The fine for failure to provide 3-NDFL depends on who and on what basis this declaration

OKTMO code in 3-NDFL Which OKTMO number should you indicate? Results In the material we will look at how

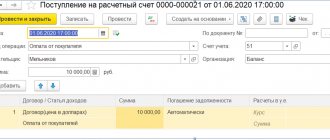

Introductory information In civil legislation there is a rule according to which the use of foreign currency, as well as

Home — Articles At the beginning of this year, the Russian Ministry of Finance approved a new PBU 23/2011 “Report

The simplified taxation system (STS, simplified) is a special tax regime used by organizations and individual

Inventories: what to include, how to take into account All company assets that have a useful life

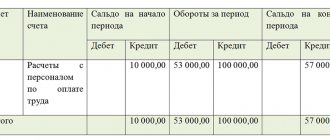

07/27/2020 Insolvent Debtors account designed to summarize information on the status of receivables written off in

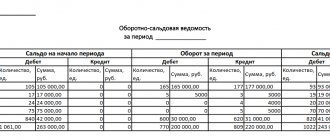

When performing control and audit activities, as well as inventory checks of the activities of any economic entity, inconsistencies are identified

Home / Taxes / What is VAT and when does it increase to 20 percent?

During its work, any business entity (individual entrepreneur or LLC) acquires a huge number of