How is the check carried out?

A desk tax audit is a check of compliance with the legislation on taxes and fees on the basis of a tax return and documents that the taxpayer independently submitted to the tax office, as well as documents that the tax authority has. This check is regulated by Art. 88 Tax Code of the Russian Federation. The start date of the audit is the date the taxpayer submits a declaration, calculation or information to the tax office.

Without exception, all declarations and calculations received from taxpayers are checked. Taxpayers are not notified of the start of a desk audit, and no decision is made on its appointment.

Registration of inspection results

After the end of the desk audit, a report is drawn up indicating the violations found and the amounts of additional taxes assessed. Within 5 working days, the inspection report is handed over to the taxpayer.

Within a month, the taxpayer has the right to submit disagreements to the desk audit report.

Within 10 working days after the expiration of the period for submitting disagreements, the head of the inspectorate makes a decision to hold the taxpayer accountable for committing a tax offense.

If the taxpayer does not agree with this decision, he has the right to send an appeal to a higher tax authority. This complaint is considered within a month from the date of filing. The consideration period may be extended, of which a notification is sent to the taxpayer.

If the taxpayer does not agree with the decision of a higher tax authority, he has the right to go to court.

If no violations are identified during a desk audit, it is automatically closed, the taxpayer is not notified about this, and documents for the audit are not handed over to him.

Where to file a complaint about violation of the deadlines for a desk audit

That is, a refund is possible no earlier than 4 months after the reports are received by the Federal Tax Service. Therefore, it makes more sense to complain about violation of the deadlines for conducting a desk audit by the tax authority only after these 4 months have expired.

Submission of an electronic complaint is made in the taxpayer’s account. To do this, you need to go to the subsection “Complaints about acts, actions (inactions) of officials” by clicking on the link “Other situations” in the “Life situations” section.

The review lasts up to 30 days, but usually the responsible department of the Federal Tax Service reacts faster than the response to the complaint arrives.

It is also possible to send a simple message about the failure to complete the inspection and return of personal income tax through nalog.ru, namely through the “Other appeals” section. It will be reviewed within the same time frame as an electronic complaint.

The complaint can also be sent to the tax authority in paper form (directly or by mail). The review period is the same - 30 days.

Normative base

The definition, procedure for conducting, and the possibility of appealing a desk audit of individuals is determined by Article 88 of the Tax Code of the Russian Federation. The content of the legal act, among other things, also: defines the goals of the enterprise, establishes who has the right to check 3-NDFL and within what time frame the check must be completed.

additionally clarify the deadline for the desk audit of 3-NDFL, namely the day when the countdown begins in accordance with clause 2 of Art. 88 Tax Code of the Russian Federation.

In a general sense, it is also very useful (as amended on December 2, 2019) about the procedure for declaring funds: it contains a link to the 3-NDFL form that is current in 2021, general rules for filling out, mandatory and voluntary grounds for submitting a document, as well as the verification procedure data set out in 3-NDFL.

How to track

Keep in mind that you can monitor the progress and deadline of the 3-NDFL desk audit on the official website of the Federal Tax Service in the personal account of an individual. There the system shows the percentage of verification of the submitted declaration. Every day it gets bigger. However, this does not mean that the inspectorate analyzes your report several lines a day.

The fact is that in your personal account, the progress of the 3-NDFL audit is reflected in the form of a calculated percentage of 3 months - from the date of the start of the desk audit to the current date.

Errors when submitting reports

Disagreements between the tax inspectorate and taxpayers often arise during the reporting process. If declarations and calculations are filled out incorrectly, the reporting verification program automatically refuses to accept them, indicating errors.

What are these errors:

1. The reporting is signed by a representative with a power of attorney, but the tax inspectorate’s database does not contain either the power of attorney itself or data on the representative.

2. The reporting is signed by a representative under a power of attorney, but the information message about the power of attorney indicates a power of attorney without the right to sign.

3. The declaration is signed by the head of the organization. But his data in the declaration does not coincide with the information in the Unified State Register of Legal Entities.

4. The primary declaration is submitted with the attribute “corrective” or vice versa.

5. Reporting is submitted using outdated and ineffective forms.

Violations due to desk audits

When conducting a desk audit of specific declarations and/or calculations, the entire taxpayer’s reporting for that period is analyzed. The data specified in the general reporting is compared with the audited one. It is during this analysis that most violations are revealed. Data from external sources, information received from taxpayers' counterparties, and previous desk audits are analyzed.

Various violations are established:

1) simple arithmetic errors;

2) discrepancy between the tax base of VAT and income tax;

3) discrepancies between 6-NDFL and RSV data;

4) violation of the procedure for recovering VAT on advance payments paid;

5) provision of an incomplete set of documents when refunding VAT from the budget or for losses;

6) understatement of revenue;

7) overestimation of expenses;

for UTII and PSN, there is a discrepancy between the physical indicator of the number of employees and the data of 6-NDFL and DAM;

9) lack of documents confirming tax benefits;

10) calculations of property tax without taking into account the cadastral value of the property.

These are the most common violations that are detected during desk tax audits. It is impossible to describe them all. But, as statistics show, 90 percent of violations and errors are made by taxpayers due to their carelessness. This is explained by both the heavy workload of accountants and the lack of experience. But we must also understand that this inattention can be costly for the organization. Therefore, very carefully check that all reporting forms are filled out correctly, do not delay submission until the last day, compare report data, and prepare packages of documents on losses and VAT refunds in advance.

What is a desk audit and why is it needed?

It does not matter for what purpose a citizen submits a declaration - with a deduction, on a mandatory basis, or for other reasons. The Federal Tax Service inspector, receiving the data in the document, must know whether the taxpayer has violated the legislation of the Russian Federation, including tax law.

A desk audit is a set of measures carried out by Federal Tax Service inspectors in order to check the real state of affairs of the declarant. The check has several tasks:

- Find out whether everything stated by the taxpayer in 3-NDFL is true;

- Check whether the citizen has money, securities or other assets hidden from taxes and, in general, from the state.

Features of the event

Verification activities begin from the moment the 3rd personal income tax is received by the Federal Tax Service, without additional notification to the person who sent the declaration. To carry out control activities, the inspector does not need additional instructions or orders from senior management.

In order to protect the rights of taxpayers when conducting an inspection, the inspector has a number of restrictions:

- control activities are carried out only for the period for which the declaration is sent, that is, for 1 calendar year;

- the official does not have the right to initiate a re-inspection or analyze additional documents not related to the declaration;

- the inspector cannot request from individuals. persons and other documents not included in the list of mandatory documents for filing a declaration.

If these restrictions are violated, the test will be terminated and its results will be cancelled.

What exactly is checked and for how long?

The check takes place in several stages and the purpose of each of them is to study:

- The reality of all specified assets. For example, if the payer indicated in the “income” section a salary of 50 thousand rubles, then all documentation with the indicated amounts will be carefully read;

- The legality of all assets specified in the declaration: grounds for accrual of money, verification of transfer recipients, etc.;

- Study of tax violations limited by law - for example, concealment of income from the Federal Tax Service.

The law requires all inspectors to make do with only those sections specified in 3-NDFL, so a large-scale study of all possible violations of the law during an inspection is impossible. Accordingly, only the reporting year is checked . The Federal Tax Service spends serious resources on a detailed study of all income only if there are compelling reasons: if violations lead to a criminal case or a thorough check is required by law (we are talking about studying the declarations of politicians before sending their candidacy for elections).

When answering the question of how long a desk audit of 3-NDFL lasts, we must turn to clause 2 of Art. 88 of the Tax Code of the Russian Federation: the legal act specifies a basic period of 3 months, the extension of which is permissible only in exceptional situations. The law establishes only a maximum period for studying documents, but not a minimum. Accordingly, a desk audit can take a very short period of time, several weeks, or even 3 months.

Why is the amount of tax to be refunded from the budget 0?

Often, when viewing the status of a declaration, users discover that they have nothing to return, although not all of the deduction has been received (if we are talking about a property deduction).

The main reason for this situation is that the inspector did not have time to fill out the table due to heavy workload, so such numbers are displayed.

You definitely need to contact technical support or call the desk inspection department and find out what’s going on. But, as a rule, camera officers say that the result of the declaration is positive and you need to wait for the overpayment to be transferred.

Another reason could be a delay in displaying information on the server.

If your return was rejected, the status would be appropriate - the tax authority has not confirmed the amount of tax deduction claimed by the taxpayer. And confirmation of a refund when its amount is zero indicates technical reasons for the situation.

But if you find inspector errors when checking 3-NDFL, what to do:

It is necessary to make copies of all documents confirming errors. It is advisable to have them certified by a notary.

First contact the inspector himself and report errors in his work. Consider how to record your appeal - in writing or using recording devices, or bring a witness with you.

If it was not possible to reconcile the disagreement, write a complaint to the head of the inspection. The period for its consideration is 10 days. If it is not satisfied, you can file a complaint with the higher tax office - the Regional Federal Tax Service.

In case of serious consequences due to an inspector’s mistake, it makes sense to file a lawsuit against the Federal Tax Service.

Desk audit statuses

Not long ago, the Federal Tax Service developed its own portal where all taxpayers can quickly access information directly coming from the inspectorate. To gain access, you just need to create your personal account on the service website https://www.nalog.ru . Step by step, enter the taxpayer’s personal data, confirm ownership of the email and/or telephone number specified during registration, and you will be able to use the services of the resource.

Let us immediately note that the status given in the taxpayer’s personal account is very conditional. 100% of the total period represents 90 days allotted to the tax inspectorate to conduct the audit. Thus, 1% in status means 0.9 days.

For example, if your personal account says that the desk audit (CD) is 44% complete, this means that the process lasts almost 40 days. Accordingly, there are 50 days left until the end. The status shows only the approximate state of the audit and does not take into account a lot of factors: the workload of the Federal Tax Service; the amount of data displayed in the declaration - the more there is, the more difficult the verification; accuracy of the information provided, etc.

How to track the status of a 3-NDFL tax audit

You can find out what status is assigned to the 3-NDFL declaration by phone, indicating your TIN. When you call you will receive the following information:

- document verification stage;

- whether any difficulties arose (for example, a counter check);

- are there any errors in the paperwork, etc.

On the Federal Tax Service hotline, the call is redirected to the required department of the tax office, which accepted the documents from the applicant.

You can send an official written request, but this will take even more time - it will last a month at best. The fastest way is to go to the Federal Tax Service portal in the Personal Account to the tab with personal messages, where information about the progress of the desk tax audit of the declaration has been received. The method is considered convenient for the user; he can independently monitor the progress of execution.

At the first stage, the status of the desk audit is “registered,” which means the documents have been accepted for consideration. From this moment the countdown of the time required for document inspection begins.

The desktop audit status “In Progress” is displayed after the “Started” status. In your personal account you can see the completion percentage. In reality, this indicator does not characterize the state of the inspection by the authorities; only the amount of time until its results is traced as a percentage.

When a review is completed, it is assigned the status “Completed.” If there is no audit status, the tax inspector should answer the questions; the reasons must be found out individually.

Features of logging into your personal account in the updated version

If a taxpayer does not know how to view the progress of a desk audit on the updated website, there are several tips below. The user needs to go to the Federal Tax Service website and fill out the fields in the form: “login”, “password”. To change the login parameters, select the appropriate section to the right of the login button: Digital signature, State services. Further details.

The updated version of the Personal Account became available to all citizens in August 2018. From now on, it is no longer possible to use the old version. The login algorithm is not complicated, the main thing is to obtain and save authorization data for the tax.ru website. The list contains three methods for obtaining a secret character set:

- Registration in person at the tax office. Personal appeal to the inspectorate. Upon presentation of your passport and Taxpayer Identification Number, an employee of the Federal Tax Service fills out an application and provides a login and password. They provide access to the taxpayer’s new personal account. If you lose your authorization data, you must contact the INFS and get it again.

- EDS stands for electronic digital signature. There is a condition for this option. The organization that issues the key certificate to confirm the digital signature must be accredited by the Ministry of Telecom and Mass Communications of the Russian Federation. Any electronic media will do, but for accurate operation you need to use the CryptoPro CSP software, version 3.6 or later.

- Profile on the State Services portal. If the taxpayer registered earlier and received the password by mail or at the MFC, then from the personal page on the State Services website you can go to the tax inspectorate’s personal account. Access to your personal account opens in one or two days.

To enter the updated account on the nalog.ru portal, you must select the “Individuals” section and go to the “Login to your personal account” tab. These actions will lead to a form for entering your login and password. A distinctive feature of the new version is a dark blue background and an updated interface. The process of the inspection itself has also changed. Now you can find out about the status only by contacting the LC message service, or wait until the tax authorities themselves send a notice. Federal Tax Service employees warn you about each step in messages.

How long will it take to review if I submit electronically?

There are several ways to send a declaration to the Federal Tax Service:

- during a personal visit;

- by mail (registered letter with an inventory);

- using online services.

The last method is the most convenient because it allows you to carry out the procedure remotely without wasting time visiting the tax authority. Electronic filing is carried out through the taxpayer’s account on the official portal of the Federal Tax Service.

Only registered users are allowed to submit documentation. You can gain access by contacting the Federal Tax Service, using the digital signature key or through the State Services portal.

ATTENTION! The law specifies an identical period for consideration of a declaration for different options for filing it. When sending a document to the Federal Tax Service in electronic form, the maximum audit period will also be 3 months.

However, in practice, the duration of the 3-NDFL check when sending it online is shorter. This is due to the advantages of this method:

- The form and sample form presented on the website exclude errors and inaccuracies;

- accompanying documentation does not require verification by an inspector. Since it is carried out when the copy is uploaded to the site, many details are determined automatically;

- The declaration review procedure and verification status are monitored in your personal account. Having received a notification about the need for clarifications or corrections, the citizen is given the opportunity to quickly correct the situation.

In practice, the average time for reviewing documentation via electronic transmission is 1-2 months .

But the period varies both up and down. In this case, exceeding the duration of the audit by more than 3 months is unacceptable.

Main features of the service

- Contains information from citizens.

- taxpayer's property: land, real estate, vehicle and their value, date of registration of property, etc.;

- benefits to which the applicant is entitled;

- the conditions of settlements with the state budget: the amount of accrued taxes, payment deadlines, information about debt.

- Communication with a tax inspector via the Internet.

- Tracking the progress and status of the desk audit using Form 3-NDFL.

- Reception of notices and receipts with the specified tax amount.

- Online payment or printing a receipt for tax payment.

- Obtaining the necessary information without a personal visit.

Deadlines and how to find out the results of the verification of reports and documents for tax refunds? You can submit documents for a tax refund on the day you submit your 3-NDFL declaration. It is allowed to submit a declaration without filling out an application for a refund, but not on the contrary. The reason is that the surplus is calculated based on paid tax receipts. If your personal account indicates that there is no data on the result of the desk audit, then the details must be clarified with the tax office.

The Tax Code sets a period of one month for payment and three for verification. This means that after three months the taxpayer will receive a decision:

- providing a tax deduction;

- refusal of payments and its reason.

If the tax office has decided to pay the funds, they will be credited to the account within a month from the date of registration. The period may differ if the application for a deduction is submitted after the completion of the inspection, which acquires the status “Completed”.

The results of checking reports and documents for tax refunds are tracked in the taxpayer’s personal account on the official website of the Federal Tax Service on the “3-NDFL” tab. This electronic service contains all the necessary information about registration, progress and confirmation or refusal of property deduction payments.

You can find out the details in person by contacting the tax authority by presenting your Taxpayer Identification Number (TIN) and your passport. If on the day of filing the tax return the current account for transferring the refund amount was not indicated, an application for its assignment is submitted after the completion of the desk audit.

The verification period may increase if an error is found in the submitted documents. You can track this in your personal account. If there are no errors, then the audit and its result can only be delayed by the demand for clarification from the taxpayer.

How many must be checked by law?

The permissible duration of consideration of 3-NDFL is regulated by tax legislation - the Tax Code of the Russian Federation. The deadline for verification is 3 months from the date of submission of the declaration to the Federal Tax Service.

The exception is the updated 3-NDFL, submitted to replace the previous document. The period for consideration is counted anew from the moment of its submission.

General provisions regarding audits are presented in the Tax Code. However, some clarifying points are further clarified in separate legal documentation:

- clarifies that when sending a declaration by mail, the consideration period is counted from the day it was received by the Federal Tax Service;

- if a citizen delivers missing papers, the countdown will begin on the day the complete package is provided;

- Recommendations for conducting desk audits and submitting documentation are given in.

The exact period is not regulated by law - only the maximum permissible inspection period is indicated, which is 3 months.

How much time is considered in practice?

In practice, the timing of the audit by tax inspectors is shorter than the maximum period specified by the Tax Code of the Russian Federation. A three-month 3-NDFL check is a rarity, most often associated with complications of the process.

The audit may be delayed for the following reasons:

- increased workload of tax authorities;

- the inspector's scrupulousness or lack of experience;

- inaccuracy or inconsistency of the data entered in the declaration, their inconsistency with the accompanying documentation, which requires clarification.

ATTENTION! In practice, the average duration of a standard 3-NDFL check is 1-2 months.

However, there are also short audit periods of several days. They are typical for departments of the Federal Tax Service with a low workload of inspectors.

About desk tax audit

The expansion of the list of activities that the tax authority has the right to carry out as part of a desk audit gradually turned it into an on-site audit. The conduct of a desk audit varies depending on the type of reporting submitted.

The timing of a desk tax audit and cases of cancellation of a decision made by the inspection by a higher tax authority are discussed in an interview with Sergei Razgulin, an actual state adviser of the Russian Federation, 3rd class.

What rules are provided by the Tax Code of the Russian Federation for desk audits?

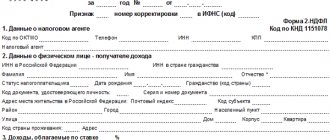

A desk tax audit is carried out on the basis of tax returns (calculations). Not every document submitted by an organization to the tax authority entails a desk audit. For example, checking certificates in form 2-NDFL is not covered by a desk audit.

During the audit, the tax authority examines the documents submitted by the taxpayer, as well as documents on the activities of the taxpayer available to the tax authority (clause 1 of Article 88 of the Tax Code of the Russian Federation). These documents include, inter alia, the taxpayer’s tax reporting for previous periods, reporting on other taxes, and reporting of other taxpayers.

A special decision from the head of the tax authority to conduct a desk audit is not required. The audit is carried out by officials of the tax authority to which the tax return (calculation) is submitted. The audit is carried out at the location of the tax authority.

From what moment does the verification period begin to count?

The audit period is the period of time during which control measures are carried out against the taxpayer.

There is uncertainty regarding the start date of the desk tax audit. Obviously, a desk audit cannot be carried out before the tax authority receives the tax return (letter of the Ministry of Finance No. 03-02-08/52 dated June 19, 2012).

Therefore, the start date of the declaration verification period does not coincide with the date on which the taxpayer’s obligation to submit a declaration is considered fulfilled.

When sending a declaration by mail or transmitting it via telecommunication channels, it is necessary to take into account that the time from the day of sending to the day of actual receipt of the declaration by the tax authority is not included in the verification period.

The Ministry of Finance does not see any difficulties in the fact that the date of submission of the declaration to the tax authority and the date of the actual start of the desk audit indicated in the inspection report may not coincide. But in any case, the inspection period begins to count from the date of receipt of the declaration by the inspectorate (letter of the Ministry of Finance No. 03-02-07/1/85955 dated December 22, 2021).

During what period does the audit take place?

As a general rule, within three months from the date the taxpayer submits a tax return (calculation).

In terms of desk audits for VAT, there are even more features.

The period for checking a VAT return is set at two months. The new two-month verification period applies to VAT returns submitted after September 3, 2021 (after the entry into force of Federal Law No. 302-FZ of August 3, 2021).

VAT returns currently submitted must be audited two months in advance. The same verification period applies to “late” primary declarations, updated VAT declarations for previous periods submitted to the inspectorate after September 3, 2021.

Reducing the time period for checking a VAT return may be important for the purpose of speeding up VAT refunds by companies (especially in the context of an increase in the rate to 20%).

In addition, this may affect the validity period of bank guarantees when applying for reimbursement.

Under what conditions will the verification period be two months?

From the text of paragraph 2 of Article 88 of the Tax Code of the Russian Federation it follows that the only condition is the absence of signs identified by the tax authority indicating a possible violation of the legislation on taxes and fees.

The criteria for reducing the period for desk audits of VAT returns in the context of applying a risk-based approach based on the ASK VAT-2 software package were set out in the Federal Tax Service letter No. ММВ-20-15/ [email protected] dated July 13, 2021. Although these criteria have now been canceled by Federal Tax Service letter No. ММВ-20-15/146 dated November 7, 2021, they will most likely continue to be applied by tax authorities in practice.

Let us note that by letter of the Federal Tax Service No. ММВ-20-15/ [email protected] dated July 27, 2021, the corresponding criteria for reducing the inspection period are outlined in relation to excise tax declarations on ethyl alcohol, alcoholic and excisable alcohol-containing products.

Can the period of a desk audit be suspended or extended?

There is no provision for suspension of the period of desk inspection. An extension of the verification period is possible in relation to the VAT return.

Before the end of the two-month period, the head (deputy head) of the tax authority has the right to decide to extend the inspection period by one month. Thus, the period for checking the VAT return will be three months.

The Federal Tax Service of the Russian Federation approved the form of the decision to extend the inspection period (Appendix No. 3 to Order No. MMV-7-2 / [email protected] dated November 7, 2018).

The decision form does not provide for indication of signs identified by the tax authority within two months indicating a possible violation of the law.

In this sense, the form of the decision does not allow the taxpayer to obtain information about the nature of possible violations.

How will a taxpayer find out about the extension of the VAT audit period?

The Ministry of Finance believed that Article 88 of the Tax Code of the Russian Federation does not contain the obligation of the tax authority to notify the taxpayer about the extension of the audit period (letter No. 03-02-07/1/70615 dated October 2, 2021).

But there is subclause 9 of clause 1 of Article 32 of the Tax Code of the Russian Federation, according to which the tax authority is obliged to send copies of decisions to the taxpayer, and therefore, including a copy of the decision to extend the audit period.

The approved form directly provides a note indicating that the taxpayer has received a decision to extend the period for conducting a desk tax audit.

It can be recommended that the VAT taxpayer, after two months, send an application to the tax authority asking for a copy of the decision to extend the audit period.

Is it possible to appeal a decision to extend the inspection period?

Like any other decision, the decision to extend the inspection period can be appealed, especially if, in relation to the taxpayer, the practice of making decisions to extend the inspection period will be systematic in nature without proper grounds. For example, if a decision to extend the audit was made, but the taxpayer was not sent requests for explanations.

Making a decision to extend the period for checking a VAT return does not mean that upon its completion an act must necessarily be drawn up to identify violations of the legislation on taxes and fees.

Can the check be completed before the allotted time expires?

The inspection may be completed before the expiration of the established periods of three and two months. Moreover, this applies to checking any declaration, and not just the VAT declaration.

But the taxpayer learns about the end of the audit period only in cases where the Tax Code of the Russian Federation obliges the tax authority to draw up a corresponding document.

What if the tax authority continues the audit beyond the deadline?

There are at least two points to note.

Firstly, verification activities must be carried out by the tax authority within the allotted time (letter of the Ministry of Finance No. 03-02-07/1-75 dated February 18, 2009). If the deadline for verifying the VAT return has expired and the taxpayer has not received a decision to extend the verification period, then in response to the received request for explanations or documents, you can respond with a letter asking to clarify the basis for sending the requirements.

Secondly, according to paragraph 14 of Article 101 of the Tax Code of the Russian Federation, failure by officials of tax authorities to comply with the requirements established by the Tax Code of the Russian Federation may be grounds for the cancellation of the decision of the tax authority by a higher tax authority or court (Resolution of the Presidium of the Supreme Arbitration Court No. 10349/09 of November 17, 2009) .

It is recommended to file objections to the act, which contains references to activities scheduled outside the inspection period, regarding the exclusion from evidence of those that were requested outside the inspection.

In this case, the timing of control activities is important. It should be noted that, for example, sending a request or ordering an examination during the audit period does not always mean that the tax authority will receive the actual result of the event during the audit.

When the inspection report is drawn up, then in the process of reviewing the inspection materials, in other words, already outside the inspection period, the head of the tax authority may assign additional tax control measures (clause 6 of Article 101 of the Tax Code of the Russian Federation). As part of these activities, the tax authority has the right to request documents from the taxpayer or persons who have information about him, interrogate witnesses, and order an examination.

What does it mean that the tax authority violates the audit deadline?

The Federal Tax Service of the Russian Federation obliges heads of territorial tax authorities to monitor compliance with deadlines, including in the current monitoring mode using the automated information system of tax authorities (letter No. ED-4-2/55 dated January 10, 2021).

Unfortunately, practice shows that the period for conducting a desk audit in itself is not preemptive (information letter of the Presidium of the Supreme Arbitration Court No. 71 dated March 17, 2003).

Missing a deadline does not prevent the identification of arrears and the drawing up of a report.

But there are examples when, in relation to desk audits that lasted a year or even more, the courts recognized missing the established deadline for conducting a desk audit as a significant violation. Such a violation may lead to the cancellation of the inspection’s decision if it cannot justify in any way the need to conduct an inspection outside the deadline.

What document is used to document the completion of the inspection?

Not everything is clear about the end date of the inspection, as well as the start date of the inspection.

The Tax Code of the Russian Federation does not provide for the preparation of a certificate after the completion of a desk tax audit. With the exception of the specifics of checking a declaration in which the right to a refund of VAT and excise taxes is claimed, the taxpayer is not notified of the end of the check if it does not reveal any violations.

The beginning and end of the audit, in accordance with paragraph 3 of Article 100 of the Tax Code of the Russian Federation, are indicated in the desk tax audit report, which is drawn up within 10 days after its completion. But an act is drawn up only if violations of the legislation on taxes and fees are identified during an inspection.

After drawing up the report, the procedure for reviewing inspection materials, making a decision and further procedures for desk and field inspections are the same.

What is the procedure for a tax authority that receives information about a taxpayer’s violations after the audit period has expired?

When no violations are found, the inspection ends without drawing up a report.

When the tax authority receives, after completing the inspection, evidence of violations committed by the taxpayer, information about the detected violations is sent to law enforcement agencies for operational investigative measures and the possible adoption of interim measures within the framework of criminal procedure legislation (letter of the Federal Tax Service of the Russian Federation No. ED-18-15/1693 dated December 18, 2014). An on-site tax audit may be scheduled for the taxpayer.

Taking into account the current practice, most likely, an unfounded decision of a lower tax authority to refund VAT will be canceled by a higher tax authority.

Under what procedure can a higher tax authority cancel a decision made by the inspectorate?

In order to control the activities of a lower tax authority, without a complaint from the taxpayer.

The grounds for cancellation are Article 31 of the Tax Code of the Russian Federation, Articles 1, 6, 9 of Law of the Russian Federation No. 943-1 “On the Tax Authorities of the Russian Federation” of March 21, 1991.

The power to cancel a decision of a lower tax authority can be exercised by a higher authority within three years from the end of the controlled tax period (Decision of the Supreme Court No. 305-KG17-5672 of October 31, 2021). That is, in 2021 - for periods starting from 2021 and subsequent ones.

It is possible that the cancellation of a decision that does not comply with the Tax Code of the Russian Federation (the taxpayer did not have the right to a VAT refund) will be carried out within a procedure similar to the consideration of an appeal. With notice of the time and place of consideration of the issue of canceling or changing the decision made by the inspectorate based on the results of a desk audit of the tax return (Decision of the Supreme Court No. 304-KG16-16943 of December 15, 2021). But it is not necessary that this procedure will be followed.

In practice, it is possible to cancel the decision of the territorial inspection by a decision of the Federal Tax Service.

Another option is for the Federal Tax Service to cancel the decision of the Federal Tax Service, which, in turn, canceled the inspector’s decision. Thus, the decision of the territorial inspection to refuse compensation will remain in force.

In such situations, the taxpayer retains the right to go to court. In this case, the case will be considered based on the actual circumstances.

Can the conclusions drawn by the inspectorate based on the results of a desk audit be revised during a subsequent on-site audit?

Conducting a desk audit that did not reveal any violations, and even conducting a desk audit that resulted in a decision on a tax refund, does not prohibit the tax authority from subsequently conducting an on-site tax audit for the same period.

The result of such a check may be additional accrual of arrears, penalties, or fines. This conclusion was made by the Constitutional Court in ruling No. 441-О-О dated April 8, 2010.

Moreover, the act and decision on the desk audit are not clarifications on the application of legislation, which exclude the possibility of holding the taxpayer liable and paying a fine (paragraph 1 of the letter of the Federal Tax Service of the Russian Federation No. SA-4-7 / [email protected] dated June 7, 2018) .

What if, regarding the results of a previously held desk audit, there is a court decision in favor of the taxpayer?

The decision of the tax authority, adopted based on the results of a desk tax audit, may be recognized by the court as invalid based on the factual circumstances underlying it, the insufficiency of the evidence provided, and violations committed by the tax authority.

However, the presence of a court decision in favor of the taxpayer based on the results of a desk audit does not prohibit an on-site audit. The conduct of an on-site audit in itself is not regarded as the tax authority overcoming a court decision made following the results of a desk audit (Determination of the Constitutional Court No. 571-O of March 10, 2021).

Based on the results of consideration of the results of an on-site audit of the same taxpayer for the same period, the court may come to a different conclusion. Taking into account the collected evidence, he may recognize the new decision of the tax authority as justified.

tax reporting desk audit tax audit

Send

Stammer

Tweet

Share

Share

What does it depend on?

The duration of a desk audit within a three-month period depends on many factors:

- the amount of information provided in the declaration;

- number of 3-NDFL filed;

- list of supporting documentation;

- types and quantities of claimed deductions;

- correctness, accuracy and reliability of information;

- inspector's workload.

ATTENTION! To reduce the review period, it is recommended to fill out reports in accordance with the designated standards.

To do this, it is convenient to use online service forms or the special “Declaration” program. The current edition can be downloaded from the official website of the Federal Tax Service. The accuracy of the entered data and the absence of conflicts with supporting documentation also reduces the duration of the audit.

Who sets the start date?

The beginning of the inspection is the day the Federal Tax Service Inspectorate receives the declaration and related documents. When starting an audit, the following conditions are met:

- To start an inspection, permissions or approvals from the authorities of the Federal Tax Service and other authorities are not required.

- The process starts without notifying the person who filed the 3-NDFL.

- When sending a declaration by mail, the process starts from the day the Federal Tax Service Inspectorate receives the letter with the inventory.

A citizen can find out about the start of an audit in the taxpayer’s personal account.

Where is the end date recorded?

The taxpayer is not informed about the completion of the desk audit. Information is provided only when the inspector identifies errors and inaccuracies.

You can find out about the end of the audit:

- upon a personal visit to the Federal Tax Service;

- by contacting the inspector by telephone;

- online - through the taxpayer’s account.

The last method is the most convenient, since the resource has a fixed deadline for completing the audit, and the review status is regularly updated.

Deadlines for consideration of the declaration

The duration of a desk audit depends on many factors and takes different times: from a couple of days to several months. However, the period for reviewing 3-NDFL cannot exceed 3 months from the date of its receipt by the Federal Tax Service.

Cancellation of the deadline is possible only upon filing an updated declaration. Then the countdown begins anew from the moment the Federal Tax Service Inspectorate receives the edited paper.

To launch an audit, the inspector must have complete information about the taxpayer. Such documents include:

- a completed declaration submitted within the period specified by law;

- supporting documentation;

- taxpayer contacts for communication.

Sample declaration 3-NDFL

If any of the required documents is missing, it must be submitted. Then the inspector has the right to call the beginning of the inspection period the day the full package of papers is provided.

3-NDFL deadlines for refunds have been missed. What to do

If you submitted your declaration and return application on time, but the money did not arrive. Find out the reason. And if it is the fault of the tax inspectorate, then you may qualify for the addition of penalties for late payment to the tax amount. Their size is the refinancing rate of the Central Bank (Clause 10, Article 78 of the Tax Code of the Russian Federation).

Deadlines for consideration of tax return 3-NDFL

You can complain about violation of deadlines to:

- the higher tax inspectorate has not yet passed 1 year from the date of violation of these deadlines,

- court within 3 months from the date of refusal to return.

Deadline for providing a deduction after submitting the application

Based on current laws, the time for crediting money is one month from the date of submission of the sent documents to the tax office. It is important to remember that when applying for a tax plan deduction, the time after which it will be provided to you is related to exactly when you sent your application with the corresponding request. Let's explore the possible options.

Terms of personal income tax reimbursement during practical consideration

If we look at the issue from a practical point of view, the time allotted for crediting a tax deduction usually ranges from six months or more. Note: this time period is counted from the day the application with the corresponding request is written, which is best sent to the tax inspector along with the 3-NDFL declaration. If you do not send this paper, but only send the tax authority calculations of the individual’s profit, no credits will be sent to your address.

As a rule, it takes a month for money to be credited

Important information

It must be said that if the tax authorities violate the deadlines established by law for refunding taxes, then a penalty will be charged daily, based on the volume of the rate of the Central Bank of the country.

If you have not received your money back on time, you need to protect the rights of the taxpayer. What they do for this:

- submit an application to the inspector at the place of registration for registration, registering the data for the return of money, warning of liability in the form of crediting a penalty for the amount required for return;

- stipulate that compensation of the required amount must be made a month from the date of the end of the verification activities (they are indicated as a desk audit, the period of which includes three months from the date of sending the declaration in form 3-NDFL);

If the money is not transferred on time, a penalty will be charged.

- It is necessary to indicate in the tax notice that when calculating the time period during which the 3-NDFL tax must be returned, one full month is not accepted. In other words, when filing an application for the return of the required amount of money, for example, on the 20th, by the first day of the next month, the money must be sent to the specified bank details.

Return according to declaration 3-NDFL. Return Features

In order to return money from the budget there are conditions. They are features.

- The deduction is made only within the limits of the tax transferred by you to the budget during the past year. Or, in other words, they will return to you no more than what you contributed.

- The deduction is returned subject to the taxpayer repaying all his debts to the budget.

- An application for a refund can only be written while it lasts 3 years after you have paid this tax (Clause 7, Article 78 of the Tax Code of the Russian Federation).

- Tax returns can be filed back up to three periods. And they are submitted in the form of a document valid in those years. So in 2021 there is an opportunity to submit declarations for 2016, 2021, and 2021. Moreover, for each year the declaration is separate and in its own form.

The exception is non-working pensioners who have bought an apartment. They can claim the deduction for 3 previous periods in one return.

You can return the tax not only by transfer to the account, but also by offset. So, both deductions and payments can be declared in one declaration. For example, payment of tax on the provision of an apartment for rent and deduction for payment for the purchase of medicines. In this case, payment and deduction compensate each other. And in Sec. 2 declarations 3-NDFL the difference is displayed - to pay or receive, which turned out to be greater.

Taxpayer personal account

You can track tax deductions in real time, without bothering Federal Tax Service employees with frequent calls, by using the online service “Taxpayer Personal Account”.

This resource allows citizens to:

- receive information about taxes (accrued, paid, overpayments and debts);

- fill out tax receipts, download them and print them;

- pay debts via online payments;

- contact the Federal Tax Service.

To find out the status of the tax deduction, you should find among the online tools of your “Personal Account” a request form related to the desk audit of 3-NDFL declarations.

There are two ways to get to your “Personal Account”.

First, enter the login and password that are in the registration card issued by the Federal Tax Service. To get a card, you need to come to the tax authorities with your passport and the original certificate with TIN. If a taxpayer has lost his login and password, it is easy to restore them by contacting the Federal Tax Service office again with the same documents as during registration.

Secondly, you can enter your “Personal Account” using a Universal Electronic Card (more precisely, an electronic signature attached to it). You can obtain a key with an electronic digital signature at one of the certification centers (as a rule, their functions are performed by regional branches of Sberbank). One of the advantages of the second method is that you can set and change the password yourself.

Both methods of logging into the “Taxpayer’s Personal Account” are free. There are currently about 2 million UEC holders in Russia.

Can it be extended?

If for some reason the Federal Tax Service’s inspection period expires, this is not a problem for civilians. Extension of the CP is impossible either from the point of view of the law or in terms of real and existing practice.

But there is one very important clarification: the desk audit begins anew each time if :

- the taxpayer for some reason withdrew the return in order to submit a new one with corrections;

- The Federal Tax Service noticed violations or incorrect filling out of the document, and then asked the applicant to correct the errors.

If, after filing a new 3-NDFL, you have to adjust it again, the deadline is also reset. Theoretically, such a “game” can take a long time, even 3 years, since the law does not provide for any restrictions on corrections and filing new declarations.

How is the updated one checked?

A declaration that is submitted by a taxpayer in order to change the data contained in the provided 3-NDFL is considered to be updated. This step is associated with identifying inaccuracies and errors during the audit. The inspector informs the taxpayer about them, who is required to explain the situation or correct the shortcomings.

When editing data and providing an updated 3-NDFL, the following conditions must be met:

- the information in the document is provided for the same reporting period;

- the paper is sent to the same department of the Federal Tax Service;

- If the citizen disagrees with the inspector’s claim, he gives an explanation. If they are sufficiently justified, the check will be completed without providing a clarifying version of 3-NDFL.

ATTENTION! If the updated declaration is sent to the inspector during an unfinished desk audit of the previous 3-NDFL, the audit period is counted anew. The examination of the previous paper stops.

The period is reset to zero, and the start of the revision will be the day the edited document was accepted. The deadline for its consideration is also 3 months. However, in practice, if shortcomings are promptly corrected and an updated 3-NDFL is provided in a timely manner, the inspection usually does not delay. 5 days are allotted for editing.

What might be the results of the check?

Roughly speaking, there are three main answer options:

- Data correction. If the tax office does not consider any source of income or purchase or sale to be legal, it has the right to request supporting documentation. After submitting the necessary papers, the CP begins again. In addition, this also includes the return of 3-NDFL to the payer due to its incorrect completion;

- Refusal. This refers to a tax deduction, the provision of which the tax office has the right to refuse (for the same reasons as stated above);

- OK. In all three cases, the Federal Tax Service is obliged to send the applicant a notification of the decision made, and strictly in writing with the seal and signature of the responsible person.

Deadline for consideration of an application for tax deduction through the authorities

Some people prefer to receive their deduction through their boss. In this case, you must first send the required official documents to the tax authority.

You can receive tax deductions through your employer

The time period allotted for approval of the right to provide this type of deduction through the boss is a maximum of a calendar month:

- from the date of sending the documentation confirming the right to receive a tax deduction for the property plan when purchasing an apartment, house, rooms, land, to pay off mortgage interest rates. Upon completion of the audit, you will be provided with a “Notification of confirmation of the taxpayer’s right to property tax deductions provided for in subparagraphs 3 and 4 of paragraph 1 of Article 220 of the Tax Code of the Russian Federation.” You must contact the company’s accounting department with this paper - then personal income tax will not be withheld from your earnings;

- from the moment of sending the application and documentation confirming the right to provide a social tax deduction for medical procedures, training, deductions in the amount of insurance premiums under a voluntary life insurance agreement. Upon completion of the verification activities, you will be provided with a “Notice of confirmation of the taxpayer’s right to receive social tax deductions provided for in subparagraphs 2, 3 and 4 (in terms of social tax deduction in the amount of insurance premiums under the voluntary life insurance agreement (agreements)) of paragraph 1 of Article 219 of the Tax Code of the Russian Federation " Please contact the company's accounting department with this paper. The social type of deduction is provided by the tax agent starting from the month the employee contacts the boss.

Often, filing a tax deduction through your boss is more complicated

When you send all the necessary official papers required to credit the tax deduction, you will need to wait for the end of verification activities and the transfer of funds according to your details.

From all of the above, we learned that the timing of the return of tax deductions is influenced by several factors, we also learned how to speed up the receipt of funds, what slows down this process and what to do if payments are late or delayed.

The influence of the deadline on the deduction of personal income tax: material interest in the speed of verification

As it turned out, conducting a desk audit of 3-NDFL in compliance with established deadlines can be beneficial not only to the inspector, who risks receiving disciplinary action for failure to comply with established requirements, but also to the taxpayer himself. This applies to people who expect to receive funds in the form of a tax deduction for expenses. Delaying the process is highly undesirable for them, so they understand the legal aspect of the situation better than others.

In particular, the minimum established period for receiving deductions from 3-NDFL is 4 months, and not 3, like the check itself. The explanation for adding it is very simple - according to the law, the relevant funds are given a month to accrue tax deduction funds. In practice, you rarely have to wait 120 days, although such cases do occur.

Duration in practice

The work of the inspections of the Tax Service of the Russian Federation shows that tax authorities quite quickly check 3-NDFL declarations and the documents attached to them. Therefore, the actual time frame for conducting a desk audit of 3-NDFL is actually shorter. This means that the tax will be returned to you faster if a deduction was claimed.

In practice, how long a desk audit of 3-NDFL takes depends on how scrupulously the inspector will study your declaration, the indicators stated in it and compare them with the attached package of documents. If errors, contradictions and other inaccuracies are identified, the audit will be delayed.

Thus, how long a desk audit of 3-NDFL is carried out directly depends on:

- the quality of filling out this declaration;

- absence of contradictions with the documents attached to it.

In this regard, we advise you to fill out 3-NDFL in 2021 in two ways:

- Online in the individual’s personal account on the official website of the Federal Tax Service.

- Using the Federal Tax Service program “Declaration 2017”:

This is important to know: Do the military pay personal income tax?

A simple example of receiving a personal income tax deduction

For those who do not yet understand how this mechanism works, let's consider the simplest situation. But, first, let's say that every citizen has the right to return up to 13% of income tax in the form of a subsequent deduction.

The taxpayer paid for his own education at a higher educational institution in the amount of 80 thousand rubles and has in his hands the corresponding supporting document. His monthly salary for the reporting period was 50 thousand rubles.

Taking into account 13% income tax, personal income tax for the year amounted to 72 thousand. By indicating a deduction in the declaration, he has the right to receive an amount not exceeding 13% of the tax, which amounted to 10 thousand 400 rubles. Considering the amount of personal income tax payment above this value, the taxpayer can count on a full refund.

Conclusion

The deadline for reviewing the 3-NDFL tax return is counted from the day the report is submitted. Now you have submitted your declaration, and then - wait for verification.

There may be calls to the tax office to explain something, to deliver documents. But if you understand well what is written in your declaration, and each figure is personally familiar, then such communication will not confuse you.

Sources

- https://www.klerk.ru/buh/articles/473436/

- https://vKreditBe.ru/sroki-kameralnoj-proverki-3-ndfl/

- https://NalogObzor.info/publ/kak-proverit-status-kameralnoi-proverki-3-ndfl-v-licnom-kabinete-nalogoplatelsika

- https://ur03.net/nalogi/deklaraciya/sroki-proverki.html

- https://ivanovasvet.ru/sroki-rassmotreniya-nalogovoj-deklaracii-3-ndfl.html

- https://www.klerk.ru/buh/articles/477351/

What if the tax authority does not calculate the deduction within the established time frame?

Sometimes the Federal Tax Service does not transfer the funds declared by the citizen within the time limits established by law. In this case, you need to figure out why the money is not being transferred to you.

Note ! If you were not credited with tax deduction money on time due to an error by an employee of this institution, then for each day of delay the amount is subject to a penalty based on the current rate of the Central Bank of Russia.

There can be many reasons for delays in the transfer of funds.

Table "The most common reasons."

| Cause | Description |

| Reason one | The desk verification activities of the data specified in the declaration have not been completed. |

| Reason two | The amount of tax paid in excess acted as compensation for existing tax debt, if any. These checks are carried out by the tax authority, without additional applications. The money that remains after compensation will be sent to the citizen’s account. |

| Reason three | The application for a refund of overpaid tax was lost by the tax authority. To protect against such cases, it is advisable to make a copy of the application and ask the employee to mark the receipt of the documentation with the date. If you have such paper, you can request interest compensation (in a situation where, from the moment the application was sent, the period specified by law for the return of the requested funds has expired). |

There are several reasons for delays in deduction payments

Note ! If the funds are not credited according to your details, then you have the right to file a complaint with a higher institution or court.

There is a possibility that the tax-paying citizen is to blame for the fact that contributions to him are delayed.

Table “Frequent reasons provoked by the applicant himself.”

| Cause | Description |

| Reason one | An incomplete package of documentation was sent or there is not enough information to conduct a full audit. Then the tax office employee will try to call you by phone or send you a letter with the relevant information: that you need to show the remaining documents. However, there are situations when a person ignores calls or lives at a different address and does not receive letters sent to him. |

| Reason two | The details to which funds should be credited were not specified, or an error was made in these data. Then the tax office will try to transfer the money to you, but, naturally, this will not end in anything. |

| Reason three | The citizen who submitted the application has debts on taxes, penalties or fines. Then the funds remaining after compensation of the said debts are credited to his account. And if the debt is higher than the requested amount, then the debt is partially closed - naturally, in this case, no money is credited to the person. Please note that employees in such situations are not obliged to inform you about these manipulations. |

| Reason four | The person did not submit an application for compensation of the necessary funds attached to the declaration. But in this application the data is written according to which the funds are credited. Naturally, in such a situation it is simply impossible to send you money. |

Sometimes the citizen himself is to blame for delays in payments

You don't have to wait until four months have passed to start finding out why the IRS is not sending a tax deduction to your account. There is a possibility that the employee was not able to clarify all the sharp corners regarding the documents you provided. This will become clear three months later (at the end of the desk verification activities). So if after the specified period everything is quiet, you can go to your personal account or, in situations where you sent all the papers yourself, you need to go to the tax office and report the results of the audit.

When the desk verification activities are completed, a verdict is made in your favor and the application for the required amount of money is sent, then the probable reason why the money has not been received into the account may be your mistake in the application. There are often situations when applicants write the details incorrectly, so the tax office simply cannot send the money.

If the applicant himself indicated the details incorrectly, the money will not be sent

If you are sure that you have not made any mistakes, but the money is not credited to you, what should you do? You can write an application to the Federal Tax Service by sending it by mail or giving it during a personal visit to the institution. The same can be done using the tax service website. If the funds do not arrive within the legally established time frame, you must send a complaint to the Federal Tax Service, and then to higher authorities.

Deadlines for filing a complaint:

- to the Federal Tax Service: one year from the date when the payment deadlines were violated;

- to court: 3 months from the date when the citizen was notified of the decision not in his favor.

Note ! The claim must be written in two copies. The paper remaining with the applicant must contain the entry number and signature of the employee involved in processing. You can also send documentation by registered letter with an inventory.

You can file a complaint if money has not been credited for a long time

If the actions taken were not enough, the citizen has the right to file a claim in court, which indicates the deadline for filing the application and completed form 3-NDFL.

Alas, the mechanisms for paying tax deductions are far from ideal. There are frequent cases of delays. Tax institutions have room for improvement. To avoid delays, you need to immediately visit the tax inspector after completing the desk audits and find out how long it will take for the funds to be credited to you.