Employer reporting

Marina Dmitrieva

Leading expert - professional accountant

Current as of June 21, 2019

Line 090 in the 6-NDFL report will reflect the tax amounts that the tax agent who generated the report returned to the individual taxpayer in the reporting period. The conditions for making such a return and the rules for entering data about it into the report are in our material.

General rules for filling out line 090 in 6-NDFL

Line 090 is the last line from the first section of 6-NDFL.

According to the general rules for forming a section of combined information, it is filled in with a cumulative total. Since the data indicated on line 090 does not need to be divided by tax rates, the line appears in one report only once (unlike data on lines 010–050). The indicator included in the line is formed as the sum of all returns of previously withheld personal income tax made by the agent company in favor of individual payers according to the standards of Art. 231 of the Tax Code of the Russian Federation (letter of the Federal Tax Service dated March 18, 2016 No. BS-4-11/4538).

Let us recall that according to the order contained in Art. 231 of the Tax Code, the tax agent must return to the individual those amounts of personal income tax that he, for some reason, withheld in excess of what was necessary. In this case, the return must also follow a certain order:

- the agent is obliged to inform the individual that excess tax has been withheld from the latter;

- To receive a refund, an individual must submit a written application for a personal income tax refund to the agent;

- in the case of recalculation of personal income tax amounts for an individual when changing tax status (from non-resident to resident), the refund of tax that could not be offset by the end of the year should be carried out not by the employer who withheld the tax, but by the Federal Tax Service, to which the individual applies independently (clause 1.1 of Art. 231 NK).

Nuances of forming line 090

When entering information in line 090 of the 6-NDFL report, you need to consider the following:

- When creating line 090, the tax agent should include there all amounts of tax returned to individuals in the current period, including those refunds that were made for excessive deductions in previous periods (letters of the Federal Tax Service dated March 18, 2016 No. BS-4-11/4538, dated July 17, 2017 No. BS-4-11/ [email protected] ).

- The amount of personal income tax that is subject to refund from the Federal Tax Service under clause 1.1 of Art. 231 of the Tax Code, in 6-NDFL the employer who withheld this tax is not entered. Please note that this aspect has not yet been specifically specified by the Federal Tax Service. However:

- clause 1.1 art. 231 of the Tax Code directly provides for the independent filing of a declaration by an individual taxpayer for the return of such personal income tax (i.e., this should not be done by a tax agent);

- in the title and procedure for filling out line 090 (the procedure was approved by order of the Federal Tax Service of Russia dated October 14, 2015 No. ММВ-7-11 / [email protected] ) we are talking specifically about the personal income tax that was returned only by the tax agent himself.

Based on these standards, we can conclude that in the event of personal income tax, the employer does not reflect the refund in line 090 due to a change in the tax status of the payer.

- The amount of special deductions provided to an individual taxpayer (for example, property) as a general rule does not fall into line 090. This follows from the procedure for filling out the declaration and from the differences between deduction and refund, following from the content of Art. 220 and 231 NK. In accordance with the order of filling in lines 040 and 070 of the report, the provided deductions will already be taken into account. Thus, additional inclusion of the results of calculation of deductions in line 090 will lead to distortion of the data in 6-NDFL.

For information on filling out line 070, see the material “Procedure for filling out line 070 of form 6-NDFL.”

Read about line 040.

An exception would be the case when, despite the individual’s request for a deduction (in the manner set out in paragraph 8 of Article 220 of the Tax Code of the Russian Federation), the agent company for some reason did not provide this deduction and still withheld the tax unnecessarily. Then the actual refund of this tax to an individual must be reflected as part of the indicator on line 090 in 6-NDFL.

Example

Employee Smolenskaya A.S. brought a notice of property deduction in February. Smolenskaya’s salary is 9,500 rubles. In January, the accountant withheld 1,235 rubles from the employee’s salary. Since February, the accountant has stopped withholding income tax from Smolenskaya’s salary. Smolenskaya wrote an application for a refund of over-withheld income tax, which was returned to her on March 5. The accountant filled out 6-personal income tax for the 1st quarter as follows (conditionally we take only the salary of this employee):

Page 020 - accrued income for January-March: 9,500 × 3 = 28,500.

Page 030 - the employee’s deductions in connection with the use of the property deduction are equal to the amount of income for January-March: 28,500.

Page 040 — calculated tax for the 1st quarter: 0, since a property tax deduction was applied to income from the beginning of the year.

Page 070 - tax withheld in the 1st quarter: 1,235 rubles, since in January 2021 the accountant withheld tax from Smolenskaya A.S.

Page 090 - tax returned by the tax agent: 1,235 rubles, excessively withheld income tax of Smolenskaya A.S., which the company returned to her on March 5.

Section 2 will look like this:

| Line number | Index | Explanations |

| Salary for January | ||

| Date of salary payment for January and personal income tax withholding | ||

| Deadline for transferring taxes to the budget | ||

| 9 500 | Smolenskaya's income for January | |

| 1 235 | Personal income tax withheld from the salary of Smolensk in January (before receiving notification of the deduction) | |

| Salary for February | ||

| Payroll taxes for February are not withheld, so the withholding date is filled in with zeros | ||

| Salary taxes for February are not withheld, so the transfer period is filled in with zeros | ||

| 9 500 | Smolenskaya's income for February | |

| Withheld personal income tax (absent, since a deduction was applied) |

Since the salary for March 2021 will be paid in April, it does not fall into section 2 of 6-NDFL for the 1st quarter.

You will find complete instructions on how to fill out line 090 when an employee receives a property tax deduction in the article “Reflection of property deduction in form 6-NDFL (nuances).”

Example

For clarity, we give an example of filling.

The company has 5 employees, this is the number of individuals. persons who received income in the current period. The amount of wages for the year is 1,950,000 rubles, 32,500 rubles for each employee per month. In the period from January of this year to October, personal income tax was withheld from employees by the tax agent in the amount of 253,500 rubles, 21,125 per month.

The actual payment of wages every month is on the 7th, so for October the tax is withheld on 08.11. In November, employee P. brings a notice from the tax office that he has the right to deduct the amount of 1,800,000 rubles.

Employee P. received wages for the period from January to October in the amount of 325,000 rubles. Tax in the amount of 42,250 rubles was withheld from this indicator. The same amount was returned to employee P. For November and December, the withholding tax is 0, since the deduction amount is greater than personal income tax.

A fee was withheld from employees in November according to the indicators of 16,900 rubles, the deduction occurred on 07.12, this amount should be transferred to the budget already on 08.12, but the value for transfer is 0, since the deduction is greater than the withheld personal income tax.

Personal income tax has already been withheld from December wages on January 7th.

- deduction amount 390,000;

- calculated personal income tax – (1,950,000–390,000) * 0.13 = 202,800;

- withheld tax – (21,125 * 10 + 16,900) = 228,150;

- transferred to the budget – 228,150 – 42,250 = 185,900.

The calculation according to Form 6 personal income tax will look like this:

| Line number | Index |

| Section 1 | |

| 010 | 13% |

| 020 | 1,950,000 (cumulative income amount) |

| 030 | 390 000 |

| 040 | 202 800 |

| 050 | 0 |

| 060 | 5 (total number of individuals who received a salary) |

| 070 | 228 150 |

| 080 | 0 |

| 090 | 42 250 |

| Section 2 | |

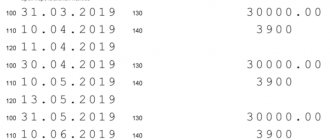

| October | |

| 100 | 30. 09 |

| 110 | 07. 10 |

| 120 | 08. 10 |

| 130 | 162 500 |

| 140 | 21 125 |

| November | |

| 100 | 30. 10 |

| 110 | 07. 11 |

| 120 | 08. 11 |

| 130 | 162 500 |

| 140 | 21 125 |

| December | |

| 100 | 30. 11 |

| 110 | 07. 12 |

| 120 | 08.12 |

| 130 | 162 500 |

| 140 | 16 900 |

Line 090 of the 6-NDFL calculation form: what does it include?

A tax agent is an employer or customer under a GPC agreement (legal entity or individual entrepreneur), who is obliged to withhold personal income tax from individual taxpayers. For ease of understanding, we will simply refer to the tax agent as the agent or employer.

The calculation of the amounts of personal income tax calculated and withheld by the agent, Form 6-NDFL, was approved by the tax authorities (Federal Tax Service order No. ММВ-7-11 dated October 14, 2015/ [email protected] ). The calculation is filled out and submitted quarterly to the Federal Tax Service at the employer’s place of registration.

Line 090 is the very last line of the 1st section. It is called "Amount of Tax Refunded by Agent". From the name it is clear that the result of this line is the entire tax that the agent returned to all his employees in accordance with the requirements of Art. 231 Tax Code of the Russian Federation.

What does it include - line 090 6-NDFL contains all the returned tax that the agent, for some reason, unnecessarily withheld from his employees.

The accountant needs to calculate line 090 when the employer withheld more personal income tax than he calculated, or retroactive deductions were provided.

Refunds of overpaid tax amounts are made by the agent at the expense of personal income tax payable to the budget in the following months, both for a specific taxpayer and for another. This position is shared by the tax authorities (letter from the Federal Tax Service of the Russian Federation for Moscow dated June 30, 2017 No. 20-15/ [email protected] ).

If the accrued income of an individual for the previous months of the reporting year is enough to provide a deduction, then personal income tax does not need to be returned. The agent will simply reduce the income by the deductions provided and will not withhold tax. Then line 090 does not indicate anything.

It should be noted that filling out line 090 in 6-NDFL is not for individual individuals, but for the agent as a whole.

Differences between deduction and return of personal income tax

From Art. 220, 231 of the Tax Code of the Russian Federation it follows that special tax deductions provided to an employee (for example, a property deduction for the purchase of an apartment or a standard deduction for a child) are not included in line 090. In this case, the employer provides a deduction rather than a tax refund. This is where these two concepts differ. The tax deduction is indicated on lines 040 and 070 of the calculation.

It’s another matter if the employer received an employee’s application to provide him with a deduction and for some reason still withheld personal income tax. This could be a counting error or, for example, a glitch in the accounting program. In this case, it is necessary to make a tax refund to the taxpayer and indicate the refund amount as part of line 090.

What are the personal income tax deductions? We wrote in the article:

- investment deduction;

- standard deduction;

- social deduction.

How to fill out line 090? In what cases is it not required to be filled out?

In line 090, data is entered on an accrual basis from the beginning of the reporting year. When forming this indicator, all personal income tax returns made during the reporting period are taken into account. Moreover, this line includes even those returns for which deductions were made in earlier periods. This position is confirmed by letter of the Federal Tax Service dated July 17, 2017 No. BS-4-11/ [email protected]

Don't know your rights? Subscribe to the People's Adviser newsletter. Free, minute to read, once a week.

For example, Rassvet LLC, guided by Art. 231 of the Tax Code of the Russian Federation, in March 2018, returns to mechanic Petrov I.S. the overly withheld tax from the income he received in November 2021 in the amount of 1950 rubles. This amount should be included in line 090 for the 1st quarter of 2021, section 1 of form 6-NDFL. In section 2 the amount is 1950 rubles. not reflected. In this case, the updated 6-NDFL for 2021 will not be submitted. But the employer is required to submit an update on Form 2-NDFL for 2021.

If the tax refund is made by the Federal Tax Service, then the agent who erroneously withheld this tax more than required does not need to fill out line 090. This happens in cases where an individual applies to the Federal Tax Service in person at the end of the year with a declaration in Form 3-NDFL, for example, to receive a social deduction.

In addition, the taxpayer must contact the tax office, and not the employer, when acquiring the status of a resident of the Russian Federation. This procedure is clearly stated in the legislation (clause 1.1 of Article 231 of the Tax Code of the Russian Federation).

How to fill out section 1 of form 6-NDFL: let’s look at an example

At Rassvet LLC for the 1st quarter of 2021, wages were accrued to 25 employees in the amount of 2,250,000 rubles, including dividends of 17,000 rubles.

For this period, employees were provided with tax deductions in the amount of 103,000 rubles.

In addition, in March 2021, Petrov I.S. was returned the excessively withheld personal income tax in the amount of 1950 rubles.

So, Rassvet LLC accrued and withheld personal income tax in the amount of 279,110 rubles. ((2,250,000 − 103,000) × 13 / 100), including a tax of 2,210 rubles was withheld from dividends. (17,000 × 13/100).

According to the lines of the declaration, the accountant must fill out:

- Line 020 “Amount of accrued income” - 2,250,000.

- Line 025 “Including the amount of accrued income in the form of dividends” - 17,000.

- Line 030 “Amount of tax deductions” - 103,000.

- Line 040 “Amount of calculated tax” - 279,110.

- Line 045 “Including the amount of calculated tax on income in the form of dividends” - 2210.

- Line 050 “Amount of fixed advance payment” - 0.

- Line 060 “Number of individuals who received income” - 25.

- Line 070 “Amount of tax withheld” - 279,110.

- Line 080 “Tax amount not withheld by the tax agent” - 0.

- Line 090 “Amount of tax returned by the tax agent” – 1950.

***

So, we learned when to fill out line 090 in 6-NDFL. Let us remind you that when creating a line, the tax agent takes into account the entire personal income tax refund made in a given reporting period for all individual taxpayers. The reason why the agent withheld tax unnecessarily (an error, a software product failure, the accountant losing the deduction application) does not matter when returning personal income tax. When changing the tax status to “resident of the Russian Federation”, tax refunds are made only by the tax authority. This is directly provided for by the Tax Code of the Russian Federation.

We explain the procedure for filling out and submitting the 6-NDFL calculation

Date of publication: 07/11/2016 10:04 (archive)

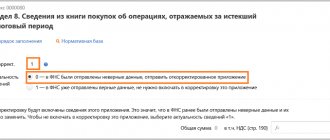

The deadline established for submitting the calculation of the amounts of personal income tax calculated and withheld by the tax agent in Form 6-NDFL for the 1st half of 2021 is approaching, which, taking into account weekends, should be submitted no later than 08/01/2016.

When submitting it, it is necessary to take into account all errors and inaccuracies that were made when submitting the calculation for the 1st quarter of 2021.

An analysis of the submitted reports for the 1st quarter of 2021 showed that typical errors when filling out the 6-NDFL calculation are the failure (incorrect completion) by tax agents of such mandatory details as the name of tax agents, tax rates, tax withholding dates, dates of actual receipt of income, tax remittance deadline etc. In addition, a number of tax agents filled in invalid tax identification numbers, tax agent names with incorrect character lengths, and overstated the number of individuals who received income.

If such errors are detected, the tax authority will certainly contact the tax agent with a request to clarify the calculation, otherwise the calculations will not be loaded into the inspection database.

Let us recall the general requirements for the procedure for filling out the calculation in form 6-NDFL.

The calculation is completed on the reporting date, i.e., on March 31, June 30, September 30, December 31 of the corresponding tax period.

The calculation form, if the tax agent has separate divisions, is filled out for each OKTMO separately. Codes according to OK (OK 033-2013), approved by Order of Rosstandart dated June 14, 2013 No. 159-st. Organizations recognized as tax agents indicate the OKTMO code of the municipality in whose territory the organization or a separate division of the organization is located. Individual entrepreneurs recognized as tax agents enter the OKTMO code at their place of residence.

Individual entrepreneurs who are tax agents who are registered at the place of implementation of activities in connection with the application of the taxation system in the form of UTII and (or) the patent taxation system, indicate the OKTMO code at the place of registration of the individual entrepreneur in connection with the implementation of such activities, in relation to their employees are assigned a code according to OKTMO at the place of their registration in connection with the implementation of such activities.

On the title page of the 6-NDFL calculation, in the field “at the location (accounting) (code)” the code of the place of submission of the declaration must be indicated. Code 212 - must be indicated in the calculation for the Federal Tax Service Inspectorate at the location of the organization, code 220 - in the calculation for the Federal Tax Service Inspectorate at the place of registration of the separate division.

If the indicators of the corresponding sections of the calculation form cannot be placed on one page, the required number of pages is filled out. In the calculation form, all details and total indicators are required to be filled in; if there is no value for the total indicators, zero (“0”) is indicated.

Features of the procedure for filling out section 1 of the calculation in form 6-NDFL.

The first section of the calculation in form 6-NDFL is filled out with an accrual total from the beginning of the year for the first quarter, half a year, nine months and a year.

Line 030 “Amount of tax deductions” is filled in according to the values of codes for types of taxpayer deductions, approved by Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected] “On approval of codes for types of income and deductions.”

When filling out line 060 “Number of individuals who received income,” all individuals who received income in the reporting period are taken into account, while a person who received income under various agreements is counted as 1 individual.

If the tax agent paid income taxed at different personal income tax rates in the reporting period, then for each rate in section 1 a separate block of lines from 010 to 050 is filled in, where each block includes total data on income taxed at specific personal income tax rates (13, 15, 30 and 35%), the deductions provided for them and the calculated personal income tax amounts.

It is important that the “Total for all rates” block is filled out only once (on the first page of section 1), it reflects the total amount of withheld personal income tax for all rates on line 070, and on lines 080 and 090 - respectively, the total amounts of non-withheld and returned personal income tax for different rates.

Features of the procedure for filling out section 2 of the calculation in form 6-NDFL.

In accordance with the clarifications of the Federal Tax Service of Russia dated February 12, 2016 No. BS-3-11/553 and dated February 25, 2016 No. BS-4-11 / [email protected] in section 2 of the calculation of Form 6-NDFL for the corresponding tax period those transactions are reflected which were committed during the last 3 months of this reporting period. Moreover, if an operation was carried out in one reporting period and completed in another, such an operation should be reflected in the completion period.

To check the accuracy and correctness of filling out the 6-NDFL calculation, it is advisable to use the Control ratios of the indicators of the calculation form, which are contained in the letters of the Federal Tax Service of Russia dated January 20, 2016 No. BS-4-11/591 and dated March 10, 2016 No. BS-4-11/3852.

If the tax authority determines the presence of false information contained in the calculation of 6-NDFL, Art. 126.1. The Tax Code of the Russian Federation provides for the liability of a tax agent in the form of a fine in the amount of 500 rubles. for each submitted document containing false information.

At the same time, according to clause 2. Art. 126.1 of the Tax Code of the Russian Federation, a tax agent is exempt from liability if he independently identifies errors and submits updated documents to the tax authority before the moment when the tax agent learned that the tax authority discovered that the information contained in the documents submitted to him was unreliable.

Filling out line 090 in 6-NDFL for 2018

Please note the procedure for filling out line 090 in 6-NDFL for 2018. In general, there are no difficulties here:

- Column 090 is filled out only in the reporting period when you received a statement and evidence from the employee that he is entitled to a deduction. This explanation is in the letters of the Federal Tax Service dated 03/18/2016 No. BS-4-11/4538, dated 07/17/2017 No. BS-4-11/ [email protected]

For example, since February 2021, an employee has the right to deduct a child, but she provided all the documentation to the organization only in August. Therefore, the accountant will return all the overpaid tax to her, starting in February, but in 6-NDFL in line 090 she will reflect this only in the 3rd quarter of 2021.

- If a company returned personal income tax or part of it to several employees, then a breakdown is not required, everything is written in one amount. Likewise, there is no need to separate income returns at different rates, if any;

- Data for 090 are summarized throughout the year.

For example, there was a return in the 2nd quarter, and then another in the 3rd. So, in the report for 9 months, enter the total amount from two returns;

- The money that the tax office returned to your employee is not shown. This fact does not concern the enterprise at all;

- If you make required deductions to the employee and there are no overpayments of income, then line 090 is not filled in. It is intended exclusively for personal income tax amounts that the company once overpaid and then returned to the employee.

Attention! Form 6-NDFL is ready for filling out for the 1st quarter of 2019. The current form 6-NDFL has been added to the “Simplified 24/7” program in order to report correctly and on time for the 1st quarter of 2021. Fill out the report in the Simplified 24/7 program and send it to the Federal Tax Service. It's free and takes just minutes. Fill out 6-NDFL for the 1st quarter of 2021>>>

Deadlines for submitting 6-NDFL

6-NDFL calculations are submitted by all tax agents at the end of each quarter. In 2021 the deadlines are:

- for the first quarter - until April 30, 2021

- for half a year - until July 31 (August 2), 2021

- nine months before October 31 (November 1), 2021

- per year - until April 1, 2022

If the deadline falls on a weekend or holiday , the calculation must be submitted no later than the next business day.

Tax agents submitting calculations for 25 or more insured persons are required to submit them electronically using the TKS.

All others can choose the form (on paper or electronically) at their discretion.

Typically, the calculation is submitted by tax agents to “their” Federal Tax Service, that is, at the place of registration of the company or at the place of registration of the individual entrepreneur. But for certain cases, separate rules are established.

Separate units

A legal entity that has separate divisions submits a calculation at the place of registration of each of them . The form includes the income and personal income tax of employees of this division.

If two separate divisions are registered with the same Federal Tax Service, but they have different OKTMO codes (belong to different municipalities), then 6-NDFL is submitted separately for each of them. If the situation is the opposite, that is, two separate divisions with one OKTMO are registered with different Federal Tax Service Inspectors, then a legal entity can register with one of the inspectorates and report to it under 6-NDFL for both divisions.

It happens that an employee managed to work in different branches during one tax period. If they have different OKTMOs, then you will have to submit several forms.

On the title page of 6-NDFL, if there are divisions, you must indicate:

- TIN of the parent organization;

- Checkpoint of a separate unit;

- OKTMO of the municipality in whose territory the employees’ place of work is located (indicate it in the payment order).

Change of address

If during the tax period to another Federal Tax Service, then two forms 6-NDFL must be submitted to the new place of registration:

- the first - for the period of stay at the previous address, indicating the old OKTMO;

- the second - for the period of stay at the new address, indicating the new OKTMO.

The checkpoint in both forms indicates the one assigned to the new Federal Tax Service.

Line 090 in 6-NDFL: example

Let's see with the help of an example when line 090 is filled out in 6-NDFL in 2021.

Example. Monthly salary of D.P. Telegina is 35,000 rubles (income - 4550 rubles). Payment of income in the company where this employee works occurs on the 6th of the next month.

- For the first half of 2021, Telegina received - 210,000 rubles, personal income tax - 27,300 rubles;

- For 9 months of 2021, Telegina’s income was 315,000 rubles, personal income tax – 40,950;

- In September, after paying her August salary, Telegina submitted a statement in which she indicated a deduction of 500,000 rubles due to her from the beginning of the year in connection with the purchase of housing.

Let's look at the features of registration of 090 in 6-NDFL.

Half-year report (2nd quarter) 2021:

| Column number | What data | Comments on the design |

| 210 000 | This is income from January to June | |

| 27 300 | Accrued income for the period January-June | |

| 22 750 | Income paid for January-May. This did not include the personal income tax amount for June, since it will be transferred to the budget only in July, and this is a different reporting period. | |

| There has been no return of income yet |

Report for 9 months (Q3) 2021:

| Column number | What data | Comments on the design |

| 315 000 | Total salary from January to September | |

| 315 000 | Since the required deduction exceeds income, Telegina’s entire salary is transferred to the deduction column. | |

| Since there is no base (deduction above salary) from which personal income tax is taken, it is not calculated | ||

| 36 400 | This is the amount of personal income tax paid in the period from January to August (35 000*8)*13%. After all, Telegina’s application was received after the payments for August were issued, which means that income was transferred for 8 months | |

| 36 400 | Telegina was refunded the entire amount of previously paid tax, which is recorded in line 090. |

As for Section 2, everything is unchanged there, but in 6-NDFL for 2021, column 140 will contain 0, because the deduction exceeds the payments and the tax is not transferred.

What is reflected in this line

How to fill out this line, depending on the taxation method. Cell number 090 is the last one in section 1 of the calculation in Form 6 of personal income tax. Like the entire section, it is filled in with a cumulative total from the beginning of the calendar year to the end of the reporting period. The procedure for filling out is the same as section 1.

There is no need to decipher the value indicated here based on income tax rates, so an equal indicator is included there. Unlike lines 010 - 050, it appears only once in the declaration.

The number indicated in the cell is an indicator reflecting the amount of personal income tax that the employer, represented by the tax agent, returned to the employee - the taxpayer.

In Art. 231 of the Tax Code of the Russian Federation states that if an employer deducts an excess income tax from a worker for an unknown reason, then he is obliged to return the amount, observing the following procedure:

- Mandatory notification to the employee of the fact of excess calculated tax. It will be an appendix to the report;

- the employee writes a written statement addressed to the employer with a request for the return of the mandatory income tax that was excessively withheld from him;

- if an individual changes status from non-resident to resident, then the refund is made not by the employer, but by the Federal Tax Service. The process occurs in the stated order.

Such explanations are described in this article.

Let's sum it up

- Line 090 in form 6-NDFL is intended to reflect the amounts of tax returned by the tax agent to taxpayers in the reporting period in accordance with Art. 231 Tax Code of the Russian Federation.

- Line 090 is located in Section 1 of the report and is subject to the general rule of this section about generating data on an accrual basis. But at the same time, the information provided in it does not need to be divided according to different rates.

- When the inclusion of information on different rates in the report results in the creation of Section 1 on several pages, line 090 should be completed only on the first of the pages.

If you find an error, please select a piece of text and press Ctrl+Enter.

How to correctly form an indicator for line 090

The employer, when filling out calculation 6 of personal income tax, takes into account the following nuances:

- When filling out line 090, the fee returned to employees from excessive collection for the reporting period is reflected;

- values returned in the previous reporting period are also taken into account;

- tax deductions that apply to specific workers do not fall into line 090 6 of personal income tax;

- if the fee is returned by the Federal Tax Service, and not by the agent, then the latter does not reflect this indicator in the cell.

But, in a situation where the excess value is withheld by the employer, and the return is made by the Federal Tax Service, the following procedure is provided:

- The employee himself, and not the agent, must file a declaration for mandatory income tax;

- line 090 reflects information only about the tax agent, but not about the taxpayer.

On a note! If a worker wrote an application for a deduction, but the employer did not do this, then he withheld an excess amount of the fee from the employee. Then the return will be reflected in line 090 in 6 personal income tax.

For example, an employee has the right to a property deduction. I brought the relevant papers only in April. Cell 030 reflects the value of the deduction provided, but from the period in which the employer received documentary evidence.

Property deductions, as a general rule, are provided from the beginning of the year. However, the employer does not have any obligation to submit a “clarification” during the period from January to April. For the first time, the deduction will be reflected in the half-year report. There is no need to correct the calculation for the 1st quarter.

Cell 070 reflects the personal income tax that the employer withheld in the current period and then returned to the employee. The same value is shown in line 090 6 personal income tax.

By the amount of tax returned by the tax agent to a specific employee, the employer reduces current payments to employees. But in cells 070 and 140 they indicate payroll tax.

It turns out that the withheld tax rate will be greater than the rate transferred to the budget. Control ratios will be separated. This is not considered an offense and no penalties may arise.

Correct formation of the deduction line

When preparing a report, the tax agent takes into account the following points:

- line 090 displays the fee that was returned to the employee from the excess deduction for the reporting period;

- those returns that were made in previous reporting are also taken into account;

- deductions that were applied to a specific individual are not displayed in the line;

- when returning the tax to the Federal Tax Service, this information is not included in the report by the tax agent.

If the return is made through the Federal Tax Service, a slightly different procedure is provided:

- the income tax return is submitted to the authority by an individual and not by a tax agent;

- line 090 should be filled out only according to the information of the employer, but not the taxpayer himself.

The tax agent needs to pay attention to the preparation of reporting. Indication of information that does not correspond to reality entails penalties, which tax inspectors have the right to impose. Cell 090 is as important as the other lines accompanying it when compiling 6-NDFL.