Hello, dear readers! In touch, Evgeniy Zhukov is an expert on legal matters at the Papa Help portal.

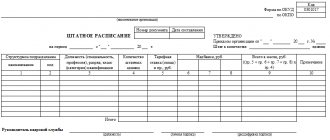

Staffing table: unified form T-3 From January 1, 2013, commercial organizations do not

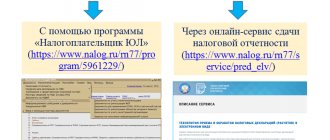

What services and programs will help you prepare a declaration under the simplified tax system In the age of universal computerization, the number

Tax offense, according to Art. 106 of the Tax Code of the Russian Federation is an illegal action (or inaction) that led to

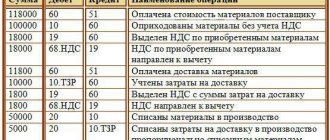

In "1C: Accounting 8" starting from version 3.0.65 you can reflect the gratuitous transfer of goods - gifts,

An employee may work for less than a full month, for example, due to another vacation or illness, recent registration

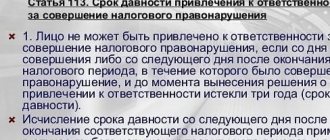

What we are talking about In tax law, there is a limitation period for bringing to liability

TIN/KPP The rules for filling out invoices, approved by Government Decree No. 1137 dated December 26, 2011, do not determine which

Cash collection involves the movement by employees of a special service of money and documentary values, such as

What rules should “simplified people” keep accounting records by? How to simplify management with minimal losses