How to reflect in the accounting of a Russian organization (limited liability company (LLC)) operations to increase the authorized capital at the expense of retained earnings based on a decision made by the sole participant of the LLC (an individual - a tax resident of the Russian Federation)?

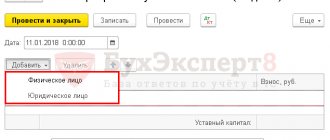

The LLC participant decided to increase the authorized capital of the LLC in the amount of RUB 2,000,000. at the expense of retained earnings. The organization does not make cash payments to the participant this year.

What reasons could there be for increasing the authorized capital of a company?

1. A new member joins the group. When a new member joins the team, he makes an additional investment (this can be cash or property). Thus, he acquires his interest in the share, the right to vote when making important decisions in the company, but also other rights and obligations that other co-founders of the LLC have, and dividends from the company’s activities. 2. They make large transactions. When transactions are concluded with large companies, including foreign ones, the amount included in the authorized capital is of particular importance. Since its value includes the minimum amount of the enterprise’s property, guaranteeing the interests of shareholders. In the event that the Company becomes bankrupt, the size of the capital is the amount that creditors are able to dispose of. Therefore, this value can be called confidence in creditors, at a time when they invest in the activities of a company that does not have the minimum capital (>10 thousand rubles). In another way, we will say that such an enterprise has a more solid appearance. 3. There are not enough funds for turnover. The funds available in the authorized capital of the Company are used to meet the economic and financial needs of the enterprise. If they are in short supply and there is no necessary profit, then additional investments are made. In addition, when the authorized capital increases due to a lack of funds, the company does not need to pay VAT. 4. Receive a license or certificates. To obtain a license or certificate, certain conditions must be met regarding the amount of the authorized capital. The larger the amount of the authorized capital, the higher the indicators of financial stability of the LLC in front of partners and creditors, and the authorities that issue the license.

Personal income tax (NDFL)

The object of personal income tax taxation for a taxpayer who is an individual who is a tax resident of the Russian Federation is income received by him, in particular, from sources in the Russian Federation (clause 1 of article 207, clause 1 of article 209 of the Tax Code of the Russian Federation).

When determining the tax base, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account, as well as income in the form of material benefits, determined in accordance with Art. 212 of the Tax Code of the Russian Federation (clause 1 of Article 210 of the Tax Code of the Russian Federation). At the same time, the list of income from sources in the Russian Federation for the purposes of calculating personal income tax is open, as follows from paragraphs. 10 p. 1 art. 208 Tax Code of the Russian Federation.

The date of actual receipt of income when receiving income in cash is defined as the day of payment of funds, including their transfer to the taxpayer’s bank accounts or, on his behalf, to the accounts of third parties (clause 1, clause 1, article 223 of the Tax Code of the Russian Federation), when receiving income in kind - the day of transfer of income in kind (clause 2, clause 1, article 223 of the Tax Code of the Russian Federation).

As noted above, when increasing the authorized capital at the expense of the company’s property (at the expense of retained earnings), the company participant does not actually receive funds, goods (work, services), or other property. Based on this, we can conclude that an increase in the authorized capital at the expense of retained earnings does not lead to the formation of income subject to personal income tax.

There are also judicial acts in which the courts came to the conclusion that the company participants have no income caused by an increase in the nominal value of their shares until the moment the company participant exercises any of their property rights, certified by the corresponding share in the authorized capital.

However, this position is not the only one. According to the Ministry of Finance of Russia, when increasing the authorized capital at the expense of retained earnings at the time of its state registration, an individual generates taxable income, which is subject to personal income tax on a general basis (see, for example, Letter of the Ministry of Finance of Russia dated May 22, 2017 N 03-04- 06/31351). As an argument for this position, clause 19 of Art. 217 of the Tax Code of the Russian Federation, which provides for non-taxable income in the form of the difference between the new and original nominal value of a share in the authorized capital, obtained only as a result of the revaluation of fixed assets (assets). Non-taxable income generated as a result of an increase in the nominal value of a participant’s share at the expense of retained earnings of previous years, Art. 217 of the Tax Code of the Russian Federation, which determines the list of income not subject to personal income tax, does not contain.

Additionally, on the question on what date income arises in the form of an increase in the nominal value of shares in the authorized capital at the expense of retained earnings from previous years, with explanations from the Ministry of Finance of Russia and the Federal Tax Service of Russia and law enforcement practice, see the Encyclopedia of disputes regarding personal income tax and insurance premiums.

In this consultation, we proceed from the assumption that the organization has decided to be guided by the explanations of the Russian Ministry of Finance.

In this case, the organization is recognized as a tax agent for personal income tax, whose responsibilities include calculating the amount of personal income tax, withholding it directly from the taxpayer’s income upon actual payment and transferring the tax amount to the budget (clauses 1, 2, 4 of Article 226 of the Tax Code of the Russian Federation) .

Since in the situation under consideration the organization does not make payments to the company participant in cash this year, there is no possibility of withholding the calculated amount of personal income tax. In this case, in accordance with paragraph 5 of Art. 226 of the Tax Code of the Russian Federation, the organization is obliged, no later than March 1 of the year following the expired tax period in which the corresponding obligations arose, to notify in writing the taxpayer and the tax authority at the place of its registration about the impossibility of withholding tax, about the amounts of income from which tax was not withheld, and the amount of unwithheld tax. For more information on this issue, see Practical Guide on Personal Income Tax.

How do they decide that it is necessary to increase the authorized capital?

As mentioned above, this decision remains with the participants of the company. As a general rule, it is required that the votes be no less than 70% of all participants combined. But such a rule is not the only one that exists. According to the charter of an LLC, it is possible to provide for much more votes that are required to make a decision regarding an increase in the authorized capital (for example, at least 75% of all participants). Note that the rules can only be changed based on the number of votes to increase them.

The decision of the meeting is confirmed by a protocol signed between the company's participants.

Distribution of LLC profits and losses

Current LLC legislation also obliges Limited Liability Companies to maintain accounting records, prepare financial statements and approve the distribution of profits and losses. In addition, the Federal Law “On LLC” defines the purposes for which the Company’s net profit can be used, namely:

- 1.

Distribution among the Company's participants. Making a decision on the distribution of profits between LLC participants falls within the competence of the General Meeting and can be made every few months (quarterly) or once every six months or a year; - 2.

Creation of a reserve fund and other funds. The procedure for creating the fund, as well as its size, must be determined in the Charter of the Company. At the same time, the creation of a reserve fund is a right, and not an obligation, of a Limited Liability Company, in contrast to Joint Stock Companies; - 3.

Increase the authorized capital. An LLC can increase its Authorized Capital at the expense of retained earnings.

How to document an increase in capital

In the decision of the meeting between the participants, you need to indicate some information, namely:

• the total amount by which the authorized capital is increased; • coefficient, which is determined by the amount of increase in relation to the share of each participant; • what size of the capital is planned; • within what period participants must deposit additional funds; • it is prohibited or possible for third parties or participants to make additional contributions to the company; • what are the deadlines for making investments; • what rules are used to resolve issues in the case of competitive proposals among participants.

How is reserve capital assessed?

Inventory for reserve capital is carried out in the same way as for additional capital. Check calculations based on reserve amounts:

• which were formed by law; • formed according to constituent documents.

They carry out an inventory of reserve capital to cover losses, pay off company bonds, and to repurchase shares if there are no other means.

Retained earnings are reflected in the financial statements, divided into four subaccounts:

• as retained earnings for previous years; • uncovered loss for previous years; • retained earnings of the current year; • uncovered loss of the current year.

Rules for accounting entries

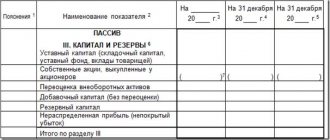

The establishment of accounting begins with the registration of founding contributions. Information is reflected in debit and credit. The main accounting account becomes “Authorized capital” (No. 80). The balance on it is considered a liability and is reflected in the third section of the balance sheet. The final value of this account must correspond to the constituent documents of the company.

Before the actual payment of contributions by the owners, the debt is formed in account No. 75. Subsequently, operations on the fulfillment of their obligations by the participants are reflected here. If necessary, the accountant opens additional accounts. Thus, transactions involving the formation, increase or decrease of capital are classified as subgroup 75.1. The payment of dividends is recorded in subaccount 75.2.

The rules for registering founding contributions depend on the form of receipts.

| Contents of operation | Debit | Credit |

| Registration of a company with an authorized capital (debt of founders for contributions) | 75 | 80 |

| Making a monetary contribution by a participant to a current account | 75.1 and 75 | |

| Payment of a contribution to the company's cash desk | 75.1 and 75 | |

| Transfer of property (fixed assets, materials, other valuables) as a contribution | , , , , , , , , | 75.1 and 75 |

Note! After full payment, account No. 80 remains unchanged throughout the entire activity of the company. Exceptions are cases when the founders decide to change the charter capital.

How is the net profit of a joint-stock company distributed?

According to the law, joint stock companies must be guided by accounting, and at the end of the financial year it is necessary to draw up an accounting report and approve the distribution of profits and losses. Therefore, it is the general meeting of shareholders that makes a decision on how to properly distribute net profit in a joint-stock company. According to the law of the Russian Federation, there are a number of main directions on how to distribute net profit. Among the directions are:

1. Dividends are paid. In this situation, profits are distributed based on the decision of society. 2. Create a reserve fund. Here, the size of the fund is established by the company’s Charter, but the minimum size can be 5% of the total capital according to the Charter. 3. A special fund for the corporatization of company employees is formed. As in the previous situation, this provision is prescribed by the charter of the joint-stock company. All shareholder funds are distributed among the acquisitions of shares that are sold by its shareholders. 4. Increase the authorized capital.

Let us note that whether or not to increase the authorized capital is decided only by the highest management body and is enshrined in the protocol.

The following methods are also used to change the size of the Criminal Code:

1. All members of the company invest additional funds. At the meeting, decisions are made on the size and timing of deposits. 2. Individual participants of the company make additional investments, which can come not only from one, but also from a group of participants. 3. Accept other participants. At the general meeting they decide whether new participants are needed or not. 4. Increase the authorized capital at the expense of retained earnings. In this situation, investment operations are carried out, as a result of which they receive additional profit and increase capital.

In a joint stock company, the authorized capital is the total nominal value of all shares. The increase is driven not only by the rise in the value of each individual share, but also by additional issues. The cost will also increase due to the fact that there is retained earnings from previous periods. Shareholders make decisions using this data.

You should pay attention to how capital moves - this is an indicator of the dynamics of the company’s capital on the last day of the current year:

• the year for which the report is being prepared; • the previous year; • two years ago.

Indicators that have an impact on the size of a company’s capital are divided into the following groups:

• increased capital, also net income; • if the property is overvalued; • income that is aimed at increasing capital; • additionally issue shares or increase the par value of these shares; • reduce capital and loss; • property is revalued; • reduce the value of shares or reduce the quantitative status of shares; • reorganize the legal entity and its dividends; • change additional capital; • change reserve capital.

An important condition is to control the increase in the amount so that it is not higher than the value of the assets, from which the amount of the reserve fund and authorized capital is subtracted according to the reporting data.

When a certain amount is contributed, this is not considered as a sale of any share of the company, so the rights to this part are not transferred to the participant. The member who contributes to the fund receives his duties and rights on the basis that he is a member of the company. It turns out that there is no purchase and sale procedure, so there is absolutely no need to use cash register equipment to carry out such operations.

An announcement is made that a member of the company is making a monetary contribution. This document includes three components:

• receipt; • announcement; • receipt order.

At each point, information is entered in the same way. It is imperative to note the basis for which the investment is made - a contribution to the authorized capital.

At the meeting, they decide not only to increase the authorized capital, but also decide whether to change the position of the announced additional shares. There are certain points during the issue of shares:

• number of other shares of different types; • choose a placement method; • form of payment and placement price.

Ways to increase UC

Authorized capital refers to the enterprise's own resources, participates in assessing its financial stability and affects profitability, which meets the interests of its participants.

For more information about equity, see our material “Equity on the balance sheet is...”.

The minimum sizes of capital assets, characteristic of organizations of various forms of ownership, are established by law. The size of the capital in an LLC in accordance with the norms of the Federal Law “On Limited Liability Companies” dated 02/08/1998 No. 14-FZ is equal to 10,000 rubles.

When determining the minimum level of capital of joint stock companies, the provisions of the Law “On Joint Stock Companies” dated December 26, 1995 No. 208-FZ are taken as a basis. The minimum amount of capital for an open-type JSC is 100,000 rubles, for a closed type - 10,000 rubles.

Read more about the amount of capital in the article “How to calculate your own working capital (formula)?”

Shareholders or participants of an enterprise have the right to increase the authorized capital at the expense of retained earnings . However, there are other ways to grow the management company:

- An increase in its size as a result of contributions made by participants, including newly admitted ones, on grounds that do not contradict the charter of the company.

- Using the additional capital of the joint-stock company.

- Using the balances of special purpose funds, with the exception of the reserve fund and the employee corporatization fund.

Moreover, the first method is typical only for an LLC, and the options listed in paragraphs 2–3 meet the requirements of a JSC.

The change in the increase in the authorized capital at the expense of retained earnings is recorded as follows:

Dt 84 “Retained earnings” - Kt 80 “Authorized capital”.

When the charter is developed independently, how are changes registered?

Starting from the moment when a decision is made to increase the authorized capital, you need to submit documents to the Federal Tax Service of Russia for the purpose of state registration within a month.

Documents required for the tax office to be submitted in order to record changes:

1. The application form (P13001), which was approved on the basis of an order of the Federal Tax Service of the Russian Federation, is signed by the sole executive body of the LLC (general director). It is necessary to fill out the title page and sheet B. The application records the amount of the contribution, what property is being contributed to the authorized capital, what are the terms and procedure for making investments, and the shares that the participants of this fund want to have. 2. Changes made to the constituent documents of the LLC, as they increase the authorized capital. 3. Charter with new amendments. 4. Receipt stating that the state duty has been paid (800 rubles).

Based on practice, we can say that tax officers, in addition to the main list of documents, also ask for a calculation of net assets and a statement of losses and profits for the past year, which should have a mark on submission to the tax office. When the application is signed, the company registers the fact that all requirements regarding retained earnings have been met and that the amount of the increase in the authorized capital is not greater than the difference between the authorized capital (the reserve fund is added here) and the charter capital.

If the document undergoes state registration and changes are made to the Unified State Register of Legal Entities, the LLC tax authorities will issue both certificates indicating that the data has been entered into the Unified State Register of Legal Entities, based on form P50003.

In the case when the decision on changes to the Charter to increase the authorized capital was not made, along with the decision on increasing the capital, therefore the participants are reassembled to make such a decision. This can happen when a contribution is made in foreign currency, therefore the decision of the meeting participants must fix the amount of the contribution in Russian rubles, translated at the rate of the National Bank of Russia on the date on which this contribution was actually made.

Authorized capital: we will increase it at the expense of profit

The authorized capital can be increased, including through retained earnings from previous years. This decision is made by the shareholders (participants) of the LLC or JSC. To make a decision to increase the initial authorized capital must be paid in full (clause 6 of article 90, clause 2 of article 100 of the Civil Code of the Russian Federation). The amount by which the authorized capital of a company is increased at the expense of its property cannot exceed the difference between the value of the company’s net assets and the amount of its authorized capital and reserve fund (Article 18 of the Federal Law of 02/08/1998 No. 14-FZ (hereinafter referred to as the Law on LLC ), paragraph 5 of Article 28 of the Federal Law of December 26, 1995 No. 208-FZ (hereinafter referred to as the Law on JSC)).

Since the increase in the capital capital at the expense of retained earnings is not associated with receiving investments, but is carried out at the expense of the resources of the company itself, the percentage ratio of the shares of participants (shareholders) as a result of an increase in the authorized capital does not change.