Introductory information

In civil legislation there is a rule according to which the use of foreign currency, as well as payment documents in foreign currency when making payments on the territory of the Russian Federation, is permitted in cases, in the manner and under the conditions determined by law (clause 3 of Article 317 of the Civil Code of the Russian Federation). That is, the use of foreign currency is, in principle, allowed. But only in cases that are expressly provided for by law. Therefore, for different types of legal relations it is necessary to analyze different legal norms. Let's look at specific examples.

Why do different sites display different dollar exchange rates (+)

The dollar exchange rate, as well as quotes for Brent oil, other currencies and financial instruments, very often differ on different sites, for several reasons. First of all, you need to understand on which website the dollar exchange rate is broadcast online. For example, very often, quotes on websites are broadcast with a delay of 15 minutes - this is one of the main reasons why quotes may not match the values on our website. It is also important to understand from which source the data is being broadcast. For example, on our website you can see the dollar exchange rate online 24 hours a day, even at times when trading is not taking place on the MICEX. This is due to the fact that the page displays the weighted average dollar exchange rate from the interbank foreign exchange market, which operates around the clock and is not an exchange market. When currency trading begins on the MICEX, quotes on Forex and on the Moscow Exchange become almost identical, due to the work of algorithms and arbitrage strategies of traders that eliminate inefficiencies in the market and quotes on Forex and on the MICEX take on identical values. You can see something similar if you look at currency trading on the spot market and on the futures market, the charts will be the same, there will only be a difference in quotes due to the specifics of the futures contract. There is another important point that explains why quotes can vary significantly between Brent oil and other futures. The fact is that futures are traded in series that differ in delivery date, for example, futures with delivery in December, March, June and September can be traded at the same time, and their quote values will be different, since they reflect price expectations in different calendar periods . It follows that if it is now December and the date is approaching the expiration of the December oil futures contract, then on one site you can see the price of $70 per barrel, and on the other $72, because on the first site the quotes of the current old contract, and on the other site updated the contract and already shows March futures. So, let's summarize. Quotes may vary on different sites for several reasons: broadcast is delayed, different data sources, different futures contracts, technical glitches. As for the quotes of currency pairs on the interbank market, it is worth remembering that the Forex market is not centralized and is not regulated by the exchange; quotes are generated by banks and liquidity providers independently, using different sources and filtering systems, so quotes on Forex obviously cannot be the same in different sources, in contrast to exchange-traded instruments, the correctness of which can always be checked on the official websites of the exchanges where one or another exchange-traded financial instrument is traded.

Converting salaries into foreign currency

Let us immediately draw attention to two important provisions of labor legislation: 1. Terms of remuneration (including the size of the tariff rate or official salary, additional payments, allowances and incentive payments) must be included in the employment contract (Part 1 of Article 57 of the Labor Code of the Russian Federation) ; 2. Payment of wages is made in cash in the currency of the Russian Federation, that is, in rubles (Article 131 of the Labor Code of the Russian Federation).

However, there is no prohibition on setting the payment in currency (for example, dollars or euros). It turns out that you can pay wages in rubles, for example, at the dollar exchange rate on the day of payment.

Risks

If we talk about risks, then it is worth mentioning one more requirement of the Labor Code of the Russian Federation: “the employer is obliged to provide employees with equal pay for work of equal value” (paragraph 6, part 2, article 22 of the Labor Code of the Russian Federation). It would seem, how does this relate to currency? However, imagine that one employee has a salary in euros, and another in rubles. With the same functionality at the end of the month, they should, in theory, receive the same amount. But if the exchange rate changes, it may turn out that ruble earnings will differ significantly.

By the way, official bodies also believe that setting wages not in rubles does not comply with labor legislation and infringes on the rights of workers (letter of Rostrud dated March 11, 2009 No. 1145-TZ). The rationale is this: a change in the exchange rate of the ruble against a foreign currency can lead to a deterioration in the employee’s remuneration conditions (for example, if the exchange rate depreciates and wages in rubles become less).

In this regard, setting wages in foreign currency is dangerous. It cannot be completely ruled out that the employer may be held administratively liable under Art. 5.27 of the Code of Administrative Offenses of the Russian Federation (which provides for fines or suspension of activities).

Selecting another financial instrument to display on the chart (+)

In the center of the page there is an interactive chart where you can view hundreds of financial market instruments in real time. The selection of the most popular instruments is presented in the “watchlist” column, which is located to the right of the chart; when you hover the cursor, a tooltip appears with a description of the selected instrument. The Traders Forum provides its users with interactive, real-time information in collaboration with Tradingview. Stock charts online. Forex, RTS, CME quotes on our forum you can always monitor all world markets online. Convenient tools for technical analysis allow you to make calculations on a web page without using a trading terminal or additional software. Flash display technology streams data with the lowest possible latency for a web interface. Stock charts online. RTS, EURUSD, SP500 index chart online. Online quotes The list of instruments provides the most liquid and popular indices, stocks and currencies. Using the window for manually entering an instrument ticker, you can independently select the instrument you need. Ticker USDRUB

— dollar exchange rate online on the stock exchange Ticker

UKOIL

— Brent oil quotes online Ticker

SPX500

— online quotes for the S&P500 index Ticker

RTS

— chart of the RTS index traded on the Moscow Exchange Ticker

DXY

— chart of the dollar index online Ticker

NAS100

— online chart of the NASDAQ 100 index Ticker

GBPUSD

- online chart of quotes for the British pound/US dollar pair Ticker

EURUSD

- online chart of quotes for the euro/US dollar pair Ticker

XAUUSD

- gold quotes on the stock exchange in real time You can always apply technical analysis tools to the chart and save the chart in the form of a graphic image on your computer or receive a link to the file. This way you can insert graphs directly into forum posts. To save or share an image, click on the camera in the green square in the upper right corner and follow the instructions

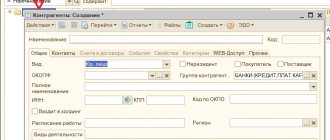

Setting currency prices in contracts

Some Russian suppliers have recently begun to offer their customers to switch to payments in foreign currency. However, as a general rule, currency transactions between residents are prohibited (Article 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”). For illegal currency transactions, Rosfinnadzor may fine the manager or chief accountant in an amount ranging from three-quarters to one of the transaction amount (Part 1, Article 15.25, Article 23.60 of the Code of Administrative Offenses of the Russian Federation).

Civil legislation provides that payments on the territory of the Russian Federation are carried out in rubles (Article 140, paragraph 1 of Article 317 of the Civil Code of the Russian Federation). At the same time, in paragraph 2 of Art. 317 of the Tax Code of the Russian Federation states that a monetary obligation can be paid in rubles in an amount equivalent to a certain amount in foreign currency or in currency. e.. In this case, the amount payable in rubles is determined at the official exchange rate of the relevant currency or y. e. on the day of payment, unless a different rate or another date for its determination is established by law or by agreement of the parties.

This means that between organizations (or entrepreneurs) the price in the contract can be set in currency or ye. In this case, the contract can agree on the rate at which the price will be converted into rubles. If there is no such agreement, then the official rate will apply. In this regard, significant fluctuations are possible in ruble terms.

What does decryption give?

If you open a bank account, then you do not need to know all the features of deciphering its categories. Credit organizations operate on the basis of the law, and the combination of numbers is formed by a specially installed computer system. Thus, there can be no error in the numerical designations, and all accounts opened by the bank are unique and valid.

However, superficial knowledge is still useful. An error in two digits when sending a payment to a legal entity’s account may result in loss of funds. After this, you will have to draw up an application for withdrawal of money, which is not a quick operation.

It is better for an organization to have the details entered into the computer in advance, in particular the account numbers of its counterparties. This will avoid numerous mistakes. Today, most banks offer electronic services for managing accounts that allow you to save payment templates, which eliminates the need to re-enter information about the recipient of funds.

Physical account faces always begin with the numbers 408. This combination is the same for all Russian banks. Despite the fact that individual entrepreneurs also act as individuals, their accounts begin in the same way as legal entities, with 407.

Price tags in e. or currency

Let's assume that the seller decides to indicate prices in currency or conventional units. However, information about goods (works, services) must necessarily contain the price in rubles. This is the requirement of paragraph 4, paragraph 2, art. 10 of the Law of the Russian Federation dated 02/07/92 No. 2300-1 “On the protection of consumer rights.”

At the same time, regarding the question of indicating prices in foreign currency or currency. e. there are different approaches. On the one hand, Rospotrebnadzor (Information dated December 17, 2014) does not exclude the possibility of establishing the contract price in rubles in an amount equivalent to a certain amount in foreign currency (cu).

On the other hand, there are precedents in judicial practice when indicating prices in foreign currency or currency. e. was recognized as contrary to the requirements of the legislation on the protection of consumer rights (see, for example, resolution of the Federal Antimonopoly Service of the Ural District dated March 13, 2007 No. F09-1474/07-S1). And for this, administrative liability is possible on the basis of Article 14.8 of the Code of Administrative Offenses of the Russian Federation. In this regard, setting prices in currencies or conventional units is quite risky.

Principle of repatriation

Important! The special conditions regime applies when making payments by residents in the IV within the framework of foreign trade activities (Article 19 of Law No. 173-FZ). This is the so-called principle of repatriation, which imposes certain responsibilities on residents (Parts 1 and 1.1 of this article):

- ensuring receipt of currency (national and foreign) due in accordance with the terms of agreements and contracts;

- repatriation to the Russian Federation of funds paid by non-residents for goods, work, services and information that were never imported into the Russian Federation, fulfilled, transferred (failure to fulfill this condition even provides for liability under Article 193 of the Criminal Code of the Russian Federation);

- receiving into your accounts from non-residents the currency due under loan agreements.

Agreement in foreign currency: tax consequences

USN and cash method

Let’s assume that an organization using the simplified tax system has entered into an agreement for the supply of goods with another organization. The contract specified the cost in dollars and payment in rubles.

When “simplified”, the date of receipt of income is the day of receipt of funds (clause 1 of Article 346.17 of the Tax Code of the Russian Federation). That is, it turns out that the price specified in the contract in dollars does not matter. The tax will need to be calculated based on the ruble amount received.

The situation is similar with income tax when applying the cash method - income is also determined on the date of receipt of funds (clause 2 of Article 273 of the Tax Code of the Russian Federation). Income is recognized in the same way under the Unified Agricultural Tax (clause 5 of Article 346.5 of the Tax Code of the Russian Federation). That is, differences in exchange rates are, in fact, not taken into account.

Exchange differences for income tax

Before 2015, amount differences could arise when calculating income tax. This happened when the foreign currency exchange rate was different on the date of recognition of income (expenses) and on the date of actual receipt of funds. Depending on the fluctuation of the exchange rate, receipts or expenses should have been reflected in non-operating income or expenses (clause 11.1, part 2, article 250, subclause 5.1, clause 1, article 265 of the Tax Code of the Russian Federation).

However, from January 1, 2015, the concept of “amount differences” is no longer used in tax accounting. Differences that arise when making payments under contracts in foreign currency or currency. That is, they must be taken into account as coursework. For more details, see “Starting 2015, tax and accounting rules will be closer to each other.”

Note that exchange rate differences arise when revaluing and depreciating obligations and claims denominated in foreign currency (if the exchange rate changes). Thus, since 2015, the value of claims (obligations) expressed in foreign currency is recalculated into rubles at the official rate established by the Bank of Russia, or at another rate determined by law or agreement of the parties, on the date of termination (fulfillment) of claims (obligations) and (or) on the last day of the current month, depending on which date came earlier (clause 8 of Article 271, clause 10 of Article 272 of the Tax Code of the Russian Federation).

VAT deductions and invoices

If the purchased goods are intended for use in transactions subject to VAT, then the buyer, if there is an invoice, has the right to accept the amount of “input” VAT for deduction after accepting the goods for registration (clause 2 of Article 171, paragraph 1 of clause 1 of Article 172 of the Tax Code RF). However, the amounts of VAT that are accepted for deduction are not adjusted if the cost of goods established in foreign currency is paid in rubles (paragraph 5, clause 1, article 172 of the Tax Code of the Russian Federation).

Positive or negative differences in the amount of VAT that arise for the buyer when paying should be taken into account as part of non-operating income or expenses on the basis of Article 250 or Article 265 of the Tax Code of the Russian Federation (paragraph 5 of clause 1 of Article 172 of the Tax Code of the Russian Federation).

Special mention should be made about the preparation of invoices. The fact is that the name of the currency is a mandatory detail of the invoice (clause 6.1, clause 5, clause 4.1, clause 5.1, article 169 of the Tax Code of the Russian Federation). The name of the currency and its digital code are indicated on line 7 of the invoice. For example, when issuing an invoice in rubles, line 7 of the invoice must be filled out as follows: “Russian ruble, 643.”

An invoice can be drawn up in a foreign currency only if the goods (work, services) are paid for in the same currency (Clause 7, Article 169 of the Tax Code of the Russian Federation). So, if the invoice is issued in euros or dollars, then in this line you should indicate: “euro, 978” or “US dollar, 840”. But issuing an invoice in . i.e., in principle, not provided for.

In this regard, if the agreement is drawn up in currency or conventional units, and payments are made in rubles, then the invoice should be issued in the currency of the Russian Federation (since the tax base is calculated in rubles, clause 4 of Article 153 of the Tax Code of the Russian Federation).

Source documents

Please note: monetary measurement of accounting objects is carried out in the currency of the Russian Federation (Part 2 of Article 12 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”). If, for example, salaries in foreign currency are reflected in the primary documents, then problems with the recognition of labor costs when calculating income tax cannot be ruled out. To recognize such expenses, we recall that the expenses must be documented (Article 255 of the Tax Code of the Russian Federation). It is possible that inspectors will consider the primary documents filled out “in foreign currency” to be inconsistent with the legislation of the Russian Federation. This may lead to problems with the deduction of VAT.

Example

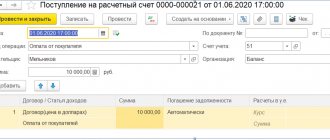

On June 1, 2021, IP Melnikov paid the Balance organization 100% of the delivery cost (Fig. 3).

Rice. 3

When selling the goods on 06/09/2020, no exchange rate differences arose; the exchange rate was taken on the date of payment.

The second option is if the payment arrived after registration. In this case, the goods are recognized at the exchange rate that was established on the date of transfer of ownership. At the time of sale, the seller’s accounting records reflect the amount of the buyer’s receivables in cu, as well as rubles, calculated at the exchange rate on the date of sale.

The amount of revenue will not be revalued, but accounts receivable expressed in monetary units will be revalued at each reporting date or at the time of full (partial payment by the buyer). Accordingly, exchange rate differences will be reflected as other income (expenses) in accounting and as non-operating income (expenses) in taxation.

Source:

Materials from the newspaper “Progressive Accountant”

Heading:

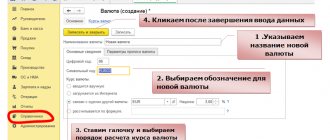

currency transactions 1C:Accounting 8

- Marina Ereyskaya, accountant-consultant Consultation lines

Sign up 7800

9750 ₽

–20%

Online gold rate | Real time gold chart

To view the chart with the gold rate, you need to go to the appropriate tab in the main window of the site. The gold rate is broadcast in real time without delay from the international interbank Forex currency market. The instrument ticker on the charts is XAUUSD. Purchasing precious metals is a great way to preserve and increase your wealth. At the moment, the dollar exchange rate has reached its highest level in the last quarter of a century, but is still growing. The online gold rate does not undergo big changes, there are no jumps in it, which means the risk of all kinds of risks when investing is significantly reduced. XAUUSD price quotes are stable and predictable, which predisposes to long-term investments in order to save and increase their resources. Factors influencing the exchange rate. Although the gold rate is stable and shows stable growth, small roughness still occurs, because the market cannot exist without risks, but they are so small compared to other rates that they are easy to neglect. Gold prices are affected by changes in global economic growth, and prices are also affected by changes in investor sentiment. You can track the gold rate online on various resources. If you are a forex player, you can easily track the rate thanks to the numerous statistical calculations provided by the exchange. Thanks to the stability of gold prices, quotes are easily predicted for several days, and sometimes weeks, in advance. Feasibility of investment. As mentioned many times above, oil prices are stable, so investing in this precious metal is relatively safe and makes the most sense, especially if you are looking for a material for long-term investment. Gold is of little interest to traders and speculators, because speculative tactics and strategies work little here due to the high rate stability. Yellow metal prefers a conservative approach, only in this case you can get a benefit, even if it will not be as large as when actively playing in the foreign exchange market, but stable, it is unlikely that you will lose your savings when investing in gold - for this you need a very try. Investing in gold guarantees that you will remain with your money in any case, since gold prices are one of the few stable things in this unstable world.

Foreign exchange interventions of the Central Bank of the Russian Federation in the foreign exchange market

Issues related to currency regulation are the responsibility of the Central Bank. He chooses the option of establishing the national currency exchange rate, which can be fixed or “floating”. The first is established officially. It means how much the state is willing to pay for a particular national currency of other countries. This rate is taken into account when concluding international treaties. To maintain a fixed exchange rate, the Central Bank has to conduct constant trading operations to buy or sell currency within the limits of its reserves. This exchange rate regulation is called motto policy. A “floating” exchange rate involves its regulation through exchange trading. In practice, there is no absolutely free market formation of exchange rates. The Central Bank always keeps its finger on the pulse of exchange rate fluctuations and, through its intervention, tries to keep them within a certain corridor. Methods such as discount policy, devaluation, currency dumping or revaluation are used as currency regulation. The essence of discount policy is to change the discount rate, which affects the inflow or outflow of capital from the country. They raise the discount rate in cases where they want to strengthen the national currency and ensure its growth. Every year, the Central Bank of the Russian Federation develops a strategy for its monetary policy, which determines the form and methods of currency regulation. It takes into account the state of the domestic economy and the processes occurring in the global financial system. In 2021, the Central Bank plans to increase the discount rate and maintain inflation at 4%. The rate of decline of the ruble can be slowed down by a reduction in capital outflow from the country and a decrease in demand for currency. Many international analysts predict that oil prices will begin to rise in 2021. This could have a serious impact on the strengthening of the ruble exchange rate.

Impact of the dollar exchange rate and oil prices on the Russian economy (+)

The day of many Russians begins and ends with searching for information about the current exchange rate. Its size affects our financial capabilities. The cost of imported goods and medicines, the cost of foreign travel, the cost of foreign cars and much more depends on it. The exchange rate is formed as a result of trading on currency exchanges. On them, money plays the role of a commodity that is bought and sold. Supply and demand determine the value of currencies in relation to each other. This is what is called the exchange rate. This value is not constant. It changes its value throughout the trading session. Until the 30s of the last century, the exchange rate of national currencies depended on the gold reserves of states. Each monetary unit corresponded to a certain gold equivalent. This approach to valuing the national currency changed with the introduction of the gold-currency system. Gold was replaced by a reserve currency, the role of which was chosen by financiers to be the US dollar. The ratio of the value of national monetary units to the dollar has become a fundamental factor in determining the exchange rate of national currencies.