The need to maintain separate VAT accounting arises when an organization has export operations

The VAT return reflects all information related to the calculation of payment of tax on

Which depreciation group does it belong to? Thus, the safe is taken into account in current assets, and the cost

Accounting is a specific activity of specific structures of any organization, which is aimed at accounting for all

Every entrepreneur who is just starting out in the world of big business faces a reasonable question:

In accordance with the form of the certificate of incapacity for work adopted by Order of the Ministry of Health and Social Development No. 347n,

Evening until what o'clock Evening comes into its own from the moment when the sun

An organization can purchase or develop a trademark (service mark) independently. At the same time she has

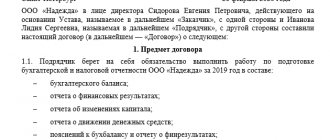

Home / Situations Back Published: 11/04/2019 Reading time: 4 min 0 458 Agreement

According to the Tax Code of the Russian Federation, the category of expenses includes losses and expenses that occurred during