Employer reporting

Marina Dmitrieva

Leading expert - professional accountant

Current as of October 8, 2020

We are talking about depositing funds when an employee cannot receive the amount allocated to him on time. Read more about the causes and consequences of this situation, as well as about the reflection in 6-NDFL of amounts that were not issued, in our material.

Need to deposit

The head of the organization independently determines the deadline for issuing wages. However, despite this, the period for issuing salaries in an organization cannot exceed 5 working days, including the day of receiving cash from a bank account.

The deadline for the payment of wages is indicated in the payroll - form No. T-49 or in the payroll - form No. T-53.

If for some reason the employee does not receive his salary during this five-day period, then it must be deposited. The salary is sent to the depositor on the last day of payment of the salary (clause 6.5 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

Results

When depositing wages, the payment of income to the employee is considered not to have been made, therefore, the tax agent’s obligation to withhold tax on the employee does not arise, and therefore, the deposit must be made taking into account the income tax.

In accordance with these postulates, Form 6-NDFL is also filled out. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Fill out the form

So, the organization deposited the salary of an employee who fell ill. The deposited salary in 6 personal income tax is reflected as follows:

- line 100 – the last day of the month for which the salary was calculated;

- line 110 – salary payment day;

- line 120 – the next business day after the date on line 110;

- line 130 – amount of income;

- line 140 – amount of tax withheld.

An employee has the right to receive a salary from the depositor at any time when he applies for it to the company. The law sets the only limit - three years. That is, you need to apply for the deposited salary no later than the statute of limitations expires.

As soon as the money is paid to the employee, personal income tax must be withheld from it and transferred to the budget no later than the next working day (clause 4 of article 226, clause 3 of article 229 of the Tax Code of the Russian Federation). The deposited salary in 6 personal income tax is reflected separately from the salary that employees received on time.

As for insurance premiums, different rules apply. Contributions for insurance against accidents and occupational diseases must be transferred no later than the 15th day of the month following the month for which they were accrued (clause 4, article 22 of the Federal Law of July 24, 1998 No. 125-FZ).

In turn, contributions to compulsory pension, social, and health insurance should be transferred no later than the 15th day of the month following the month for which contributions were accrued (clause 3 of Article 431 of the Tax Code of the Russian Federation).

Read also

20.11.2017

6-NDFL and deposited salary

This means that for the purposes of filling out the calculation in the case of salary deposition, the following postulates are correct, based on the general norms of legislation:

- payment of deposited income is considered to be the date of its actual payment to the employee;

- The deadline for transferring tax when depositing wages is the day following the day of actual payment of such wage payments.

You can check yourself before submitting your calculations to the fiscal authorities by reading the materials:

- “How is the desk audit of the 6-NDFL report carried out?”;

- “Control ratios for checking form 6-NDFL.”

Example

Salary payments for March were made from the organization's cash desk from April 12 to April 16. Employee Ivanov was on sick leave at that time, so the income due to him was deposited. The deposited salary payments were issued to the employee only on May 13, on the same day the tax on the employee was transferred to the budget.

Filling out form 6-NDFL (in terms of the depositor) for the six months will be as follows:

| Form position | Reflection date |

| 100 | 31.03.20__ |

| 110 | 13.05.20__ |

| 120 | 14.05.20__ |

| 130, 140 | Total amounts for income paid and tax withheld |

More information about filling out position 100 of the calculation can be found in the article “Procedure for filling out line 100 of form 6-NDFL” .

Check whether you filled out 6-NDFL correctly using the Ready-made solution from ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

How is salary deposited in 1C:8.3?

How is salary deposited in 1C: Accounting 8.3? Take the “Salary Payment Statement” (“Salary” – “Salary Payment” or the “Salary” tab) (SMS, Fig. 1).

The “Add” button makes a new statement. In the document that appears, the type of issue is “From the cash register”. Click “Fill”, then “Calculate”. The document is automatically filled in.

Then for the employee whose salary should be deposited, in the required column we make o. This mark changes both for individuals and simultaneously for everyone.

We carry out the “Salary Payment Statement”.

We will perform the deposit on its basis.

Click “Actions” – “Create based on”. We are looking for “Deposit of organizations”. The document will be located in “Salary” – “Salary payment” – “Deposit documents” (see Fig. 2).

A document for deposit in 1C is created automatically. Afterwards it should be carried out, and then the wiring should be checked. The posting will be: Debit 70 Credit 76.04. Subaccount 04 to account 76 “Settlements with various debtors and creditors” is “Settlements for deposited amounts”.

The printed version of “Depositing Organizations” is the “Depositor Card”.

Depositing wages in “1C: Salary and Personnel Management 2.5” is carried out similarly to “1C: Enterprise Accounting 2.0”.

In “1C: Enterprise Accounting 3.0”, salary deposition takes place with the request “Statements for salary payment through the cash register” (“Employees and salaries” - “Salary” - “Statements to the cash desk”) (Fig. 3).

In “Salary Deposit” (“Employees and Salary” – “Salary” – “Deposit”) (Fig. 4) a statement is taken according to which the salary is deposited in 1C, and a list of employees.

How to deposit your salary: step-by-step algorithm

When the deadline for paying wages expires, the cashier must check the payroll, recalculate the amounts paid and find out the amount of the balance. In column 23, opposite the names of employees who did not manage to receive the money, the entry “Deposited” is made or the same stamp is affixed. At the end of the statement the amounts are written down. Important: The totals of amounts paid and amounts to be deposited must be equal to the final amount on the statement.

The salary to be deposited must be submitted to the bank the next day after the end of the salary payment period. Record the deposit in the register. There is no unified form for the register of depositors; it can be compiled in free form. The register must contain the following details:

- company name or full name of the individual entrepreneur;

- date of registration of the register;

- period of occurrence of deposited funds;

- payroll number;

- Full name and personnel number (if any) of the employee who did not receive the money;

- amount of unpaid salary;

- total amount for unpaid salary;

- cashier's signature with transcript.

You can also include other details that are important to the company in the register. Transfer the data from the register to the ledger for recording deposited amounts. The book form can also be created independently or taken as a basis for forms for budgetary organizations. Document the accounting of salary deposit operations by posting:

Dt 70 Kt 76-4 - deposited salary not received by employees; Dt 51 Kt 50-1 - deposited salary deposited into the current account.

When an employee who has not received a salary applies for it, the amount will need to be given upon first request, written or oral. There is no deadline for issuing the deposited salary. You need to receive the salary amount from the bank, draw up a cash order in the name of the employee, and reflect the date and number of the order in the book of accounting for deposited amounts.

The issuance of the salary must be recorded in the register of deposited amounts, a note about the amounts received must be placed next to the employee’s name and the date must be indicated. You need to keep salary deposit registers for five years. Record the accounting of the transaction for issuing deposited salary by posting:

Dt 50-1 Kt 51 - money received from the bank to pay the deposited salary; Dt 76-4 Kt 50-1 - the employee was given a deposited salary.

OSNO and UTII

Deposited salary is part of the total accrued salary. And the costs of wages for employees engaged in both types of activities are distributed between the general system and UTII (clause 9 of Article 274 of the Tax Code of the Russian Federation).

Income tax expenses include the part of the salary related to the general taxation system. The date of recognition of expenses in this case will be the day:

- salary calculations (using the accrual method) (clauses 1 and 4 of Article 272 of the Tax Code of the Russian Federation);

- payment of deposited wages (using the cash method) (Clause 2 of Article 273 of the Tax Code of the Russian Federation).

The part of the salary related to activities on UTII is not taken into account in expenses (clause 9 of article 274, clauses 4 and 7 of article 346.26 of the Tax Code of the Russian Federation).

The employee’s status changes during the year from non-resident to tax resident of the Russian Federation

In the first and second quarters of this year, the director of the company was not a tax resident of the Russian Federation. Personal income tax was withheld from his income at a rate of 30 percent. These payments were reflected in the 6-NDFL calculations for the first quarter and half of the year. In the third quarter, the director received the status of a tax resident of the Russian Federation. Consequently, the tax rate on all income paid to him for the year changes to 13 percent. What to do with already submitted 6-NDFL calculations?

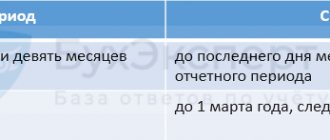

As you know, the calculation in Form 6-NDFL is drawn up on the reporting date, that is, on March 31, June 30, September 30, December 31 of the corresponding tax period. In this case, section 1 of the 6-NDFL calculation is filled out with an accrual total for the first quarter, half a year, nine months and a year (see, for example, letters of the Federal Tax Service of Russia dated 02/25/16 No. BS-4-11/ [email protected] and dated 03/18/16 No. BS-4-11/ [email protected] ).

Applying these rules to the situation under consideration, we obtain the following. Section 1 of the 6-NDFL calculation for the first quarter must be completed as of March 31, 2021, and for the six months - as of June 30. Since as of these dates the director of the organization was not a tax resident of the Russian Federation, then in the calculations of 6-NDFL for the first quarter and for the six months in relation to income paid to this employee, a tax rate of 30 percent should be reflected. In the future, no changes are required to these calculations, since in this case no errors were made when filling out the primary reports (clause 6 of Article 2 of the Tax Code of the Russian Federation). The 6-NDFL calculation for the nine months of 2021 will need to be filled out in the generally established manner, that is, the director’s income, subject to personal income tax at a rate of 13 percent from the beginning of the year, should be indicated both in section 1 (with this rate reflected in line 010) and in section 2 regarding payments for July-September.

If the employee does not come to collect his salary

The period for an employee to submit a request for payment of deposited wages to the employer is not limited by law (letter of Rostrud dated December 9, 2009 No. 6646-T3).

However, it is limited by the general 3-year limitation period (Article 196 of the Civil Code).

If an employee, having applied for payment of deposited wages, is refused, he has 3 months to go to court.

The court may decide to satisfy the claim if the general, that is, 3-year limitation period, has not expired.

This period is counted precisely from the moment the employer refuses to pay wages, and not from the day the account payable on deposited wages arises (letter of the Federal Tax Service of the Russian Federation dated October 6, 2009 No. 3-2-06/109).

Why may personal income tax not be withheld?

Payments are usually made through the cash register. One employee’s bonus was transferred to his plastic card (outside the salary project). In the 2-NDFL , the personal income tax amount for this premium is not taken into account as withheld. How can this be fixed?

Statement of Accounts must be drawn up , in which income tax withheld from the premium must be present in the personal income tax to be transferred . If it has not been updated, then most likely the date of payment in the Statement of Accounts earlier than the date of the accrual document ( Award ):

If everything is in order with the dates, but personal income tax is still not withheld, then you can try to use the document Personal Tax Accounting Operation (Taxes and Contributions - Personal Income Tax Accounting Operations) and fill out information on the withheld personal income tax on the Withheld at all rates .

See additionally - Techniques for correcting personal income tax and reflecting changes in reporting

What transactions are involved in salary deposition?

Let us demonstrate the accounting intricacies of salary depositing using examples.

Example No. 1. From the company's cash desk, the responsible person was provided with 400 thousand rubles to pay salaries to the staff of the remote branch. Upon completion, 50 thousand rubles were returned. They were issued in the form of depositary debt.

| Contents of operation | Debit | Credit | Amount, rub. |

| Amounts allocated from the cash desk for reporting to the person issuing the money (a mark is placed on off-balance sheet account 18 “Retirement of funds from the institution’s accounts”) | 208 11 560 “Increase in accounts receivable of reporting persons for wages” | 201 34 610 “Retirement of funds from the institution’s cash desk” | 400 000 |

| The distributor gave out the salary | 302 11 830 “Reduction of payables on wages” | 208 11 660 “Reduction of accounts payable of reporting persons for wages” | 350 000 |

| The funds were returned to the cash desk (a note is made on off-balance sheet account 18 “Retirement of funds from the institution’s accounts” with a minus sign) | 201 34 510 “Receipts of funds to the institution’s cash desk” | 208 11 660 “Reduction of accounts payable of reporting persons for wages” | 50 000 |

| Unclaimed wages have been deposited | 302 11 830 “Reduction of payables on wages” | 304 02 730 “Increase in accounts payable for settlements with depositors” | 50 000 |

There is a nuance: when it is not the cashier who pays, but the distributors, account 208,000 00 “Accounting for settlements with accountable persons” will not be involved in the work. Relations with responsible persons are closed before the deposit is registered.

Example No. 2. The company calculated salaries for April 2021. It was paid from the cash register from May 4 to May 6, 2021, according to the statement. After issuance, it was discovered that the funds were not issued to two employees in the amount of 13,871 rubles. and 17,400 rub. The deposited salary was released on May 25 and May 31, 2021, respectively.

In financial statements, salaries are classified as expenses for the month of accrual. Receipt or non-receipt does not matter (clause 5 of PBU 1/2008):

DEBIT 20 (23, 25, 26, 29, 44) CREDIT 70

- salary calculated; DEBIT 70 CREDIT 50 (51)

- salary was issued.

To account for deposited money, take account 76 “Settlements with various debtors and creditors” subaccount 4 “Settlements for deposited amounts”:

DEBIT 70 CREDIT 76-4

- wages that did not reach the employee on the due dates were deposited.

When issuing deposited funds, use the debit of account 76-4 and the credit of cash accounting accounts:

- accounts 50 “Cash desk” – deposited salary is paid through the cash desk;

- account 51 “Current accounts”, if the deposited salary is transferred to the person’s bank account.

Write-off of deposited income tax debt

If an employee has not applied for his salary within 3 years, the employer can write it off in tax accounting.

Due to the expiration of the limitation period, accounts payable for deposited wages are subject to inclusion in non-operating income (letter of the Federal Tax Service of the Russian Federation dated October 6, 2009 No. 3-2-06/109).

Income in the form of accounts payable on deposited wages is taken into account on the last day of the reporting period in which the statute of limitations expired (letter of the Ministry of Finance of Russia dated October 21, 2019 No. 03-03-06/1/80551).

How to submit 2-NDFL if a foreign employee is given income in kind?

In 2021, foreign employees were given gifts, but due to the fact that there were no payments in cash, personal income tax could not be withheld. For employees, there is only a copy of a foreign passport, no address. a 2-personal income tax form for natural income (gifts) with characteristics 2 and 1 ? Will such reports be accepted without an address?

In this case, you really should submit 2-NDFL with signs 2 and 1 , and addresses are not indicated in the reports, so the certificates must successfully pass verification by the Federal Tax Service.