in the overpayment. In turn, fund employees make a decision on this application no later than ten working days from the moment they receive an application for the return of the overpaid amount. If the decision is positive, the excess amount will be returned within 1 month. If the Pension Fund fails to comply with the established deadlines, the payer must be returned the amount of the overpayment along with the accrued percentage of the penalty for each day of delay.

Is it possible to collect interest from the Social Insurance Fund if contributions were collected illegally?

There was such a case in the judicial practice of the Ural District. An on-site inspection of the Social Insurance Fund discovered a shortage of payments for accidents at the enterprise and presented a demand for its payment. The organization complied with this requirement, but then decided to challenge it and filed a lawsuit demanding the return of the excessively collected amount, as well as interest accrued on it.

By the decision of the Arbitration Court in this case (No. A50-29761/2018 dated 06/06/2019), the FSS demand was declared invalid and illegal. Thus, the court satisfied the taxpayer's claim. The FSS tried to build its defense, referring to the provisions of Art. 26.12 of the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against accidents at work and occupational diseases” and insisted that these payments were overpaid and not collected. This means that there is no basis for calculating interest.

Illegal assessment of taxes and fines. How to prove it in court?

The above law states that acts of bodies monitoring the payment of insurance premiums do not have the same signs of compulsoryness that acts of tax authorities have, therefore the positions of the Constitutional Court of the Russian Federation, set out in the ruling dated December 27, 2005 No. 503-O, and the position of of the Presidium of the Supreme Arbitration Court of the Russian Federation, set out in Resolution No. 16551/11 dated April 24, 2012.

But the court, even after the appeal, did not change its statement that the fund’s requirement to pay the additional accrued amount of the fee, which was identified during the on-site inspection, is the basis for considering it excessively collected, and not excessively paid, thereby taking the side of the policyholder.

For your information. According to clauses 1, 2 of Art. 26.1 of Federal Law No. 125-FZ, if a fact of non-payment or incomplete payment of insurance premiums on time is revealed, then this arrears must be collected. The collection procedure is provided for in Art. 26.6 and 26.7 of Federal Law No. 125-FZ.

If there is a debt to the Pension Fund

If an organization or individual entrepreneur has a debt to the Pension Fund, it will be repaid from the overpaid amount. That is, the Fund will first reconcile your payments, then the amount of arrears will be deducted from the amount of your overpayment. And the remainder (if anything remains) will be returned to the policyholder.

However, you will not always get your money back. It is impossible to return the surplus if it was deposited and paid in the RSV-1 form and distributed to the individual accounts of employees. In this case, an offset may be made against future payments by the policyholder.

In Form 23 of the Pension Fund of the Russian Federation, the form contains the payer’s data, the name of the overpayment amount and the details for which the refund will be made.

Sample application for a pension in 2020

The state's obligation includes providing citizens who have reached advanced age with decent maintenance. Persons who have reached retirement age acquire the right to monthly financial support from the state. To appoint him, every citizen is required to fill out an appropriate application.

An application for a pension is drawn up on a unified form, which can be purchased at the Pension Fund branch or on the official portal. The time of predetermination of pension payments depends on the correct execution of the form. If any inaccuracies or crossing-outs are found in the form, Pension Fund specialists may not accept the documents until the form is refilled and the comments are corrected.

Downloads:

When and where to apply for a pension

It must be borne in mind that a request for predetermination of an old-age pension, drawn up in any form or filled out on the old template, will not be accepted.

Today, the methods for sending a request for pension predetermination have become more expanded. Today this can be done in the following ways:

- When visiting the Pension Fund (PFR) in person

- Send an application through the multifunctional center (MFC)

- Through a trusted person, with a notarized power of attorney.

- By using the Internet, going to the State Services website

- By sending a request by registered mail, with acknowledgment of delivery to the recipient

- Through an institution at the place of work.

It is necessary to send materials for the predetermination of a pension without delay, after reaching retirement years, since the start date for receiving a pension is the date of registration of the application. There is no compensation for missed time.

When sending an application by mail, the start date of payments is the day marked at the post office upon receipt of the application from the pensioner.

When registering an application, an employee of the Pension Fund or MFC is required to write a receipt indicating receipt of the package of materials with the date displayed.

From this time, within 10 days, the Pension Fund is obliged to make a decision on the allocation of pension benefits.

If the form is filled out incorrectly or the list of documents is insufficient, the Pension Fund employee is obliged to notify the applicant about this. 3 months are given to eliminate comments.

Review period

After the documents for the purpose of the pension benefit are accepted by the Pension Fund of Russia specialists, the law provides for a decision within 10 days and notifying the applicant of the positive decision of the application.

If the documents attached to the request are insufficient, Pension Fund employees are obliged to request the submission of the missing papers. Time to eliminate comments is given up to 3 months.

After a positive conclusion about the purpose of the pension, the pensioner begins to receive benefits from the first day of the coming month, after registering the application.

How to apply for a pension

To assign a pension benefit, you need to prepare some certificates. To do this, it is advisable to contact the Pension Fund advisory window the day before to find out the list of documents required for the purpose of the pension.

When the date arrives to receive a pension benefit, the prepared documents along with the request form should be sent to the Pension Fund. Working persons who wish to receive an old-age pension can continue to work (there is no need to quit). It will be enough to provide a work record book, having previously received it from the personnel department.

You can send documents using the following methods:

- Personal delivery of documents to Pension Fund specialists

- Through MFC

- By electronic sending, through the State Services website

- Using the services of a trusted representative

- Through the services of the post office, by sending a registered letter

- Contacting the management of the company

If a person wants to use the Internet when assigning a pension benefit, then he will need to register on the State Services website. It is better to do this in advance.

You can send an application by logging into your personal account on the site and opening the appropriate tab. The request and the documents required in the application are sent in electronic form.

To consider a request for pension provision, regardless of the method of sending, 10 days are allotted from the date of registration of receipt of the request by the Pension Fund. If there are comments regarding the preparation of the request or insufficient attached materials, the applicant is sent a notification with a proposal to eliminate the comments. Up to 3 months are given to correct comments.

After eliminating the comments and adopting a resolution on the purpose of the pension benefit, the pensioner begins to receive the benefit the next month after its appointment.

How to compose

The application for a pension is filled out on a specially accepted form, which can be obtained either from the Pension Fund or on the State Services portal.

The basic rules for filling out the request form include the same requirements as for other official documents:

- Handwriting when filling out an application manually must be legible, so it is advisable to fill out the form in printed characters

- All required fields must be filled out in the form.

- Strikethroughs, corrections and other erasures are not permitted.

- The form is filled out in the pensioner’s own handwriting, with his personal signature, or with the signature of an authorized representative.

The application form is unified. It needs to display the following:

First, fill in the name of the Pension Fund branch where the documents are sent.

The name of the form is already available; you just need to check whether you have taken the correct form to fill out.

Paragraph 1.

- The full name of the applicant is filled in here.

- The next line displays the insurance account number.

- Then citizenship

- If a person has a residence address abroad, then the necessary information is filled in, and in the box about permanent place of residence, a tick is placed in the right place; if not, the column is skipped.

- Then the registration address in the Russian Federation and actual place of residence are displayed.

- Below, in the appropriate line, fill in the phone number and a little later the applicant’s passport information.

- Next, fill in the gender of the requester.

This completes filling out the first page of the form.

Point 2.

This paragraph records information about the authorized person if the pensioner used his services.

This paragraph records information about the authorized person if the pensioner used his services.

Point 3.

9) Here you need to check a box indicating what type of pension benefit the applicant is counting on. To assign a full benefit, it is advisable to mark 2 boxes where insurance and funded pensions are registered.

Point 4.

10) At this point, you need to carefully read the questions and tick the appropriate boxes.

11) When asked about the presence of dependents, you must either write “NO” if there are no dependents, or put a number indicating the number of dependents.

Point 5.

12) This section is intended to display instructions for the behavior of a pensioner when assigning a pension. There is no need to fill out anything here. You need to read the text carefully. The signature at the end of the form will indicate a warning to the pensioner about his behavior during retirement.

Point 6.

13) Here fill in the list of documents attached to the request.

Points 7, 8 and 9.

14) The seventh paragraph is completed if the pensioner wishes to receive notification of the purpose of the pension in electronic form (electronic box indicated)

16) In the eighth paragraph, the applicant signs, with a transcript of his signature, certifying the accuracy of the completed information.

16) The ninth paragraph displays the address where a bank account should be opened to transfer the pension.

The collected list of documents must be attached to the form:

- Applicant's civil passport

- Insurance certificate SNILS

- Labor book (if it is missing, other labor contracts)

- TIN

- Certificate of work experience

- Marriage certificate (if available)

- Children's documents (if it contains them)

- Military ID for serving in the army

- Certificate of earnings for 12 months.

Download instructions for completing the form

Source: https://zayavi.com/zayavlenie-o-naznachenii-pensii-obrazets-zapolneniya/