The state seeks to support small and medium-sized businesses. This support is most often expressed in the form

VAT on exports for organizations on the simplified tax system. Organizations on the simplified tax system are not payers.

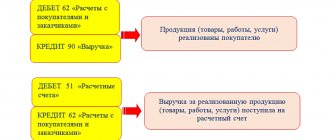

Most companies use non-cash payments in their work. This is a convenient method of calculation for both

How to draw up a power of attorney to submit reports to the tax office? Unified form for transfer of tax authorities

09/19/2019 0 202 5 min. The legislation provides for several types of employment with mandatory documentation.

Transport tax is a fee paid to the local budget of the region by the owners of all vehicles equipped with

Account 51 “Current accounts” is intended to summarize information on the availability and flow of funds

A part-time employee means savings on salary. But only when everything is finalized

The concept of OKVED After registration, companies are assigned individual numbers and codes that reflect the selected type

Kontur.Accounting - cloud accounting for business! Quick establishment of primary accounts, automatic calculation of taxes, sending reports