OKTMO code in 3-NDFL

What OKTMO number should you indicate?

Results

In the material we will analyze how to determine OKTMO for the 3-NDFL declaration. Let's consider whether there are differences in which OKTMO code to indicate in 3-NDFL for tax refund and its additional payment.

If you have questions or need help, please call Free Federal Legal Advice.

- The call throughout Russia is free 8 800 350-94-43

What is OKTMO code

OKTMO is the code in the 3-NDFL declaration. The form must indicate many different codes that hide one or another meaning. This system is designed to maximize the reduction and accuracy of the entered information.

The abbreviation is revealed as an all-Russian classifier of municipal territories. A specific OKTMO consists of 8 or 11 characters that imply some kind of municipality - city, district, town, village, etc. Down to the smallest settlements, like microdistricts, etc.

Until 2014, only OKATO was used, which did not cover all administrative-territorial units and did not allow Rosstat to generate accurate statistical data. Therefore, it was replaced with a narrower indicator.

The issue itself consists of the following sections:

- the first 2 digits are subjects of Russia;

- the next 3 digits are a city district or municipal district;

- the remaining numbers are the specific locality.

So, if we are talking about a large city, then the last characters will contain zeros, since the city number will be reflected after the region.

In what cases is it required

The indicator is used in many tax reports and accounting documents, since it is uniform throughout Russia. But specifically, individuals most often encounter it in 3-NDFL, for example, when applying for a deduction or if it is necessary to pay tax, where it is necessary to indicate OKTMO.

On what sheets is it written:

- section 2 - as a payment information for the inspection for payment or return of personal income tax;

- Appendix 1 – as details of the employer.

It is assigned to each legal entity and individual entrepreneur at the time of registration and entry into the Unified State Register of Legal Entities or the Unified State Register of Individual Entrepreneurs. As a rule, the subject learns information about the assigned OKTMO from Rosstat, since it is this agency that actively works with this classifier.

We recommend additional reading: Sample of filling out 3-NDFL when selling a car less than or more than 3 years old

Address

In certificates 2-NDFL and 3-NDFL, when filling out the field “Address of place of residence in the Russian Federation,” individuals must enter their place of residence in full, based on the data indicated in the passport. If the passport contains incomplete information (for example, there is no apartment number), then in such a situation you need to take a certificate of registration, which the individual receives at the passport office. The “Place of residence in the Russian Federation” field can be left empty, but the “Address” and “Country code” fields must also be filled in.

It is important to keep in mind the following elements:

- postal code (index of the postal company located at the place of residence of the tax payer);

- region code (territorial code at the place of residence, which is indicated in the Directory “Codes of the Subjects of the Russian Federation”);

- area;

- city/urban town/village;

- street, house number, apartment.

A specific house can be indicated either using letters or numbers (for example, 5 A or 5/2). In the “Body” field, you must indicate the modification of the object.

Where to find out the OKTMO code

Depending on the purpose for which OKTMO is needed, it can be found in existing documents or determined using a special service. So, for example, to fill out forms that require information about the employer, it is enough to use a 2-NDFL certificate or another accounting document of the company. As a rule, the company's registration information is indicated in the header.

And if you need to find out OKTMO to fill out the “Section 2” sheet of 3-NDFL, then the electronic service on the tax website – nalog.ru – will help.

OKTMO at the place of residence of an individual

Section 2 in 3-NDFL reflects the entire outcome of the report - tax payment, refund or no payment. In any case, you need to enter the KBK and OKTMO so that when automatically reading the information, the system correctly determines to which or from which Federal Treasury account the operation will be performed.

It is necessary to determine the OKTMO code in 3-NDFL at your place of residence. To do this, follow the instructions:

- Open the tax website.

- In the search bar, enter the phrase “Find out OKTMO.”

- From the results, select the service with the matching name.

- On the service page, fill in 2 fields – region and municipality. The data is displayed according to the FIAS address system.

- OKTMO will be displayed.

An alternative method is suitable if the details are needed not to fill out 3-NDFL, but to directly pay the tax when you do not have a ready-made receipt. To do this, follow the algorithm:

- Open the tax website.

- In the search bar, enter the phrase “Pay your taxes.”

- Select – “Individuals”.

- Next, indicate payment of taxes.

- For myself.

- Check the box and give permission to use your personal information.

- Click on “Fill in all details”.

- An important parameter here is whether the inspection and the territory are in the same region or not. If you pay tax at your place of registration, then in one. If the tax is paid to the Federal Tax Service of another entity, then the details are different.

- Select the inspectorate to which you want to pay the amount. You can immediately enter the code if you know it, or search in the list.

- Check the “Define by address” box. In a new line, enter your residence address. If you enter an index, the region and city will be downloaded automatically.

- An OKTMO corresponding to the specified data will appear.

- Next, fill out the remaining parts of the payment order and, using the completed receipt, complete the transaction in any convenient way.

OKTMO code according to OKATO

Through the announced service, you can determine the required OKTMO not only with the help of the municipality, but also by OKATO, if you know it. But in 3-NDFL, for example, for a property deduction, it is OKTMO that needs to be indicated.

We recommend additional reading: Filling out 3 personal income tax declarations for individual entrepreneurs: simplified tax system, UTII, OSNO and zero

If you fill out 3-NDFL according to the samples at the stands at the Federal Tax Service, then all the codes can be found in the examples. The “Declaration” program for 3-NDFL, which is easy to use from the website, also allows you to quickly enter OKTMO. An alternative is an online service in the taxpayer’s Personal Account, where all codes are also entered automatically as the user enters data.

Download the OKTMO code book

It’s easy to find your OKTMO code at your place of residence for 3-NDFL in directories for federal districts:

- Central;

- Northwestern;

- Southern;

- North Caucasian;

- Privolzhsky;

- Ural;

- Siberian;

- Far Eastern.

Click on the desired link and find the required municipality in the list.

Which OKTMO should I indicate?

After it has become clear what the all-Russian classifier is intended for and what each of its digits means, it remains to figure out which code should be indicated and where. The simplest method, which is often chosen by most taxpayers, is the help of a tax agent. You just need to come to the tax office and ask exactly what numbers should be present in the OKTMO cell.

How to find out the code yourself

There is another method by which an individual can find out OKTMO without leaving home. This is one of the most popular methods today, which is carried out through Internet resources.

There are many special sites designed specifically for these purposes, which contain a database that encrypts all municipalities of Russia.

You can find out OKTMO via the Internet in two different ways:

- Through OKATO. The declaration, as a rule, requires the registration of another abbreviation OKATO, which is scary at first glance, which differs from the designation OKTMO only in the last three letters, denoting an abbreviation for such a phrase as administrative-territorial division. If the taxpayer has already entered OKATO, then when writing it on the website, the program will give him the numbers of the required OKTMO.

- Through the name. This method is even easier than the first. First, you will need to enter numbers approved by current legislation and characterizing a specific subject of the Russian Federation. It is quite easy to recognize them, for example, with the help of a special reference book, which is called: “Codes of the subjects of Russia.” When an individual begins to enter them into the required field of the program, the names of municipalities will automatically appear. After this, in order to see OKTMO, you just need to click and select the name the taxpayer needs.

Where to enter OKTMO

It's no secret that the 3-NDFL form consists of many sheets, and you only need to enter information in some of them. You need to fill out sheets that require registration of general information, and then sheets related to a specific type of tax deduction.

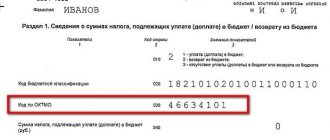

OKTMO is indicated in one of the required sheets, namely the one entitled section one. This page of the 3-NDFL declaration of an individual is devoted to data related to the amounts of taxes that must either be reimbursed from the state treasury or additionally paid into it. After cell number 020 there is a field labeled 030, in which you must enter this code.

How else can you find out the code?

There is another additional method by which you can find out the combination of numbers that encodes the municipality. This method is implemented in exactly the same way as the previous described methods - via the Internet. An individual will only need to know the tax office number.

The taxpayer needs to indicate the tax service number, and then the coordinates of the place where he is officially registered. After this, the program will show the code of interest to the individual.

How to correctly fill out OKTMO in the 3-NDFL declaration

3-NDFL tax forms are automatically scanned to download information from them into the AIS-Tax database (automated information system), therefore there are strict graphical requirements for filling out the form.

So, in the 3-NDFL declaration, the OKTMO code, as well as other values, inspection number, amounts, titles and names, are written according to the following rules:

| Criterion | Requirement |

| Ink | Black, purple and blue only |

| Font | Printed, capital |

| Filling in the fields | For each symbol there is a separate cell |

| Corrections | Not allowed |

Please note - you need to enter OKTMO according to the inspection to which you are registered. This is not always the Federal Tax Service Inspectorate at the place of actual residence, because a person can register in one city, but actually live and be registered for tax purposes in another.

Your lawyer

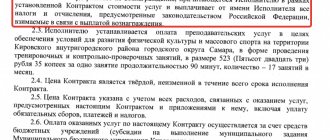

If, based on the results of calculations, the amounts subject to refund from the budget were determined for the tax that was paid (withheld) in various administrative-territorial entities, as well as in the case of determining the amounts of tax subject to payment (surcharge) for different codes (refunds from different codes) budget classification of tax revenues of budgets, Section 1 is filled out separately for each OKTMO code and code of budget classification of tax revenues of budgets, respectively. That is, several Sections 1 can be filled out with different OKTMO codes or budget classification codes for budget tax revenues.

Please note that you should not search in the street classifier, because OKTMO is a municipal classifier, not an address classifier. You can search for cities, settlements, city districts. It is also recommended to check the OKTMO code with your tax office.

Filling example

Example 1

Egor Belyshev sold the car in December 2021, which he inherited in the same month. The cost of the transaction is 400,000 rubles. He lives and is registered with the Federal Tax Service in the city of Maykop.

Based on the results of calculations in 3-NDFL, a tax payable arises, therefore, in section 2, the line “tax payable” is filled in and it is required to enter OKTMO at the place of residence of the individual. How to determine it:

- Open the Federal Tax Service website.

- Find the service page.

- Specify the subject of the Russian Federation – 01, Republic of Adygea. She's first on the list.

- Next, select the municipality - the city of Maykop.

- OKTMO: 79701000. Write it down in line 030 of the sheet.

In Appendix 1 of Form 3-NDFL you need to indicate the source of income. In case of sale of property to an individual, the source is the buyer. Therefore, on the sheet it is enough to indicate the last name, first name and patronymic of the second party to the transaction, without details. If the income is received from a legal entity and individual entrepreneur, then OKTMO can be easily found in the documents of the entity, for example, in the 2-NDFL certificate.

Example 2

Egor Belyshev lives in Moscow under temporary registration. Permanent registration is in Bataysk. He is employed by a company that submits reports about him as part of personalized employee records. In November, he made a profit due to savings on interest and is required to submit Form 3-NDFL in the coming year.

In Section 2 of 3-NDFL, he will indicate OKTMO at his place of permanent registration, although he received his income in Moscow. The basis is Article 11. Clause 1 of Article 83, Clause 3 of Article 228, Clause 2 of Article 229 of the Tax Code of the Russian Federation. The place of residence and income does not matter. Otherwise, citizens living abroad and making profits in Russia would easily avoid taxation.

In the service, you need to indicate the Rostov region as the region, and the municipality - the city of Bataysk. OKTMO: 60707000.

Budget classification code in the personal income tax refund application

You can find out OKTMO for filling out an application for a personal income tax refund on the Federal Tax Service website using the “Find out OKTMO” service. KBK – budget classification code. Each tax and each action with it (offset, refund, transfer to the budget) corresponds to a specific KBK code. The budget classification code indicated in 2021 in the application for personal income tax refund is 182 1 0100 110.

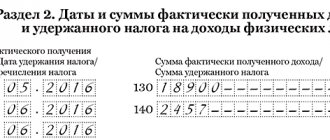

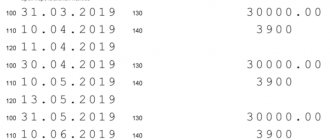

- Personal income tax calculated for payment (line 070);

- amount withheld at the source of payment (p. 080).

The first value (page 070) shows how much personal income tax needs to be paid to the budget, taking into account all deductions claimed by the taxpayer. And the amount in line 080 reflects how much tax the employer has actually already transferred for the taxpayer. The difference between these values is refundable.

Example 4

Alexey earned 410,500 rubles from the company in 2021. From this money, his employer transferred personal income tax to the budget - 53,365 rubles. This is withholding tax. In the same year, Alexey spent 41,600 rubles on his studies. and wants to get a deduction from this money. Funds spent on training, according to paragraph 2 of paragraph 1 of Article 219 of the Tax Code, reduce the tax base for personal income tax. This means, taking into account the deduction, this base for Alexey is 368,900 rubles. (410,500 – 41,600).

We determine the calculated tax amount: 368,900 × 13% = 47,957 (rub.).

Now we calculate the difference, i.e. the personal income tax that Alexey can return: 53,365 – 47,957 = 5,408 (rub.).

What to do if you specified the wrong code

An error in the code at the place of residence of the 3-NDFL declaration has 3 situations:

- you discovered it before you submitted 3-NDFL to the Federal Tax Service;

- you learned about the error after submitting Form 3-NDFL to the inspectorate;

- The tax office itself notified about the presence of inaccuracies and inconsistencies in 3-NDFL.

In the first case, you need to replace the sheet Section 2 of the 3-NDFL form and write down the information correctly on the new page. In the second, contact the inspectorate and find out whether an updated report needs to be submitted. In the third, the Federal Tax Service itself will require you to submit an adjustment form or explanations, otherwise it will refuse 3-NDFL, for example, if a deduction for return was presented for it.

The correction form differs from the usual one only in the correction code on the title page: instead of “000”, “001” is placed. Facial errors are also corrected. The entire procedure for submitting and checking updated reporting is set out in Article 81 of the Tax Code of the Russian Federation. As a rule, an error in OKTMO does not apply to cases requiring changes to the submitted 3-NDFL: in practice, tax authorities only require explanations in free form, but in order to avoid misunderstandings it is necessary to clarify the actions.

We recommend additional reading: Code of the type of income in the 3rd personal income tax declaration