Who passes the ERSV for the 3rd quarter of 2021

ERSV is submitted to the Federal Tax Service by all employers: legal entities and individual entrepreneurs.

Attention! If there were no accruals in favor of employees, policyholders are required to submit a zero calculation, indicating the values “0” in the required sections and appendices. Entrepreneurs who do not employ hired personnel have the right not to submit this form.

Policyholders will submit the DAM for the 3rd quarter of 2021 to the tax authorities in the form approved by Order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected] (KND 1151111). Officials did not make any changes to the DAM form in the 3rd quarter of this year.

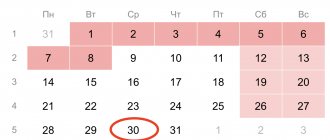

For the 3rd quarter, the DAM form is filled out using data on insurance premiums accrued on an accrual basis from payments to workers during the first 9 months of the calendar year. The last day on which an accountant can submit the DAM for the 3rd quarter of 2021 without negative consequences for his company is 10.30.2020 - Friday.

EXPLANATIONS from ConsultantPlus experts: Failure to timely submit a calculation of insurance premiums may result in a fine and other negative consequences... Find out exactly what sanctions the fiscal authorities can apply in the Ready-made solution from K+. Get trial access to K+ for free.

Appendix 3 to Section 1

It deciphers the insurer's expenses for the purposes of compulsory social insurance. Each line can include up to four indicators:

- Number of cases of payments or their recipients.

- Number of payment days.

- The amount of payments.

- Including paid from the federal budget (if this category of payments provides for this possibility).

Lines Adj. 3 correspond to the types of benefits paid:

- On page 010, the amounts of sick leave are given without taking into account payments to foreign citizens and stateless persons, but including citizens of the states of the Eurasian Economic Union (EAEU).

- On page 011 of them, payments are allocated for external part-time workers.

- Line 020 reflects sick leave paid to foreigners and stateless persons, excluding citizens of the EAEU states.

- On page 021, information on external part-time workers is highlighted, similar to page 011.

- Line 030 reflects payments of maternity benefits.

- On page 031 of them, payments for external part-time workers are allocated.

- On page 040, the amounts of one-time benefits for early registration of pregnant women are indicated.

- On page 050, information is provided on payments of a one-time benefit for the birth of a child.

- On page 060 indicate the amount of monthly child care benefits.

- On page 061 of them, payments for the first child are allocated.

- On page 062 - payments for caring for the second and subsequent children.

- On page 070, they provide payment for additional days to care for disabled children.

- Line 080 reflects insurance premiums accrued for payment from line 070.

- On page 090 they show the amount of the funeral benefit.

- On page 100, all the above types of payments are summed up.

- On page 110 from page 100, unpaid benefits are allocated.

Nuances of filling out the DAM report for the 3rd quarter of 2020

For 9 months of 2021 the following is filled out:

| Action | Sheet | Chapter | Subsection | Application |

| Necessarily | Title | No. 1 and No. 3 | No. 1.1 and No. 1.2 | No. 1 and No. 2 to section 1 |

| When paying social benefits | No. 3 to section 1 |

On the title page, when entering accounting information into the DAM for the 3rd quarter, enter code 33 in the “Calculation (reporting) period” field. Otherwise, the DAM title book for 9 months is filled out in the same way as for the first half of 2021.

The amounts of insurance premiums in a single DAM for 9 months are recorded on an accrual basis. In section 1, on lines 030, 050, 070, 090, 110, 120, the data is indicated in the total amount for January – September, and on lines 031–033, 051–053, 071–073, 091–093, 111–113, 121– 123 - directly for the 3rd quarter, broken down by month.

ATTENTION! Lines of section 1 that are prohibited from being filled in simultaneously:

- block of lines 110–113 - fixes the amount of social contributions for VNIM to be paid;

- block of lines 120–123 - contains the amount of excess of social payments over social contributions for VNiM.

For lines 010–062 of subsection 1.1 and lines 010–060 of subsection 1.2 of Appendix 1 to Section 1 of the DAM for the 3rd quarter, similar filling rules apply - data on accrued contributions is indicated:

- cumulative total from the beginning of 2021;

- in total for the last 3 months of the reporting period, in this case for July, August, September;

- for each month 3 quarters separately.

We talk about adjusting personalized information in the DAM on the forum

Section 3 of the DAM for the 3rd quarter of 2021 contains the personal data of each employee (subsection 3.1) and information on pension contributions from payments in their favor for July - September 2021 (subsection 3.2.1). In line 020 of section 3, when submitting the DAM for 9 months, indicate code 33.

Read here what nuances to take into account when transferring an employee from one department to another.

Title page

This section of the report contains information about the originator and the form itself:

- The TIN code allows you to identify the report preparer as a taxpayer. For legal entities it consists of 10 characters, for individuals - of 12.

- The KPP code (reason for registration) is assigned only to legal entities. The fact is that organizations can be registered in several divisions of the Federal Tax Service - not only at the place of primary registration, but also where the branch, real estate, etc. are located. The basis for registration in this inspection is indicated by the checkpoint code.

- The correction number indicates whether the submitted report is primary or corrected. For primary, indicate the code 0–, then 1–, 2–, etc.

- The billing (reporting period) is indicated by a two-digit code. He is chosen from App. 3 to Order. For the report for the second quarter of 2021 (or rather, for the half-year, since reporting periods are determined on an accrual basis), code 31 is used.

- The calendar year is indicated in four-digit format; for the current year it is 2021.

- Field “Provided to the tax authority” - here the code of the department of the Federal Tax Service of the Russian Federation is given in a four-digit format.

- Field “At location (registration)” - indicate the basis for submitting the form to this inspection. Codes are taken from Appendix. 4 to Order. For example, for a report provided by a Russian organization at the place of registration of the parent company, this is 214, and at the location of the branch - 222.

- Field “Name (full name)” - we provide the full name of the organization (branch) in accordance with the charter. For an individual, you must indicate your full name without abbreviations.

- The code for the type of economic activity is indicated in accordance with the all-Russian classifier OKVED-2.

- The fields “Form of reorganization (liquidation)” and “TIN (KPP) of the reorganized organization” are filled in if the report is submitted by the legal successor. The reorganization form code is selected from Appendix. 2 to Order. In this case, you need to keep in mind that for the successor’s report in App. 3 provides separate codes for reporting periods.

- Contact phone number.

- The number of sheets of the report itself and supporting documents (if any).

- Information about the person who signed the report (full name, signature, date). For an organization, this must be a manager or other person who has the right to sign. The individual signs the report independently. A representative can also sign the form on behalf of the payer; in this case, in the appropriate field, you must indicate the representative code - 2 and fill out information about the power of attorney.

Sample of filling out the DAM for the 3rd quarter

To help you understand the sequence and procedure for entering accounting data into a single DAM for the 3rd quarter of 2021, our experts filled out a calculation for you based on the following data:

LLC "Quorum" on OSN outsources accounting and tax accounting of small companies. Contribution rates are standard, there are no benefits.

There are 2 specialists on staff with whom employment contracts have been concluded, there are no contractors:

| Employee's full name | Monthly payments in his favor, rub. |

| Vasiliev Alexander Petrovich | 30 000 |

| Smolnikov Andrey Vladimirovich | 20 000 |

When submitting the DAM for the 3rd quarter of 2021, the Quorum accountant will fill out the title page and all mandatory sections, subsections and appendices. In section 3, the legal entity will indicate the personal data of each member of the workforce, as well as payments to them and accrued pension contributions.

Note! Since April 1, 2020, SMEs have been calculating insurance premiums at reduced rates.

EXAMPLE of calculating insurance premiums at reduced rates from ConsultantPlus: In 2021, payments in favor of the employee amounted to: - for January - 17,000 rubles; — for February — 16,000 rubles; — for March — 15,000 rubles…. Read the continuation of the example in K+. Trial access to K+ is free.

We recommend that you familiarize yourself with the ERSV sample for 9 months of 2020 in more detail using the link.

Additional report sheets

Not all payers fill out the parts of the form discussed below. The need to include them in the report is related to certain characteristics of the insured (organizational and legal form, type of activity, taxation system, eligibility for various benefits, etc.).

The sheet “Information about an individual who is not an individual entrepreneur”, if necessary, serves as an addition to the title page. It is filled out if the form is submitted by an individual who has not indicated his TIN. The personal data this sheet contains allows you to identify such a report submitter:

- Date and place of birth.

- Citizenship.

- Details of the identity document

- Residence address in the Russian Federation (for foreigners you can indicate the address of business).

Results

The DAM for the 3rd quarter of 2021 is filled out according to the same rules as in the 2nd quarter.

During this year, officials issued several important clarifications on the nuances of filling out a single calculation, as well as on the issues of calculating social contributions. A special section on our website will help you read about them, as well as learn about all the innovations in a timely manner.

See also “ERSV for the 3rd quarter - checklist for filling out”.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Procedure for submitting a report and sanctions for violations

The deadline for the DAM form for the reporting period is no later than the 30th day of the month following the reporting period (clause 7 of Article 431 of the Tax Code of the Russian Federation). Thus, the report on insurance premiums for the 2nd quarter of 2018 must be submitted no later than July 30, 2018.

Sanctions for violation of deadlines for submitting a report are provided for in paragraph 1 of Art. 119 of the Tax Code of the Russian Federation. The fine is 5% of the amount of unpaid contributions for each month of delay (including incomplete ones). A maximum fine (30% of the amount of arrears) and a minimum fine (1,000 rubles) have also been established. Thus, if the report is submitted in violation of the deadlines, but all contributions are paid on time, then the fine will be fixed - 1,000 rubles.

Tax authorities cannot block an invoice for failure to submit calculations for insurance premiums for the reporting period, since it is not a tax return (letter of the Ministry of Finance dated April 21, 2017 No. 03-02-07/2/24123).

Program for generating calculations for insurance premiums

The ERSV form for reflecting data on accrued contributions, base, expenses for VNIM and other indicators is available in all special services for generating reporting documents. This is, for example, 1C, as well as the official federal program of the Federal Tax Service called Taxpayer Legal Entity. Unlike 1C, which must be purchased for use and subsequent regular updates, Taxpayer Legal Entity is available at any time on the federal tax inspectorate portal.

The Federal Tax Service program makes it possible not only to enter data correctly, but also to clarify the presence of errors. Before sending the ERSV to your tax office, be sure to check the calculation of insurance premiums using the Federal Tax Service formulas. Recommended KS are given in Letters from tax authorities - more details about the ratios here. If you do not check, any inaccuracies will be discovered by the inspector upon acceptance, and adjustments will still have to be made in order for the report to be considered accepted.

Who entered the calculation and why?

The form and rules for filling out the unified calculation of insurance premiums (ERSV) are developed and approved by the Federal Tax Service. Starting from reporting for the 4th quarter, a new form of calculation for insurance premiums is in effect: in 2021, the Federal Tax Service accepts only the DAM form from Order No. ED-7-11/ dated 10/15/2020.

ERSV was introduced when insurance premiums were transferred to the jurisdiction of the tax service - in 2021. Until the end of 2021, policyholders reported to the Pension Fund and used other forms for reporting on pension insurance:

- RSV-1;

- RSV-2;

- RV-3.

IMPORTANT!

Contributions for accidents and occupational diseases (injuries) are transferred to the Social Insurance Fund. The Social Insurance Fund accepts quarterly 4-FSS reports.