04/04/2019 Starting from the tax period for the first quarter of 2021, the VAT return is submitted

If you seriously decide to start trading, then you will have to choose which method of calculating the cost

After the President of the Russian Federation signed the law on the next amendment to the Tax Code, many

Deadline for transferring the single tax to KBK in 2017 Payers of the simplified tax system must calculate quarterly

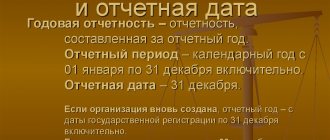

The only reporting period established by Federal Law dated December 6, 2011 No. 402-FZ “On Accounting” is

Tax authorities cannot conduct desk audits in relation to 2-NDFL Certificates submitted by the tax agent, because

Receiving property as a contribution to the authorized capital is a special operation. The founder must restore

How to reflect in the accounting of a Russian organization (limited liability company (LLC)) operations to increase

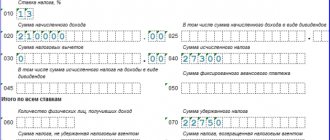

Employer reporting Marina Dmitrieva Leading expert - professional accountant Current as of June 21, 2019

Do I need a stamp on the job description approval stamp? Both methods of approval have the same legal validity