Civil legislation makes it possible to use someone else’s property both on a paid basis (lease agreement) and

Cargo transportation is a popular and in-demand business area. Both organizations and

Excise taxes and VAT are one of the key concepts for economists dealing with the peculiarities of

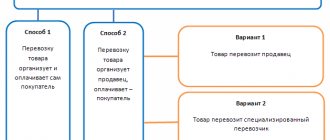

Methods for reimbursement of transportation costs under a supply agreement The supply agreement may provide for several options

The key resource of any manufacturing company is fixed assets, the analysis of which traditionally includes an assessment

According to the law, a certificate of incapacity for work is a valid reason; if it is available, the employer is obliged to pay monetary compensation.

Home / Taxes / What is VAT and when does it increase to 20 percent?

When registering a business entity, regardless of its organizational and legal form, the types of

Legal topics are very complex, but in this article we will try to answer the question “To

The head of an LLC is usually called the general director, but there are other options: director, president. Differences