Working in any position and becoming ill, an employee has every right, in accordance with current legislation, to receive payments in connection with disability.

Recently, the procedure for calculation and payment has changed slightly, but the employee’s rights are protected at the same level. But exactly what rights and benefits he has in the current 2021 will have to be sorted out, since this issue is of great interest to employees, and experienced accountants will also be interested in these innovations. Up-to-date information is provided by the FSS website.

Deception will not work

All payments of cash benefits from government funds are subject to thorough checks, therefore, overpayments calculated on the basis of false documents will be returned to the appropriate government fund.

Ways to verify the provided data

The calculation and payment of social benefits is a very important and responsible moment in the activities of the employer. From the outside, the state conducts inspections and checks the activities of employers.

A package of primary documents is examined for verification. Registers of synthetic and analytical accounts are used. The balance and corresponding accounts 70 and 69 are checked.

Average daily earnings

Calculated using the formula:

- SDR - average daily earnings;

- ZR - employee’s earnings;

- 730 — number of calendar days for the billing period.

This procedure for calculating average daily earnings is established for all categories of workers by the rules set out in paragraph 16 of the regulations approved by Decree of the Government of the Russian Federation dated July 15, 2007 No. 375.

Maximum average earnings

Minimum average earnings

The minimum wage is approved every year. Sometimes it changes throughout the year.

The calculation procedure is as follows: multiply the minimum wage amount on the date of opening the temporary disability certificate by the billing period (24 months) and divide by 730 (the number of days in the billing period).

Calculation procedure

The question most often arises is what payments are not included in the calculation of sick leave in 2021. In order to accurately calculate how much must be paid to an employee in connection with his temporary disability, the employer must comply with the rules for calculating sick leave, for which he must determine:

- billing period;

- the employee’s earnings for the pay period;

- average daily earnings;

- employee's insurance record;

- amount of payment in connection with temporary disability.

Then make the appropriate payment.

Key Aspects

The social rights of every citizen and person are enshrined in the basic law of the country - the Constitution. Legislators of the Russian Federation went further and provided social guarantees for stateless persons and foreign citizens.

The legislative framework

The right to work of Russian citizens and provision of workers during the period of incapacity for work is guaranteed by a number of legislative acts.

The most significant:

- The Constitution of the Russian Federation, in particular, Article 39. Social rights and guarantees of stateless persons and foreign citizens are regulated by Article 62.

- Federal Law No. 255-FZ. It came into force on January 1, 2007;

- The range of relationships in the field of occupational diseases and accidents that occur at work is regulated by regulatory act No. 125-FZ.

Who is eligible for payments?

When considering the issue of receiving social benefits, we mean insured persons.

For complete clarity, they need to be listed:

- Citizens of the Russian Federation;

- citizens of a foreign state temporarily or permanently located and residing in Russia;

- persons without any citizenship or nationality, also living in the country.

These citizens, in addition to the above grounds, must:

- Be in an employment relationship. That is, they are required to begin cooperation after signing an employment contract, such a norm is fixed in the Labor Code of the Russian Federation, or they are allowed to perform labor duties before signing an employment contract, but with the knowledge of the employer or his representative.

- Be in the state or municipal service.

- Engage in individual activities as an entrepreneur, lawyer, member of a peasant farm, member of a tribal or family community inhabiting the North of the country.

- Be voluntary payers of insurance premiums in accordance with Federal Law No. 90-FZ of December 31, 2002

Functions of a medical institution

The main functions of processing and issuing sick leave are assigned to medical institutions by legislation, namely by order No. 31n of the Ministry of Health and Social Development dated January 24, 2012.

It is worth considering the basic rights, powers and rules for applying and receiving workers to medical institutions:

- A sick leave certificate is issued and can be issued to the employee on the day of application or its closure.

It can be handed out on the opening day only if it is referred or applied to another medical institution. This institution extends the sheet, closes it and hands it out. If you are undergoing inpatient treatment, the sheet is issued on the last day of treatment and discharge.

- A certificate of incapacity for work in case of pregnancy and childbirth is issued on the day of its closure.

- Sick leave is granted for a period of no more than 15 days - this is the maximum period for which documents can be issued by attending physicians (solely). The right to further extension passes to the medical commission.

- The period for issuing sick leave by dentists and paramedics has also increased. Instead of 5 days, they are given the right to extend sick leave to 10 days.

These restrictions are provided to prevent pressure on employees of medical institutions and to prevent corrupt practices.

The task of the employer and the Social Insurance Fund

An employee’s work activity is closely connected with the main participants in social assistance payments - the employer and the social insurance fund.

When carrying out their activities, the FSS bodies pursue the following goals and perform the following tasks:

- for the payment of benefits to citizens in case of incapacity for work, for treatment, rehabilitation and sanatorium-resort treatment;

- take part in the development and coordination of state programs on health and labor protection;

- organize work to train specialists and improve their qualifications;

- interact in the implementation of their tasks with other bodies.

The main task of the employer is the fair and timely calculation and payment of social contributions on behalf of the employee. In addition to the main task, the employer is required by legislators to issue certificates for the last 2 years, or the entire period preceding the day of applying for the certificate (if this period is less than 2 years).

Watch the video about calculating sick leave in 2020

Methodology for calculating sick leave in 2021 with examples

For a clear example of calculating benefits, consider the following situation. There is information about an employee who has worked for the company for 7 years and has a similar insurance record. The total accrual for 2 years was 900 thousand rubles . Stay on sick leave – 10 days . So, in order to calculate temporary disability benefits, you must perform a number of actions:

- First, you need to calculate the average daily income - 900,000/730 days = 1,232.90 rubles.

- Since the employee has 7 years of experience, he can receive 80% of his income, i.e. The average daily income must be multiplied by 80% and equals 1232.90 * 80% = 986.30 rubles.

- As a result, the disability benefit is 986.30 rubles * 10 days of sick leave = 13808.50 rubles. This formula applies in 2021.

What is included in the amount of earnings?

Sick leave is calculated based on wages for the last 2 years, i.e. in 730 days . The accrual comes from wages and other accruals, which are confirmed by certificates from employers. Such certificates must be issued by each employer, both at the request of the employee and without it.

When calculating sick leave, all bonuses and remunerations that were paid to the employee for a certain period are taken into account. According to Federal Law No. 212-FZ of July 24, 2009, they must make social contributions to the social insurance fund.

Depending on experience

The benefit paid directly depends on the employee’s length of service:

- To receive 100% sick pay, you must have more than 8 years of work experience.

- If the insurance activity lasts from 5 to 8 years , then the employee receives 80% of his average monthly income.

- If the service is less than 5 years , the employee will receive only 60% of his average monthly salary.

Without experience, you can only get the minimum wage - minimum wage.

Excluded periods

Temporary disability benefits are accrued for a 2-year period, with the exception of certain periods:

- stay and care for a disabled child,

- the length of time the woman is on maternity leave,

- time of incapacity;

- paid parental leave,

- the period of release of an employee from his position, with the condition of maintaining wages (full or partial, for part-time work), if no payments were made to the social insurance fund.

The accrual of benefits after maternity leave can occur with an application to replace the unprofitable period with a more profitable one at the discretion of the employee, i.e. Years may change.

Calculation of average daily earnings

The main criterion for calculating the benefit is the amount of average daily income accrued over the last two years, i.e. in 730 days.

Example. Salaries for 2012 amounted to 600,000 rubles and for 2013 – 650,000 rubles. But there are maximum restrictions for accounting for benefits: for 2012 - 512 thousand rubles, and for 2013 - 568 thousand rubles. Then, in order to calculate the average daily earnings, it is necessary to carry out a number of mathematical operations.

Sample calculation of earnings:

The income for 2 years is added up (512,000 + 568,000 = 1,080,000 rubles ) and divided by 730 days, i.e. number of days for 2 years: 1479.45 rubles.

If there is no income

Slightly different calculations and accrual rules apply to persons who had no earnings during the billing period or who had earnings below the established level.

For them, an accrual scheme is used based on the minimum wage (minimum wage), according to the minimum wage.

When an employee works part-time, benefits are calculated in proportion to the minimum wage. If an employee works in an area where a regional coefficient is in effect, then benefits are calculated according to the minimum wage in proportion.

When a child is sick

A sick leave can also be issued in the event of a child’s illness. In this case, the employee receives 100% payment for the first 10 days, and in subsequent days - only 50% of the average monthly salary.

Domestic and work injury

A different amount of sick leave payment is calculated for employees whose incapacity for work occurred in the event of an occupational disease or occurred as a result of professional activity ( code 02 ).

The amount of the benefit is paid in 100% proportion to income, but the payment cannot exceed 4 minimum established amounts of insurance payment.

There are no restrictions on the maximum amount that is taken into account.

Part-timer

Concluding employment contracts is possible with any number of employers, unless the signing of such is prohibited by law. All benefits and allowances provided for by current legislation must be paid to the part-time worker in full from his average earnings.

Payment can be made at all places of his work. Or you can apply for it at one of the places of work of his choice, where he works part-time or full-time.

If there is no certificate

For employees for whom benefits are calculated without a certificate of income (2NDFL) from a previous place of work, the rule for calculating the minimum wage applies. But such an accrual has some nuances: the amount of the minimum wage is divided by the number of months in which the moment of incapacity occurred.

After dismissal

The legislator prudently took care of dismissed employees: even after dismissal, the employee can hope to receive benefits in case of disability.

He can receive a payment in the amount of 60% of the average monthly earnings if no more than 30 days have passed since the dismissal, and at the time of the onset of incapacity he is not employed.

Accounting nuances when accruing: taxation and postings

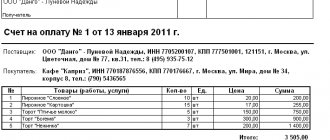

The basis for the calculation and payment of temporary disability benefits is sick leave. When paying cash benefits through the cash register, accounting records transactions in the following way:

Benefits have been accrued - Debit 69 of account and CREDIT 70 - Social settlements. insurance.

Social insurance payments have been made - DEBIT 70 and CREDIT 50.

Modern employment has become much more complicated for job seekers. Find out what hiring tests employers use. The task of a patent attorney is to assist in registering a trademark. Read how to avoid mistakes during the procedure in this article.

Autonomiya is an excellent example for the name of a car service. Lots of examples of LLC names here.

What income is taken into account?

When calculating compensation for lost earnings, all income from which insurance premiums were withheld is taken into account. The list of its sources is regulated by Federal Law No. 255 of December 29, 2006, which defines the order of relationships, rights and obligations of participants in insurance relations. It does not include payments from which mandatory payments have not been made and have the status of benefits and material assistance. The calculation takes into account profit having the status:

- Wages from which social contributions were withheld;

- Wages from which mandatory payments were not withheld due to the classification of a person’s activity into a category from which income is exempt from insurance contributions;

- Awards for certain results;

- Rewards for achievements.

When determining the total amount of payments to an employee and his length of service, days of leave without pay, for child care, or taken for education and passing exams are not taken into account. Days added to vacation provided due to the employee’s illness during official paid leave or the need to care for a child are not included in the calculation. If, due to problems in the organization of activities, there was downtime in it, and during this period the employee fell ill, then these days are not included in the calculation.

Destination of benefit

If, at the time of the insured event, the sick employee had worked for the previous two years and continues to work in the same company, then the benefit will be paid to him by this employer.

If there were several employers, then there are three options for calculating benefits (Article 13 of the Federal Law of December 29, 2006 No. 255-FZ).

1. First option: if at the time of the insured event the insured person works for several employers and was employed by them in two calculation years, then the benefit is assigned and paid by each employer without taking into account the payments of the other employer.

Example

An employee of Passive LLC, Rogov, works part-time at Aktiv CJSC. In the previous two years, he worked in the same organizations. In March of this year, Rogov was ill. From the clinic, the employee brought two certificates of temporary incapacity for work - for each organization. Each of them will pay him the benefit based on the amounts paid to Rogov for the billing period.

2. Second option: if at the time of the insured event a person works in several organizations, and in the two previous years he worked in others, then he can receive benefits at one of the last places of work of his choice.

Example

An employee of Passive LLC, Rogov, in one of the two years preceding the year of granting benefits, worked at Passive LLC and part-time at Aktiv CJSC, in the other - at Saldo LLC and part-time at Accept LLC. In March of this year, Rogov was ill. The employee brought a certificate of temporary incapacity for work from the clinic. To assign and pay benefits, he can present it either to Passive LLC or to Aktiv CJSC. The selected organization will assign and pay benefits to Rogov, taking into account payments from all employers.

3. Third option: if at the time of the insured event a person works in several organizations, and in the two previous years he worked for both these and other employers, then he can receive benefits either for each place of work without taking into account payments from other employers (first option), or at one of the last places of work of your choice (second option).