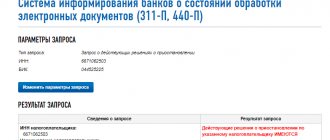

Tax authorities cannot conduct desk audits in relation to 2-NDFL Certificates submitted by the tax agent, because these certificates are not a tax return or calculation (Article 80, paragraph 1 of Article 88 of the Tax Code of the Russian Federation). However, this does not mean that inspectors do not study the received Certificates at all. Moreover, if they identify any inaccuracies in them, they will ask the tax agent to provide written explanations on personal income tax (Article 31 of the Tax Code of the Russian Federation). And it is better not to ignore such requests. Otherwise, officials of an organization or individual entrepreneur may be fined in the amount of 2,000 rubles. up to 4000 rub. (Part 1 of Article 19.4 of the Code of Administrative Offenses of the Russian Federation).

The most frequently asked questions from the tax office

Usually, the requirement to provide explanations comes some time after submitting all kinds of reports and declarations, so any, even the most minor, error or inaccuracy in the documents can become the reason for them. In many cases, clarification is required for VAT indicated for reimbursement due to discrepancies in information about taxable bases in income tax returns and, again, VAT, if there is a discrepancy in data from counterparties. Questions may cause unreasonable losses when checking the accrual of income tax, filing an updated declaration or calculation in which the corrected amount of tax payable is less than that originally sent, etc.

Procedure upon receipt of a request

After the taxpayer receives requests for clarification, he must check the documents submitted to the tax office with the data in his hands.

First of all, when checking a VAT return, the amounts indicated in it are analyzed (for their compliance with the amounts for all incoming and outgoing invoices). Next, dates, invoice numbers, and other details (TIN, KPP, addresses, etc.) are examined in the same way.

If questions arise regarding the simplified taxation system or income tax return, you should analyze all the amounts of expenses and income that were accepted for their calculation. All other types of documents that raise questions from the tax inspectorate are also checked using the same algorithm as above.

Attention: the law does not say that explanations must be given in writing, i.e. this means that they can also be provided orally. However, in order to avoid further disagreements, it is better to take care of drawing up a written response.

What to do when the tax demand is unfair

It happens that the tax inspectorate demands explanations unreasonably, i.e. no errors were made in the reporting. In such situations, you cannot ignore letters from the tax office either.

In order to avoid any sanctions (including sudden tax audits), it is necessary to promptly notify the supervisory service that, in accordance with the information of the enterprise, all the information provided is correct.

In any case, when drawing up a response, you must remember that for the tax office it is not so much the content of the letter that is important, but the fact of the response to the request itself.

Sample of a response to a tax request for clarification

As mentioned above, there is no unified response form for giving tax explanations, so you can compose it in any form. It is worth noting that the form of the response must be extremely correct and standard in terms of the rules for preparing such papers.

- First, on the left or right (it doesn’t matter) you need to indicate the addressee, i.e. exactly the tax office where the response is sent. Here you need to enter its number, as well as the region and locality to which it belongs.

- Next, the sender of the letter is indicated: the name of the company, its address (actual), as well as the telephone number (in case the tax inspector has any additional questions for clarification) is written.

- Further in the answer you should refer to the request number (and the tax service always assigns numbers to such documents), and its date (note: not the date of receipt, but the date of preparation), and also briefly outline the essence of the question.

- After this, you can proceed directly to giving explanations. They should be written in as much detail as possible, with all the necessary links to documents, laws, regulations, etc. The more carefully this part of the answer is prepared, the greater the chance that the tax office will be satisfied with it.

In no case should you give unreliable or deliberately false information in your answer - they will be quickly detected and then immediate sanctions from the tax authorities will follow.

- After the explanation is given, it is necessary to certify the letter with the signature of the chief accountant (if necessary), as well as the head of the company (required).

When to write an answer

If, as a result of an audit, the organization received a letter from the tax office requesting clarification, most likely, errors were identified during automatic reporting control. However, an institution is not always obliged to respond to a request from the Federal Tax Service. Explanations must be sent if the inspector has questions regarding the conduct of desk audits of periodic or final reporting.

The most common inaccuracies that imply a response to a request from the tax office for clarification are:

Thus, an explanatory letter in response to a request for clarification must be sent if discrepancies are identified during desk audits (clause 3 of Article 88 of the Tax Code of the Russian Federation). But it will not be superfluous for the taxpayer if he sends explanatory information to the request of the Federal Tax Service that is not related to the camera room. This will help formulate a clear position of the institution in resolving a particular problem.

Paying personal income tax late = fine.

Let’s say that an inaccuracy caused by a human factor is discovered in the fiscal reporting: the amount of accrued personal income tax or the fiscal payment made, the amount of the deduction, the amount of the salary of an employed specialist are incorrectly indicated. The explanatory document must indicate that the cause of the inaccuracy was a trivial typo. A new report with the adjustments made is attached to it.

Head of Tax Service No. 3 in Moscow

From PJSC "Spetstorg"

7701518772/ 770112155

Reg. No. 56781457895211

In the submitted certificate 2-NDFL for Petrova A.A. a technical error was made, which resulted in a difference between the amounts of tax accrued and paid for 2021. Personal income tax on the income of Petrov A.A. was transferred to the state budget in a timely manner and in full.

The adjusted 2-NDFL certificate was provided to the Federal Tax Service dd.mm.yyyy.

Attachment: Copy of the 2-NDFL certificate for A.A. Petrov.

Chief accountant Ivanov B.B.

A different situation is the discrepancy between the data in form 2-NDFL and the declaration submitted by the citizen himself. When creating the latter, the employee can indicate income from sources other than wages. The employer is not required to know all the “ins and outs” of the employee. In his explanations, he indicates that the information sent to the Federal Tax Service earlier is correct, and the employing company does not have information about other income of the specialist.

If you find an error, please highlight a piece of text and press Ctrl Enter.

In the near future, any company may receive a request from the Federal Tax Service regarding the need to clarify certain data for 2014. After all, after companies and individuals report income subject to personal income tax, tax authorities begin to carefully study reporting on this tax.

Be careful: the inspection does not have the right to conduct a desk check of 2-NDFL certificates. After all, such certificates are not declarations. Therefore, the requirements usually contain a reference to Article 31 of the Tax Code of the Russian Federation. This rule allows inspectors to request from the company any information related to the payment of taxes.

It is safer to make such a request, otherwise there is a possibility that the Federal Tax Service will fine the chief accountant in the amount of 2000-4000 rubles. (Part 1 of Article 19.4 of the Code of Administrative Offenses of the Russian Federation).

We have prepared four sample explanations for you, by sending which to the Federal Tax Service you can remove all inspectors from the certificates without harming the company.

Towards zero settlement

19.4 Code of Administrative Offenses of the Russian Federation).

Towards zero settlement

What happens if you don’t send a response to the tax office?

If an enterprise that has received a request from the tax authorities to provide explanations ignores this request, then, according to paragraph 1 of Art. 129.1 of the Tax Code of the Russian Federation, the consequence may be administrative liability and penalties in the amount of 5,000.00 (if the answer is not provided once) to 20,000.00 rubles (if this is a repeated violation).

Among other things, providing detailed explanatory information will lead to a dialogue with the Federal Tax Service and further resolution of the situation, while an unanswered request may lead to serious proceedings that do not exclude going to court.

What circumstances will help reduce the fine?

Having analyzed arbitration practice over the past 3 years, we have identified frequently encountered mitigating circumstances. At the same time, we conditionally divided them into three types.

The range of circumstances that the courts recognize as mitigating is pleasantly surprising in its diversity

TYPE 1. “Universal”. Absolutely everyone can refer to these circumstances - both organizations and individual entrepreneurs, regardless of the type of violation committed. Universal circumstances include:

- bringing to tax liability for the first time

- lack of intent to commit a violation

- repentance and recognition of one's guilt

- the good faith of the taxpayer, which consists in the timely payment of all taxes and the submission of reports. However, not all courts take this circumstance into account as a mitigating factor, rightly noting that “the good faith of the taxpayer is the norm of behavior in tax legal relations

- the difficult financial condition of the taxpayer, documented, in particular, the presence of debt to a large number of creditors (from the budget and suppliers to personnel, the company has been declared bankrupt or is in a pre-bankruptcy state (for example, stable unprofitability or cases where the size of net assets is less than the authorized capital);

- absence of an accountant from the organization at the time of the violation (due to illness or vacation

However, keep in mind that tax authorities or judges may object to you: the fact that the company’s chief accountant was absent for some reason is not a mitigating circumstance. After all, the manager, being the person responsible for the state of accounting and reporting, can involve other persons to ensure compliance with tax laws

- status of a budgetary institution or city-forming enterprise

- conducting socially significant activities, for example, in such areas as:

— construction and renovation of social facilities

— supply of food products for budgetary institutions and remote settlements

- provision of sponsorship and charitable assistance, financing of social and cultural events

TYPE 2. “Specific”. These circumstances are typical only for certain tax violations.

| Type of violation | Extenuating circumstances |

| Delay in filing a declaration (Clause 1, Article 119 of the Tax Code of the Russian Federation) |

|

| Non-payment (incomplete payment) of tax (Article 122 of the Tax Code of the Russian Federation) |

|

| Failure to submit to the inspection documents and information necessary for tax control (Article 126 of the Tax Code of the Russian Federation) or requested during a counter audit (Article 129.1 of the Tax Code of the Russian Federation) |

|

* Some courts believe that if the tax is paid by the time the audit decision is made, then the fine under Art. 122 Tax Code cannot be After all, this article does not provide for liability for late payment of tax

**Know that you should not be held accountable under Art. 122 of the Tax Code of the Russian Federation, if in the previous period you overpaid a certain tax, which

- covers the amount of tax underestimated in the subsequent period and is subject to payment to the same budget, or is equal to it;

- was not previously offset against other debts on this tax.

After all, the understatement of the tax did not lead to the creation of a debt to the budget in terms of payment of this tax.

*** There is an opinion that in this case the taxpayer is exempt from liability for failure to submit documents due to the lack of wine

TYPE 3. “Individual”. These circumstances can only be cited by entrepreneurs as individuals:

- being dependent on minor children and (or) other family members (elderly parents, wife

- presence of disability

- advanced (retirement) age

- serious illness of the individual entrepreneur himself or his close relatives

- difficult financial situation, burdened by the presence of credit obligations

How to write an explanation for a tax inspection request

The procedure for submitting a response with explanatory information is prescribed in the Tax Code of the Russian Federation. After completing a desk audit of periodic or final reporting, the inspector sends a letter to the institution in paper or electronic form about identified discrepancies that are subject to clarification, clarification or adjustment.

The organization must generate and submit explanatory material within five working days from the date of receipt of the request from the Federal Tax Service (Clause 3 of Article 88 of the Tax Code of the Russian Federation). The letter is written in any form. If a taxpayer is preparing a response to a request regarding a desk tax audit, then he should use the sample that will be presented later in the article.

A response to a request for clarification can be submitted through an electronic document management system with the mandatory use of an electronic signature, by email, by courier, or directly to the inspectorate (the letter must be registered in the office). To prove his position, the taxpayer prepares a package of documents with all the necessary attachments, certified and signed by the head.

If the specialist is sure that there cannot be any inaccuracies or discrepancies in the reporting submitted by him, then the explanation must indicate that the declaration or report for the specified period does not contain errors. If errors were nevertheless made, the taxpayer can submit an adjustment to the declaration clarifying the submitted information (clause 1 of Article 81 of the Tax Code of the Russian Federation).

If technical errors or inaccuracies are discovered that do not affect the taxable base and the amount of calculated tax, the explanatory material can describe the current situation, noting that the correct option is provided in the response to the request or in the updated declaration.

We petition to reduce the fine

So, now you know how you can “put pressure on pity.” But this is not enough. It is necessary to correctly state all available mitigating circumstances in the application and promptly send it to the inspectorate:

- a violation was discovered during an on-site or desk inspection - within 15 working days from the date you received the inspection report

- the violation was not detected as part of an inspection - within 10 working days from the date of receipt of the act of discovery of the violation

According to the law, the inspection itself must identify the presence of circumstances mitigating liability, but there is no need to rely on its awareness.

Here is an example form of a request to take into account mitigating circumstances when making a decision on bringing to tax liability.

To the Head of the Federal Tax Service of Russia No. 21 from FlashCo LLC, TIN 7721025156, checkpoint 772101001, address: 109375, Moscow, st. Yunykh Lenintsev, 64, tel.:

Ref. No. 39n dated November 30, 2012

APPLICATION for consideration of mitigating circumstances

Inspectorate of the Federal Tax Service No. 21 for the city of Moscow conducted a desk tax audit of the VAT declaration of FlashCo LLC for the third quarter of 2012, during which it was established that the Company submitted this declaration untimely (submitted on October 29 instead of October 22).

Based on the results of the audit, an act dated November 23, 2012 was drawn up, in which it is proposed to bring the Company to tax liability under clause 1 of Art. 119 of the Tax Code of the Russian Federation for violating the deadline for submitting a declaration in the form of a fine in the amount of 8,250 rubles.

We ask you when making a decision based on the results of the inspection on the basis of sub. 4 p. 5 art. 101, paragraph 4 of Art. 112 and paragraph 3 of Art. 114 of the Tax Code of the Russian Federation, reduce the amount of the fine due to the presence of the following mitigating circumstances: 1. The company is brought to tax liability for the first time under Art. 119 of the Tax Code of the Russian Federation. 2. The offense was committed unintentionally. 3. The company admits its guilt in committing the offense. 4. The delay was due to the absence of the chief accountant due to illness during the submission of the declaration. 5. The period of delay is insignificant (5 working days). When applying to the Federal Tax Service or the court for the application of mitigating circumstances, declare them “in bulk”, in the aggregate. The more circumstances you indicate, the higher the chances that the fine will be reduced

The possibility of taking into account the above circumstances as mitigating factors is confirmed by the judicial and arbitration practice of the Moscow region (see, for example, Resolutions of the Federal Antimonopoly Service dated May 22, 2012, dated July 11, 2011, dated August 4, 2011 10 AAS dated September 13, 2011

Attachments: 1. A copy of the certificate of temporary incapacity for work of the chief accountant M.N. Kurochkina. 2. Staffing table 3. Order on appointment to the position of chief accountant These documents confirm that there is only one accountant on staff. That is, in his absence no one could do his work

If your inspection ignores the request received, do not give up. Send a complaint to the Federal Tax Service stating that when making the decision to prosecute, the mitigating circumstances you stated were not taken into account (although they should have been!). The Tax Service itself says that they must be indicated in the complaint, this is necessary “for the correct and timely consideration of the case

If the higher tax authority does not heed your request, and the amount of the fine is significant, it is advisable to challenge the tax authority’s decision in court. Judges, as a rule, are willing to take into account existing mitigating circumstances.

You can apply for mitigation of liability in court even if you have not declared anything to either the inspectorate or the Federal Tax Service.

True, we came across one decision where the judges remained cold to the taxpayer’s request to reduce the fine, saying the following: “The large amount of penalties is the result of illegal actions of the Company itself, and therefore there are grounds for reducing it. not installed

By the way, mitigating circumstances must also be taken into account when imposing an administrative penalty. Therefore, many of the circumstances we have cited can “shoot” even in the case when an administrative fine is imposed on an organization or its official (entrepreneur) (no matter what offense

If an administrative body or court considers your existing circumstances to be mitigating, then they will impose a fine at the lower limit of the sanction established by the relevant norm, since it is impossible to reduce the administrative fine below the lower limit

If you have questions in the field of accounting, taxation, law or personnel and you need an answer based on the legislative framework with links to primary sources, feel free to contact us. Experienced practitioners will prepare a response with justification and conclusions regarding your question.

Response to VAT return requirement

A sample response to a request to the tax office for a VAT return must be generated electronically if the organization, by law, must submit a report through electronic document management tools (clause 3 of Article 88 of the Tax Code of the Russian Federation). To respond to a VAT request, there is a specially approved form, therefore, based on clause 1 of Art. 129 of the Tax Code of the Russian Federation, the taxpayer is obliged to comply not only with the conditions for electronic submission, but also with the form of explanations submitted. As supporting documentation for VAT, a specialist can prepare copies of invoices and purchase and sales books.

Response to claim for damages

The sample response to the Federal Tax Service's claim for losses must contain information on why the taxpayer has an excess of expenses over income. The main thing that a specialist should note when drawing up an explanation is the economic efficiency and feasibility of increased costs, and also attach supporting documents to the answer for each type of expense incurred.

If inspectors find errors during the calculation check, they will demand an explanation. We have found three main reasons why tax authorities may request clarification on 6-NDFL. See this article for sample answers.

Tax not withheld

If you did not withhold tax, the above scheme is expanded. You will need:

- withhold personal income tax from the next payment to the employee;

- pay it to the budget, not forgetting about penalties;

- submit an updated 6-NDFL.

All this must be done quickly, before the tax authorities see your mistake or decide to check you. If you have time to deal with personal income tax before then, a fine can be avoided, even if the error dates back to last year (see letter from the Federal Tax Service dated April 24, 2019 No. BS-3-11 / [email protected] ).

What if the employee has already quit?

Unfortunately, in this case a fine cannot be avoided. You will adjust 6-NDFL, but another mandatory condition for non-application of liability (on payment of tax and penalties) will not be able to be fulfilled. This means that there are no grounds for exemption from the sanction. And do not forget to notify the Federal Tax Service and the employee about the unwithheld tax amount. If this is last year, you will have to submit an updated 2-NDFL. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Explanations to the tax office for 6-NDFL: sample 1

According to the 6-NDFL calculation, inspectors immediately figure out that the company paid the tax late. To do this, tax officials look at how much tax and what payment deadline the company has written down in lines 070 and 120. These indicators are compared with the amounts and dates of payments in the budget settlement card. If the tax withheld is more than the tax paid, inspectors require an explanation. You must answer in free form. See sample below.

Explanations to the tax office for 6-NDFL Sample 1

TIN 7701025478, checkpoint 770101001, OGRN 1045012461022

Moscow, st. Basmannaya, 25

To the Head of the Federal Tax Service of Russia No. 1 for Moscow

Ref. No. 87 from 11/14/16

We present an updated calculation in which personal income tax was excluded from the salary for September from line 070. At the same time, we inform you that we do not consider this procedure for filling out line 070 to be unreliable information, since in the order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] there are no clear rules for filling it out.

1. Copy of payment order for personal income tax payment No. 381 dated September 30, 2016.

2. Copy of the bank statement for 09/30/16.

General Director Astakhov I.I. Astakhov

Reasons why the Federal Tax Service requests clarification

In fact, there are many reasons to ask the tax agent for clarification on personal income tax. For example, the agent may be asked to explain why the amounts of calculated, withheld and paid personal income tax on the income of a particular employee differ or why deductions were incorrectly applied. Or, for example, inspectors may inquire about the reasons for the reduction in the amount of personal income tax paid this year compared to that listed last year, if such a reduction exceeds 10% (Letter of the Federal Tax Service of Russia dated July 17, 2013 No. AS-4-2/12722).

Explanations to the tax office for 6-NDFL: sample 2

The company may also have been confused about how to fill out the withheld tax in line 070 of the 6-NDFL calculation. First, the entire tax that was withheld until the date of the calculation was recorded in line 070. Then line 070 coincided with line 040 (calculated tax). Then the Federal Tax Service clarified that in line 070 it is necessary to fill out only the tax that the company withheld on the last day of the reporting period (letter dated May 24, 2016 No. BS-4-11/9194). The companies redid the reports, and lines 040 and 070 no longer matched. Now inspectors are demanding to know why. To answer the requirement, write explanations in free form.

Please note in your explanation that there are no errors in the calculation. And the numbers in lines 040 and 070 should not match. This follows from the control ratios (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11/ [email protected] ).

Tell the inspectors that in line 040 the company recorded tax calculated on the income that employees received during the reporting period. Next, explain that in line 070 the company showed the tax that it withheld during the reporting period. For this reason, the numbers in lines 040 and 070 do not match. That is, explain why the information in lines 040 and 070 is different. Otherwise, if you simply say that there are no errors in the calculation, the inspectors will again demand an explanation.

In the explanations, it is worth giving a calculation of the difference and referring to letters from the Federal Tax Service on how to fill out lines 040 and 070. This way, inspectors will immediately see that everything is in order in the calculation and will not ask additional questions.

Explanations to the tax office for 6-NDFL Sample 2

Limited Liability Company “Company”

127138, Moscow, st. Basmannaya, 25

To the Head of the Federal Tax Service of Russia No. 8 for Moscow

Ref. No. 142/О from 09.08.16

about the different amount of tax in lines 040 and 070 of the 6-NDFL calculation

In response to the request for explanations (ref. dated 08.08.16 No. 52-12-13/142), Limited Liability Company “Company” reports that the calculated tax in line 040 and the withheld personal income tax in line 070 differ due to the fact that the company issued salaries for March in April 2021.

The salary for January – March 2021 is 10,000,000 rubles, deductions are 84,000 rubles. The calculated personal income tax in line 040 is equal to RUB 1,289,080. ((RUB 10,000,000 – RUB 84,000) x 13%).

LLC “Company” issued salaries for March in the amount of 3,000,000 rubles on April 5, 2021. The tax on this amount is 390,000 rubles. (RUB 3,000,000 x 13%). The Federal Tax Service recommends recording in line 070 of the 6-NDFL calculation only the tax that the company withheld on the last day of the reporting period (letters dated 05.24.16 No. BS-4-11/9194, dated 05.16.16 No. BS-4-11/8609) .

In accordance with the control ratios, the difference in the lines is not an error (letter of the Federal Tax Service of Russia dated March 10, 2016 No. BS-4-11 / [email protected] ).

General Director I.I. Astakhov

Explanatory note about the reason for non-payment of personal income tax

Filling out the calculation does not always go smoothly. After all, no one is immune from mistakes and from what foot the tax inspector got up today. That's why we decided to bring it for you.

Inevitable Document

Since 2021, the range of responsibilities of tax agents has expanded dramatically. Every quarter you have to submit reports on form 6-NDFL. As soon as it arrives at the inspectorate, tax officials immediately begin to study it. Moreover, this happens within the framework of desk control, on the premises of the Federal Tax Service. That is, the presence of a representative of the company that submitted the next payment is not expected.

The problem is that during such an audit, the inspection specialist, while studying your reporting, may have questions about filling it out. And only a tax agent can remove them.

But it’s better to be able to predict such situations.

When, for example, due to an error in 6 personal income tax, explanations to the tax office could immediately clarify the company’s position and its reputation as a conscientious tax agent.

We will talk about the most common such situations below and along the way we will give an example of explanations to the tax office regarding 6 personal income tax. The form and content of this calculation appendix are not regulated in any way by law. Therefore, freedom of creativity is already your trump card. But I think that the approach to this document should be approximately the same when giving explanations as part of a tax audit.

Towards zero settlement

It has already become an established practice that Form 6-NDFD with zero columns does not need to be sent to the inspectorate. Meanwhile, this does not prevent the inspection from asking why you did not submit the calculation. And it's better to answer. Moreover, sometimes it makes sense to proactively submit such a letter.

19.4 Code of Administrative Offenses of the Russian Federation).

Initially, the accrual indicators are compared with the calculation of 6-NDFL, after which the payment is compared with the actual documentation. The company may also be charged a penalty if the tax is not paid on time.

At the tax office, the timeliness of tax assessment is carried out by comparing the dates written in line 120 and the date when the actual payment of the tax amount to the budget was registered.

The current version of Art. 123 of the Tax Code of the Russian Federation establishes liability for tax agents for unlawful failure to withhold and transfer (incomplete withholding and (or) transfer) within the period established by the Tax Code of the Russian Federation of tax amounts subject to withholding and transfer by the tax agent: a fine of 20% of the amount subject to withholding or transfer.

Even in the Letter of the Ministry of Finance of Russia dated 04.04.2017 No. 03-02-08/19755 it was said that the Tax Code of the Russian Federation does not provide for the release of a tax agent from liability depending on the period of unlawful failure by him to fulfill the established obligation to withhold and transfer the amount of tax to the budget system of the Russian Federation. As for the reason why personal income tax was not paid on time, financiers note that the absence of a person’s guilt in committing a tax offense in accordance with paragraphs. 2 p. 1 art.

109 of the Tax Code of the Russian Federation is a circumstance that precludes bringing this person to justice for committing a tax offense. When applying a tax sanction, the court or tax authority considering the case takes into account circumstances that exclude the person’s guilt in committing a tax offense, or circumstances that mitigate liability for committing a tax offense (Articles 111 and 112 of the Tax Code of the Russian Federation).

But in practice, neither the lack of intent to commit a tax offense, nor the commission of a tax offense for the first time, nor the difficult financial situation of the tax agent, nor any other reasons were accepted by the tax authorities as circumstances excluding or mitigating guilt in this case.

In Letter No. 03-04-05/16172 dated March 15, 2018, representatives of the Ministry of Finance directly indicated that the tax agent does not transfer his own funds, but funds withheld directly from the taxpayer’s income upon their actual payment. Accordingly, by failing to remit personal income tax within the prescribed period, the tax agent is illegally using taxpayers’ funds, which is unacceptable.

At the same time, in practice, tax authorities tried to apply Art. 123 of the Tax Code of the Russian Federation and in the case of timely payment of personal income tax to the budget, but with errors in the payment order, for example, when paying personal income tax by a separate division of the organization. Although, according to the legal position of the Supreme Arbitration Court, a tax agent is recognized as having fulfilled its obligations to the budget system of the Russian Federation in the event of calculation, withholding and transfer of tax to the appropriate account of the Federal Treasury (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 23.

2013 No. 784/13 in case No. A06-9384/2011). Also, the Presidium of the Supreme Arbitration Court came to the conclusion that incorrect indication of the OKATO code in payment documents does not lead to the formation of arrears and cannot be considered as a basis for accrual of penalties, since the tax was transferred to the budget system of the Russian Federation by the tax agent within the prescribed period.

A similar position is reflected in the Ruling of the Supreme Court of the Russian Federation dated March 10, 2015 No. 305-KG15-157 in case No. A40-19592/14. Accordingly, indicating the details of an organization instead of indicating the details of its separate division is not a basis for recognizing the obligation to pay tax to the budget system of the Russian Federation as unfulfilled.

The Letter of the Federal Tax Service of Russia dated November 24, 2017 No. GD-4-11/23852 clearly states that the Tax Code of the Russian Federation does not provide for liability for improper performance by a tax agent of its duties, in particular for violation of the procedure for transferring withheld personal income tax. Consequently, if the tax agent withheld personal income tax and transferred it in a timely manner and in full, the tax authority has no grounds to bring him to tax liability in accordance with Art. 123 Tax Code of the Russian Federation. This position was reflected in the Resolution of the Supreme Arbitration Court of the Russian Federation dated March 24, 2009 No. 14519/08.

At the same time, tax authorities remind that violation of the procedure for transferring taxes leads to difficulties in identifying payments by the tax authority, as well as difficulties for the tax agent himself in clarifying the grounds, type and identity of the payment. It's hard to disagree with this.

PERSONNEL (100) 5.1. Vacation (7) 5.10 Salary (5) 5.2. Maternity benefits (1) 5.3. Sick leave (7) 5.4.

Dismissal (11) 5.5. General (21) 5.6. Local acts and personnel documents (8) 5.7. Occupational safety (8) 5.8. Hiring (3) 5.9.

Foreign personnel (1) 6. Contractual relations (34) 6.1. Bank of contracts (15) 6.2. Conclusion of an agreement (9) 6.3.

Additional agreements to the contract (2) 6.4.

Termination of the contract (5) 6.5.

Claims (3) 7. Legislative framework (37) 7.1.

5.1. Art. 23 of the Tax Code of the Russian Federation). If receipt of the electronic request is not confirmed, this threatens to block the taxpayer’s bank accounts (Clause 3 of Article 76 of the Tax Code of the Russian Federation). There is no officially approved sample explanatory letter sent in response to the Federal Tax Service's request for clarification.

Is this legal? It is right that the requirements submitted by the Federal Tax Service may not have the stamp of the tax authority (letter of the Federal Tax Service of the Russian Federation NED-3-2/2739 dated July 15, 2015). Question No. 3.

The tax office has no right to charge you a fine for refusing to provide explanations. However, it is in your best interests to provide explanations, because

Based on discrepancies between the declaration data and the tax authorities, you may be charged additional taxes or payments, and this is more complicated.

Rate the quality of the article. It is best, of course, in such a situation to predict such a course of events, and if any error is discovered, it is best to immediately submit the necessary explanations to 6-NDFL in order to clarify the position of the company, as well as its reputation as a conscientious agent performing the duties assigned to it obligations. In case of zero

4): “...a disproportionately large fine can turn from a measure of influence into a tool for suppressing economic independence and initiative, excessive restriction of freedom of enterprise and property rights, which, by virtue of... the Constitution of the [RF]...ch.

1 tbsp. 34, part 1-3 art. 35, part 3 art. 55 of the Constitution of the Russian Federation is unacceptable.” It often happens that a company or entrepreneur has been fined, but they have nothing to object to on the merits of the violation committed - yes, they are guilty... And this is where mitigating circumstances can come to the rescue, because:

- If there is at least one such circumstance, the tax penalty must be reduced by at least half. 3 tbsp. 114 Tax Code of the Russian Federation. Moreover, the minimum fine may also be reduced (for example, 1000 rubles for late submission of the declaration, paragraph 1 of Art.

Aelita LLC received a requirement to provide

If you withheld personal income tax, but did not transfer it (untimely transferred) it to the budget, then in addition you will be charged a penalty. Penalties must be paid together with the amount of arrears for personal income tax or after payment of the entire amount of such tax. In accordance with the information provided, the response to the Federal Tax Service can be drawn up as follows: “LLC___ when calculating wages for July 2021.

withheld personal income tax in the amount of___. When transferring the amount of personal income tax to the budget on ____(date), the payment order by mistake did not reflect the entire amount of withheld tax; ___ (amount) was transferred. This error was discovered and corrected by us on ___(date) ourselves. Along with the personal income tax surcharge, we calculated and paid penalties.

We invite you to familiarize yourself with: Distribution agreement for the placement and sale of goods (with the condition of the exclusive rights of the distributor)

How to fill out a personal income tax payment form