Kontur.Accounting - cloud accounting for business!

Quick establishment of primary accounts, automatic tax calculation, online reporting, electronic document management, free updates and technical support.

Try it

When working with contracts, you can come across the notes “excluding VAT” and “VAT not subject to” when determining the contract price, shipping documents, and invoices. In this article we will tell you the difference between “Without VAT” and “Not subject to VAT” and what wording to indicate in the documents.

How to calculate revenue?

For the purposes of calculating and controlling revenue, the following rules apply:

Rule 1. Control the amount of revenue

The right to exemption is lost from the 1st day of the month in which revenue exceeds RUB 2,000,000.

Example

applies VAT exemption from 1 May. It is necessary to control revenue for:

- May June July

- June July August

- August, September, October

- Etc.

Rule 2. Revenue is calculated according to accounting data

Rule 3. We take into account the nuances of calculation

- Revenue is calculated without VAT;

- Advances are not taken into account in the calculation.

Rule 4. Only revenue that is subject to VAT is included in the calculation

According to paragraphs 3 and 4 of the Resolution of the Plenum of the Supreme Arbitration Court dated May 30, 2014 No. 33, receipts from transactions not subject to VAT are not taken into account in revenue.

The following receipts are not subject to VAT:

- From activities in respect of which UTII or PSN is applied;

- From transactions that are exempt from VAT on the basis of Article 149 of the Tax Code of the Russian Federation;

- From transactions that are not recognized as subject to VAT on the basis of Article 146 of the Tax Code of the Russian Federation;

- From the sale of goods (works, services), the place of sale of which is not recognized as the territory of the Russian Federation.

Contract No. _____ for the provision of services

K-sk

"04" March 2021

Open Joint Stock Company "Organization No. 1", hereinafter referred to as the "Customer", represented by Director Ivanov Ivan Ivanovich, acting on the basis of the Charter, on the one hand, and the Limited Liability Company "Organization No. 2", hereinafter referred to as the "Contractor", in the person of Director Petrov Petrovich, acting on the basis of the Charter, on the other hand, we have concluded this agreement as follows:

Subject of the agreement

1.1. The Contractor provides equipment repair services to the Customer, and the Customer undertakes to pay for these services on the terms established by this agreement.

Cost and payment procedure

2.1. The cost of the services provided is 1,500.00 (One thousand five hundred) rubles 00 kopecks, for the entire period of provision of services. VAT is not assessed due to the fact that the “Contractor” applies a simplified taxation system, based on clause 2 of Art. 346.11 Chapter 26.2 of the Tax Code of the Russian Federation and is not a VAT payer, according to the letter of the Ministry of Taxes of the Russian Federation dated September 15, 2003 No. 22-1-14/2021-AZh397, invoices are not issued.

2.2 Services are considered provided after the parties sign the certificate of delivery/acceptance of services provided.

2.3. Payment for services under this agreement is made within 5 (five) banking days from the moment of issuing the invoice and/or signing the Agreement for the provision of services, by non-cash transfer of funds to the Contractor's bank account, or in another way.

3. Rights and obligations of the parties

3.1. The Customer undertakes: 3.1.1. Ensure unobstructed access to equipment to be repaired. 3.1.2. Accept the services provided. 3.1.2. Make full payment for the services provided in the amount and manner provided for in this Agreement.

3.2. The Contractor undertakes: 3.2.1. Provide equipment repair services. 3.2.2. The Contractor has the right to involve non-employees of the Contractor in the provision of services.

4. Responsibility of the parties and resolution of disputes

4.1. For failure to fulfill or improper fulfillment of obligations arising from this agreement, the Parties bear responsibility, the basis and amount of which are established by the current legislation of the Russian Federation.

4.2. Disputes and disagreements arising between the Parties in connection with the fulfillment of obligations under this agreement are resolved through negotiations, including through claims.

4.3. If the Parties fail to resolve the dispute pre-trial, it is referred by the interested party for resolution to the Arbitration Court.

Duration and procedure for termination of the contract

5.1. The agreement comes into force from the moment of signing and is valid until the parties fully fulfill their obligations under this agreement.

Final provisions

6.1. This agreement has been drawn up in 2 (two) original copies, one of which is kept by the Contractor, the other by the Customer, each of which has equal legal force.

7. Legal addresses and bank details of the parties Customer:

OJSC "Organization" Legal address: ___________________________ Actual address: ______________________________ Taxpayer Identification Number ____________ KPP __________

account ___________________________ Bank__________________________ BIC _________________________ Director_____________I.I. Ivanov

"__" ____________20__

Executor:

LLC "Organization No. 2" Legal address: ___________________________ Actual address: ______________________________ Taxpayer Identification Number ____________ Checkpoint __________

account ___________________________ Bank__________________________ BIC __________________________

Director_____________P.P. Petrov

"__" ____________20__

How to exercise the right to release?

You can start applying the exemption from the first day of any month. To do this, no later than the 20th day of the month from which the exemption applies, you must submit to the Federal Tax Service:

- Notice “On the use of the right to exemption from the taxpayer’s obligations related to the calculation and payment of VAT”;

- An extract from the balance sheet and/or profit and loss statement (of the organization) or an extract from the book of income and expenses (IP);

- Extract from the sales book.

It is also necessary to restore VAT on the residual value of fixed assets (intangible assets) and on the value of inventories that, before the application of the exemption, were not used in transactions subject to VAT.

Invoice without VAT, when and who applies

Submit your VAT return using the Kontur.Accounting web service. The system itself will generate a declaration based on primary documents and check it before sending. Get free access for 14 days

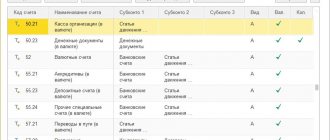

An important difference between firms exempt from tax under Art. 145 of the Tax Code of the Russian Federation, from special regime officers - the need to issue invoices from the island. They need to prepare invoices when selling services, goods and work, as well as when receiving advance payments from customers, and register the invoice in the sales ledger.

In addition, such invoices can be prepared by organizations and individual entrepreneurs in special regimes or carrying out operations and selling goods exempt from taxation under Art. 149 of the Tax Code of the Russian Federation. They have no obligation to issue invoices, but they have the right to do so, for example, at the request of the buyer. The seller, at his own discretion, agrees or refuses such a request, but he will not receive any obligations and will not lose anything. To do this, fill out the document correctly. Previously, invoices indicated “VAT exempt”, but now fields 7 and 8 are marked “Without VAT”. They are not required to register the invoice in the sales book, but if they wish to register the document, the right is retained.

The counterparty who received an invoice without VAT does not enter the document into the purchase book, since there is no tax in it. If there is no tax, there is nothing to deduct, and you will not be able to use it even if you have completed documents.

What to do with the VAT return?

For the period during which the VAT exemption was applied, declarations are not provided.

If the exemption is applied from the first month of the quarter, then the restored VAT is included in the declaration for the last quarter preceding the application of the exemption.

If the exemption applies from the second or third month of the quarter, then the declaration for this quarter must be submitted according to the general rules. In this case, the declaration reflects only transactions for the period of the first quarter before the start of application of the exemption. Such a declaration also includes the restored VAT.

Without VAT

The parties to the agreement agreed that the payment amount is indicated without VAT. This corresponds to the requirement of Article 168 of the Tax Code of the Russian Federation, which states that the amount of VAT is presented in addition to the price of the goods, work or service. Therefore, if the seller is exempt from VAT under Article 145 of the Tax Code of the Russian Federation, then he does not charge VAT to the buyer.

And if the seller has an obligation to pay VAT, he has the right to simply increase the cost of shipment by the amount of the tax and indicate this in invoices for payment.

It is possible to increase the price specified in the contract by the amount of VAT, without concluding an additional agreement on increasing the cost, if the payment amount is indicated in the contract without VAT. This corresponds to the norms of Article 168 of the Tax Code of the Russian Federation.

How to confirm compliance with the conditions of release?

By the 20th day of the month following the 12th month of application of the exemption, you must provide the following to the Federal Tax Service:

Documents confirming that within 12 months the revenue was within 2,000,000 rubles. for every 3 consecutive calendar months (extract from the balance sheet/profit and loss account and sales ledger);

Notification of the extension of the use of the right to exemption over the next 12 calendar months or the refusal to use this right.

What does “excluding VAT” mean?

Indication in the documents “excluding VAT” means that the sales price does not include tax. Organizations that make such a note do not pay tax or are temporarily exempt from paying it.

Firms using special regimes are exempt from paying VAT - simplified tax system, unified agricultural tax, ENDV, PSN and companies combining several regimes (we wrote about paying VAT under the simplified system here). Special regimes are convenient because they replace a number of taxes, including VAT.

Companies and individual entrepreneurs on the OSN can also sell goods and provide services without tax if they comply with the quarterly revenue limit and do not produce excisable goods. Revenue received for 3 consecutive months should not exceed 2 million rubles. By exceeding the limit, the taxpayer will lose the opportunity not to pay tax.

What happens if you do not provide documents for release?

If the taxpayer does not submit a Notice of transition to exemption and extension of the exemption period for the next 12 months, then he will not lose the right to work without VAT.

However, it is worth filing a notice to avoid blocking accounts due to the fact that the tax authority was not notified of the taxpayer's use of the exemption.

If the taxpayer does not provide documents confirming the legality of the application of the exemption, then he loses the right to this exemption for the entire period of its application. In this case, it is necessary to charge additional VAT, pay penalties and fines.

Individual entrepreneur – VAT

In accordance with paragraph 1 of stat. 163 of the Tax Code, an individual entrepreneur is a VAT payer on the same basis as ordinary enterprises. That is, value added tax is equally applied by both individual entrepreneurs and legal entities when selling goods or services. For example, if the cost of a product is 100 rubles, upon sale it is necessary to add VAT on top at a rate of 18 or 10%, depending on what exactly the entrepreneur sells (produces) (stat. 164).

Taxation of individual entrepreneurs with VAT depends on what regime the business is in. Some special tax systems provide entrepreneurs with the opportunity to legally reduce the fiscal burden by replacing a number of taxes with the payment of a single one, levied under UTII, simplified tax system, unified agricultural tax or patent. Let's consider whether the individual entrepreneur pays VAT under the simplified tax system or other special tax regimes.

VAT in a contract: right or obligation

According to the Civil Code of the Russian Federation, when concluding an agreement, the parties independently prescribe its terms. Indication of the subject of the contract, the transaction price, the payment procedure - all this is indicated in the agreement as agreed and at the discretion of the parties. The question arises: how legal is it to indicate in the agreement the cost of goods without VAT? Is the contract considered valid? What right do individual entrepreneurs and legal entities have to indicate/fail to indicate VAT in an agreement? Read more about this below.

Rules and restrictions for legal entities

The Civil Code of the Russian Federation does not provide for any restrictions when drawing up an agreement by legal entities - the organization specifies all the terms of the agreement at its discretion. But at the same time, you should not forget about the tax consequences and, before drawing up an agreement without VAT, familiarize yourself with the position of the Tax Code on this issue.

Tax legislation determines that VAT transactions carried out by an organization must be confirmed by documents, including an agreement.

For example, your organization, as a legal entity, sells goods and submits VAT for payment to the buyer. In this case, the amount of tax must be indicated separately both in the invoice and in the contract. The same rule applies in the opposite case: if you accept VAT as a deduction, then you should have an invoice and an agreement with allocated VAT.

- Your organization uses a special regime and is not a VAT payer. For example, you use the “simplified tax” or pay imputed tax;

- As a legal entity, you purchase goods that are not subject to VAT. A similar rule applies in the production of such goods;

- You are an importer of goods not subject to VAT;

- You export goods abroad. Both the export of goods previously purchased and the sale of own-produced products are not subject to VAT.

As you can see, tax legislation provides for a wide range of conditions for legal entities, within which there is no VAT taxation. If your transactions fall under the criteria specified above, you may not indicate the amount of VAT in the agreement or indicate “excluding VAT”.

Exemption from VAT obligations of a taxpayer who is a participant in the Skolkovo project

A separate preferential category consists of participants in the Skolkovo project. This cannot be called a special regime, but Skolkovo residents also do not belong to enterprises with small amounts of revenue. Which organizations are exempt from VAT in this case depends on the following criteria:

- Type of activity, i.e. whether the organization has the status of a project participant.

- The total amount of accumulated profit. For corporate research centers this is 1 billion rubles, for other project participants - 300 million rubles. Moreover, the profit is summed up not from the beginning of activity, but from January 1 of that year, when sales revenue exceeded 1 billion rubles.

- For a corporate research center, an additional criterion is used - it must sell at least 50% of its products (services) to related parties.

You can read more about these criteria in Art. 145.1 Tax Code of the Russian Federation.

VAT on top of the contract price

“The cost of services under the contract is ___ rubles. without VAT. The customer pays additional VAT.”

VAT – CD * 18%,

Where CD is the cost of services (works, goods) under the contract.

Example No. 4.

Stimul LLC sells computer equipment to Safari JSC. In the section “Cost of goods” in the agreement it is stated: “The cost of services under the contract is 802,450 rubles. without VAT. The customer pays additional VAT.”

RUR 802,450 * 18% = 144.441 rub.

https://www.youtube.com/watch?v=ytaboutru

RUR 802,450 RUR 144,441 = 946.891 rub.

The invoice is drawn up by the Stimul accountant as follows: (click to expand)” style=”fancy”]

| Name | Price | VAT | Price |

| Dell monitor | RUR 802,450 | RUR 144,441 | RUR 946,891 |

| TOTAL: | 946.891 (nine hundred forty-six thousand eight hundred ninety-one) rub. 00 kopecks, incl. VAT 144.441 (one hundred forty-four thousand four hundred forty-one) rub. 00 kop. | ||

We suggest you read: How to find out if a Patent is ready to work in Moscow

[/su_spoiler]

Demand or ask?

The current tax legislation does not provide for the obligation of the simplified tax operator to provide his counterparties with any evidence of the application of the simplified tax system. Therefore, it is impossible to demand such documents from a simplifier. However, he can be asked to provide evidence that he uses a special regime. Moreover, some simplifiers themselves, together with a set of documents, for example, an invoice or an agreement, submit a letter on the application of the simplified tax system for the counterparty. After all, it is easier to submit such documents than to spoil relations with your partners.

VAT in 223-FZ

223-FZ does not provide clear instructions for determining the NMCC and concluding a contract. Article 4 only states that the notice must contain information about the NMCC and the procedure for its formation (with or without the costs of paying duties, taxes and other obligatory payments). The procurement regulations should regulate the comparison of price offers of potential contractors working with different tax regimes.

Opinions on this issue are again divided:

- The Decision of the St. Petersburg OFAS Russia dated August 12, 2015 on complaint No. T02-405/15, the Decision of the Khabarovsk OFAS Russia dated September 30, 2014 No. 157 states that VAT must be taken into account when evaluating proposals , otherwise the principle of equality is violated and cost-effective spending of the budget.

- In the Resolution of the Federal Antimonopoly Service of the East Siberian District dated May 15, 2015 No. F02-1709/2015 in case No. A33-10428/2014, the Ruling of the Supreme Court of the Russian Federation dated April 11, 2017 in case No. 304-KG16-17592, A27-24989 /2015, on the contrary, it is reported that valuation excluding VAT does not create unequal conditions for participation .

There is no consensus on calculating the cost of a contract concluded with a contractor under a special regime. A reduction in the price of a contract for the VAT rate with the winner is almost always recognized as unlawful, however, in practice, the reduction if the contractor applied the simplified system to the contract was recognized as legal (decision of the Chelyabinsk OFAS dated November 3, 2016 on complaint No. 77-03-18.1/2016).

Due to the fact that departments do not have a clear position on this issue, certain risks arise for the parties. Therefore, the Procurement Regulations are the only tool for resolving disputes; all requirements must be specifically identified in it.

Individual entrepreneur for VAT - what reports to submit

The main type of reporting for individual entrepreneurs for VAT is a tax return. The form is submitted for tax periods, which are set to one quarter (Article 163). The method of presentation is electronic. The deadline for submission is the 25th day of the month following the reporting month. Is there a zero VAT return for individual entrepreneurs? This is possible if the entrepreneur is a VAT payer, but for some reason did not conduct business. In this case, the individual entrepreneur is required to submit profit reports, as well as value added tax, to the control authorities in order to avoid fines for failure to submit declarations.

VAT for individual entrepreneurs under the simplified tax system

According to paragraph 3 of Art. 346.11 all entrepreneurs using the simplification are exempt from the obligation to pay VAT. The same applies to those businessmen who work on imputation (clause 4 of stat. 346.26), patent (clause 11 of stat. 346.43), agricultural tax (clause 3 of stat. 346.1). However, this statement is true in general cases, but some individual situations require the calculation and payment of value added tax even by entrepreneurs. In particular, VAT for individual entrepreneurs on simplified and other special regimes arises when:

- Import of products.

- Issuing an invoice to your customers with the allocated tax amount.

- Payment of rental services to owners of municipal or state property.

- Carrying out business transactions under agreements of joint activity, simple partnership, trust management and others according to Stat. 174.1.

- In a number of other cases, in accordance with legislative norms.

Practice of FAS and AS on contracts with VAT

Suppliers working on a simplified taxation system, when faced with 44-FZ contracts with VAT, often file complaints with the FAS: at a maximum, in order to sign an agreement without taking into account the tax, and at a minimum, to refuse the conclusion without entering into the RNP.

The practice of the Federal Antimonopoly Service, as well as Arbitration Courts, in this matter is ambiguous. Much depends on the position of a particular management.

In our work practice, we attended meetings where representatives of regulatory authorities recognized the customer’s right to demand that the winner of a government order issue an invoice. Thus, even if the supplier is under a special tax regime, he will have to file a tax return and pay VAT on the price of the government contract.

And in this case, “simplified” organizations are in a less favorable situation than companies on OSNO, because companies with the simplified tax system will not be able to deduct the amount of this tax, unlike companies on the general taxation system.

If you work under a special taxation regime, then it is important to review the terms of the government contract also in terms of including VAT in the NMCC. After all, even if you win a tender, the execution of which involves issuing an invoice and paying taxes to the budget, and contact the FAS to protect your interests, there is a high probability that the decision will be made in favor of the customer.

Due to the lack of unity in the practice of the Federal Antimonopoly Service and the Arbitration Courts, it is impossible to predict in advance the outcome of the meeting on VAT issues in contracts under 44-FZ. It would be most rational to study similar cases in the region of interest and rely on the practice of a particular OFAS.

© LLC MKK "RusTender"

The material is the property of tender-rus.ru. Any use of an article without indicating the source - tender-rus.ru is prohibited in accordance with Article 1259 of the Civil Code of the Russian Federation

Estimated VAT amount

VAT = CD (contract price) * 18 / 118.

Having calculated the amount of tax, you need to issue an invoice to the customer, where the amount of VAT is indicated on a separate line. To avoid disagreements with the buyer and the tax authorities, supplement the contract with an additional agreement, which specifies the contract price and the amount of tax.

Example No. 3.

A contract for the supply of paper was concluded between JSC Sfera and LLC Baza. The contract specifies the cost of delivery - 18,314 rubles. There is no information about VAT in the agreement. JSC Sfera and LLC Baza are VAT payers, transactions under the agreement are taxable.

RUR 18,314 *18 / 118 = 2.794 rub.

| Name | Price | VAT | Price |

| A4 paper | RUB 15,520 | RUB 2,794 | RUR 18,314 |

| TOTAL: | 18.314 (eighteen thousand three hundred fourteen) rubles. 00 kopecks, incl. VAT 2.794 (two thousand seven hundred ninety-four) rub. 00 kop. | ||

Sample of drawing up a contract without VAT

The contract without VAT is standard and includes the following main sections:

- basic information: name, date and place of conclusion of the agreement;

- details of the parties: name, legal address, bank details of the parties to the transaction;

- subject of the contract: products or services to be sold;

- rights and obligations of the parties;

- liability of counterparties, fines for violation of the contract;

- unforeseen and other circumstances that may affect the fulfillment of the terms of the contract;

- the price of the contract (it is in this section that the phrase “Excluding VAT” should be indicated in the case of tax exemption or “VAT not subject to” in the case of a benefit).

The importance of correctly drawing up a contract without VAT is beyond doubt. Errors in its preparation can lead not only to penalties, but also to deterioration of relations with business partners.

Thus, in our work we are guided by the principle of division of labor: each specialized specialist is engaged in his own area of work. Agree, this is convenient and correct. Because, for example, a payroll accountant does not fully understand the intricacies of calculating and paying VAT.